This version of the form is not currently in use and is provided for reference only. Download this version of

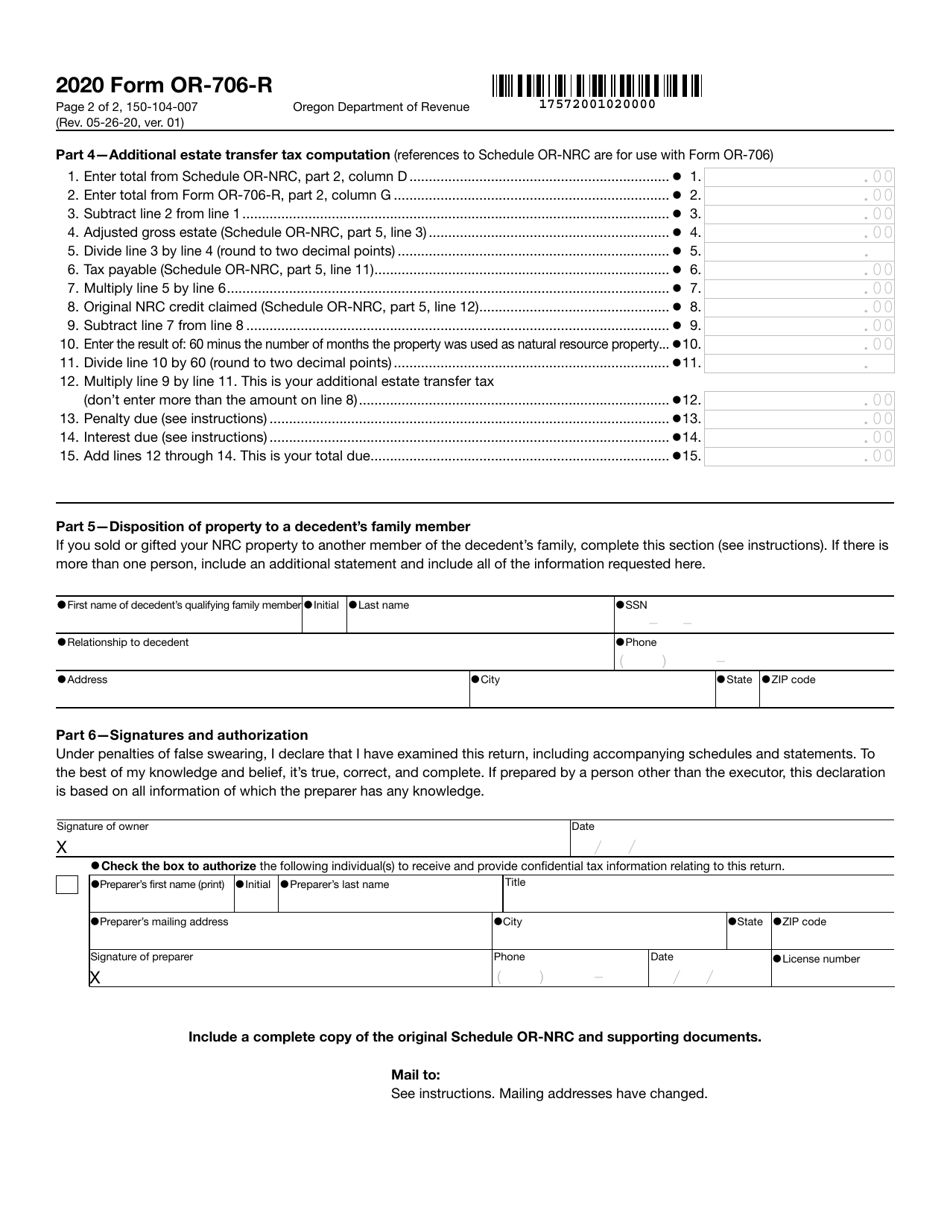

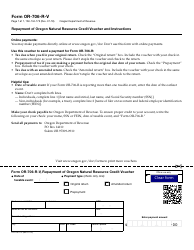

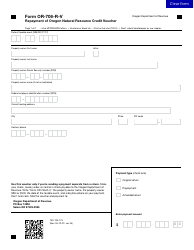

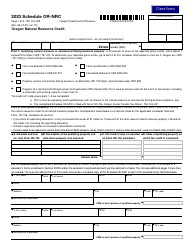

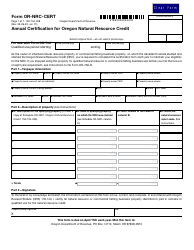

Form OR-706-R (150-104-007)

for the current year.

