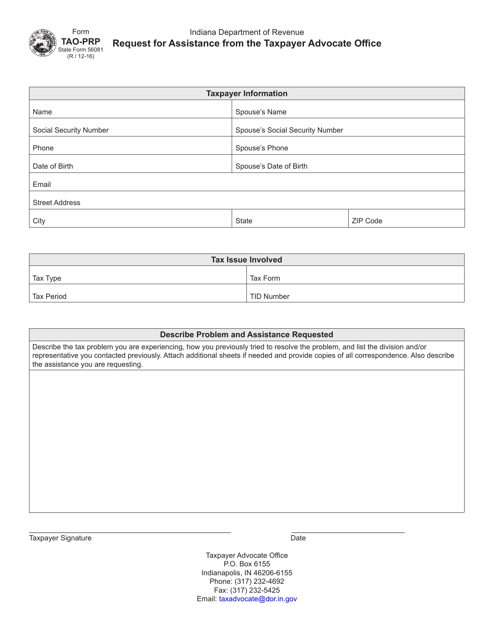

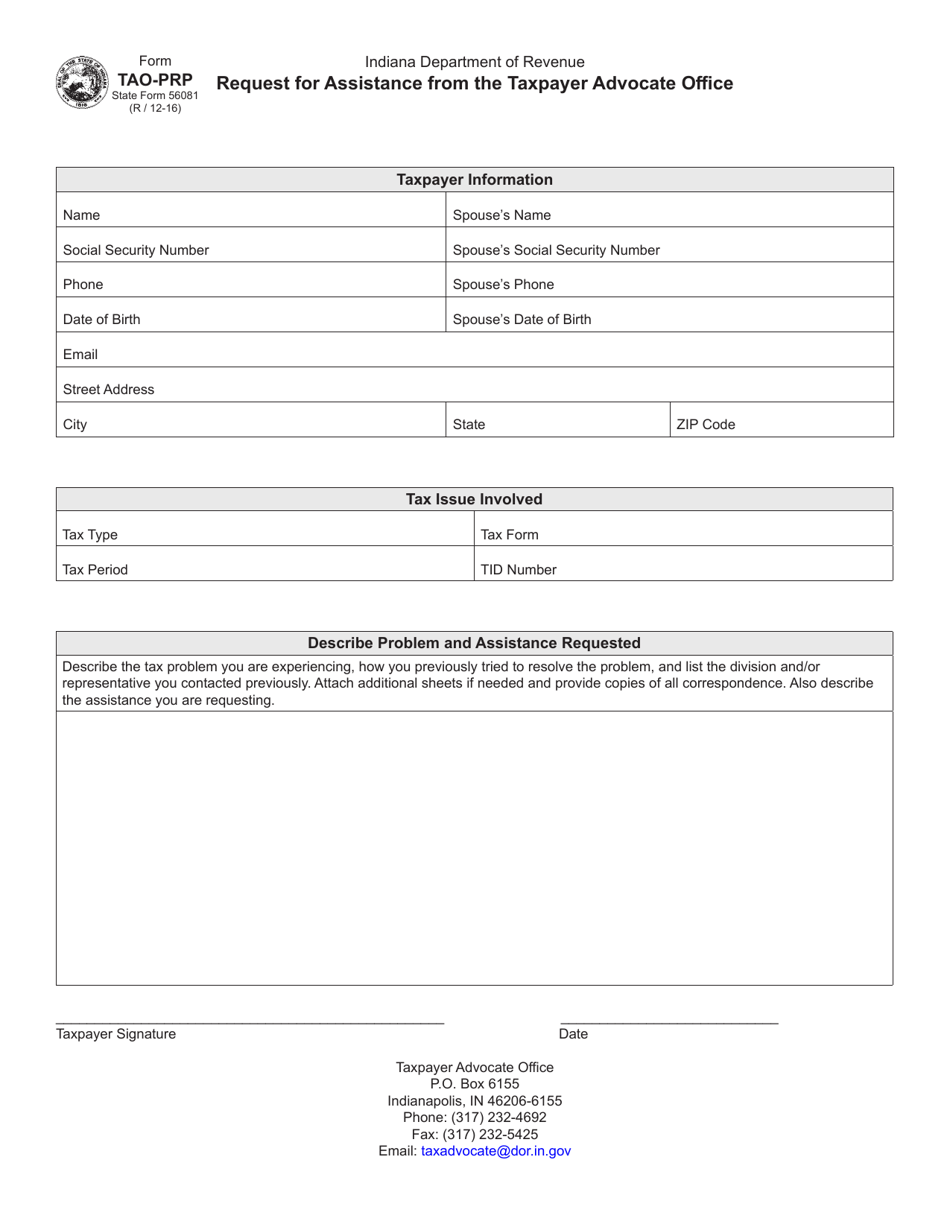

Form TAO-PRP (State Form 56081) Request for Assistance From the Taxpayer Advocate Office - Indiana

What Is Form TAO-PRP (State Form 56081)?

