This version of the form is not currently in use and is provided for reference only. Download this version of

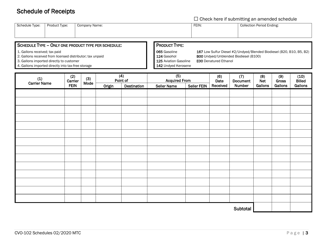

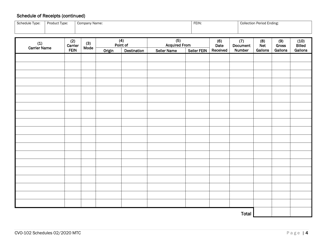

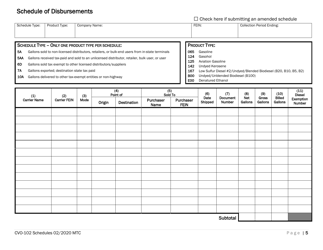

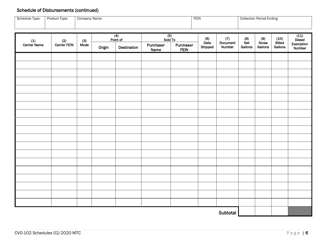

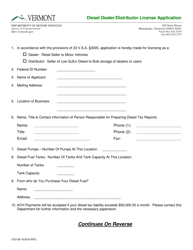

Form CVO-102

for the current year.

