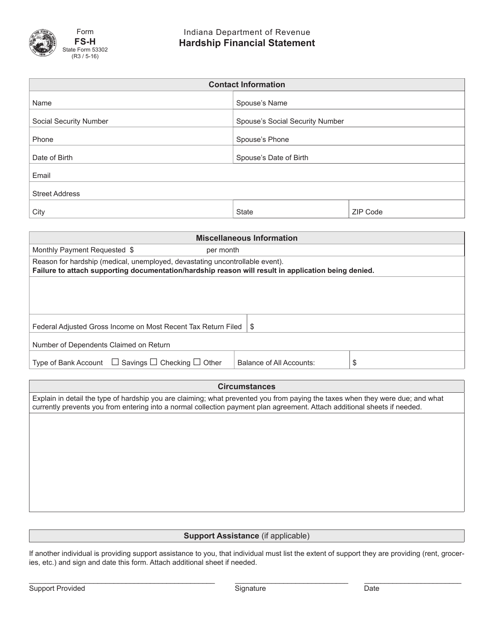

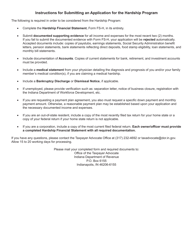

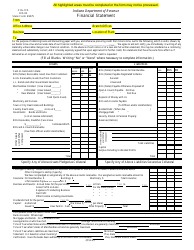

Form FS-H (State Form 53302) Hardship Financial Statement - Indiana

What Is Form FS-H (State Form 53302)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FS-H?

A: Form FS-H is the Hardship Financial Statement, also known as State Form 53302, used in the state of Indiana.

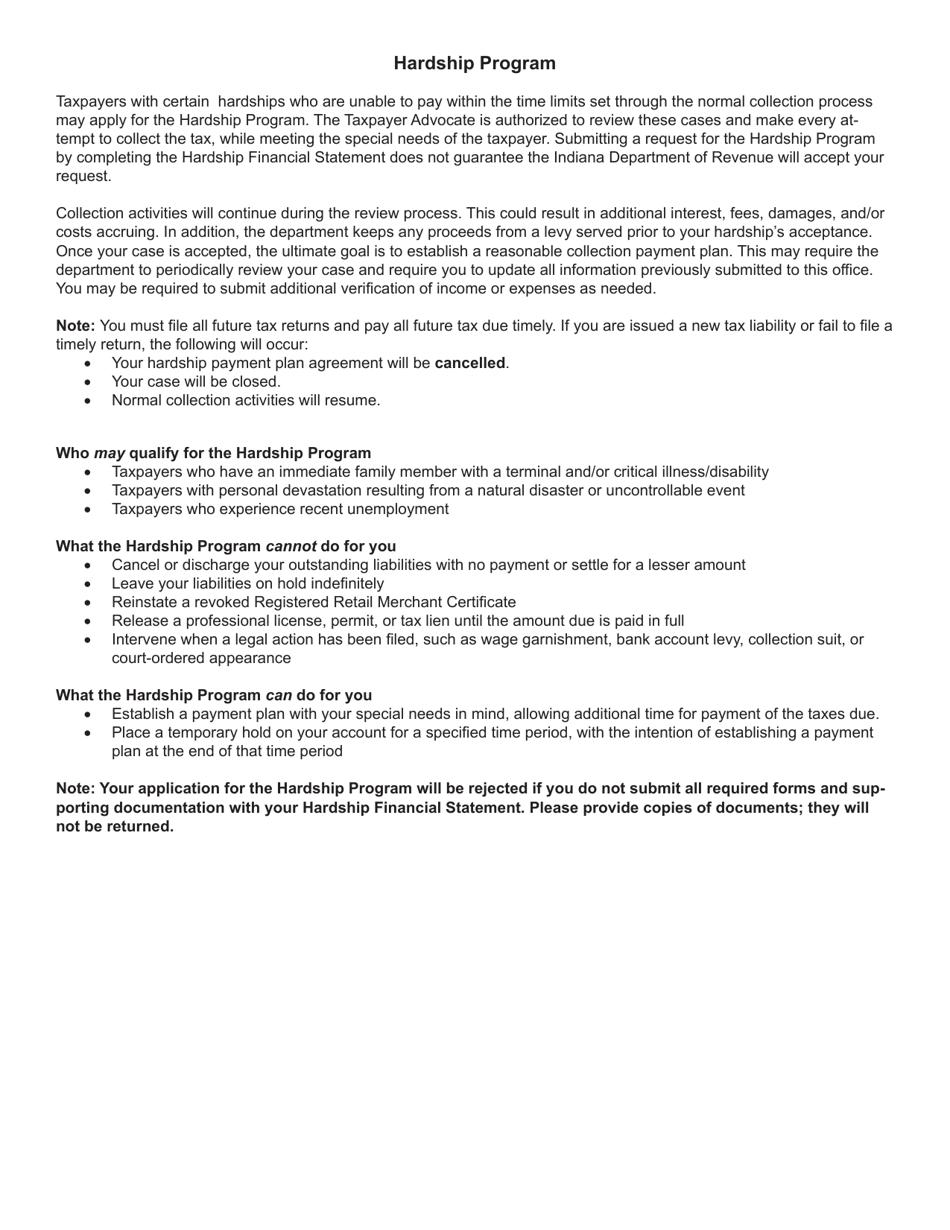

Q: What is the purpose of Form FS-H?

