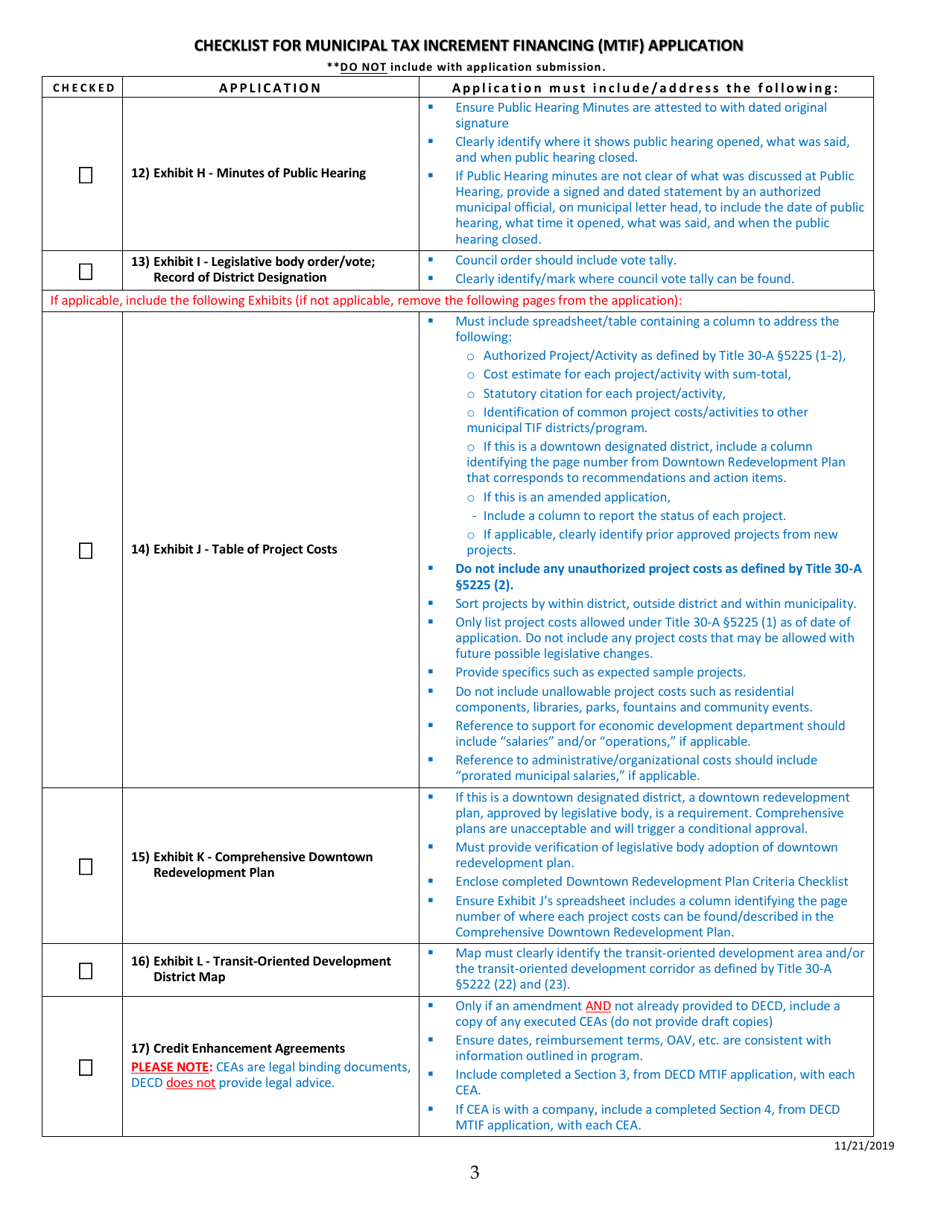

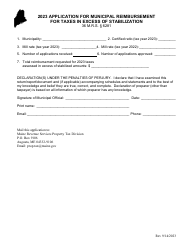

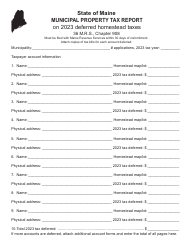

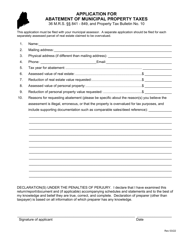

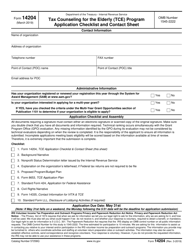

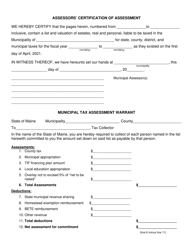

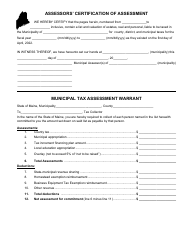

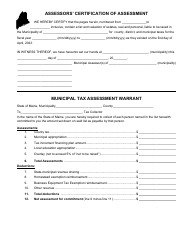

Checklist for Municipal Tax Increment Financing (Mtif) Application - Maine

Checklist for Municipal Tax Increment Financing (Mtif) Application is a legal document that was released by the Maine Department of Economic & Community Development - a government authority operating within Maine.

FAQ

Q: What is Municipal Tax Increment Financing (MTIF) in Maine?

A: Municipal Tax Increment Financing (MTIF) is a program in Maine that allows municipalities to use property tax revenue from a specific development project to fund public infrastructure improvements within the designated district.

Q: How can a municipality apply for MTIF?

A: To apply for MTIF, a municipality must complete and submit the MTIF Application to the Economic and Community Development Department in Maine.