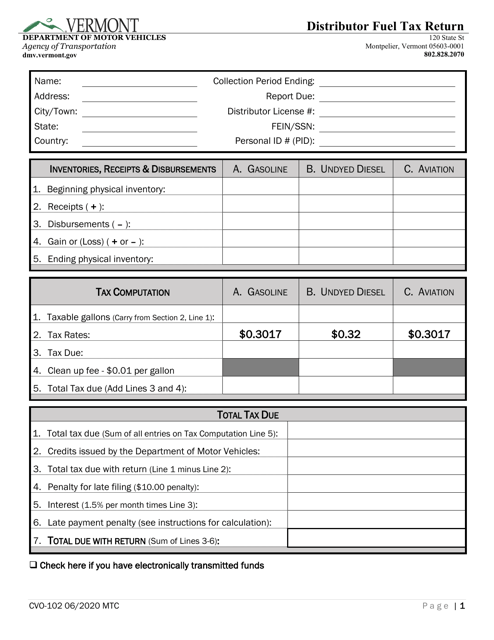

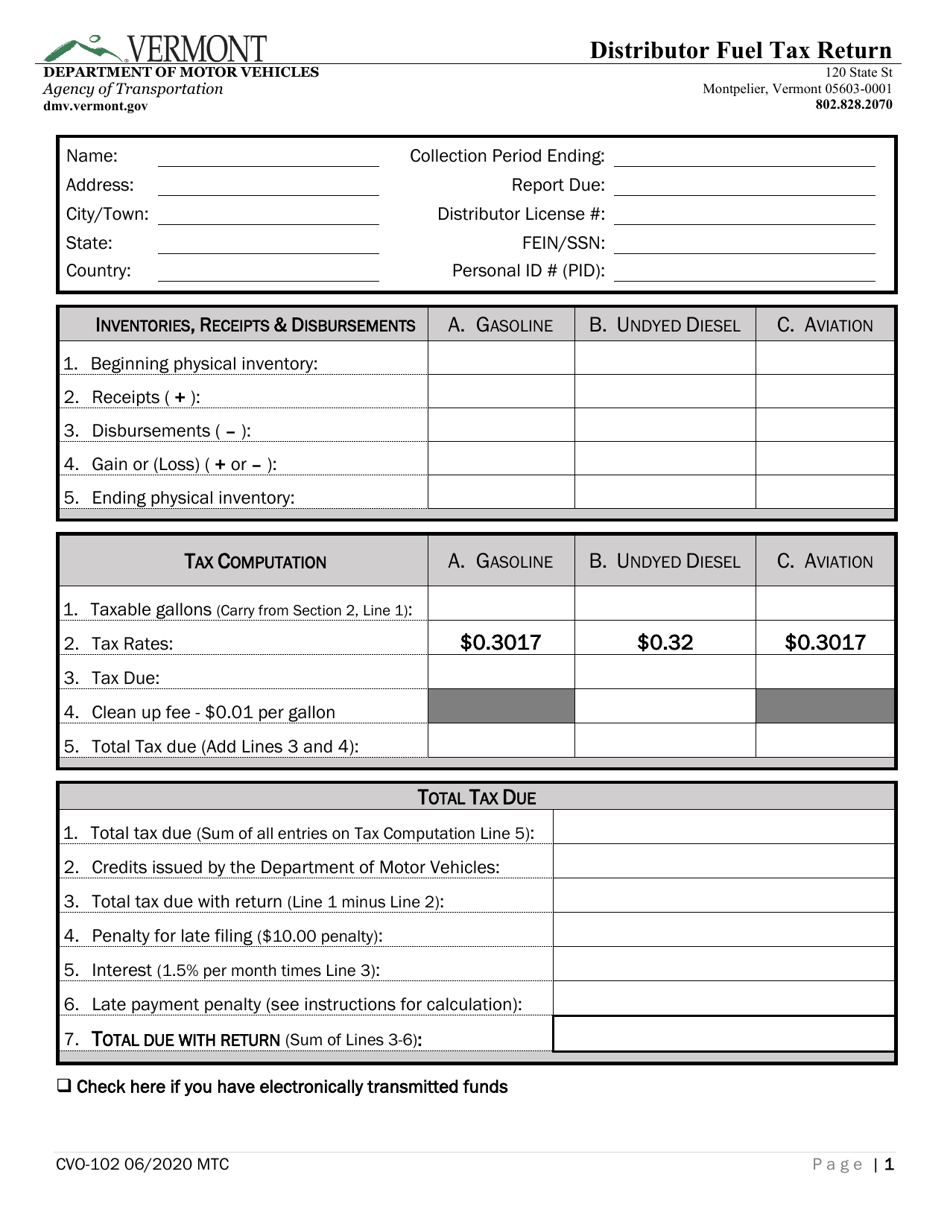

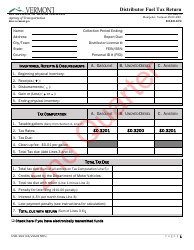

Form CVO-102 Distributor Fuel Tax Return (Q3) - Vermont

What Is Form CVO-102?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CVO-102?

A: Form CVO-102 is the Distributor Fuel Tax Return form for the state of Vermont.

Q: What is the purpose of Form CVO-102?

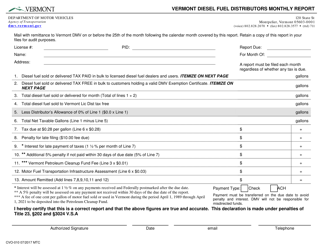

A: The purpose of Form CVO-102 is to report and pay fuel tax for distributors in Vermont.

Q: What quarter does Form CVO-102 cover?

A: Form CVO-102 covers the third quarter.

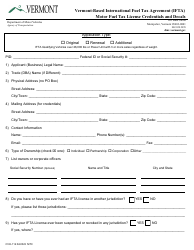

Q: Who needs to file Form CVO-102?

A: Distributors of fuel in Vermont need to file Form CVO-102.