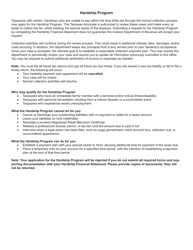

A: The purpose of Form FS-H is to assess a person's financial situation and determine if they qualify for certain financial assistance programs in Indiana.

Q: Who needs to fill out Form FS-H?

A: Individuals who wish to apply for financial assistance programs in Indiana may need to fill out Form FS-H.

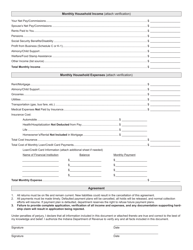

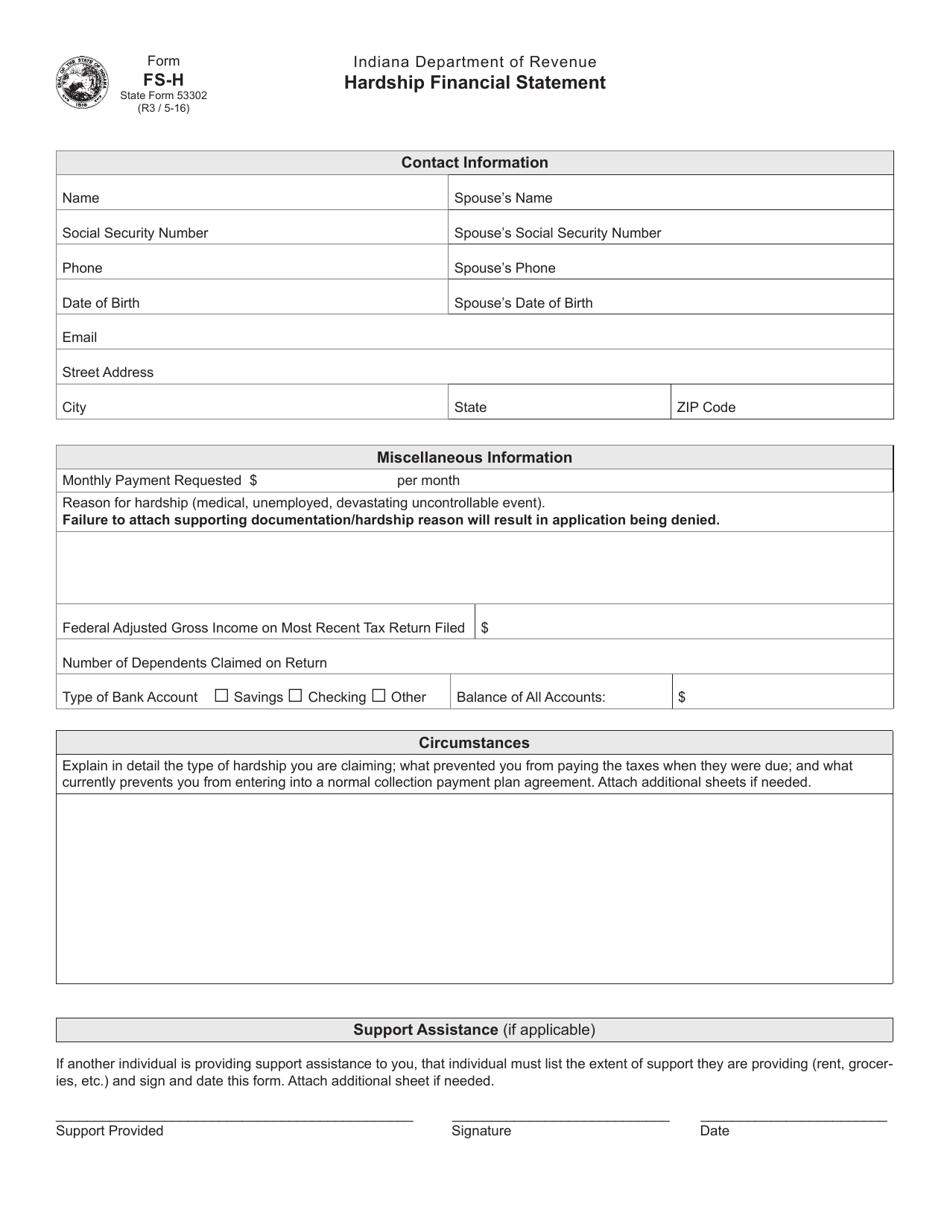

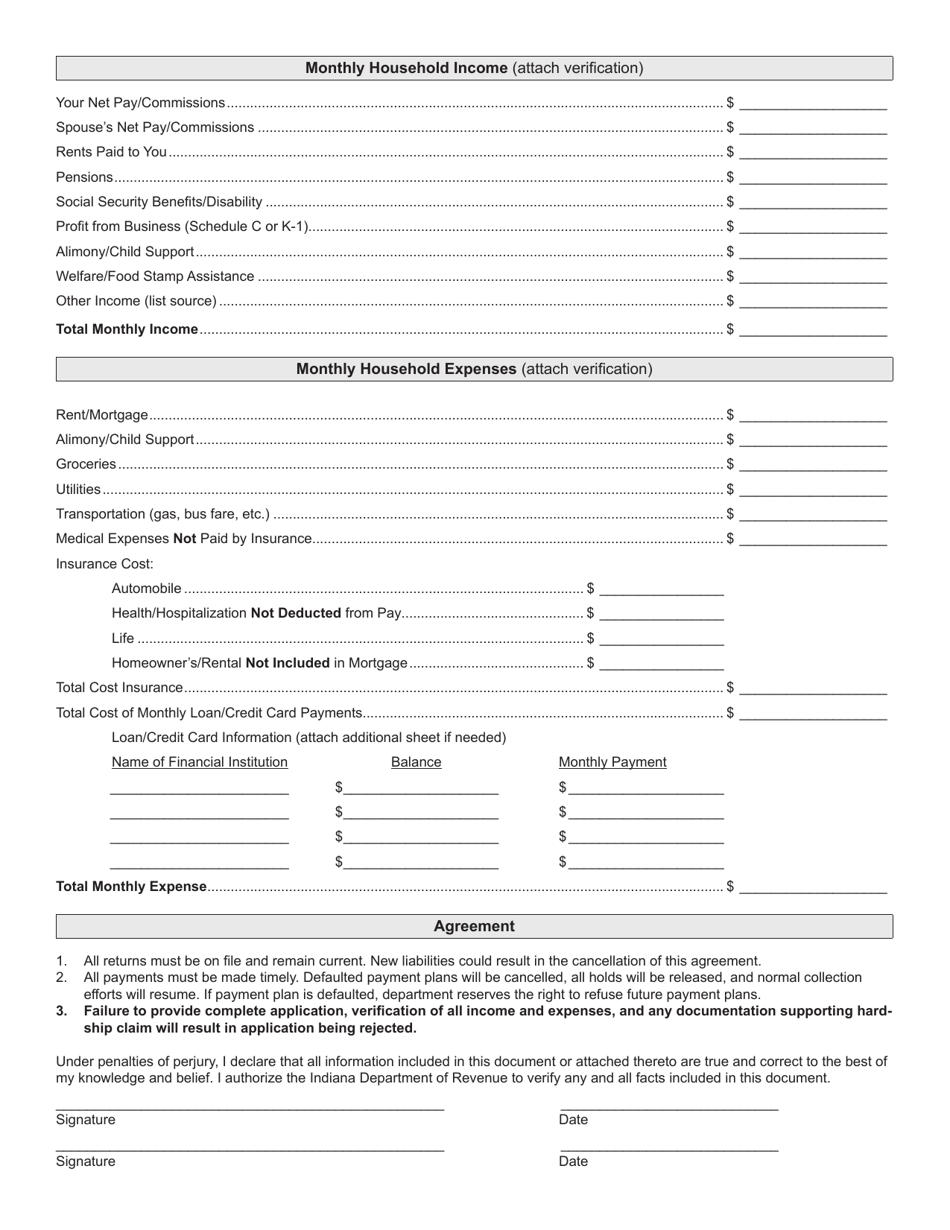

Q: What information is required on Form FS-H?

A: Form FS-H requires information about your income, expenses, assets, and liabilities, as well as any special circumstances affecting your financial situation.

Q: Is Form FS-H only for Indiana residents?

A: Yes, Form FS-H is specifically for Indiana residents who need to apply for financial assistance programs in the state.

Q: Are there any fees associated with submitting Form FS-H?

A: No, there are no fees associated with submitting Form FS-H.

Q: Can someone help me fill out Form FS-H?

A: Yes, you can seek assistance from the relevant government offices or agencies that offer financial assistance programs in Indiana.

Q: What should I do after completing Form FS-H?

A: After completing Form FS-H, you should submit it to the appropriate government office or agency as instructed in the program guidelines.

Q: How long does it take to process Form FS-H?

A: The processing time for Form FS-H may vary depending on the specific financial assistance program and the workload of the government office or agency handling the applications.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FS-H (State Form 53302) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.