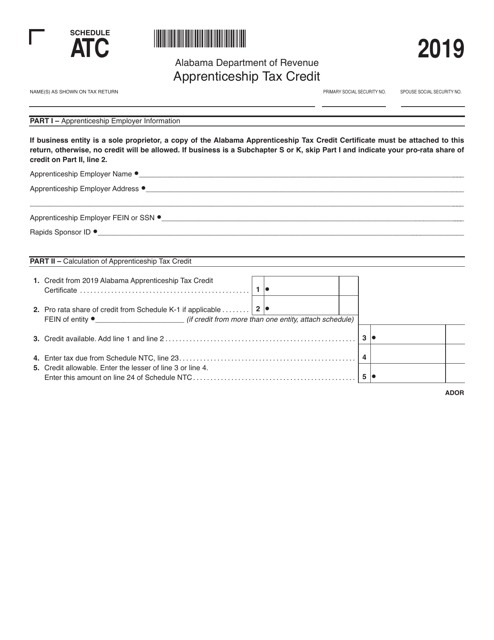

Schedule ATC Apprenticeship Tax Credit - Alabama

What Is Schedule ATC?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Schedule ATC Apprenticeship Tax Credit in Alabama?

A: The Schedule ATC Apprenticeship Tax Credit in Alabama is a tax credit available to employers who hire and train apprentices.

Q: How does the Schedule ATC Apprenticeship Tax Credit work?

A: Employers who meet the eligibility criteria can claim a tax credit based on the wages paid to qualified apprentices during their first year of employment.

Q: Who is eligible for the Schedule ATC Apprenticeship Tax Credit?

A: Employers who are registered with the Alabama Department of Commerce, have a qualified apprenticeship program, and meet certain wage requirements may be eligible.

Q: What are the benefits of the Schedule ATC Apprenticeship Tax Credit?

A: The tax credit reduces the employer's state tax liability, providing an incentive for hiring and training apprentices.

Q: How can employers claim the Schedule ATC Apprenticeship Tax Credit?

A: Employers must complete Schedule ATC and attach it to their Alabama income tax return to claim the tax credit.

Q: Are there any limitations or restrictions to the Schedule ATC Apprenticeship Tax Credit?

A: Yes, there are limitations on the number of apprentices for whom the credit can be claimed, as well as a cap on the total amount of credits that can be claimed.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule ATC by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.