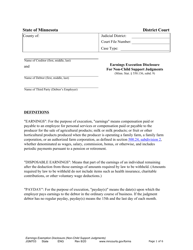

Form JGM701 Instructions - Execution Levy on Earnings - Minnesota

What Is Form JGM701?

This is a legal form that was released by the Minnesota Judicial Branch - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form JGM701?

A: Form JGM701 is a form used in Minnesota for executing a levy on earnings.

Q: What is a levy on earnings?

A: A levy on earnings is a legal process where a creditor can take a portion of a debtor's earnings to satisfy a debt.

Q: Who can use Form JGM701?

A: Form JGM701 can be used by creditors in Minnesota who want to execute a levy on a debtor's earnings.

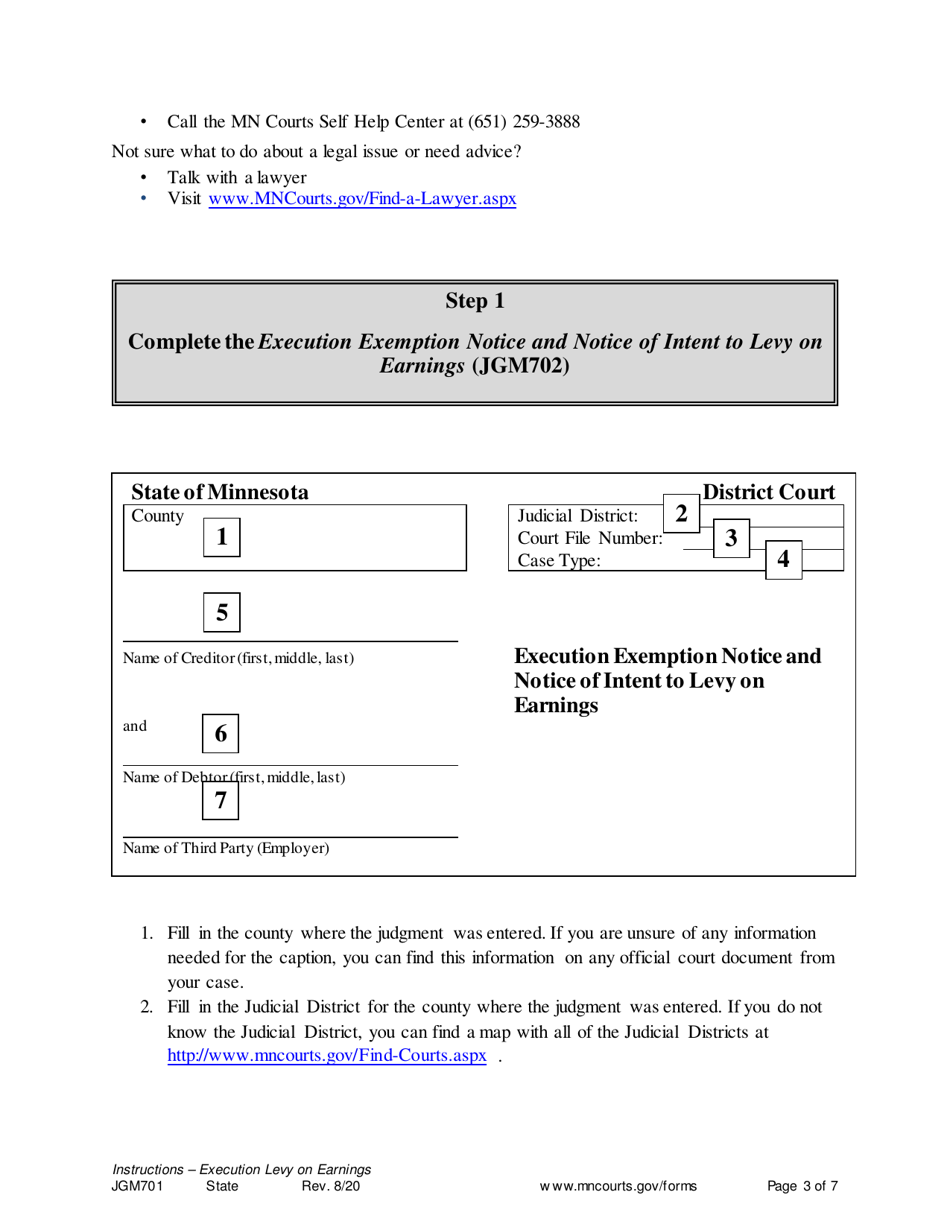

Q: What information is required on Form JGM701?

A: Form JGM701 requires information such as the debtor's name, address, and employer, as well as the amount of the debt.

Q: How can Form JGM701 be filed?

A: Form JGM701 can be filed with the court electronically or by mail.

Q: Are there any fees for filing Form JGM701?

A: Yes, there are fees associated with filing Form JGM701. The amount varies depending on the county where it is filed.

Q: Can Form JGM701 be used to levy on earnings outside of Minnesota?

A: No, Form JGM701 is specific to executing a levy on earnings in Minnesota.

Q: What happens after Form JGM701 is filed?

A: After Form JGM701 is filed, the court will review the form and if approved, the creditor can begin the process of collecting from the debtor's earnings.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Minnesota Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form JGM701 by clicking the link below or browse more documents and templates provided by the Minnesota Judicial Branch.