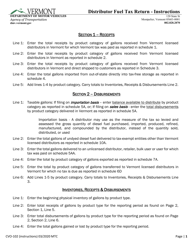

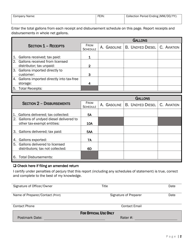

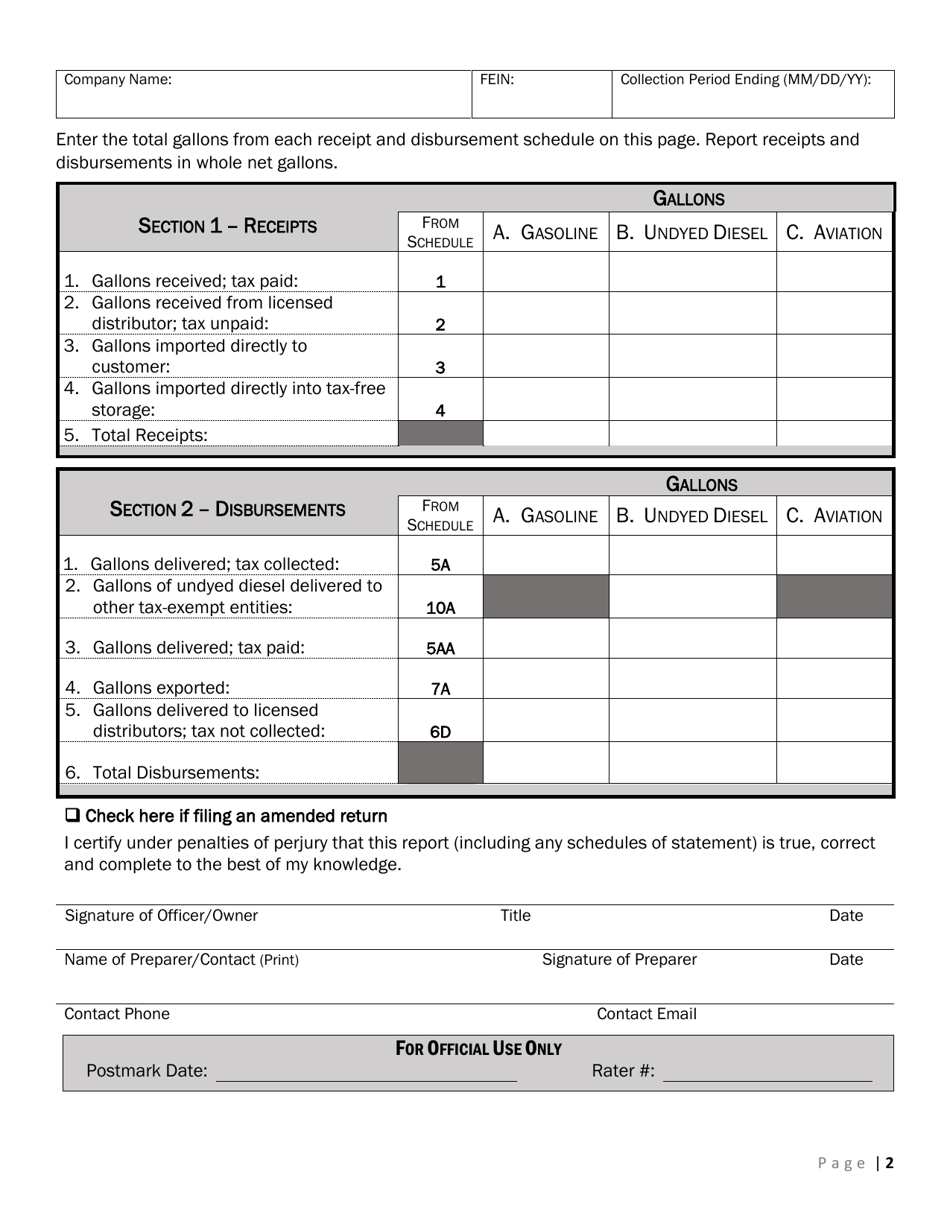

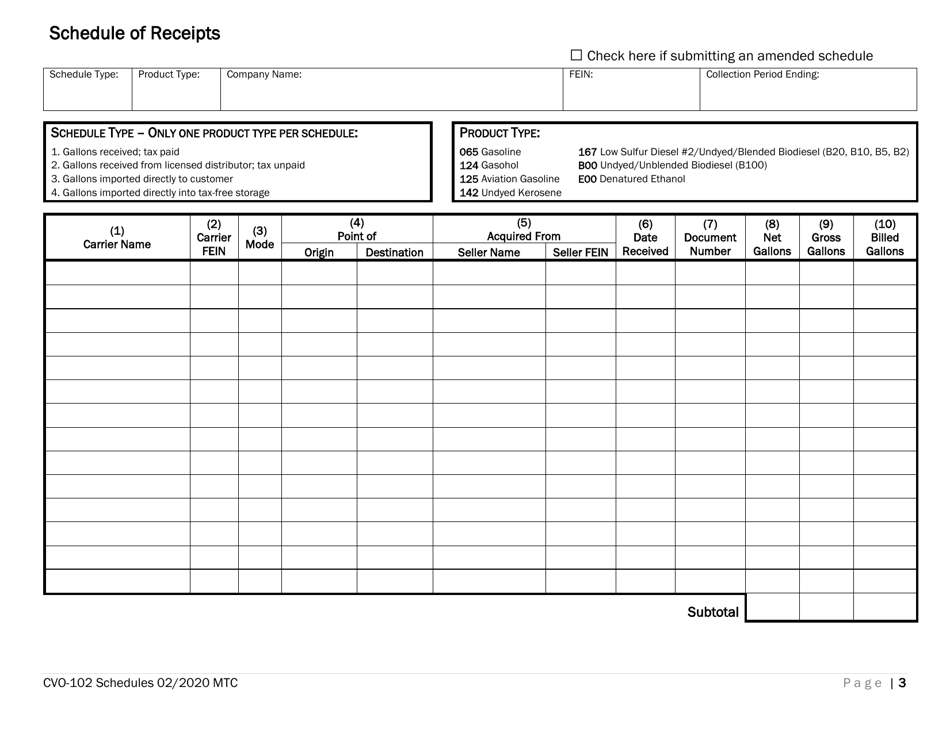

Q: What information is required on Form CVO-102?

A: Form CVO-102 requires information such as gallons of fuel distributed, tax due, and any credits or refunds.

Q: When is Form CVO-102 due?

A: Form CVO-102 is due on the last day of the month following the end of the quarter.

Q: How can I pay the fuel tax on Form CVO-102?

A: Fuel tax can be paid electronically or by mail with a check or money order.

Q: Are there any penalties for late filing or payment of Form CVO-102?

A: Yes, there are penalties for late filing or payment of Form CVO-102, including interest on overdue amounts.

Form Details:

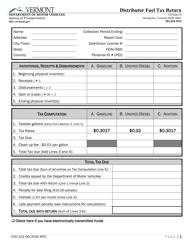

- Released on June 1, 2020;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CVO-102 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.