This version of the form is not currently in use and is provided for reference only. Download this version of

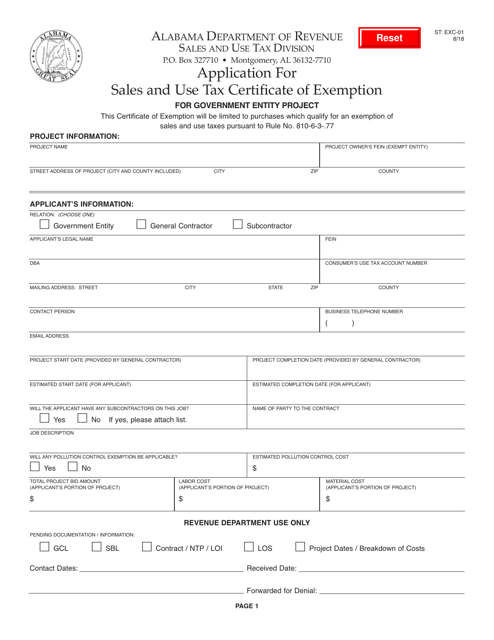

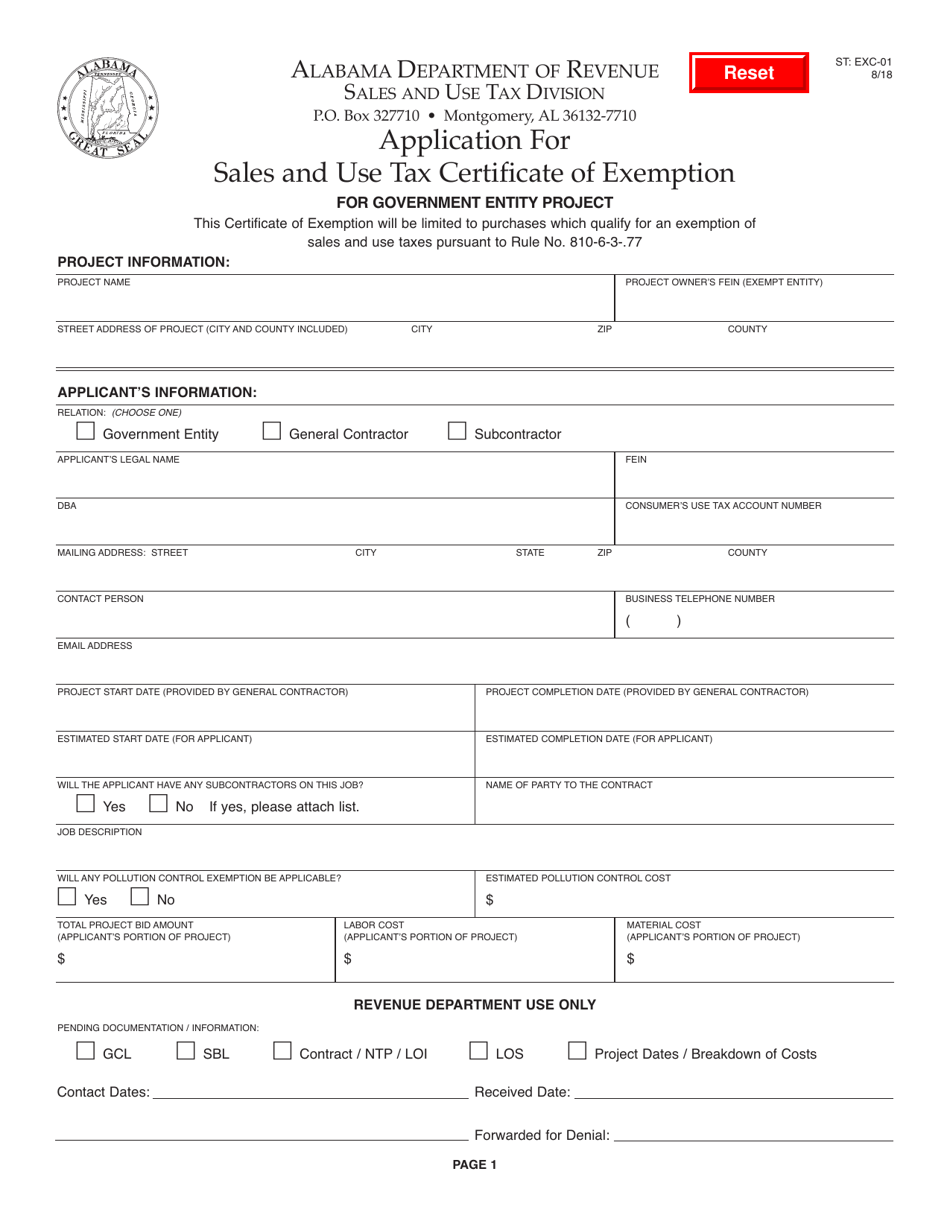

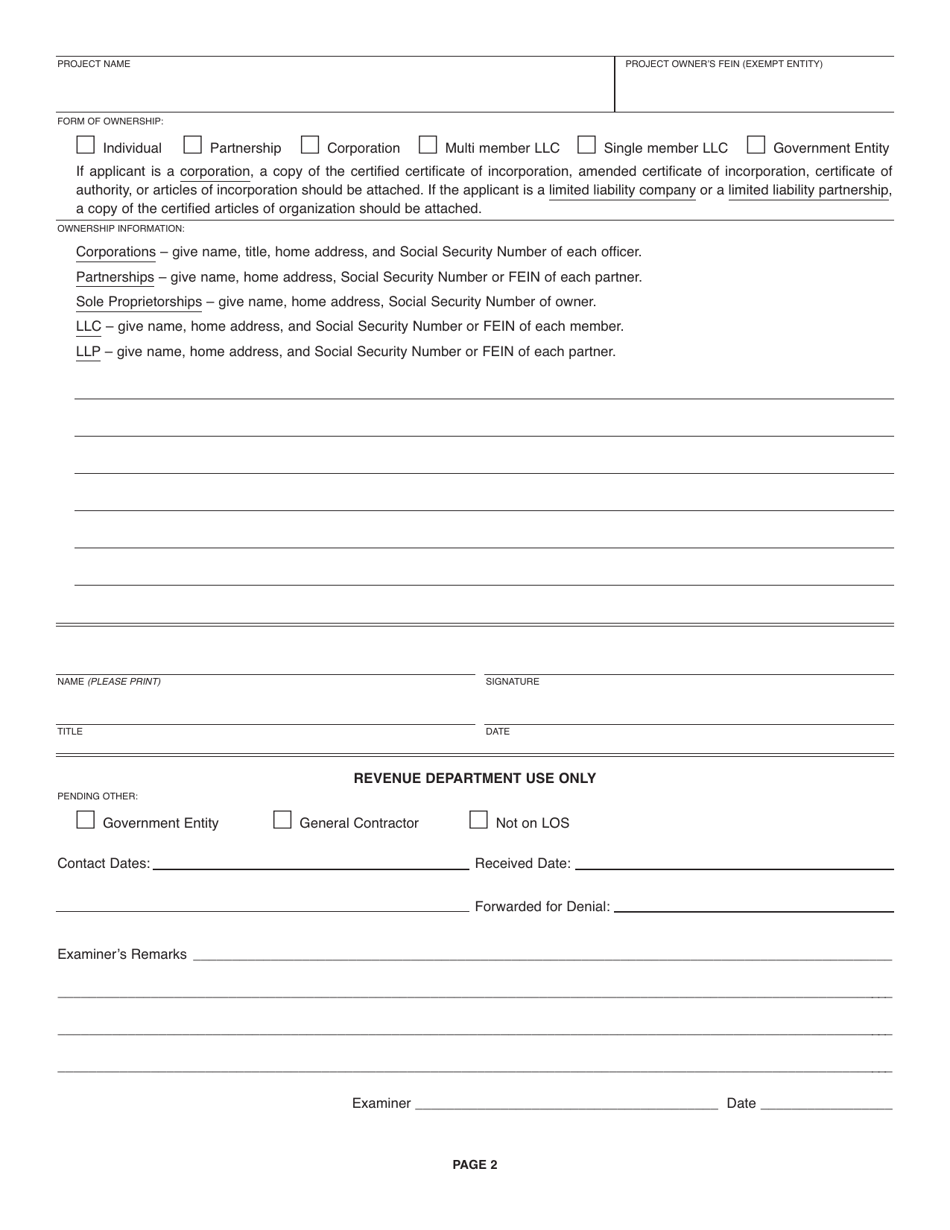

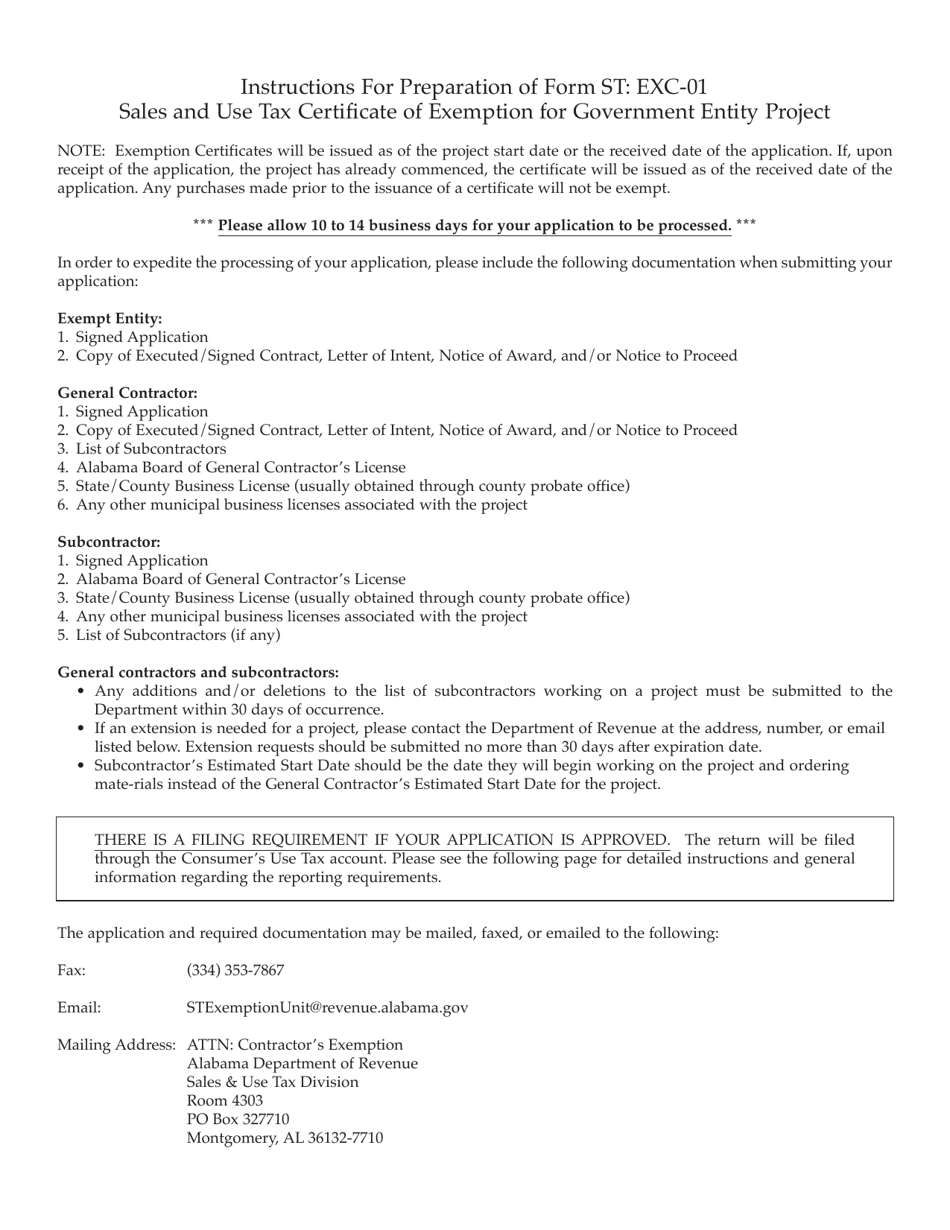

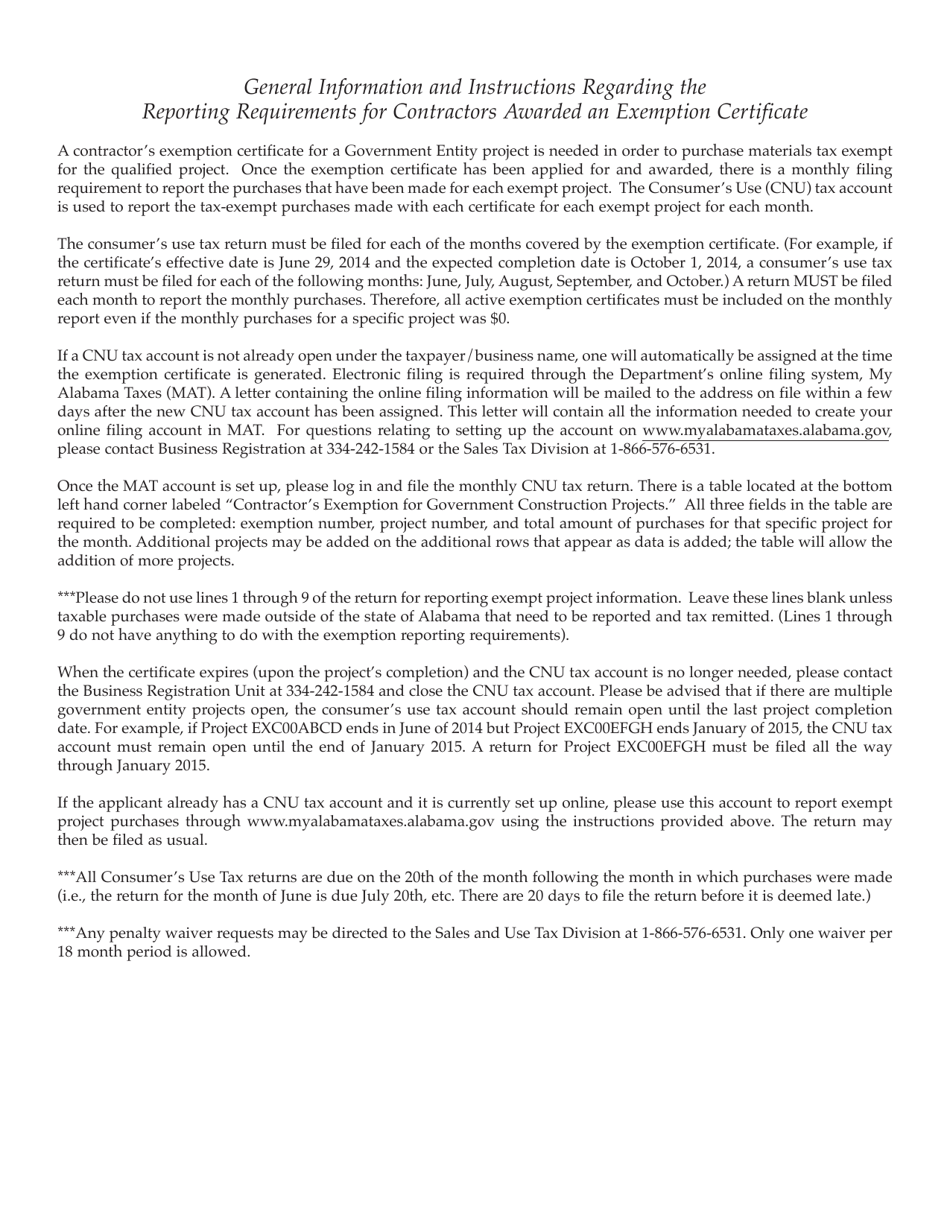

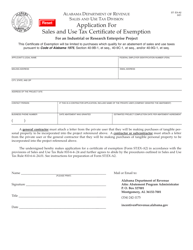

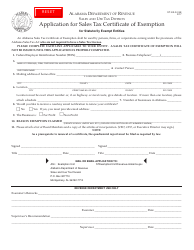

Form ST: EXC-01

for the current year.

Form ST: EXC-01 Application for Sales and Use Tax Certificate of Exemption for Government Entity Project - Alabama

What Is Form ST: EXC-01?

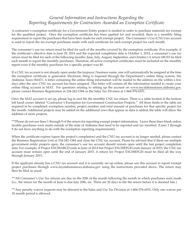

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST: EXC-01?

A: Form ST: EXC-01 is an application for Sales and Use Tax Certificate of Exemption for Government Entity Project in Alabama.

Q: What is the purpose of Form ST: EXC-01?

A: The purpose of Form ST: EXC-01 is to allow government entities in Alabama to apply for a sales and use tax exemption for a specific project.

Q: Who can use Form ST: EXC-01?

A: Form ST: EXC-01 can be used by government entities in Alabama.

Q: What is the benefit of using Form ST: EXC-01?

A: Using Form ST: EXC-01 allows government entities in Alabama to obtain a sales and use tax exemption for a specific project.

Q: Is there a fee for submitting Form ST: EXC-01?

A: There is no fee for submitting Form ST: EXC-01.

Q: How long does it take to process Form ST: EXC-01?

A: The processing time for Form ST: EXC-01 varies, but it generally takes a few weeks.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST: EXC-01 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.