This version of the form is not currently in use and is provided for reference only. Download this version of

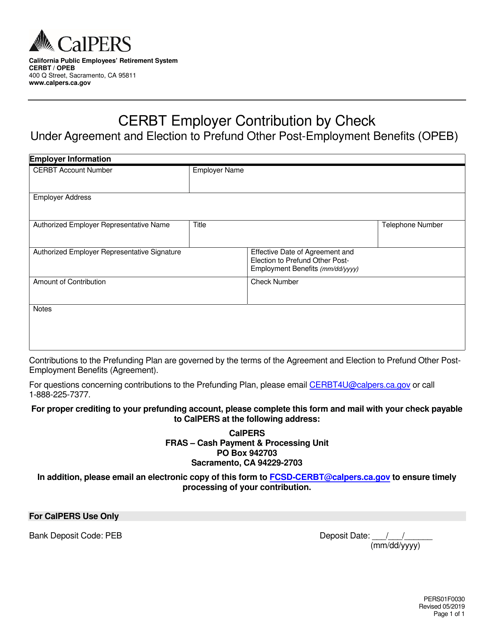

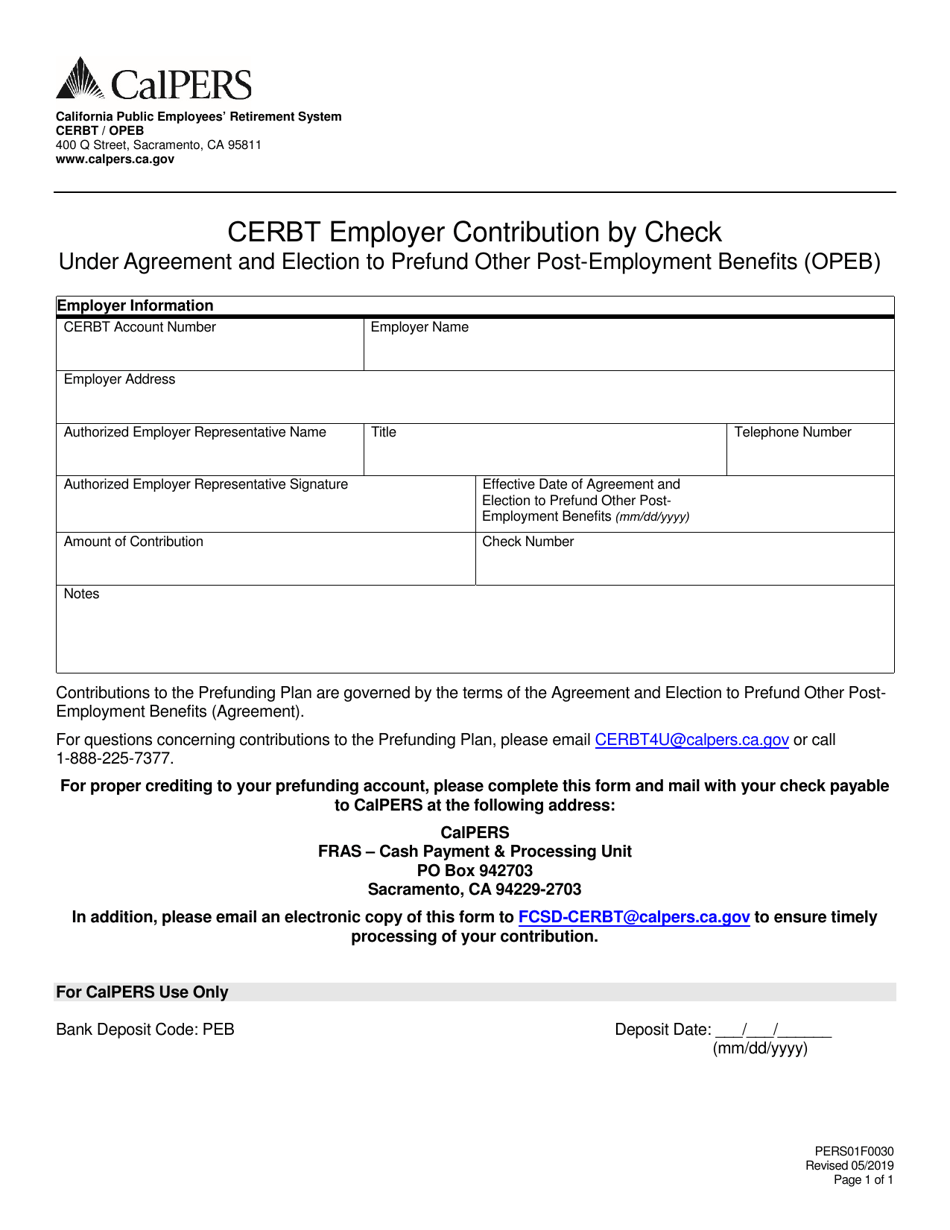

Form PERS01F0030

for the current year.

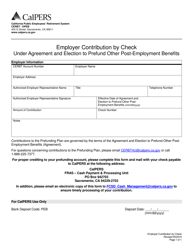

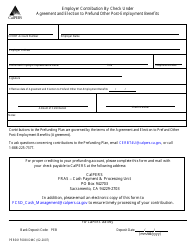

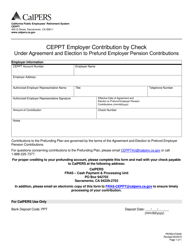

Form PERS01F0030 Cerbt Employer Contribution by Check Under Agreement and Election to Prefund Other Post-employed Benefits (Opeb) - California

What Is Form PERS01F0030?

This is a legal form that was released by the California Public Employees' Retirement System - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PERS01F0030?

A: Form PERS01F0030 is a form used in California to document employer contributions by check under an agreement and election to prefund other post-employed benefits (OPEB).

Q: What is the purpose of Form PERS01F0030?

A: The purpose of Form PERS01F0030 is to provide a way for employers in California to make contributions by check towards the prefunding of other post-employed benefits (OPEB).

Q: Who should use Form PERS01F0030?

A: Employers in California who have elected to prefund other post-employed benefits (OPEB) and make contributions by check under an agreement should use Form PERS01F0030.

Q: What is meant by prefunding other post-employed benefits (OPEB)?

A: Prefunding other post-employed benefits (OPEB) refers to setting aside money to finance benefits that will be provided to employees after they retire or leave employment.

Q: Is Form PERS01F0030 specific to California?

A: Yes, Form PERS01F0030 is specific to California and is used by employers in the state.

Q: What are other post-employed benefits (OPEB)?

A: Other post-employed benefits (OPEB) are benefits provided to employees after they retire or leave employment, such as health insurance or pension benefits.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the California Public Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PERS01F0030 by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.