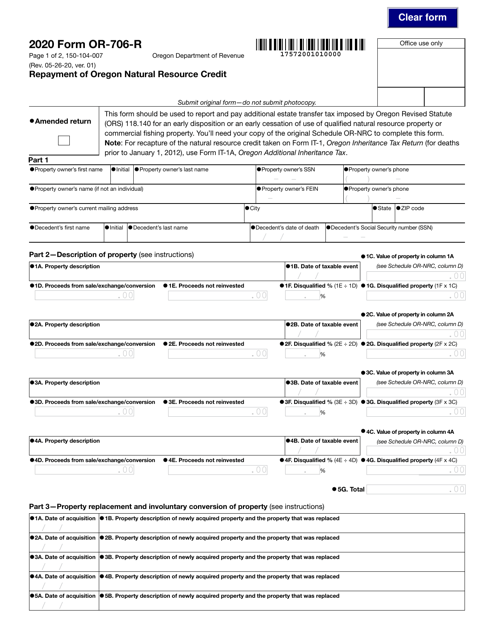

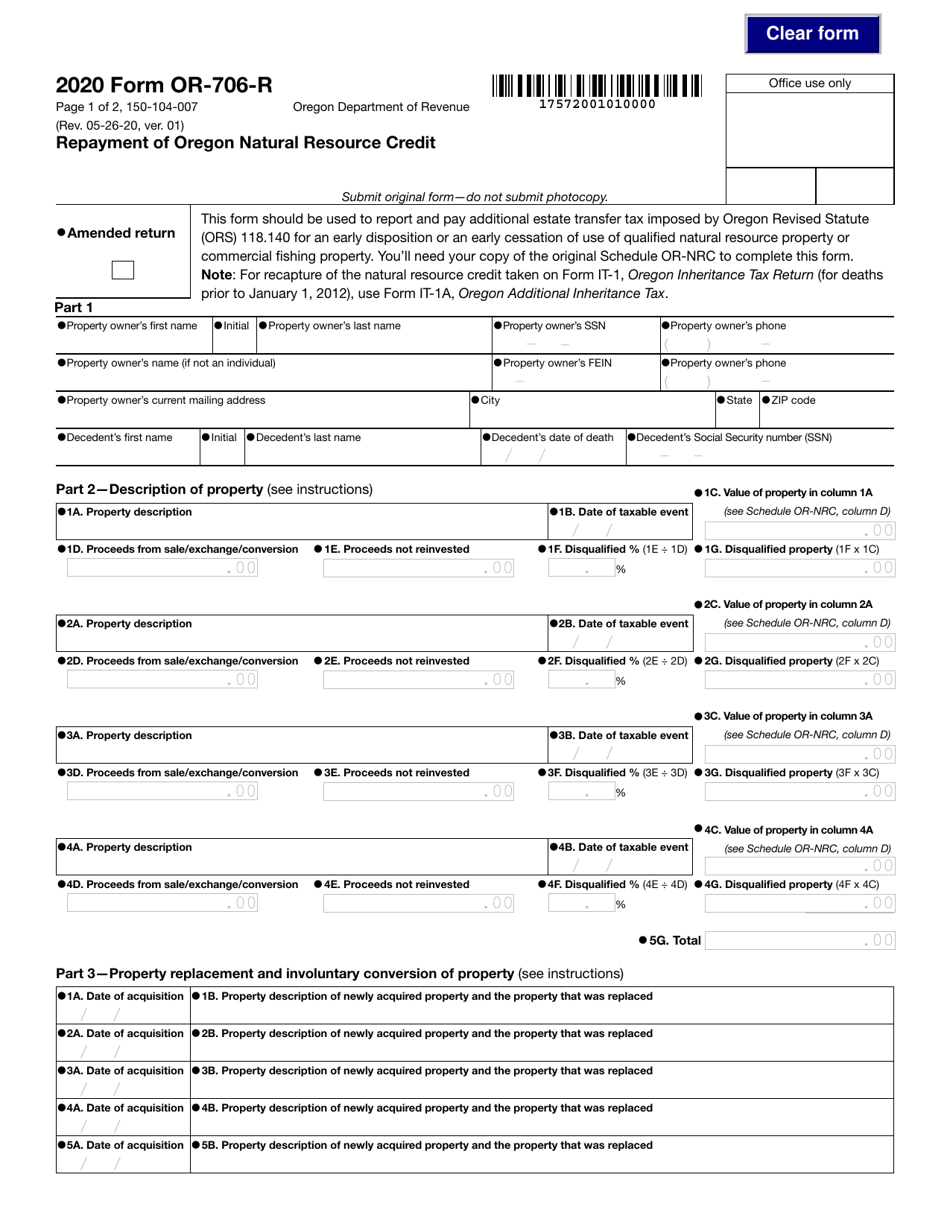

Form OR-706-R (150-104-007) Repayment of Oregon Natural Resource Credit - Oregon

What Is Form OR-706-R (150-104-007)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-706-R?

A: Form OR-706-R is a form used for the repayment of Oregon Natural Resource Credit in Oregon.

Q: What is the purpose of Form OR-706-R?

A: The purpose of Form OR-706-R is to repay the Oregon Natural Resource Credit.

Q: What is the form number for OR-706-R?

A: The form number for OR-706-R is 150-104-007.

Q: What is the Oregon Natural Resource Credit?

A: The Oregon Natural Resource Credit is a credit that can be claimed by qualifying taxpayers for the restoration, enhancement, or protection of Oregon's natural resources.

Q: Who is eligible for the Oregon Natural Resource Credit?

A: Eligibility for the Oregon Natural Resource Credit depends on meeting certain criteria, such as ownership or leasehold interest in Oregon natural resources.

Q: When is Form OR-706-R due?

A: The due date for Form OR-706-R is determined by the Oregon Department of Revenue and can vary.

Q: Are there any penalties for late repayment?

A: Penalties may apply for late repayment of the Oregon Natural Resource Credit. It is important to timely file and repay the credit to avoid penalties.

Q: Is the repayment of the Oregon Natural Resource Credit optional?

A: No, if you claimed the Oregon Natural Resource Credit and are required to repay it, you must file Form OR-706-R and make the repayment.

Q: Can I claim the Oregon Natural Resource Credit again after repaying it?

A: Yes, you may be eligible to claim the Oregon Natural Resource Credit again in future tax years after repaying it.

Form Details:

- Released on May 26, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-706-R (150-104-007) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.