This version of the form is not currently in use and is provided for reference only. Download this version of

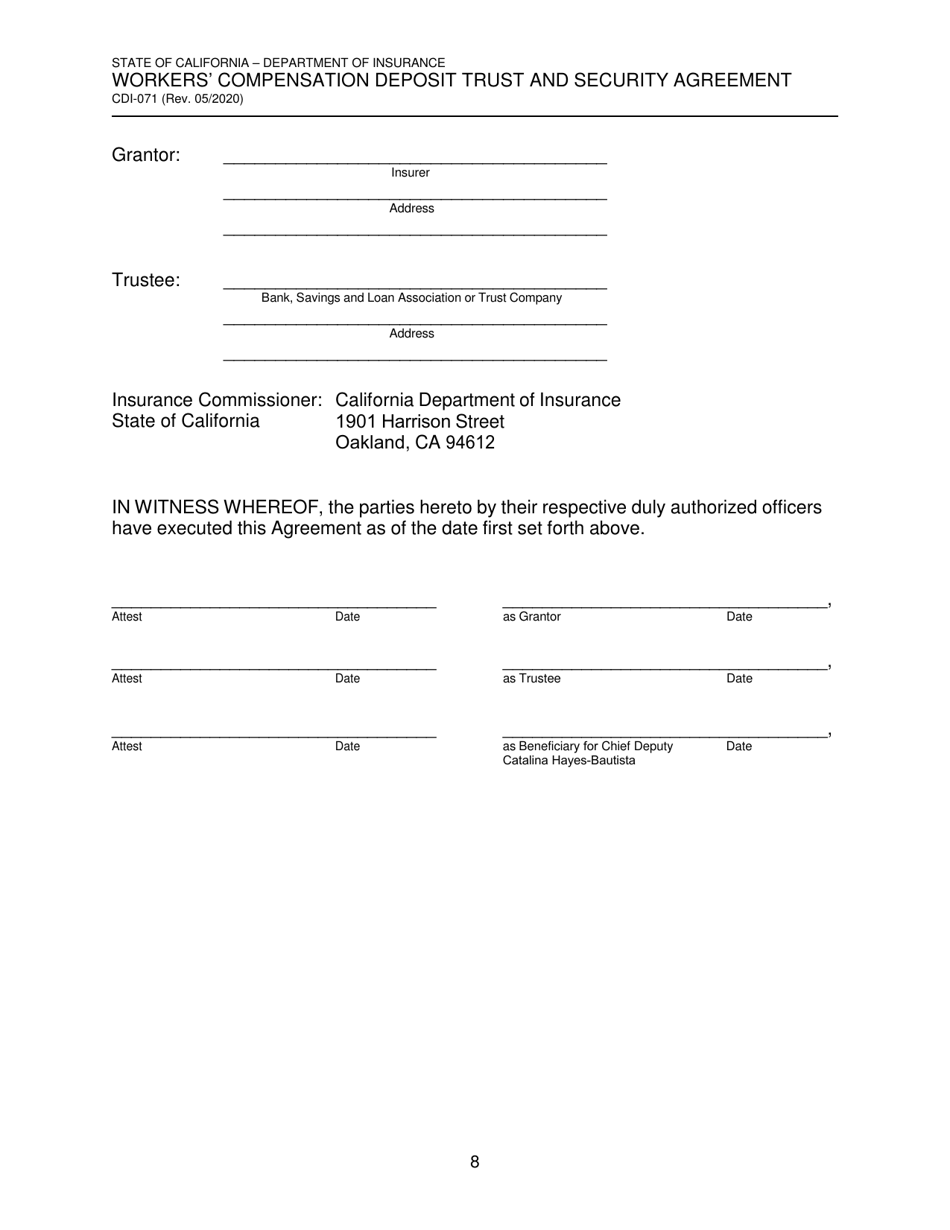

Form CDI-071

for the current year.

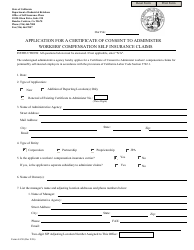

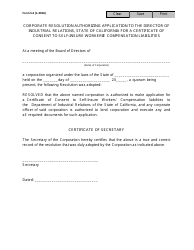

Form CDI-071 Workers' Compensation Deposit Trust and Security Agreement - California

What Is Form CDI-071?

This is a legal form that was released by the California Department of Insurance - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDI-071?

A: Form CDI-071 is the Workers' Compensation Deposit Trust and Security Agreement specifically used in California.

Q: What is the purpose of Form CDI-071?

A: The purpose of Form CDI-071 is to establish a deposit trust and security agreement for workers' compensation liabilities.

Q: Who uses Form CDI-071?

A: Form CDI-071 is used by employers in California who need to establish a deposit trust and security agreement for workers' compensation liabilities.

Q: What is a deposit trust and security agreement?

A: A deposit trust and security agreement is a financial arrangement where an employer deposits funds into a trust account to ensure payment of workers' compensation claims.

Q: Is Form CDI-071 specific to California?

A: Yes, Form CDI-071 is specific to California and is used to comply with the state's workers' compensation requirements.

Q: Is Form CDI-071 mandatory for all employers in California?

A: Form CDI-071 is not mandatory for all employers in California. It is typically required for larger self-insured employers or those who do not meet certain financial thresholds.

Q: What are the consequences of not complying with Form CDI-071 requirements?

A: Failure to comply with Form CDI-071 requirements may result in penalties or sanctions from the California Department of Insurance.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDI-071 by clicking the link below or browse more documents and templates provided by the California Department of Insurance.