This version of the form is not currently in use and is provided for reference only. Download this version of

Form SI-PT

for the current year.

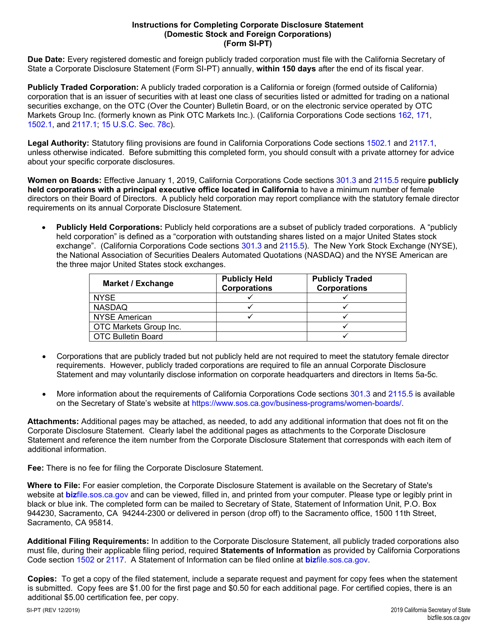

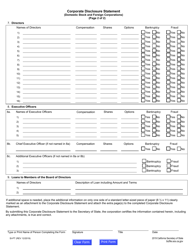

