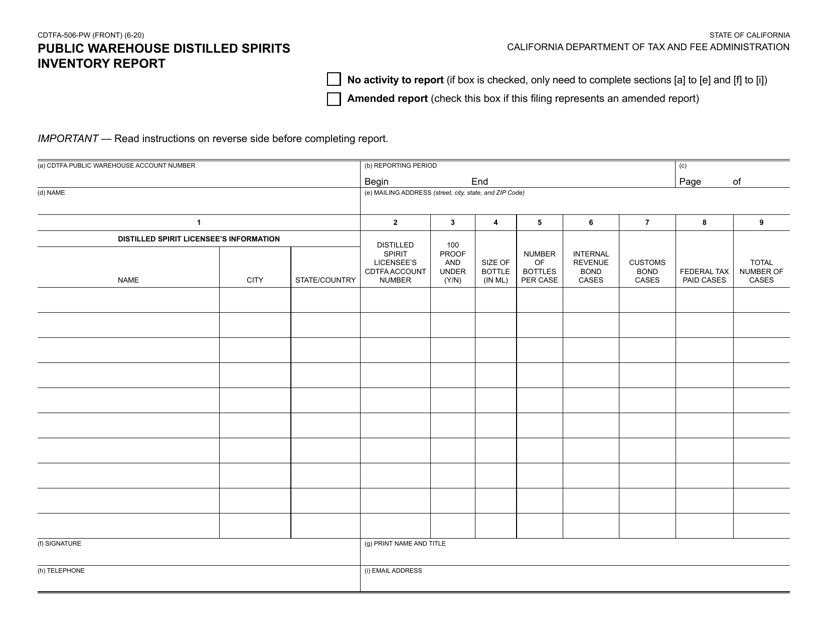

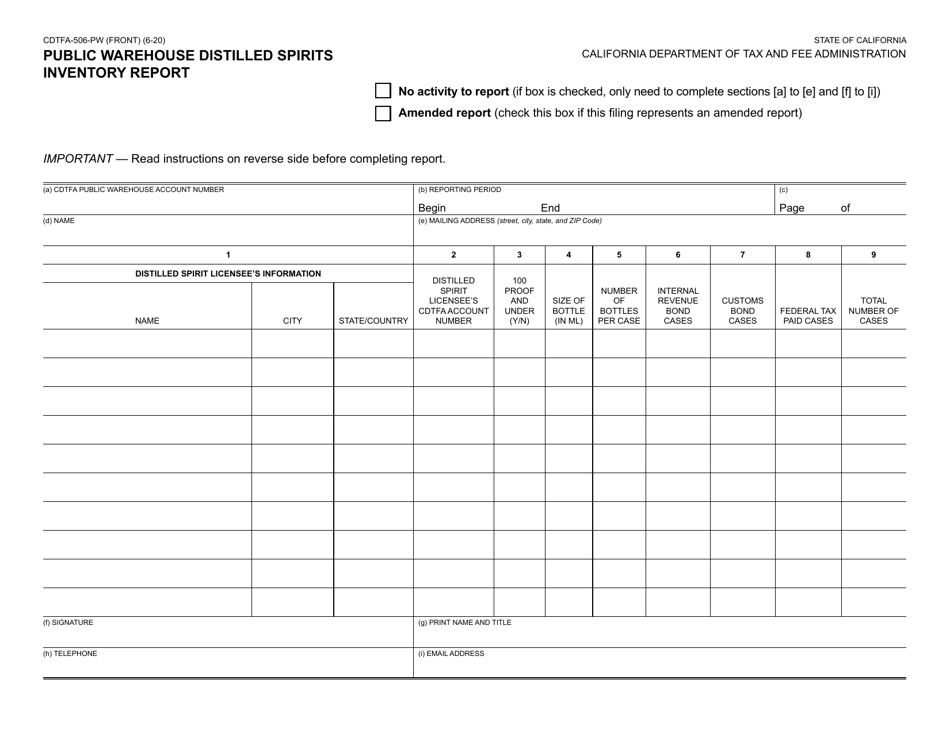

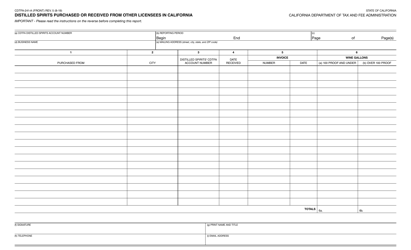

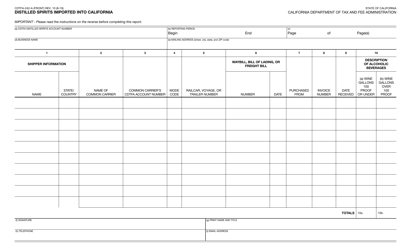

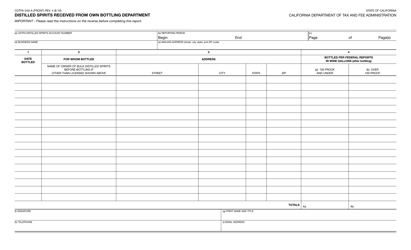

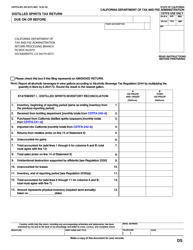

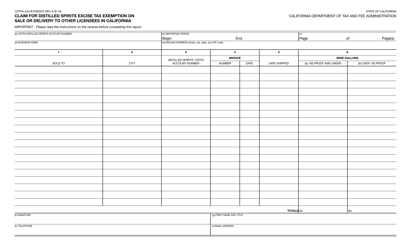

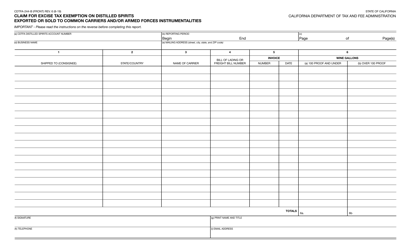

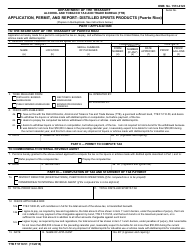

Form CDTFA-506-PW Public Warehouse Distilled Spirits Inventory Report - California

What Is Form CDTFA-506-PW?

