This version of the form is not currently in use and is provided for reference only. Download this version of

Form SI-550

for the current year.

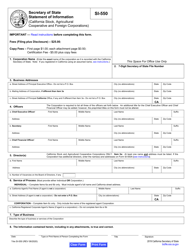

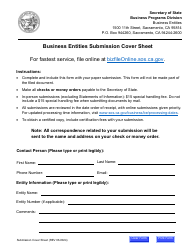

Form SI-550 Statement of Information (California Stock, Agricultural Cooperative and Foreign Corporations) - California

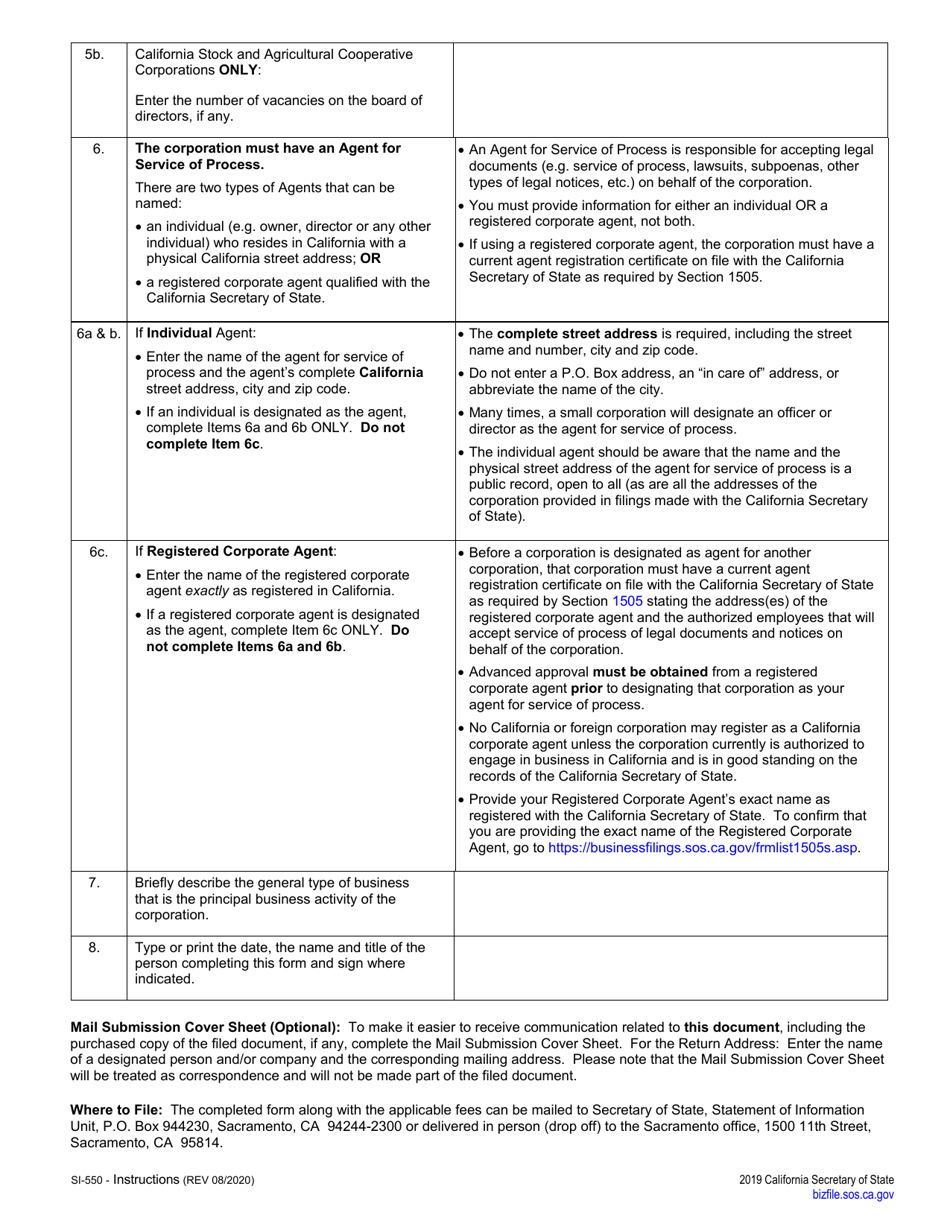

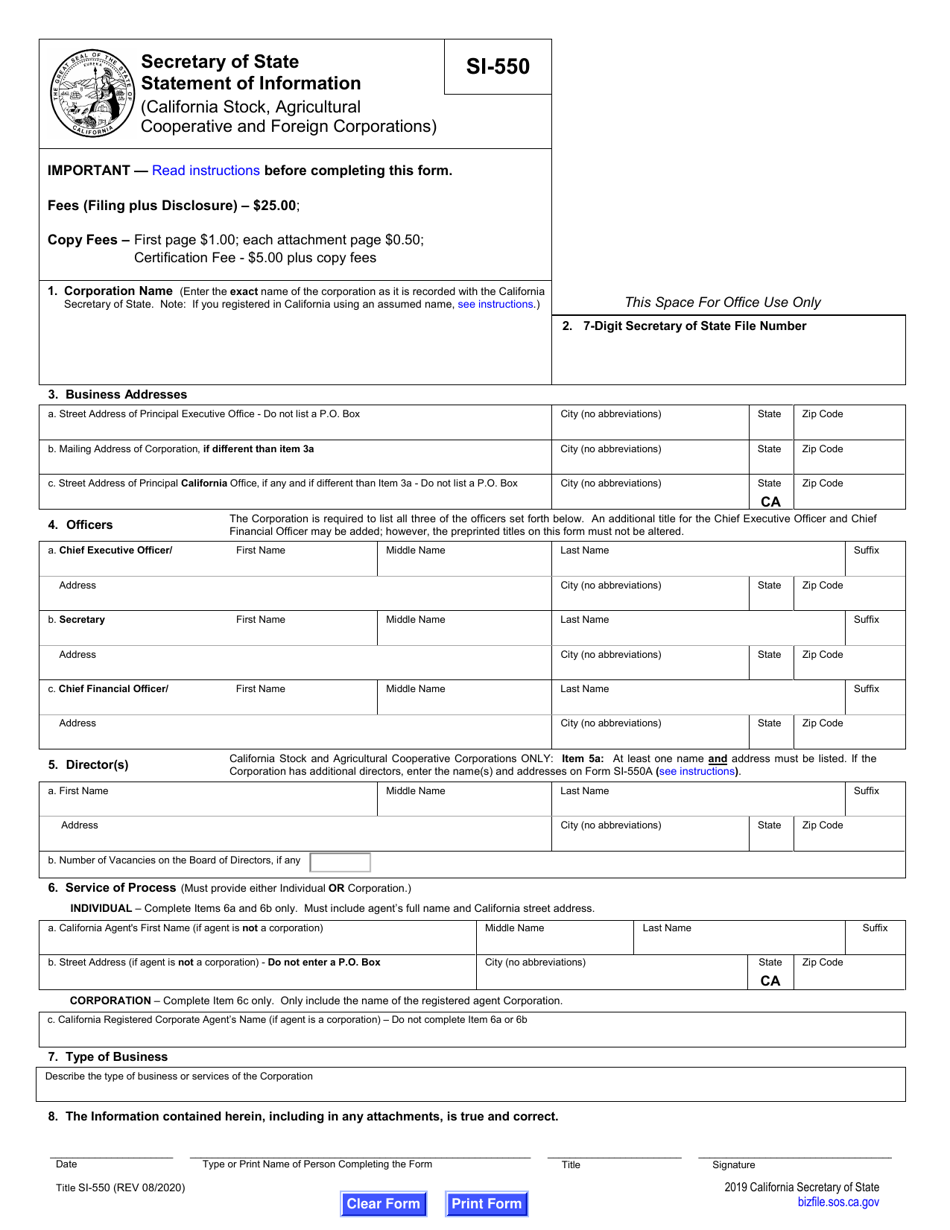

What Is Form SI-550?

