This version of the form is not currently in use and is provided for reference only. Download this version of

Form FRD-1 (State Form 55213)

for the current year.

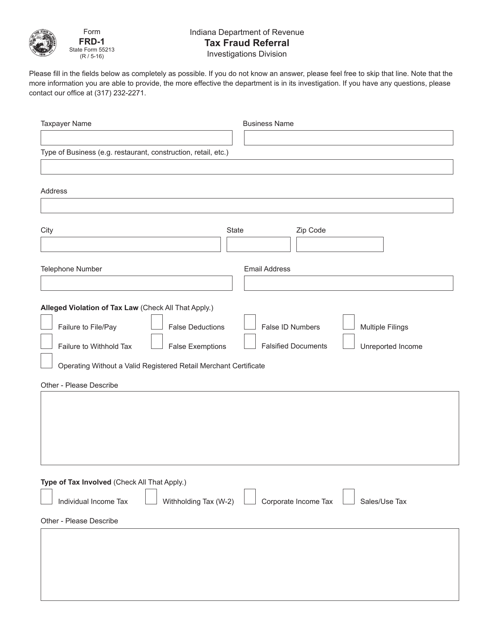

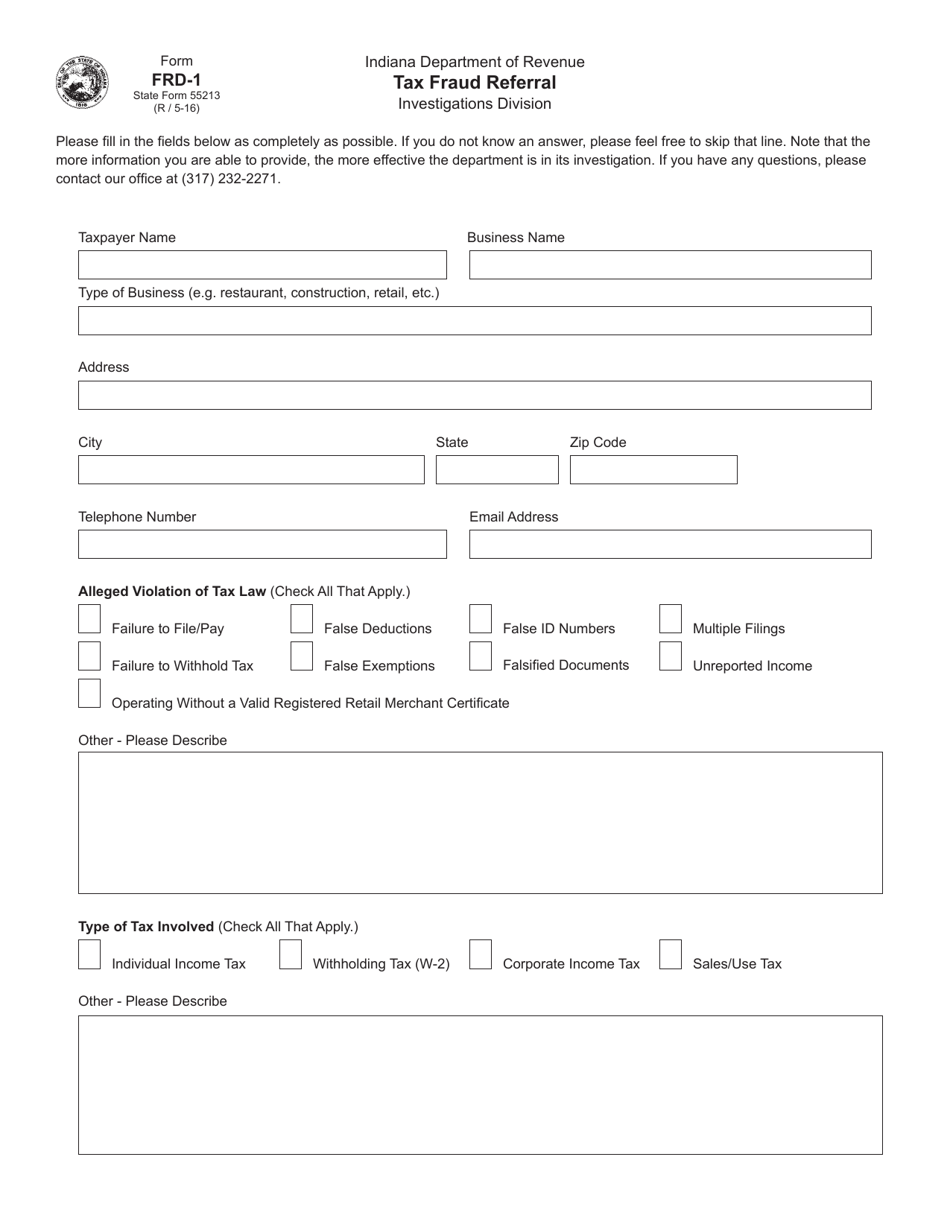

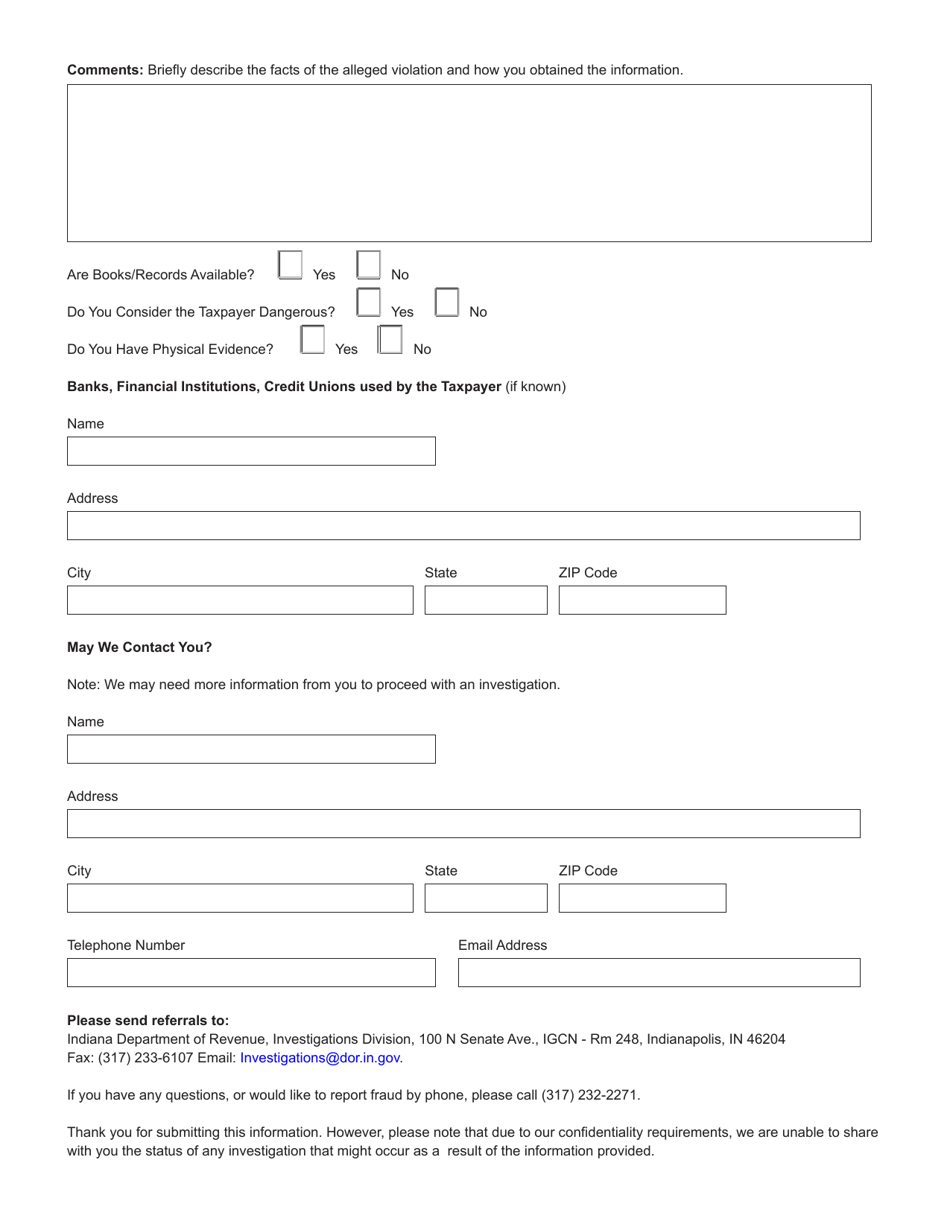

Form FRD-1 (State Form 55213) Tax Fraud Referral - Indiana

What Is Form FRD-1 (State Form 55213)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FRD-1?

A: Form FRD-1 (State Form 55213) is a Tax Fraud Referral form used in Indiana.

Q: What is the purpose of Form FRD-1?

A: The purpose of Form FRD-1 is to report suspected tax fraud to the Indiana Department of Revenue.

Q: Who can use Form FRD-1?

A: Anyone who suspects tax fraud in Indiana can use Form FRD-1 to make a referral.

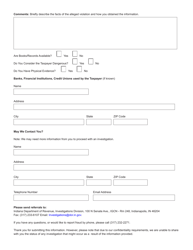

Q: What information is required on Form FRD-1?

A: Form FRD-1 requires information about the suspected fraudster, details about the alleged fraud, and contact information of the person making the referral.

Q: Can I remain anonymous when submitting Form FRD-1?

A: Yes, you can choose to remain anonymous when submitting Form FRD-1.

Q: What happens after I submit Form FRD-1?

A: The Indiana Department of Revenue will review the information provided on Form FRD-1 and investigate the alleged tax fraud.

Q: Is there a deadline for submitting Form FRD-1?

A: There is no specific deadline for submitting Form FRD-1, but it is recommended to report suspected tax fraud as soon as possible.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FRD-1 (State Form 55213) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.