This version of the form is not currently in use and is provided for reference only. Download this version of

Form FIS1040

for the current year.

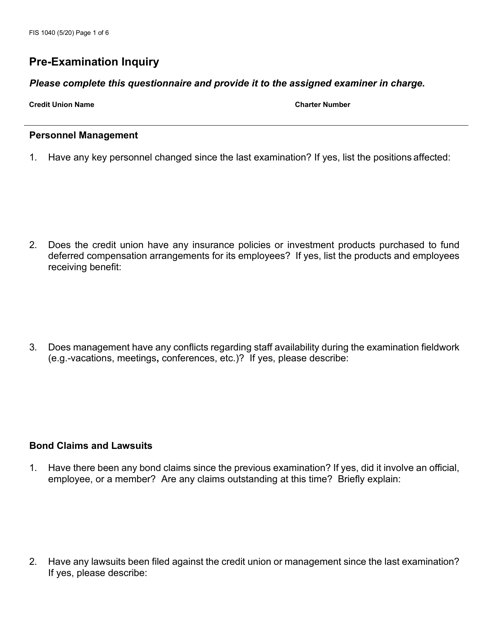

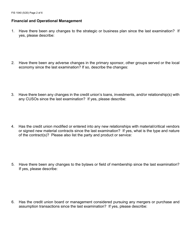

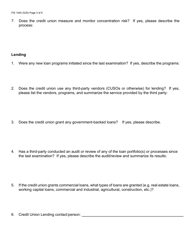

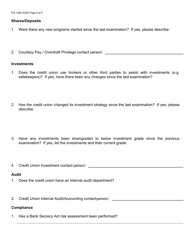

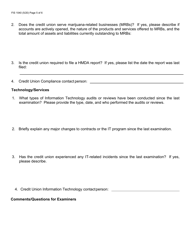

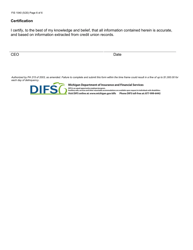

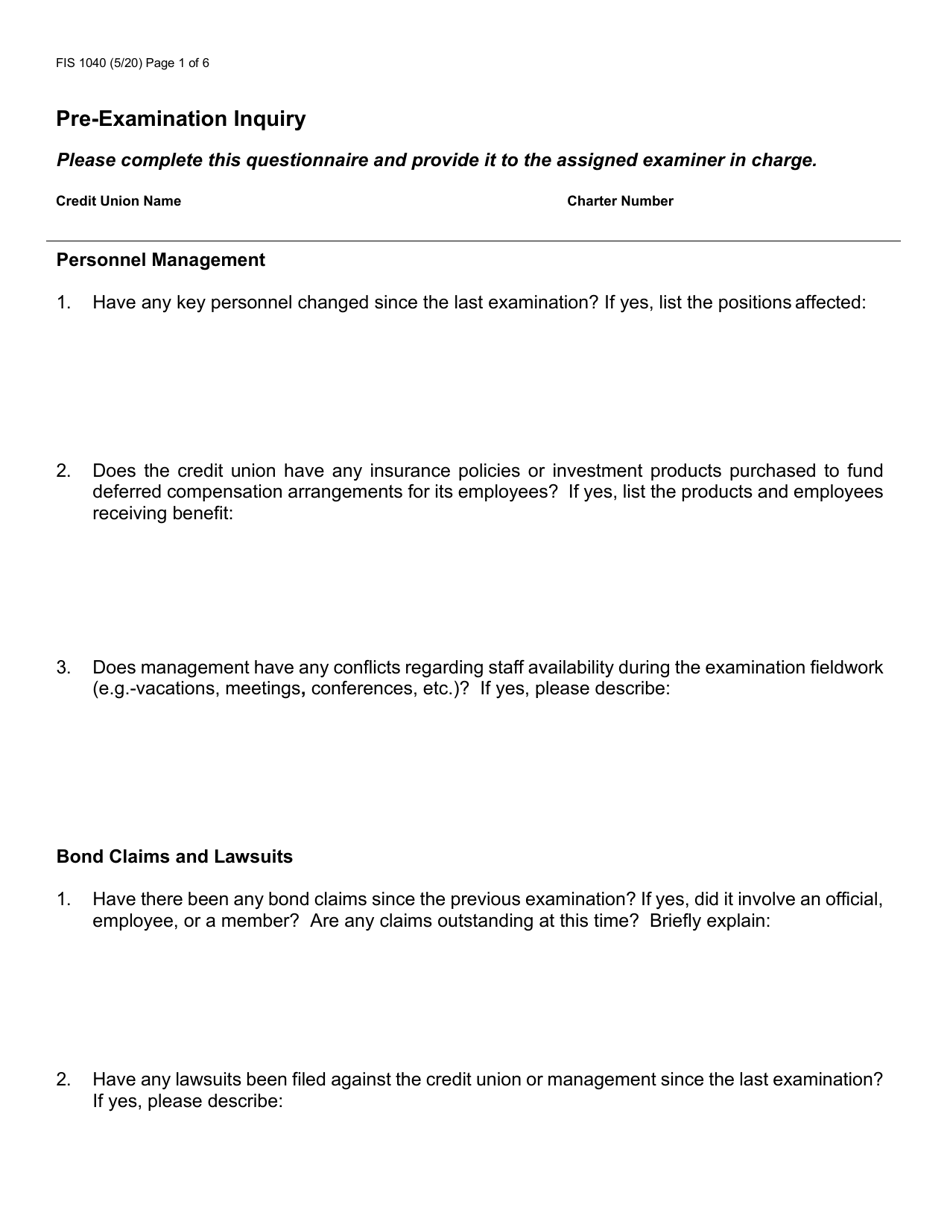

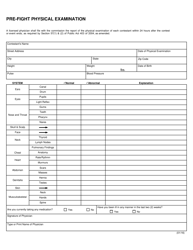

Form FIS1040 Pre-examination Inquiry - Michigan

What Is Form FIS1040?

This is a legal form that was released by the Michigan Department of Insurance and Financial Services - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form FIS1040?

A: Form FIS1040 is a pre-examination inquiry form used in Michigan.

Q: What is the purpose of the Form FIS1040?

A: The purpose of the Form FIS1040 is to facilitate the pre-examination process for specific tax situations in Michigan.

Q: Who uses the Form FIS1040?

A: The Form FIS1040 is used by individuals and businesses in Michigan who need to initiate a pre-examination inquiry.

Q: What is a pre-examination inquiry?

A: A pre-examination inquiry is a formal request for review and clarification of specific tax issues before an actual examination.

Q: What information is required on the Form FIS1040?

A: The Form FIS1040 requires detailed information about the specific tax issue, including relevant tax years and any supporting documentation.

Q: Is there a deadline for submitting the Form FIS1040?

A: Yes, there is a deadline for submitting the Form FIS1040, which is specified on the form.

Q: Can I submit the Form FIS1040 electronically?

A: No, the Form FIS1040 must be submitted in paper format by mail or in person.

Q: What happens after I submit the Form FIS1040?

A: After you submit the Form FIS1040, the Michigan Department of Treasury will review your request and provide a written response with further instructions.

Q: Can I appeal the decision made based on the Form FIS1040?

A: Yes, you have the right to appeal the decision made by the Michigan Department of Treasury based on the Form FIS1040.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Michigan Department of Insurance and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIS1040 by clicking the link below or browse more documents and templates provided by the Michigan Department of Insurance and Financial Services.