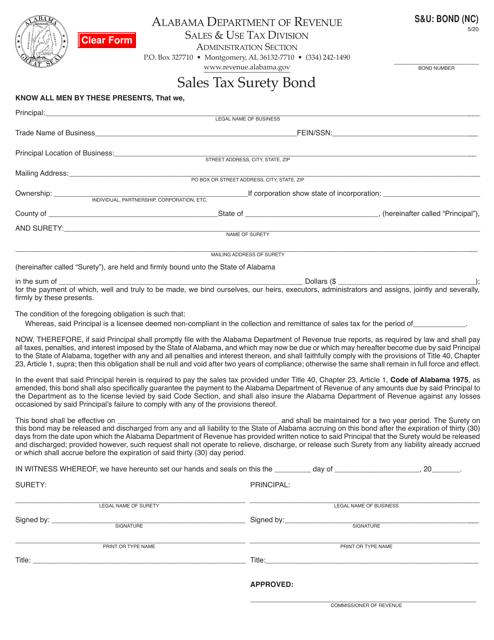

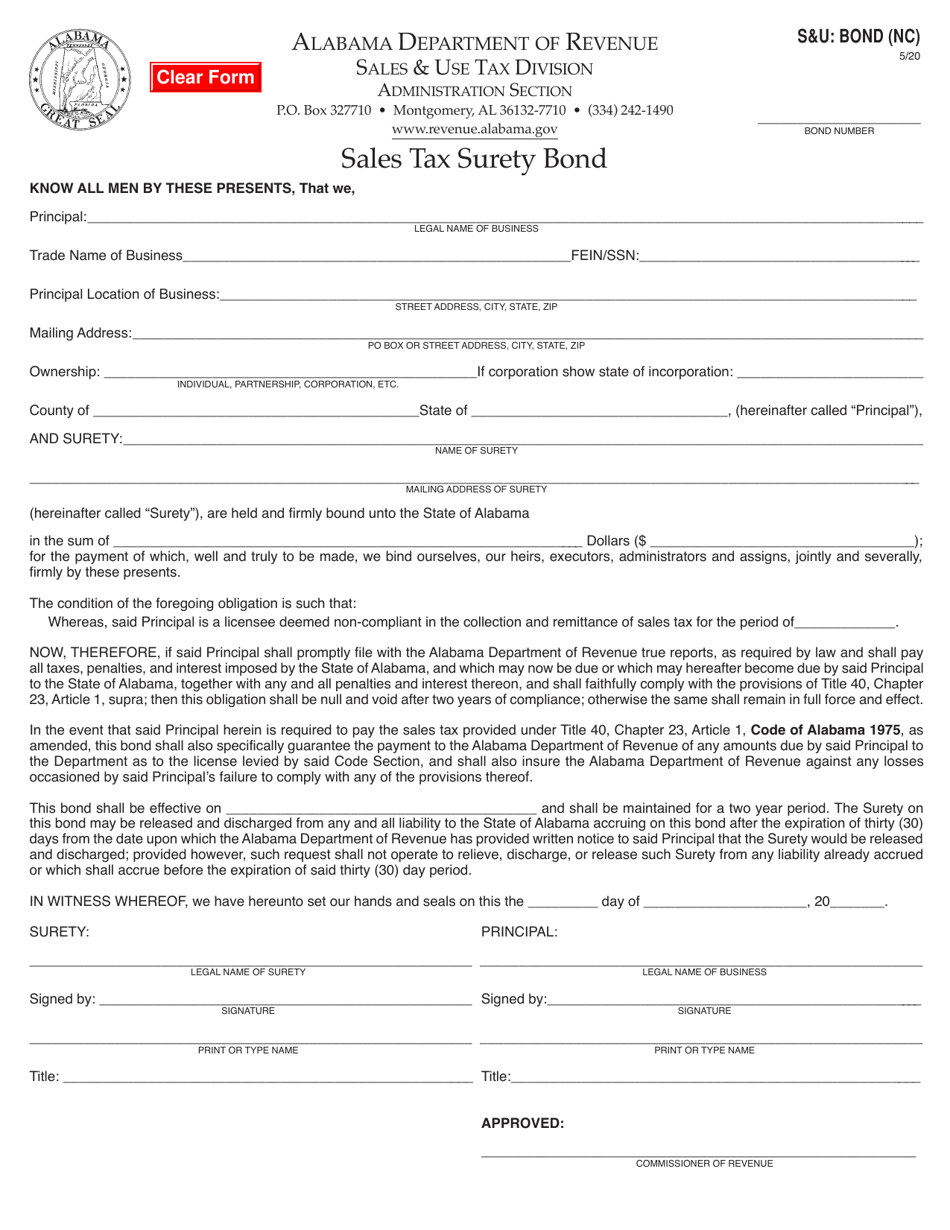

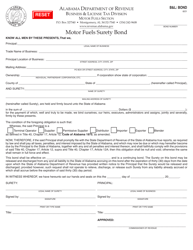

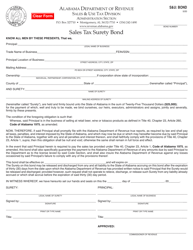

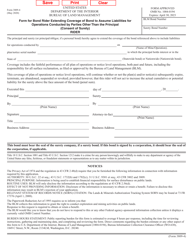

Form S&U: BOND (NC) Sales Tax Surety Bond (Non-compliant Taxpayers) - Alabama

What Is Form S&U: BOND (NC)?

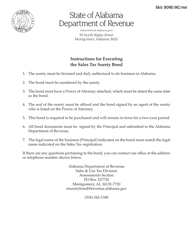

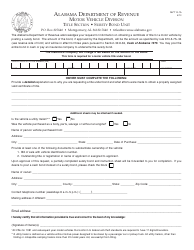

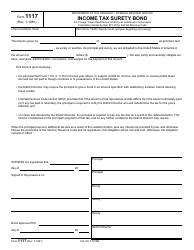

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the S&U: BOND (NC) Sales Tax Surety Bond?

A: It is a surety bond required for non-compliant taxpayers in Alabama to ensure payment of sales tax liabilities.

Q: Who needs to get this bond?

A: Non-compliant taxpayers in Alabama who have unpaid sales tax liabilities are required to get this bond.

Q: Why do non-compliant taxpayers need this bond?

A: The bond ensures that non-compliant taxpayers will fulfill their payment obligations for sales tax liabilities.

Q: How does the bond work?

A: The bond acts as a guarantee that the non-compliant taxpayer will pay their sales tax liabilities. If they fail to do so, the bond provides compensation to the state.

Q: What happens if a non-compliant taxpayer doesn't get this bond?

A: Failure to obtain the required bond may result in penalties, fines, or other legal consequences for the non-compliant taxpayer.

Q: How do I apply for the S&U: BOND (NC) Sales Tax Surety Bond?

A: To apply for this bond, you should contact a licensed surety bond provider or an insurance agent who specializes in surety bonds.

Q: How much does the bond cost?

A: The cost of the bond can vary depending on factors such as the taxpayer's credit history and the amount of sales tax liability.

Q: How long do I need to keep this bond?

A: The required duration for keeping the bond may vary. It is generally advisable to contact the Alabama Department of Revenue for specific information.

Q: Can I cancel the bond once it's been obtained?

A: Typically, surety bonds cannot be canceled by the bondholder. The bond remains in effect until the bond term is completed or canceled by the surety company.

Q: Are there any alternatives to obtaining this bond?

A: It is advisable to consult with the Alabama Department of Revenue for any available alternatives or options for non-compliant taxpayers.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S&U: BOND (NC) by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.