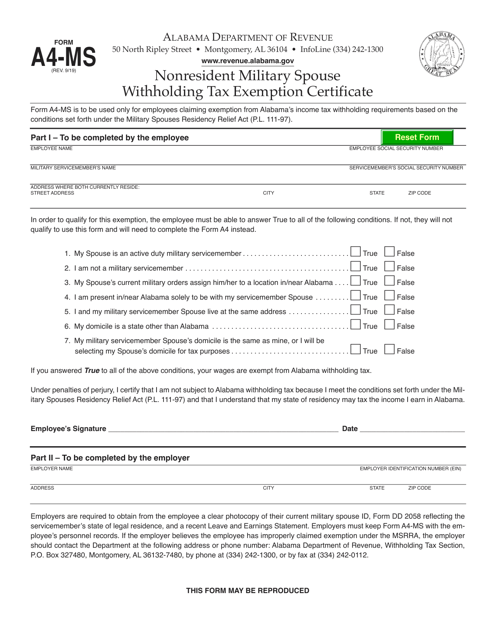

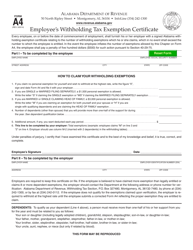

Form A4-MS Nonresident Military Spouse Withholding Tax Exemption Certificate - Alabama

What Is Form A4-MS?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A4-MS?

A: Form A4-MS is the Nonresident Military Spouse Withholding Tax Exemption Certificate.

Q: Who is eligible to use Form A4-MS?

A: This form is specifically for nonresident military spouses.

Q: What is the purpose of Form A4-MS?

A: The purpose of this form is to claim an exemption from withholding tax in the state of Alabama.

Q: What is withholding tax?

A: Withholding tax is the money that is withheld from an employee's wages and paid directly to the government as a prepayment of income tax.

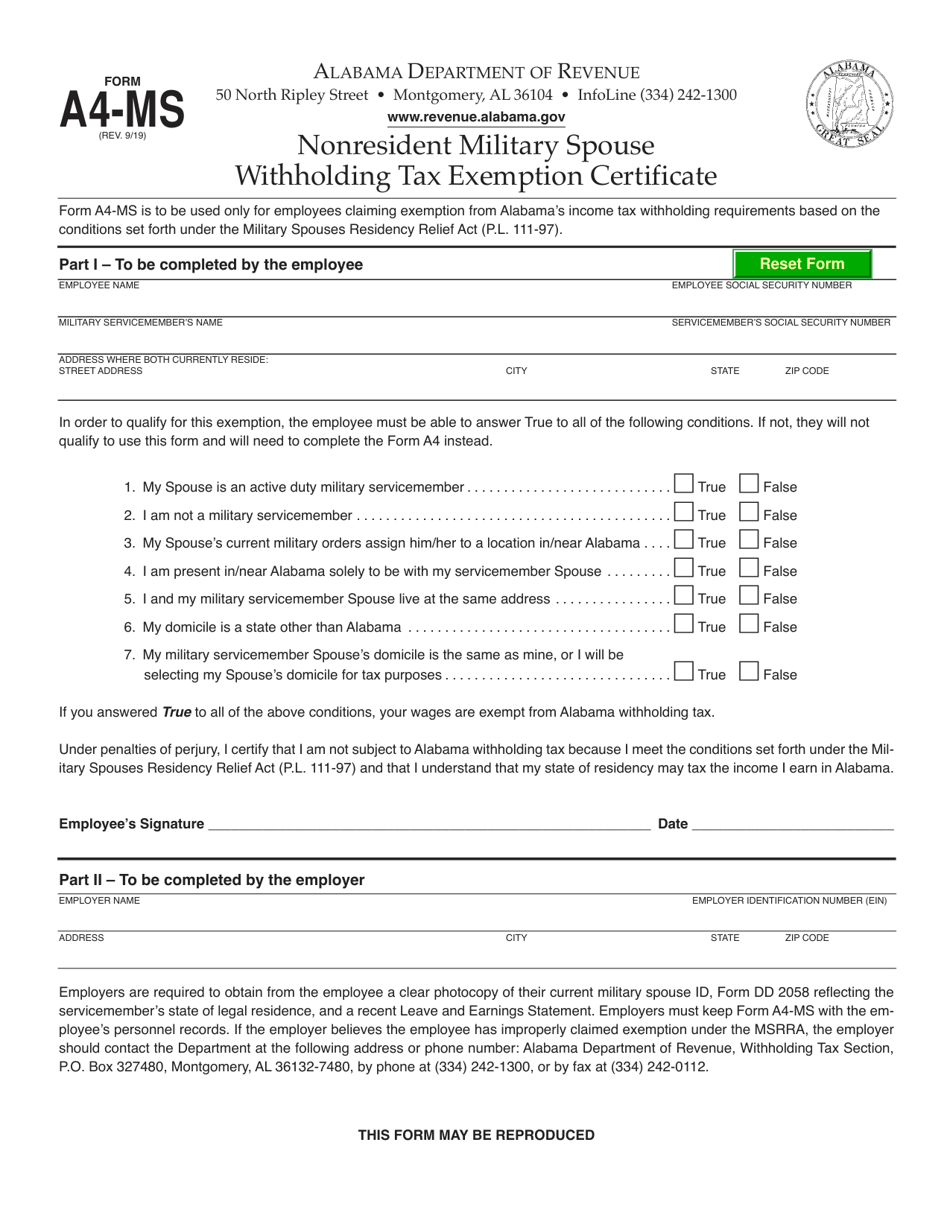

Q: What information do I need to provide on Form A4-MS?

A: You will need to provide your personal information, such as your name, address, and Social Security Number, as well as your spouse's military information.

Q: When should I submit Form A4-MS?

A: You should submit this form to your employer as soon as possible after becoming a nonresident military spouse in Alabama.

Q: Is Form A4-MS only applicable to Alabama?

A: Yes, this form is specifically for claiming an exemption from withholding tax in the state of Alabama.

Q: Do I need to renew Form A4-MS annually?

A: No, once you submit this form to your employer, it is valid until you or your spouse's military status changes.

Q: What should I do if my military spouse's status changes?

A: If your military spouse's status changes, you should notify your employer and submit a new Form A4-MS if necessary.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A4-MS by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.