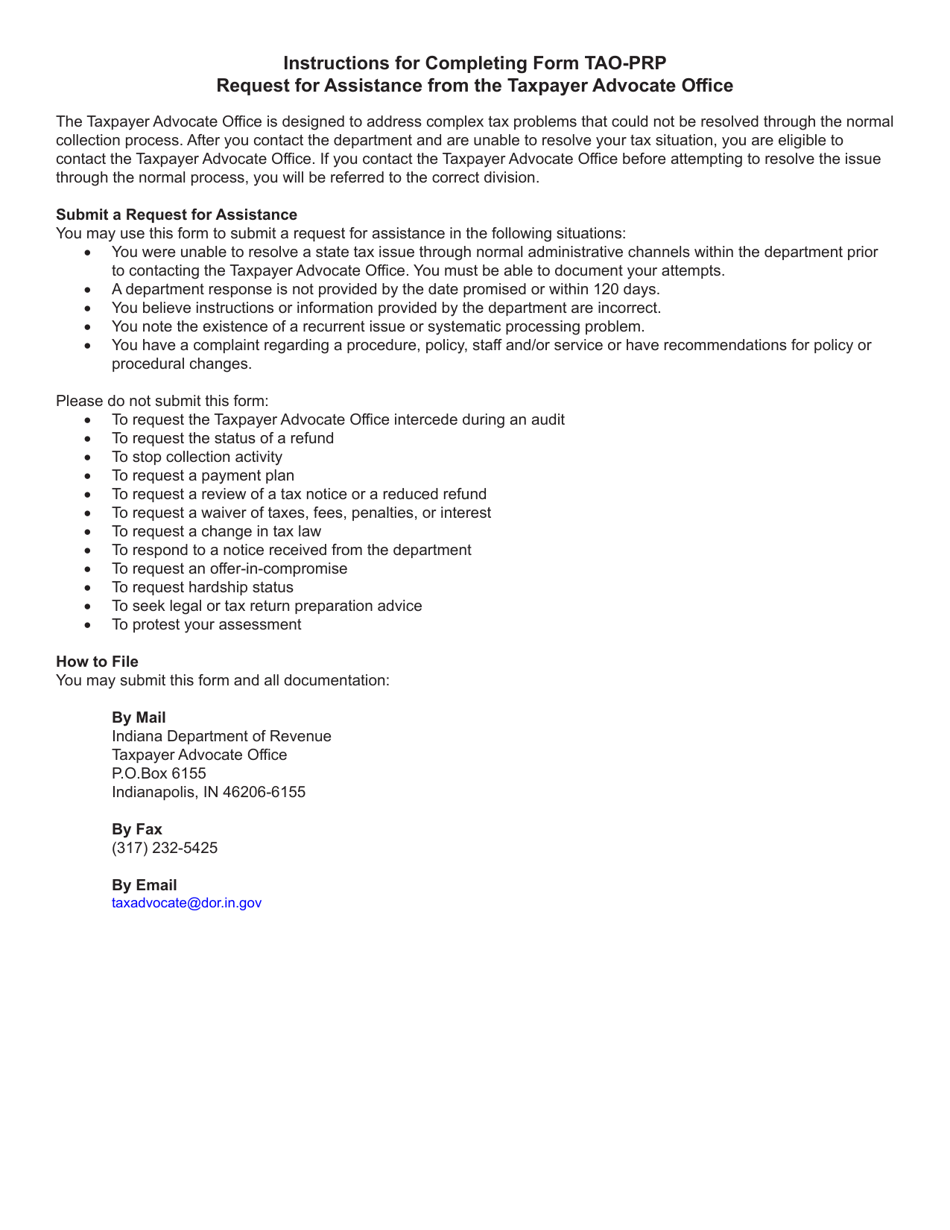

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TAO-PRP?

A: Form TAO-PRP is the Request for Assistance From the Taxpayer Advocate Office in Indiana.

Q: What is the purpose of Form TAO-PRP?

A: The purpose of Form TAO-PRP is to request assistance from the Taxpayer Advocate Office in Indiana.

Q: Who can use Form TAO-PRP?

A: Any taxpayer who needs assistance from the Taxpayer Advocate Office in Indiana can use Form TAO-PRP.

Q: How do I fill out Form TAO-PRP?

A: To fill out Form TAO-PRP, you need to provide your personal information, describe the issue or problem you are facing, and indicate the type of assistance you are requesting.

Q: Is there a deadline for submitting Form TAO-PRP?

A: There is no specific deadline mentioned for submitting Form TAO-PRP. However, it is recommended to submit the form as soon as you need assistance.

Q: Is there a fee for submitting Form TAO-PRP?

A: No, there is no fee associated with submitting Form TAO-PRP.

Q: What happens after I submit Form TAO-PRP?

A: After you submit Form TAO-PRP, the Taxpayer Advocate Office will review your request and provide assistance or guidance accordingly.

Q: Can I request assistance for any tax-related issue using Form TAO-PRP?

A: Yes, you can request assistance for any tax-related issue you are facing using Form TAO-PRP.

Q: Can I submit Form TAO-PRP electronically?

A: No, Form TAO-PRP cannot be submitted electronically. It must be printed, signed, and mailed or faxed to the Taxpayer Advocate Office in Indiana.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TAO-PRP (State Form 56081) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.