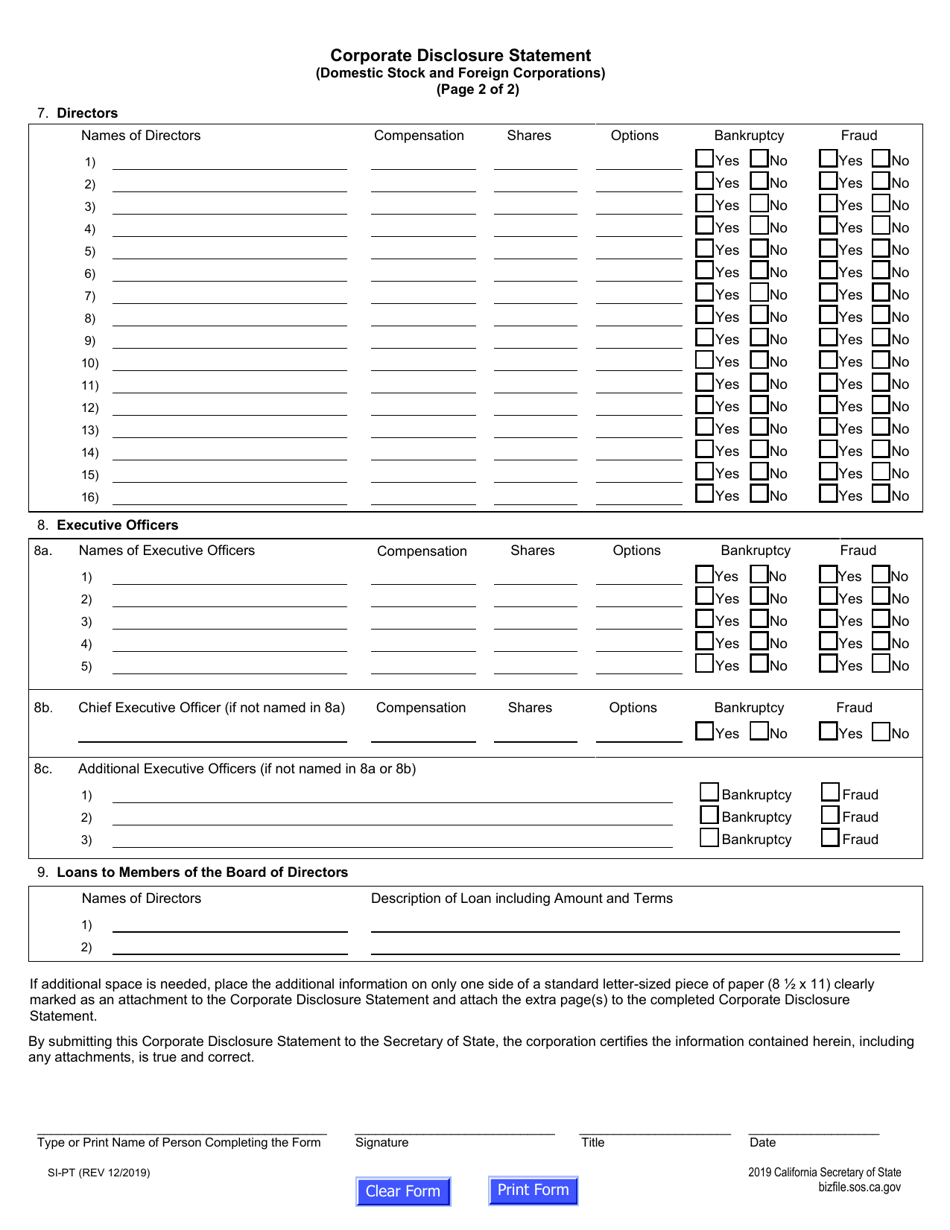

Form SI-PT Corporate Disclosure Statement (Domestic Stock and Foreign Corporations) - California

What Is Form SI-PT?

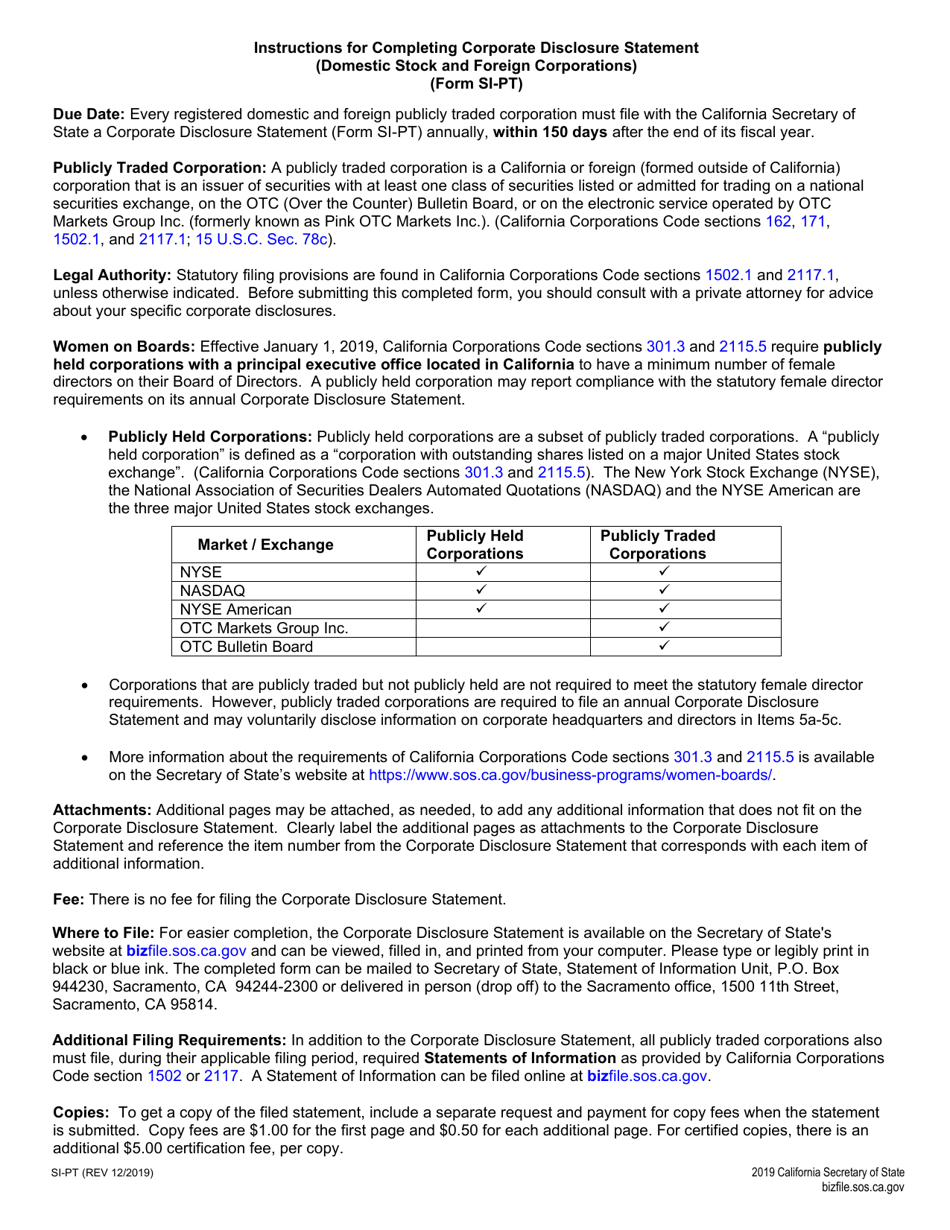

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SI-PT?

