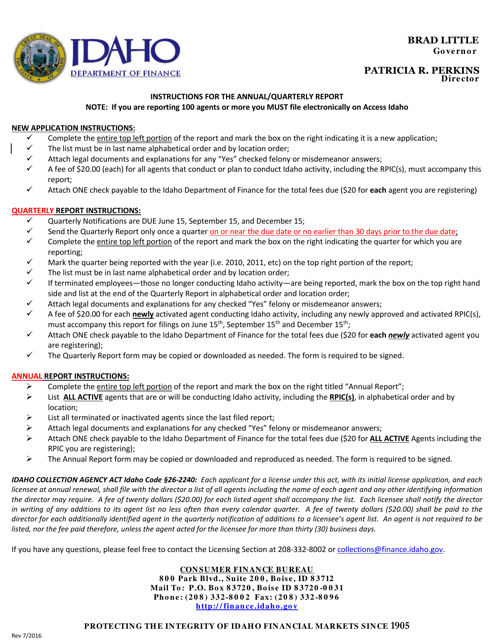

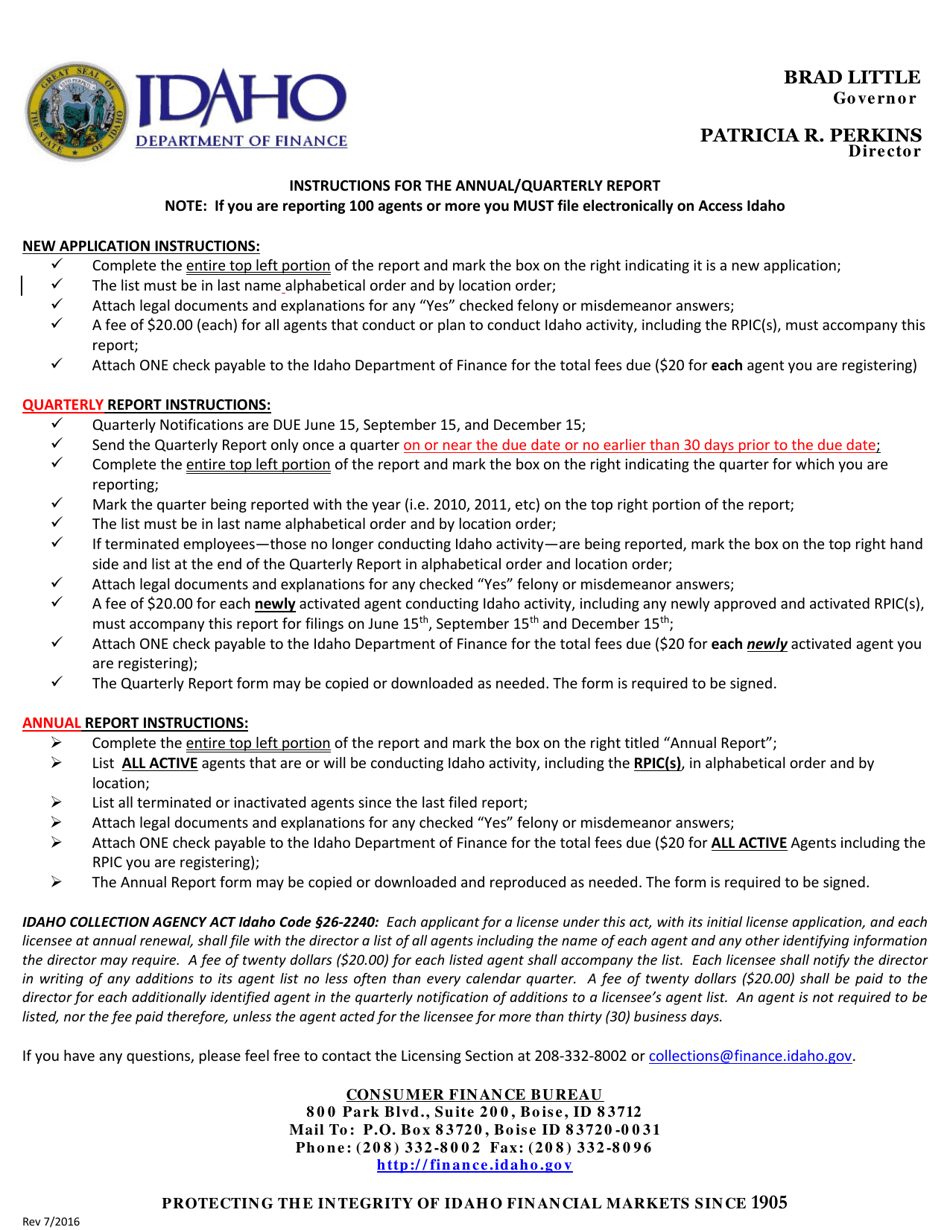

Annual / Quarterly Notification of Agents / Collectors - Idaho

Annual/Quarterly Notification of Agents/Collectors is a legal document that was released by the Idaho Department of Finance - a government authority operating within Idaho.

FAQ

Q: What is the Annual/Quarterly Notification of Agents/Collectors?

A: The Annual/Quarterly Notification of Agents/Collectors is a requirement in Idaho for businesses to notify the state about their designated agents or collectors.

Q: Who is required to submit the Annual/Quarterly Notification?

A: All businesses operating in Idaho that have designated agents or collectors must submit the Annual/Quarterly Notification.

Q: When is the Annual/Quarterly Notification due?

A: The specific due dates vary depending on the type of notification (annual or quarterly), but generally, it must be submitted by certain dates in January, April, July, and October.

