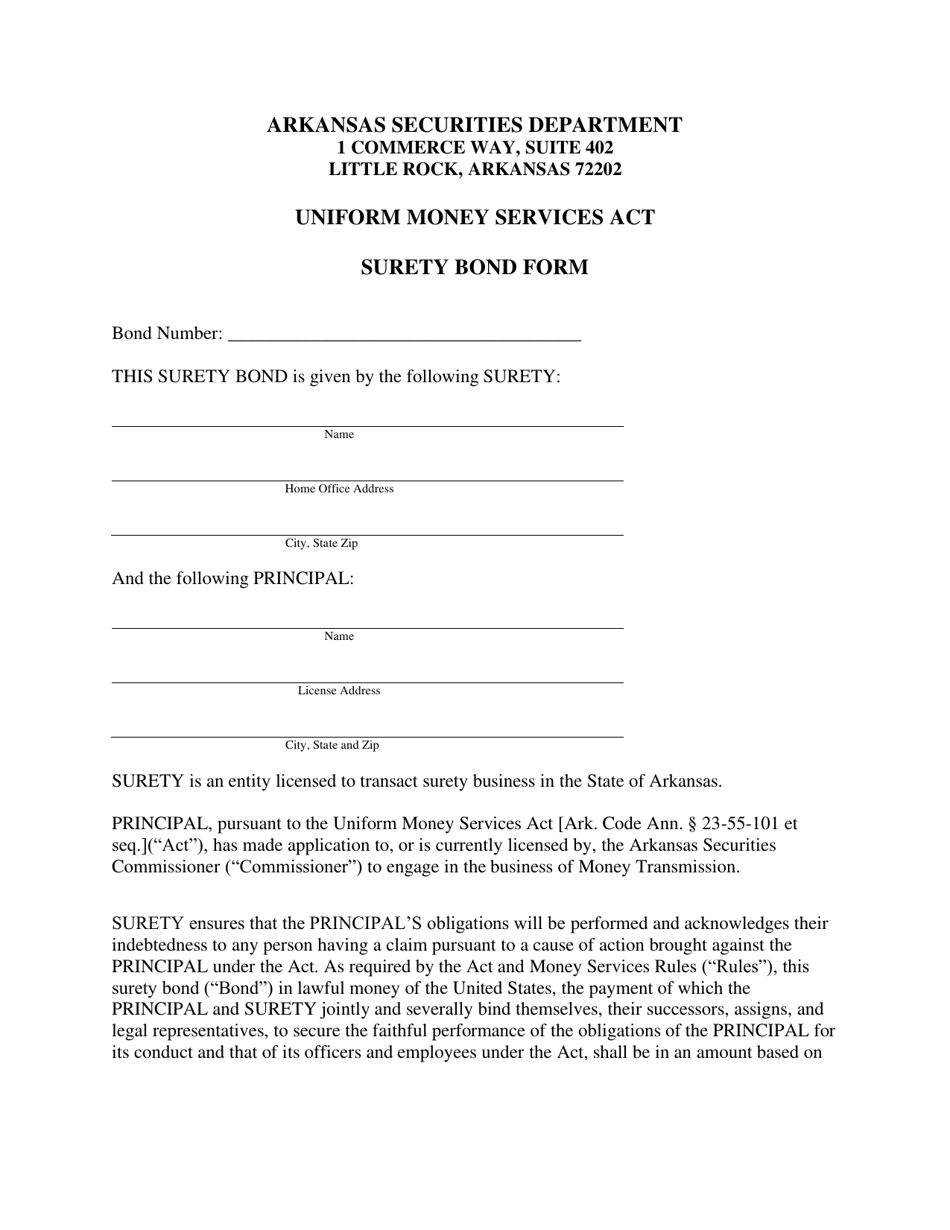

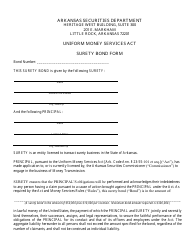

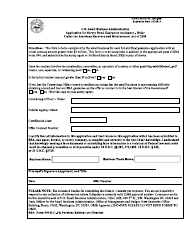

Surety Bond Form - Arkansas

Surety Bond Form is a legal document that was released by the Arkansas Securities Department - a government authority operating within Arkansas.

FAQ

Q: What is a surety bond?

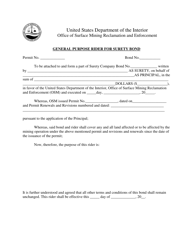

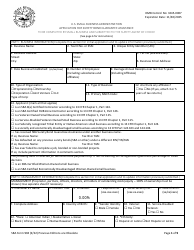

A: A surety bond is a legal contract between three parties: the principal (the person or business obtaining the bond), the obligee (the party requiring the bond), and the surety (the company providing the bond). The bond guarantees that the principal will fulfill their obligations in accordance with the terms of the bond.

Q: Why would someone need a surety bond in Arkansas?