A: Form SI-PT is the Corporate Disclosure Statement for Domestic Stock and Foreign Corporations in California.

Q: Who needs to file Form SI-PT?

A: Domestic stock and foreign corporations in California need to file Form SI-PT.

Q: What is the purpose of Form SI-PT?

A: The purpose of Form SI-PT is to provide information about the corporate structure and ownership of the corporation.

Q: When should Form SI-PT be filed?

A: Form SI-PT should be filed within 90 days of initially registering to do business in California.

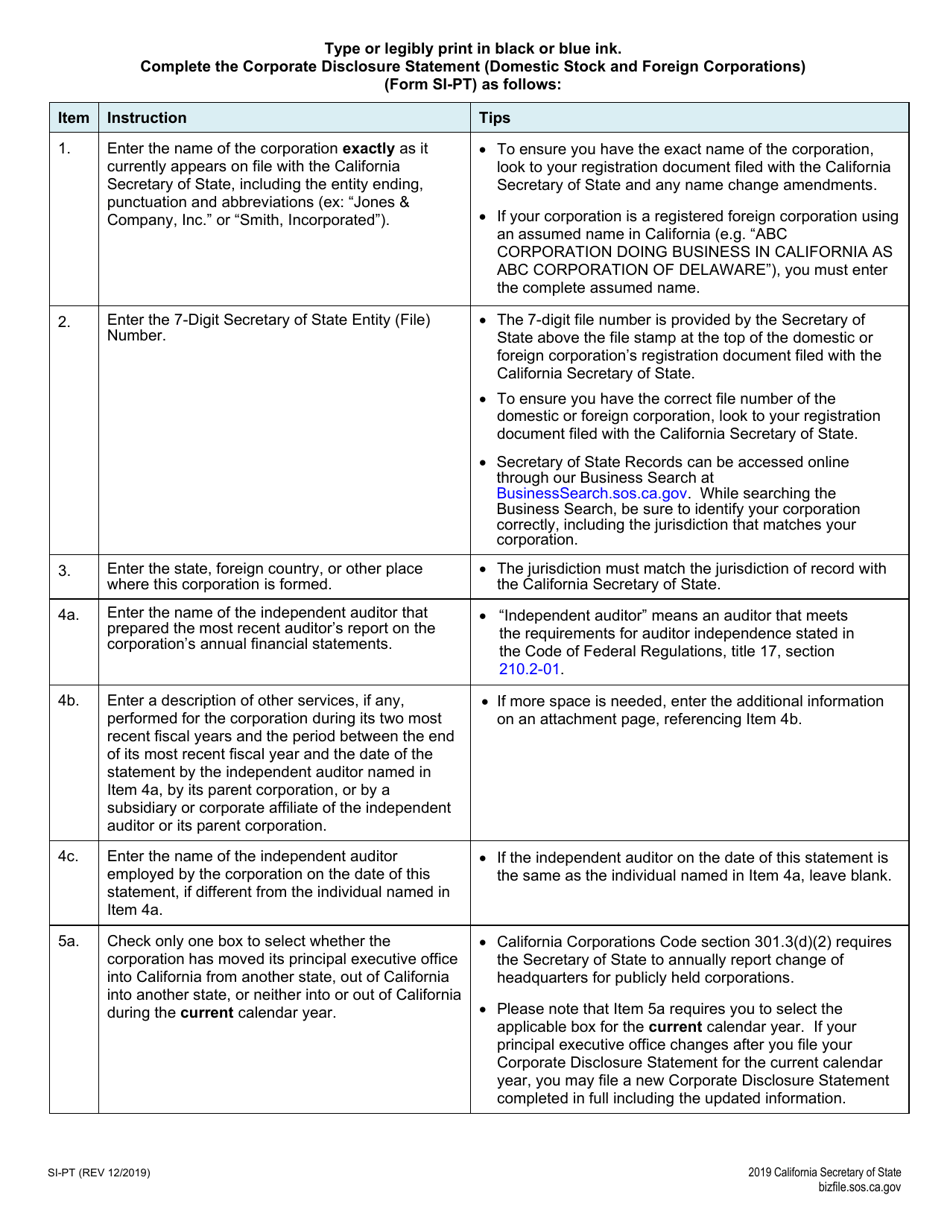

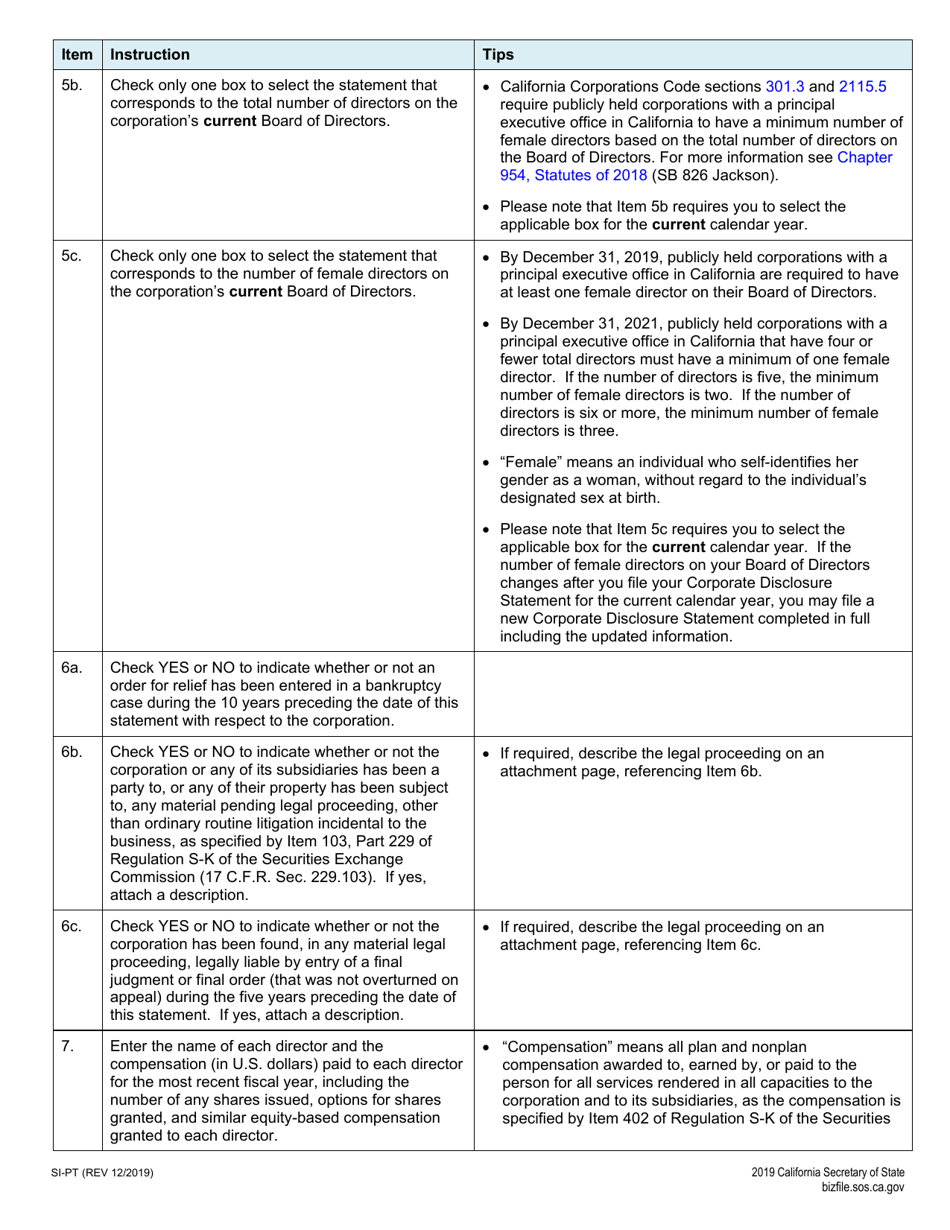

Q: What information is required on Form SI-PT?

A: Form SI-PT requires information about the corporation's directors, officers, shareholders, and registered agent.

Q: Are there any fees associated with filing Form SI-PT?

A: Yes, there is a filing fee for submitting Form SI-PT to the California Secretary of State.

Q: What happens if I don't file Form SI-PT?

A: Failure to file Form SI-PT can result in penalties and potential loss of corporate privileges in California.

Q: Can I amend Form SI-PT after filing?

A: Yes, you can file an amended Form SI-PT to update or correct any previously submitted information.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SI-PT by clicking the link below or browse more documents and templates provided by the California Secretary of State.