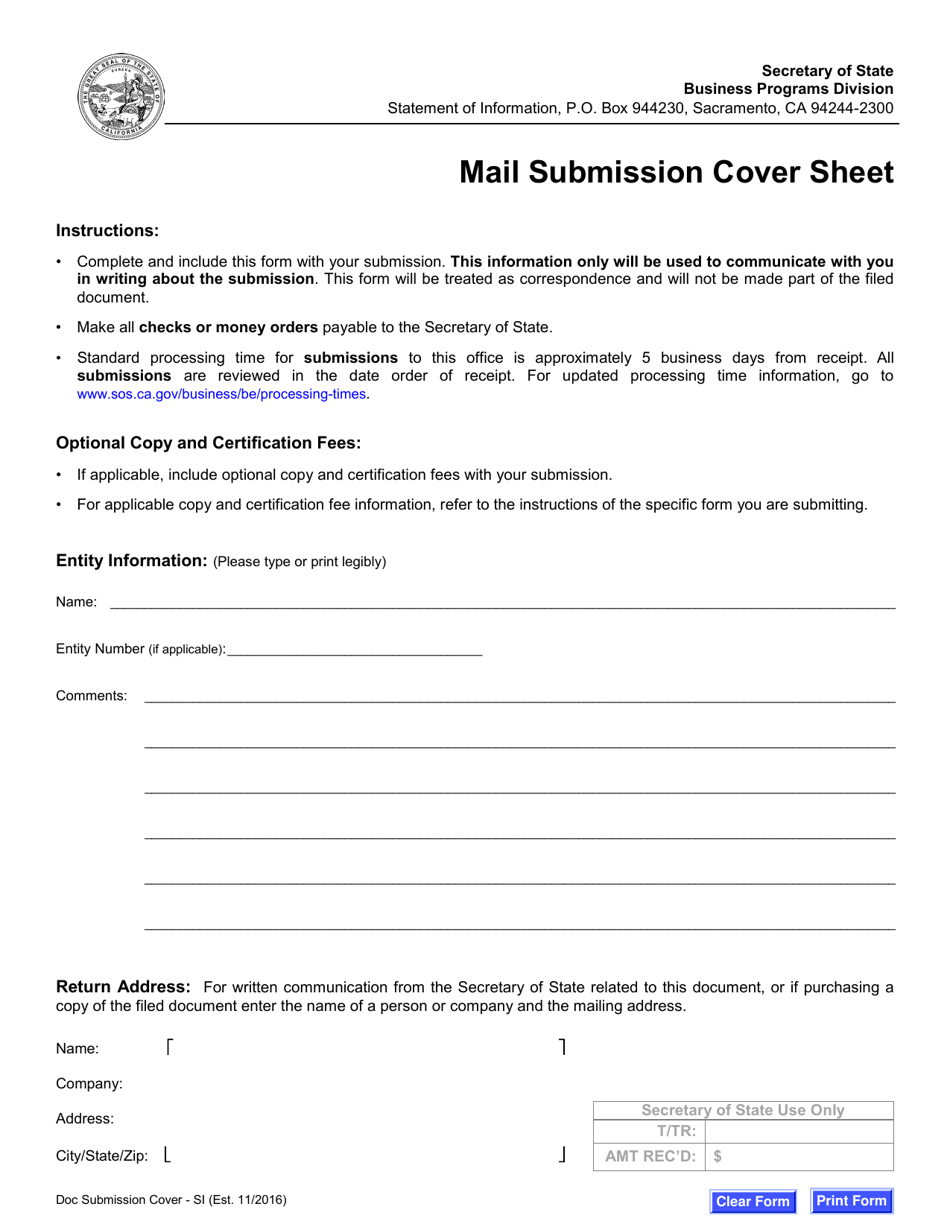

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

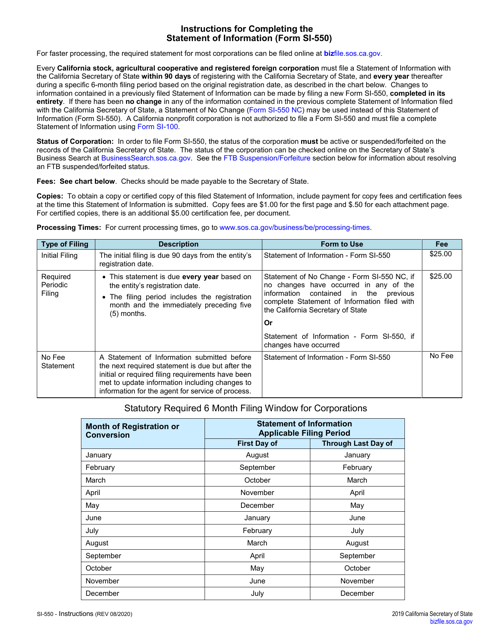

Q: What is Form SI-550?