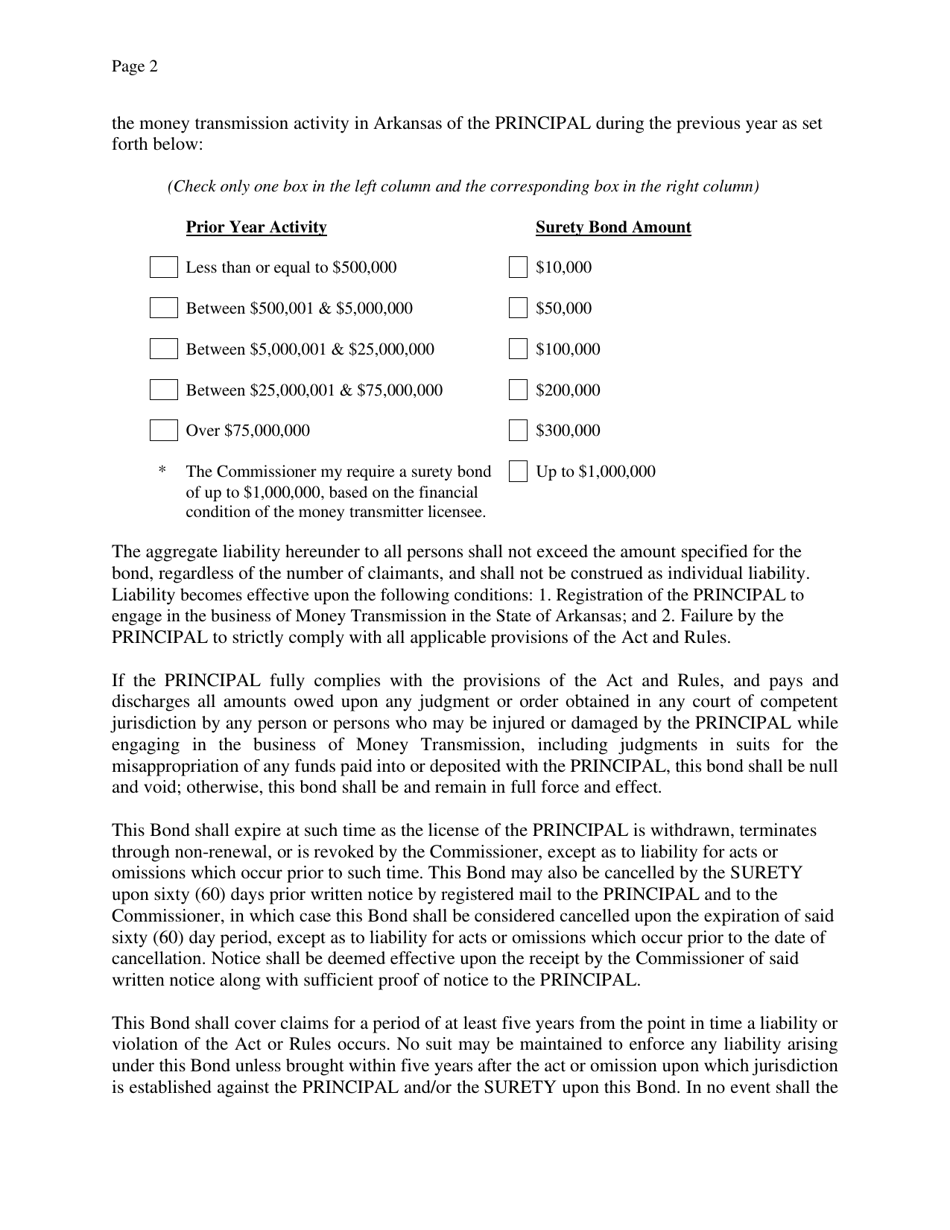

A: In Arkansas, certain professions and businesses are required by law to obtain a surety bond. This is done to provide financial protection to consumers and ensure that the bonded party complies with applicable laws and regulations.

Q: How much does a surety bond in Arkansas cost?

A: The cost of a surety bond in Arkansas varies depending on several factors, including the type of bond required, the bond amount, and the applicant's creditworthiness. It is best to contact a licensed surety bond provider to get an accurate quote.

Q: How long does it take to get a surety bond in Arkansas?

A: The time it takes to obtain a surety bond in Arkansas can vary depending on the type of bond and the applicant's specific circumstances. It is advisable to start the application process ahead of time to allow for any necessary underwriting and processing.

Q: Are there alternatives to a surety bond in Arkansas?

A: Yes, in some cases, alternatives to surety bonds may be accepted. These alternatives can include cash deposits, letters of credit, or self-insurance options. It is important to check with the specific obligee to determine acceptable alternatives.

Q: Can I cancel a surety bond in Arkansas?

A: Generally, surety bonds in Arkansas cannot be canceled by the principal. However, there may be provisions for cancellation or termination in the bond agreement. It is recommended to review the terms of the bond and consult with the surety bond provider.

Q: What happens if a claim is made on a surety bond in Arkansas?

A: If a valid claim is made on a surety bond in Arkansas, the surety bond provider will investigate the claim and, if necessary, provide financial compensation to the obligee up to the bond amount. The bonded party (principal) is then responsible for reimbursing the surety for any claims paid.

Q: Do I need a surety bond for my construction project in Arkansas?

A: Yes, most construction projects in Arkansas require contractors to obtain a surety bond. This bond ensures that the contractor will meet their contractual obligations and provides financial protection to the project owner.

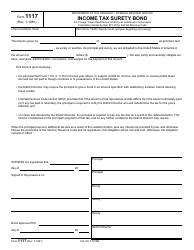

Q: What are some common types of surety bonds in Arkansas?

A: Some common types of surety bonds in Arkansas include contractor license bonds, motor vehicle dealer bonds, court bonds, and performance bonds for construction projects. The specific bond requirements will depend on the industry and applicable laws.

Form Details:

- Released on March 1, 2020;

- The latest edition currently provided by the Arkansas Securities Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Securities Department.