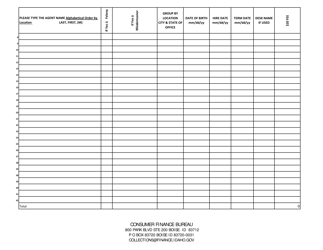

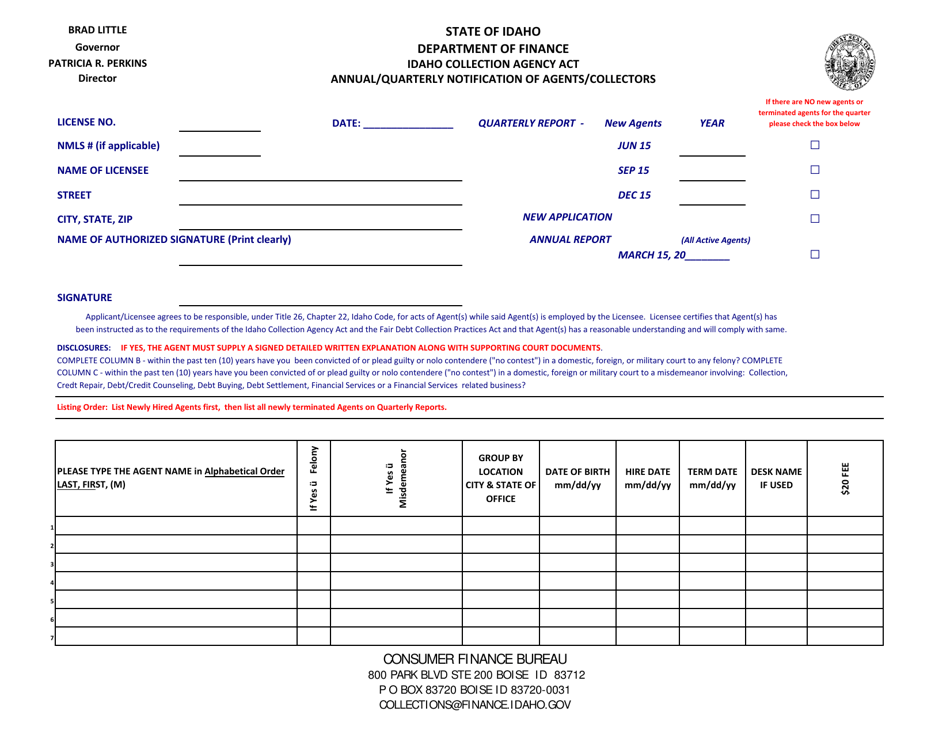

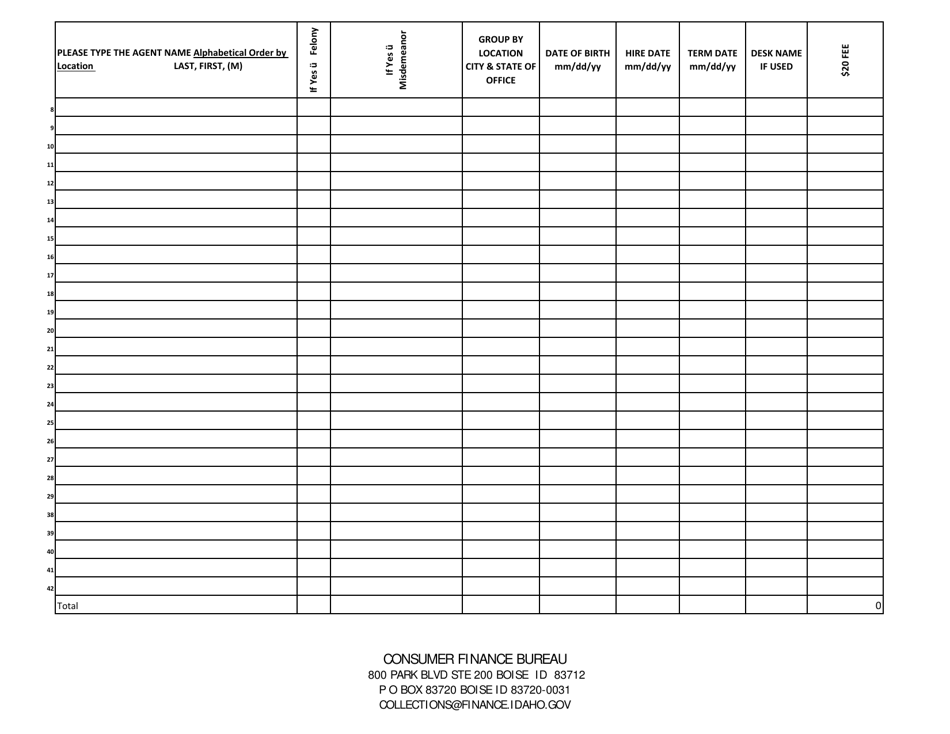

Q: What information do I need to provide in the Annual/Quarterly Notification?

A: You will need to provide information about your business, including the name and address of your designated agent or collector.

Q: Are there any penalties for not submitting the Annual/Quarterly Notification?

A: Yes, failing to submit the Annual/Quarterly Notification or providing inaccurate information may result in penalties imposed by the Idaho State Tax Commission.

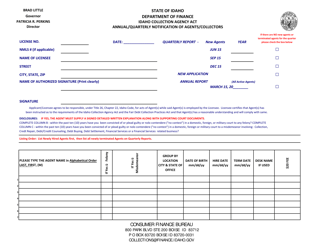

Form Details:

- Released on July 1, 2016;

- The latest edition currently provided by the Idaho Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Idaho Department of Finance.