A: Form SI-550 is the Statement of Information form that needs to be filed by California Stock, Agricultural Cooperative and Foreign Corporations.

Q: Who needs to file Form SI-550?

A: California Stock, Agricultural Cooperative and Foreign Corporations need to file Form SI-550.

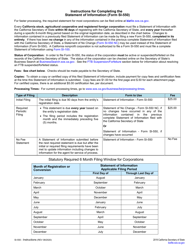

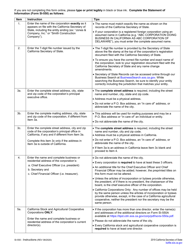

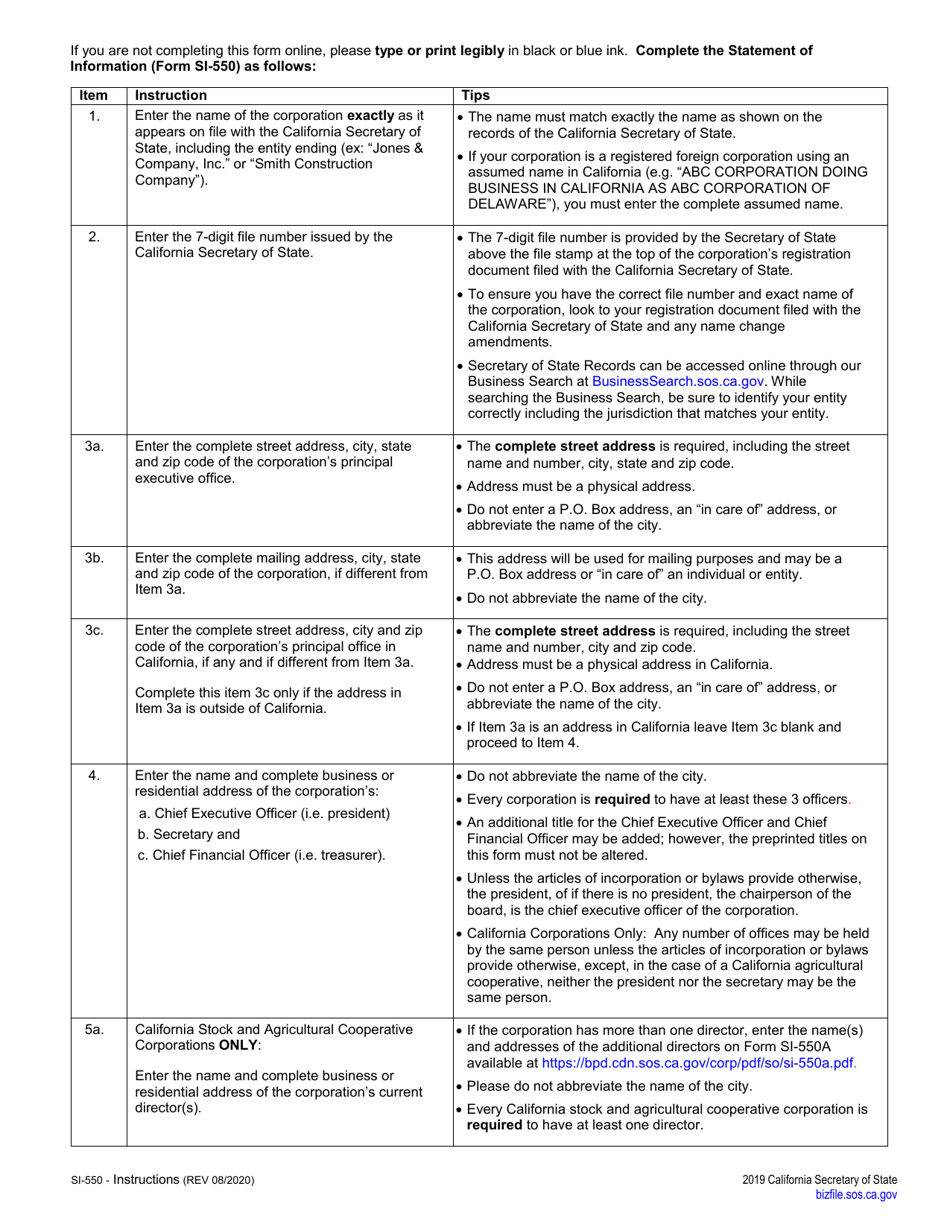

Q: What information is required on Form SI-550?

