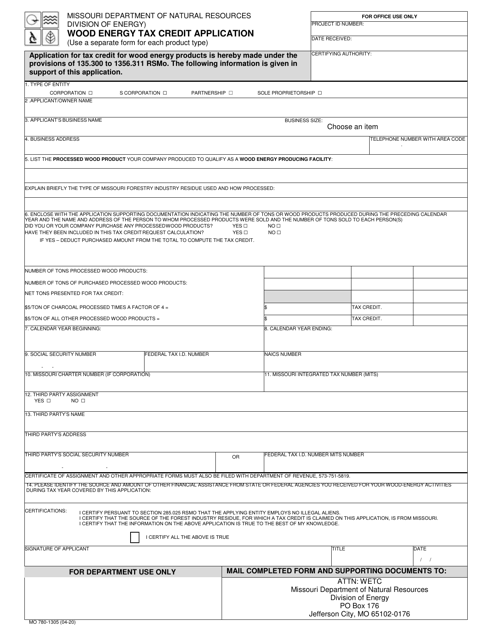

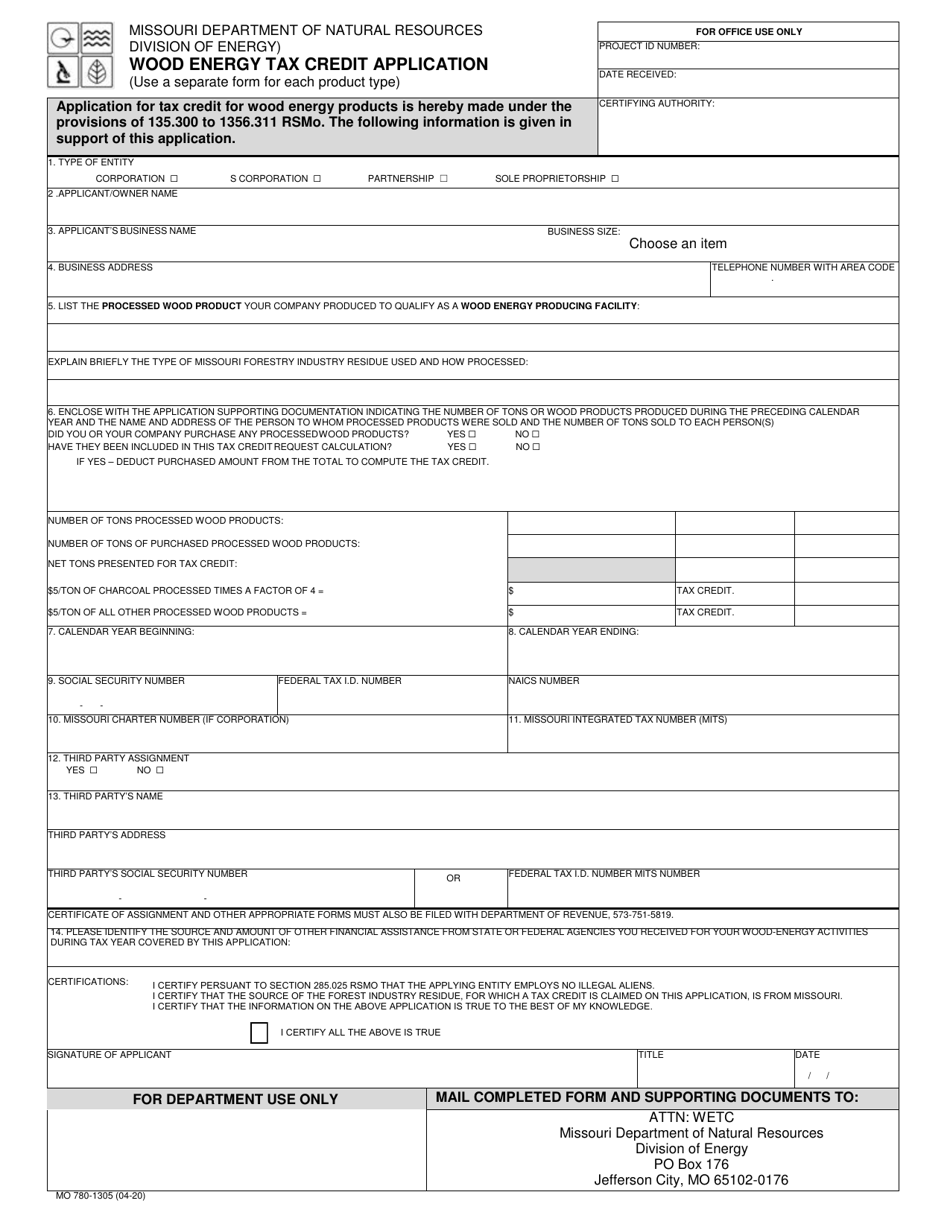

Form MO780-1305 Wood Energy Tax Credit Application - Missouri

What Is Form MO780-1305?

This is a legal form that was released by the Missouri Department of Natural Resources - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO780-1305?

A: Form MO780-1305 is the Wood Energy Tax Credit Application in Missouri.

Q: What is the purpose of Form MO780-1305?

A: The purpose of Form MO780-1305 is to apply for the Wood Energy Tax Credit in Missouri.

Q: What is the Wood Energy Tax Credit?

A: The Wood Energy Tax Credit is a tax credit offered in Missouri for using biomass as a source of energy.

Q: Who is eligible to apply for the Wood Energy Tax Credit?

A: Any individual or business in Missouri that uses biomass for energy purposes may be eligible for the Wood Energy Tax Credit.

Q: What is considered biomass for the Wood Energy Tax Credit?

A: Biomass for the Wood Energy Tax Credit includes wood chips, wood waste, and other forms of organic material that can be converted into energy.

Q: Are there any supporting documents required with Form MO780-1305?

A: Yes, you may be required to submit supporting documentation such as receipts and proof of biomass usage along with Form MO780-1305.

Q: How long does it take to process Form MO780-1305?

A: The processing time for Form MO780-1305 can vary. It is recommended to allow several weeks for processing and to check the status of your application with the Missouri Department of Revenue.

Q: Is the Wood Energy Tax Credit refundable?

A: No, the Wood Energy Tax Credit is not refundable. It can only be used to offset your Missouri state tax liability.

Q: Can I claim the Wood Energy Tax Credit for multiple years?

A: Yes, if you continue to meet the eligibility requirements, you can claim the Wood Energy Tax Credit for multiple tax years in Missouri.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Missouri Department of Natural Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO780-1305 by clicking the link below or browse more documents and templates provided by the Missouri Department of Natural Resources.