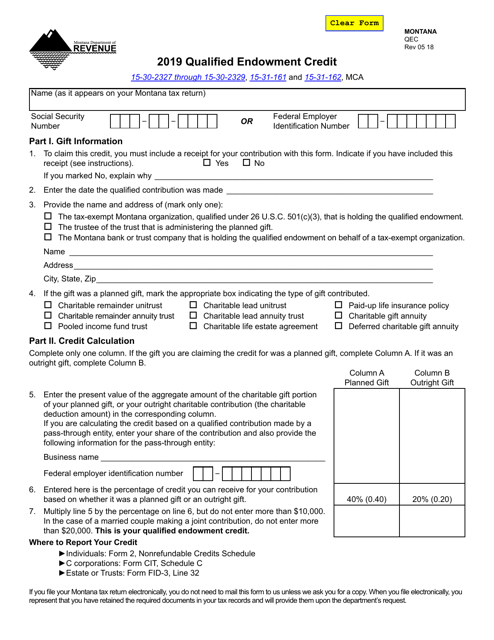

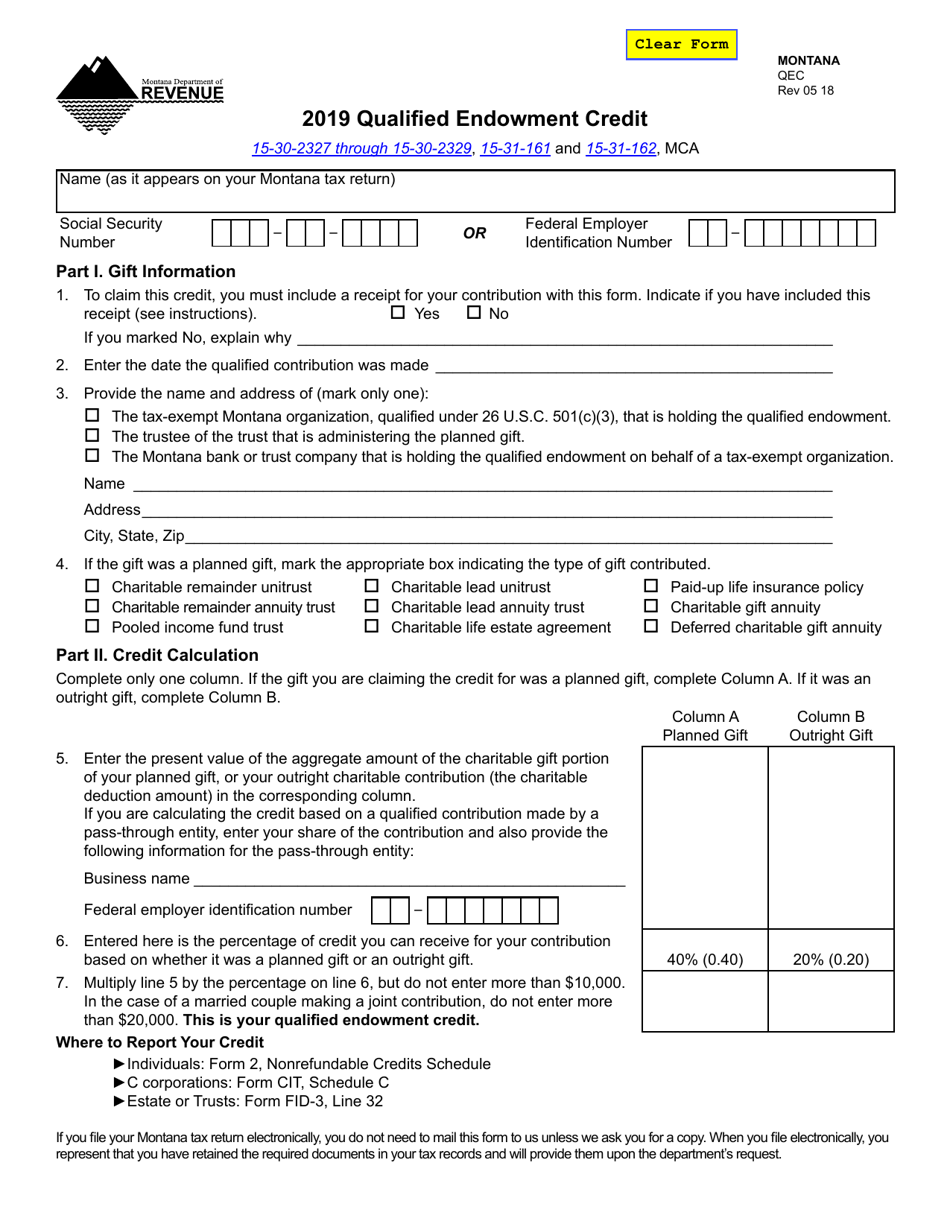

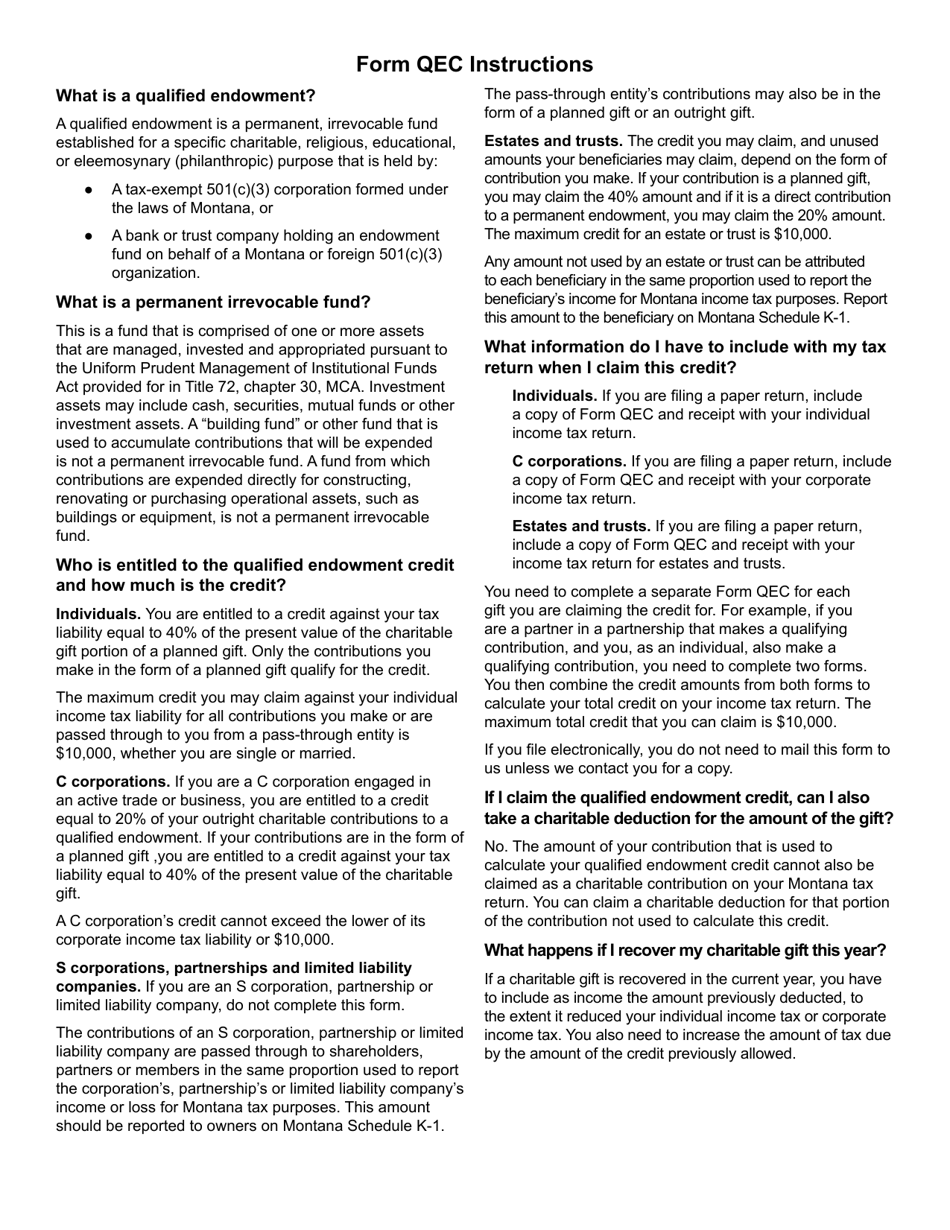

Qualified Endowment Credit - Montana

Qualified Endowment Credit is a legal document that was released by the Montana Department of Revenue - a government authority operating within Montana.