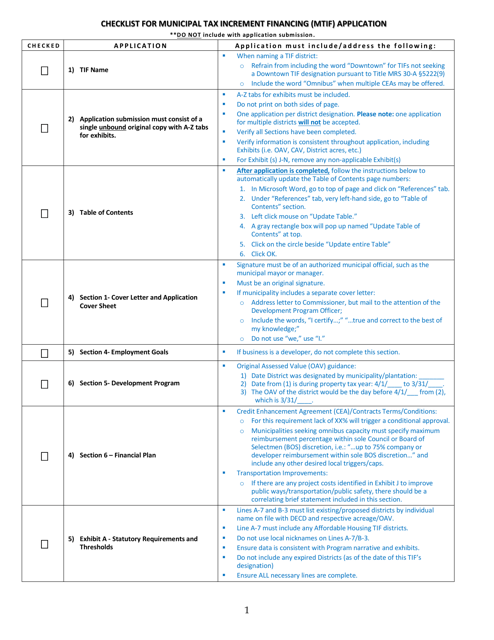

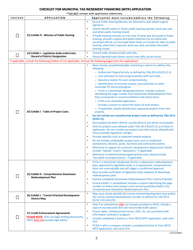

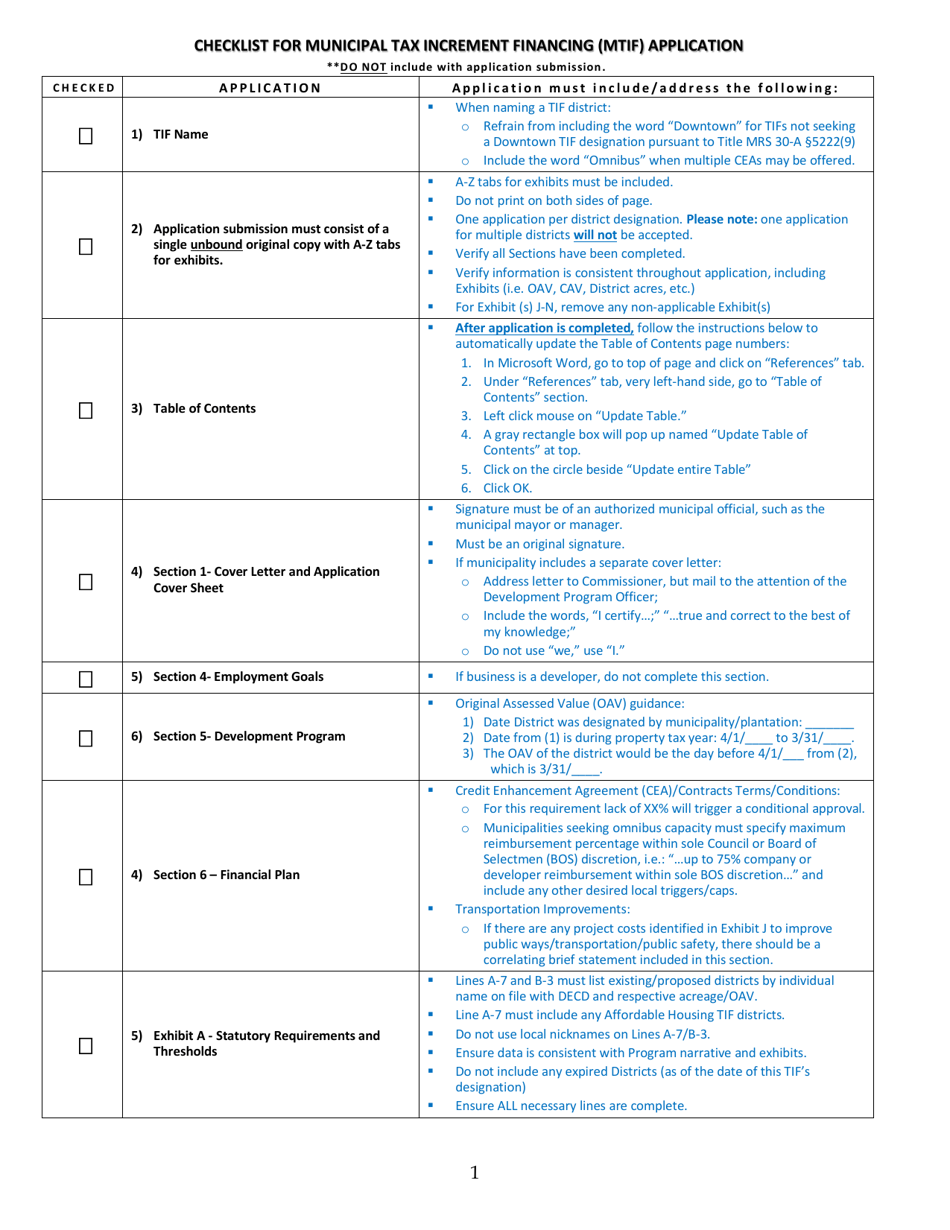

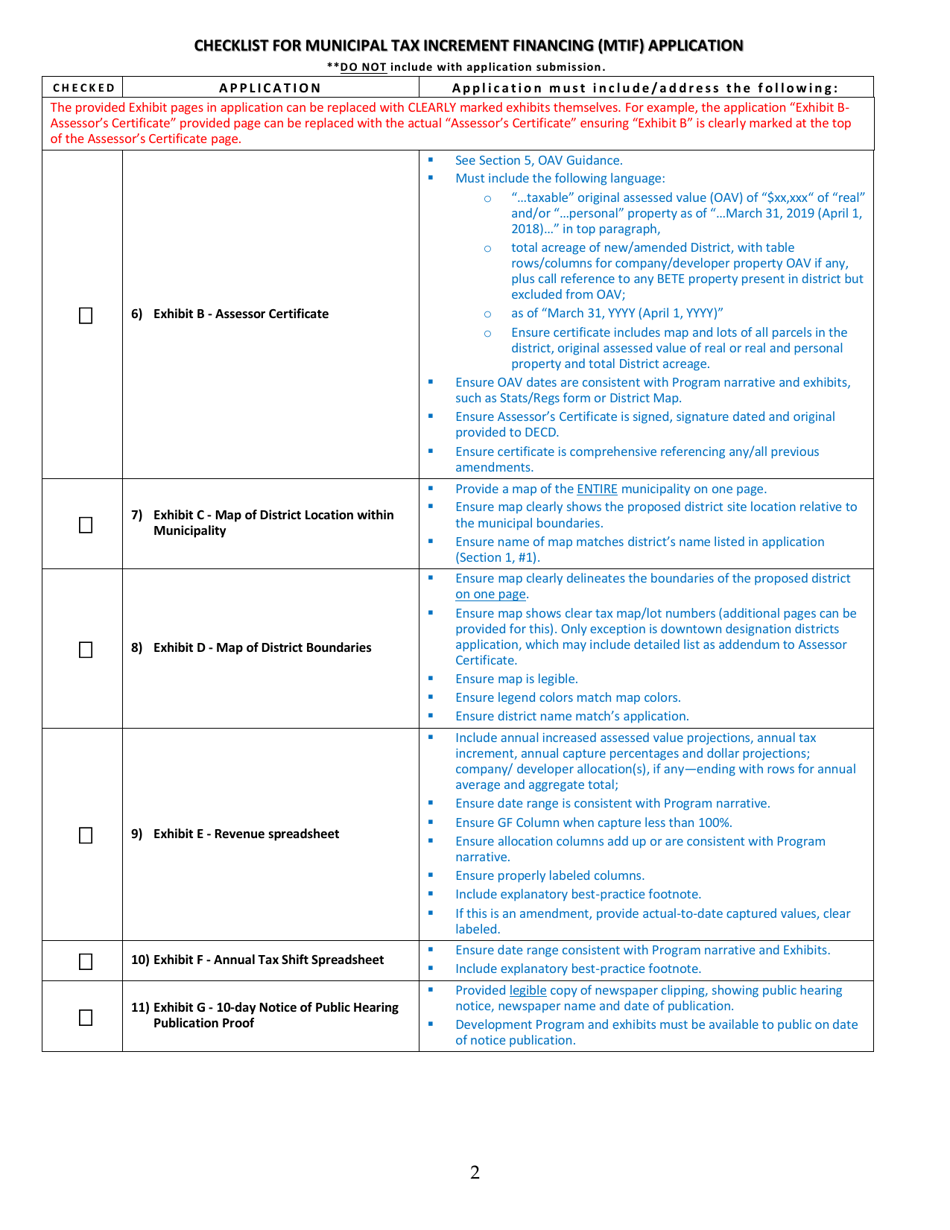

Q: What should be included in the MTIF Application?

A: The MTIF Application should include a project description, a project financing plan, a summary of the public infrastructure improvements to be funded, and evidence of community support for the project.

Q: Who reviews the MTIF Application?

A: The MTIF Application is reviewed by the Economic and Community Development Department, which evaluates the project's economic impact, financial feasibility, and compliance with MTIF program guidelines.

Q: What happens after the MTIF Application is approved?

A: Once the MTIF Application is approved, the municipality can enter into a Tax Increment Financing Agreement with the property owner. This agreement outlines the terms and conditions of the financial benefits provided by MTIF.

Q: What are the benefits of MTIF?

A: MTIF can provide municipalities with the opportunity to fund public infrastructure improvements without relying on traditional tax revenue. It can also stimulate economic development and attract new businesses to the area.

Q: Are there any requirements or restrictions for MTIF projects?

A: Yes, MTIF projects must meet certain criteria and comply with program guidelines. The project must demonstrate a public benefit, have a positive impact on the local economy, and be consistent with the municipality's comprehensive plan.

Q: How long does the MTIF financing last?

A: The duration of MTIF financing varies depending on the project, but it typically lasts for a specified number of years, during which the municipality can collect a portion of the property tax revenue generated by the development.

Q: Can a municipality terminate an MTIF agreement?

A: Yes, a municipality can terminate an MTIF agreement if the project fails to meet its obligations or if there is a breach of the agreement's terms and conditions.

Form Details:

- Released on November 21, 2019;

- The latest edition currently provided by the Maine Department of Economic & Community Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Economic & Community Development.