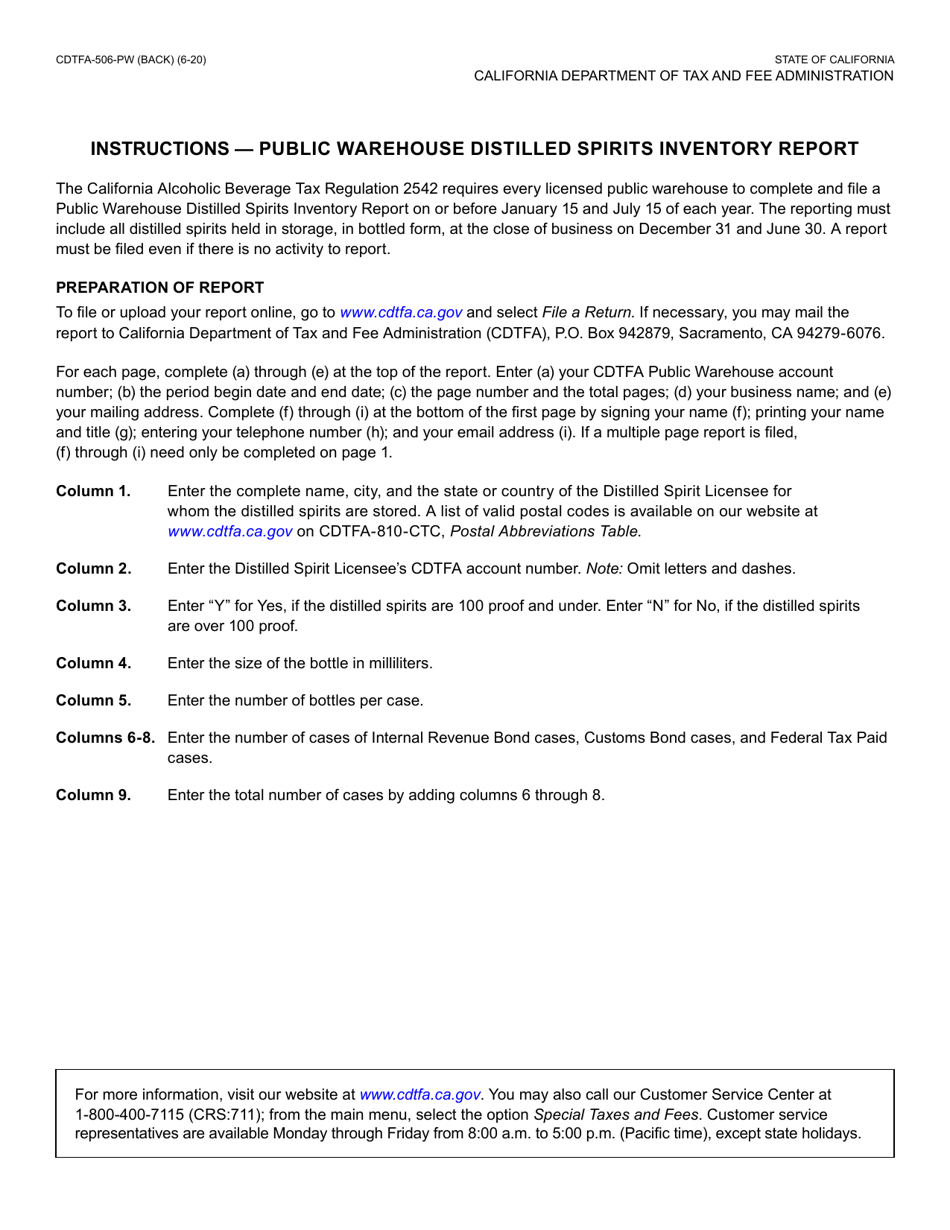

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-506-PW?

A: Form CDTFA-506-PW is the Public WarehouseDistilled SpiritsInventory Report.

Q: What is the purpose of Form CDTFA-506-PW?

A: The purpose of Form CDTFA-506-PW is to report the inventory of distilled spirits held in a public warehouse in California.

Q: Who needs to file Form CDTFA-506-PW?

A: Public warehouses that store distilled spirits in California need to file Form CDTFA-506-PW.

Q: When is Form CDTFA-506-PW due?

A: Form CDTFA-506-PW is due on or before the 15th day of the month following the reporting period.

Q: Are there any penalties for not filing Form CDTFA-506-PW?

A: Yes, there are penalties for not filing Form CDTFA-506-PW, including late filing penalties and interest charges.

Q: What information is required on Form CDTFA-506-PW?

A: Form CDTFA-506-PW requires information such as the warehouse operator's name, license number, and the quantity and value of distilled spirits held in the warehouse.

Q: Do I need to attach any documents to Form CDTFA-506-PW?

A: No, you do not need to attach any documents to Form CDTFA-506-PW unless specifically requested by the CDTFA.

Q: What should I do if I have any questions about Form CDTFA-506-PW?

A: If you have any questions about Form CDTFA-506-PW, you can contact the CDTFA directly for assistance.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-506-PW by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.