FAQ

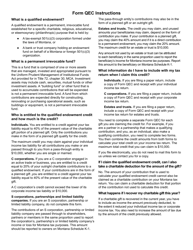

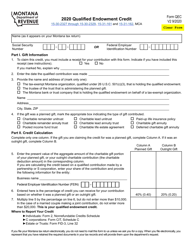

Q: What is the Qualified Endowment Credit?

A: The Qualified Endowment Credit is a tax credit in Montana.

Q: How does the Qualified Endowment Credit work?

A: The credit is available to individuals and businesses that contribute to qualified endowment funds.

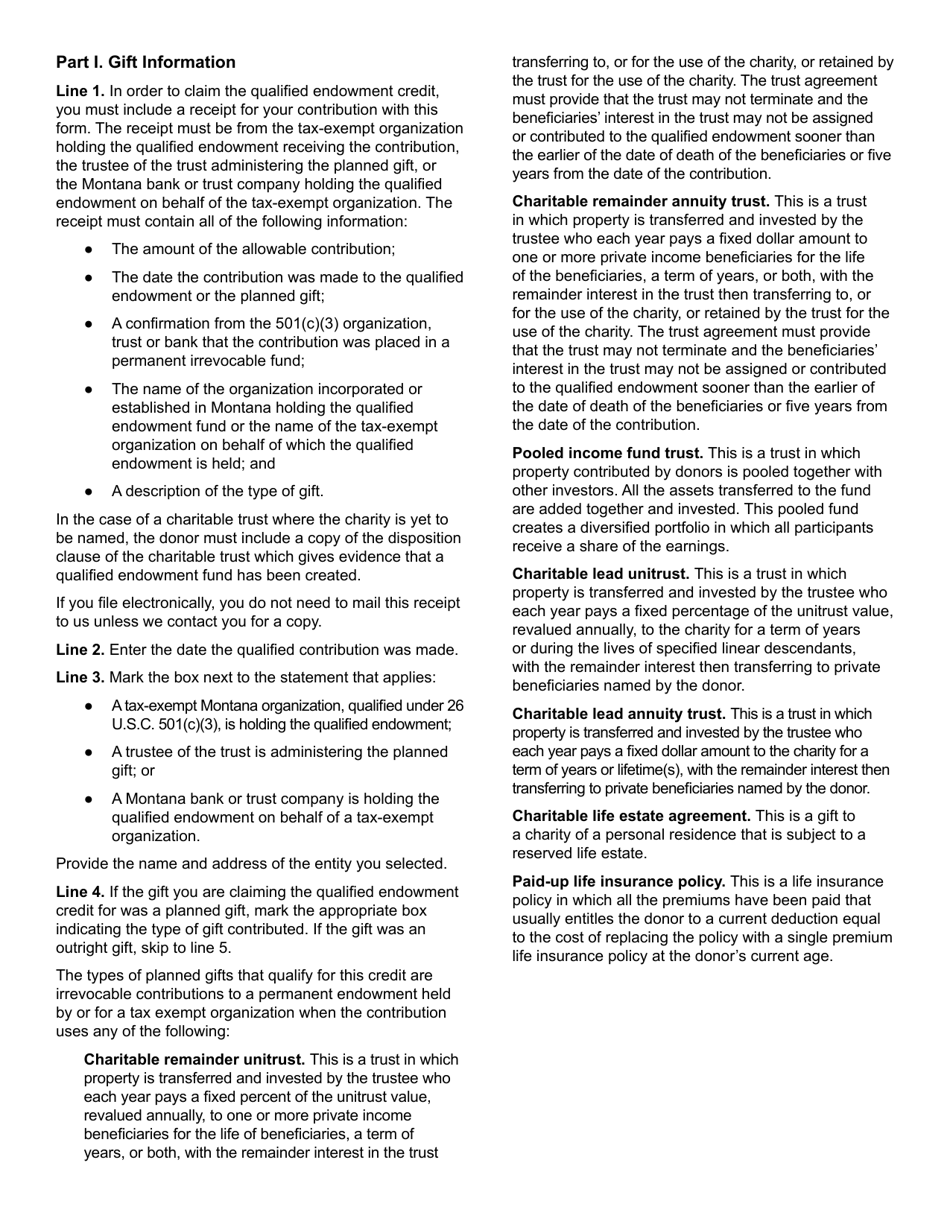

Q: What is a qualified endowment fund?