A: Form SI-550 requires information about the corporation's name, type, address, registered agent, officers, and directors.

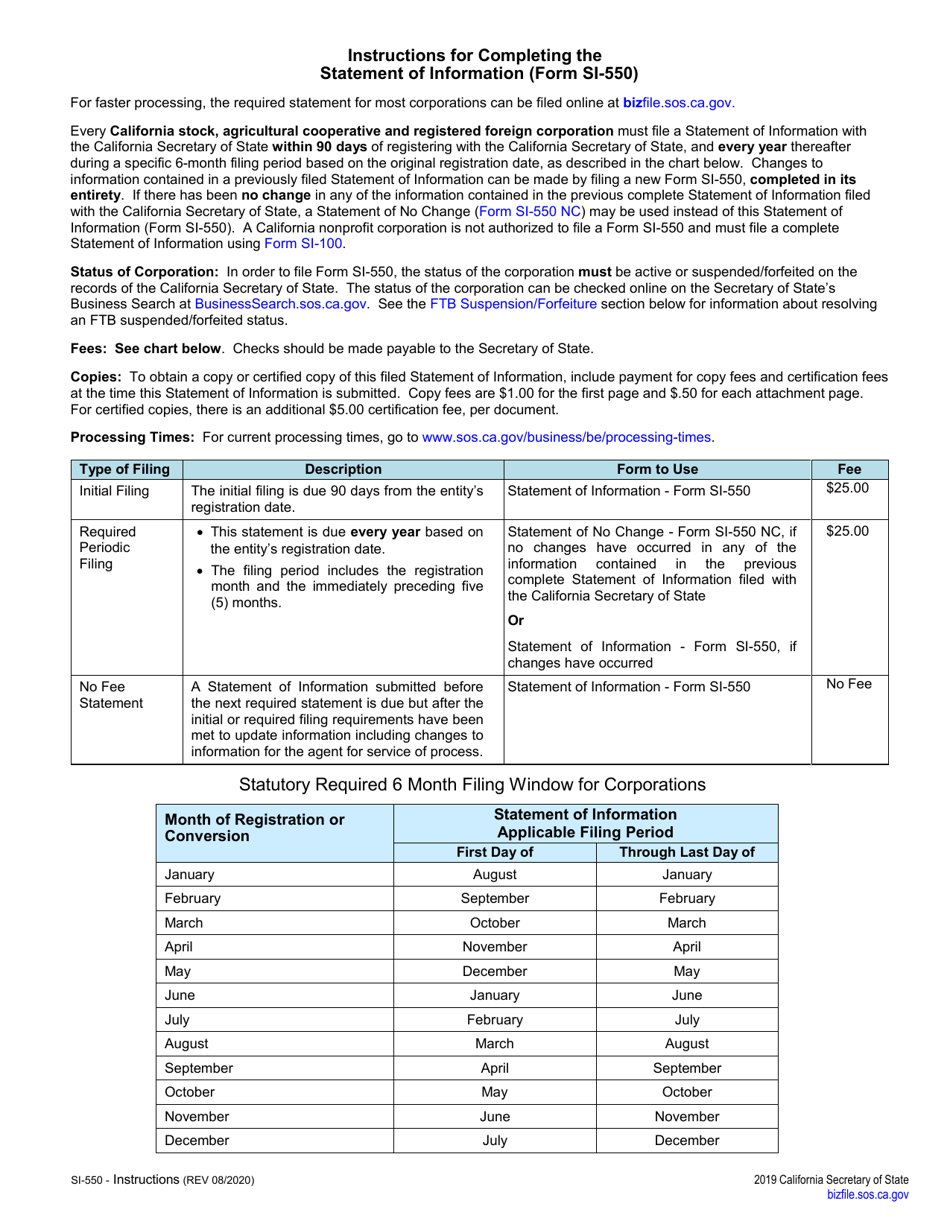

Q: When does Form SI-550 need to be filed?

A: Form SI-550 needs to be filed within 90 days of incorporating, qualifying, or registering with the California Secretary of State.

Q: What is the filing fee for Form SI-550?

A: The filing fee for Form SI-550 is $25.

Q: Is Form SI-550 required every year?

A: No, Form SI-550 is only required to be filed every two years for most corporations.

