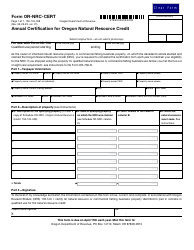

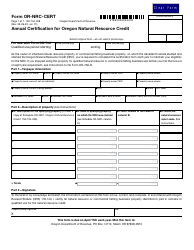

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 150-104-003 Schedule OR-NRC

for the current year.

Instructions for Form 150-104-003 Schedule OR-NRC Oregon Natural Resource Credit - Oregon

This document contains official instructions for Form 150-104-003 Schedule OR-NRC, Oregon Natural Resource Credit - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-104-003 Schedule OR-NRC is available for download through this link.

FAQ

Q: What is Form 150-104-003?

A: Form 150-104-003 is a tax form used in Oregon.

Q: What is Schedule OR-NRC?

A: Schedule OR-NRC is a part of Form 150-104-003.

Q: What is the Oregon Natural Resource Credit?

A: The Oregon Natural Resource Credit is a tax credit for individuals or businesses that invest in qualifying natural resource projects in Oregon.

Q: Who is eligible for the Oregon Natural Resource Credit?

A: Individuals or businesses that invest in qualifying natural resource projects in Oregon are eligible for the credit.

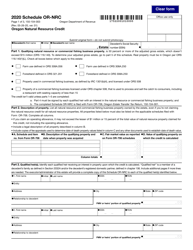

Q: How do I claim the Oregon Natural Resource Credit?

A: You need to complete Schedule OR-NRC and include it with your Oregon tax return.

Q: What information do I need to complete Schedule OR-NRC?

A: You will need information about your qualifying natural resource project, including the project identification number.

Q: What expenses are eligible for the Oregon Natural Resource Credit?

A: Expenses related to qualifying natural resource projects, such as restoration costs or renewable energy equipment costs, may be eligible for the credit.

Q: Is there a limit to the amount of the Oregon Natural Resource Credit?

A: Yes, the credit is limited to 50% of your tax liability for the year.

Q: Can I carry forward unused credits?

A: Yes, you can carry forward unused credits for up to five years.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.