A: A qualified endowment fund is a permanent fund that is established and maintained by a charitable organization.

Q: What is the purpose of the Qualified Endowment Credit?

A: The credit is designed to encourage donations to qualified endowment funds in Montana.

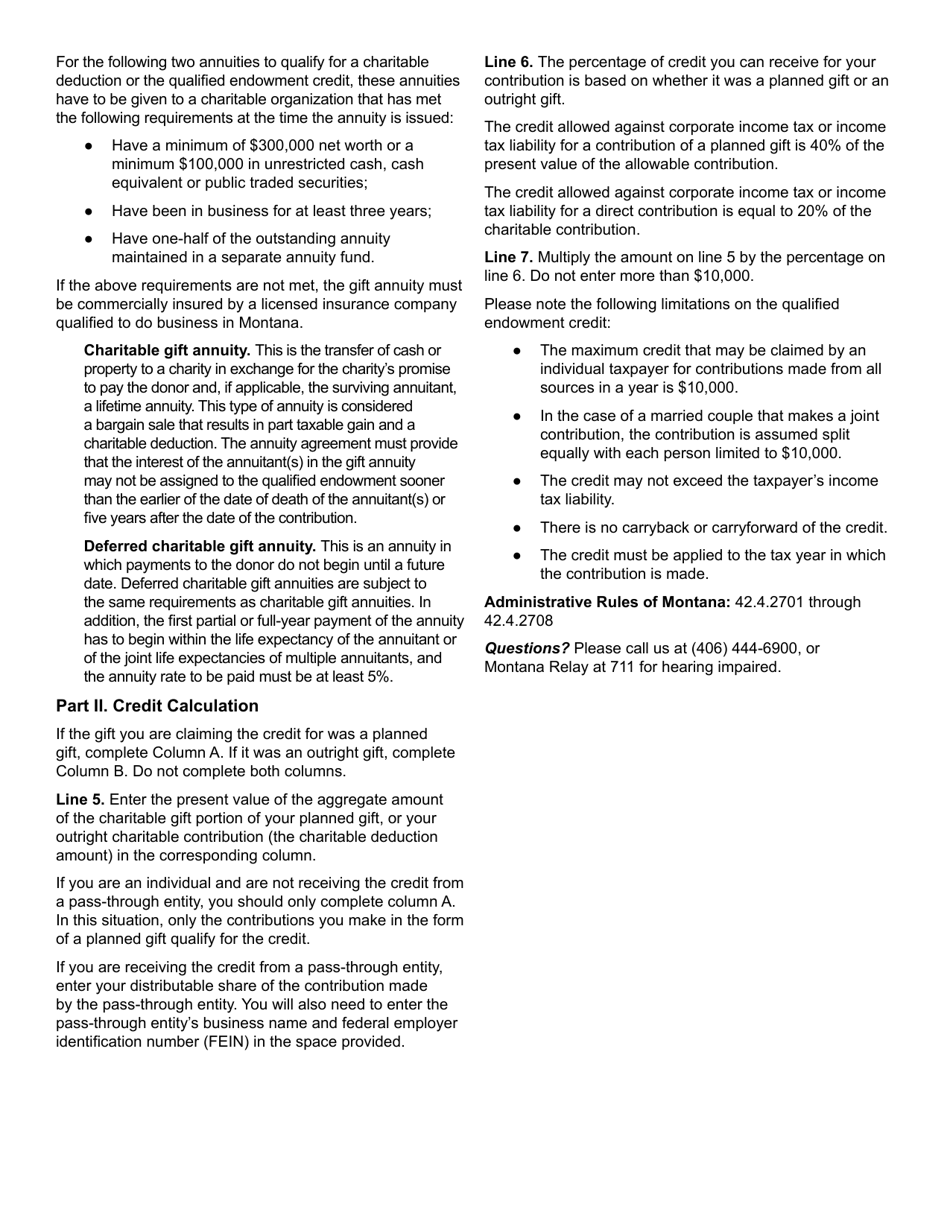

Q: How much can I claim as a credit?

A: The amount of the credit is 40% of the contribution, up to a maximum of $10,000 for individuals and $20,000 for corporations.

Q: Who is eligible for the Qualified Endowment Credit?

A: Individuals and corporations that contribute to qualified endowment funds in Montana are eligible for the credit.

Form Details:

- Released on May 1, 2018;

- The latest edition currently provided by the Montana Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.