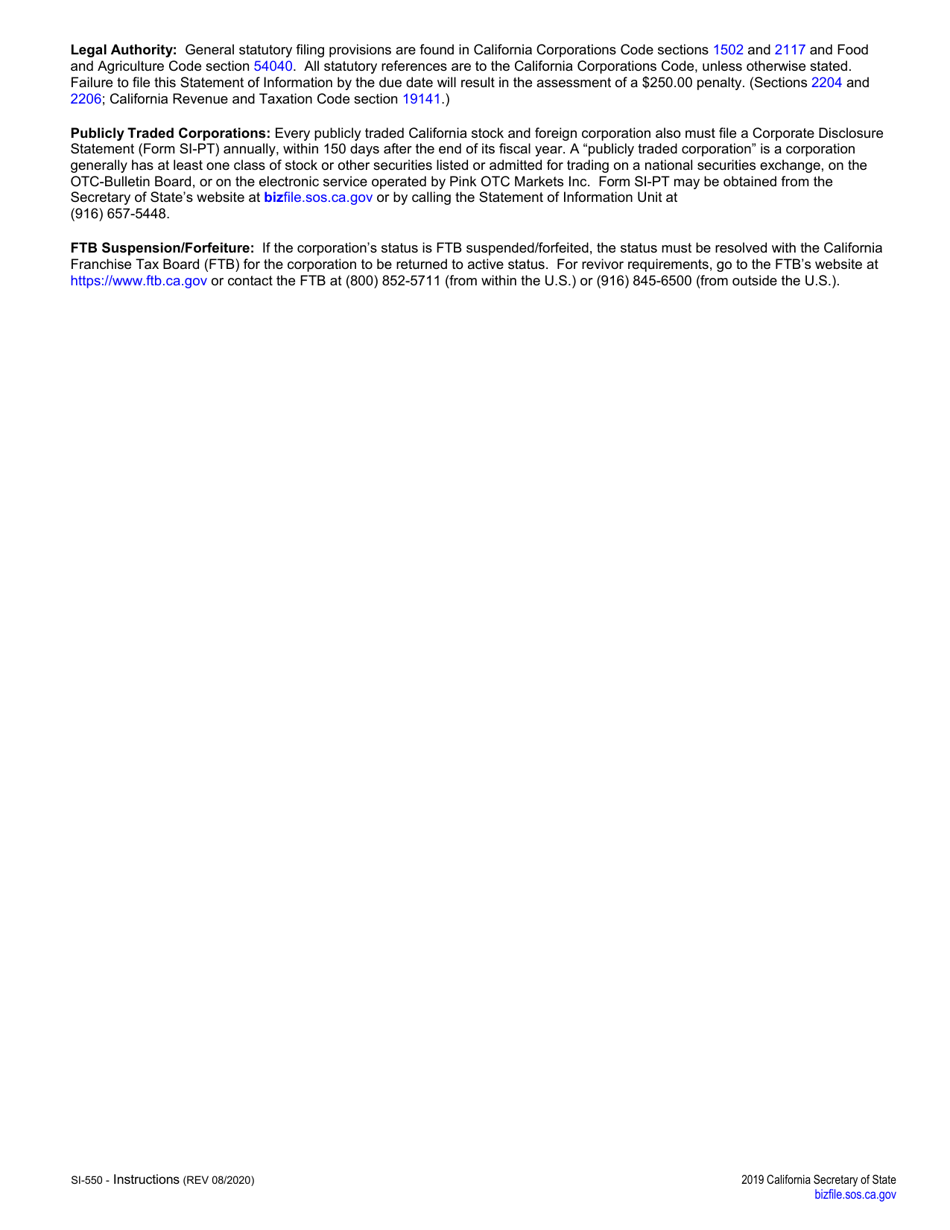

Q: What happens if Form SI-550 is not filed?

A: Failure to file Form SI-550 can result in penalties and the corporation being suspended or dissolved.

Q: Can Form SI-550 be amended?

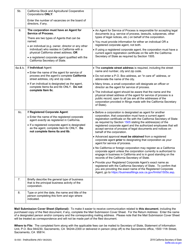

A: Yes, changes to the information provided on Form SI-550 can be made by filing an amended form with the California Secretary of State.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SI-550 by clicking the link below or browse more documents and templates provided by the California Secretary of State.