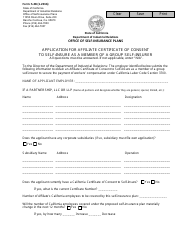

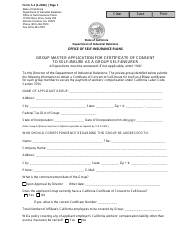

This version of the form is not currently in use and is provided for reference only. Download this version of

Form P-1

for the current year.

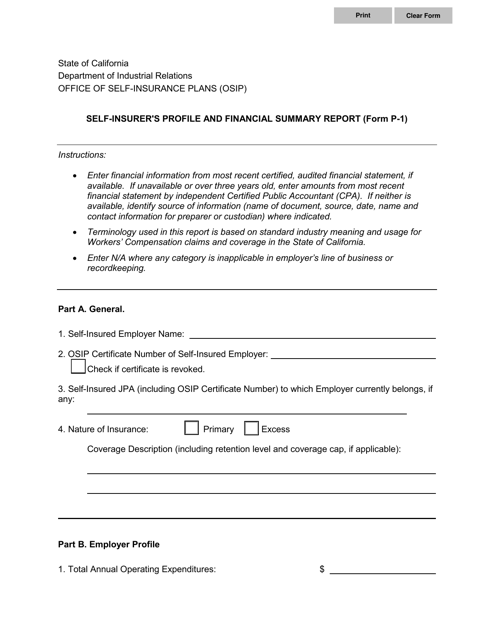

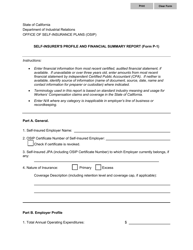

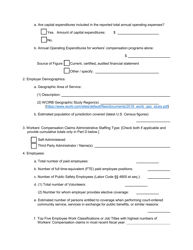

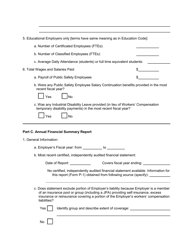

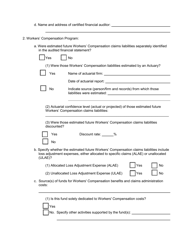

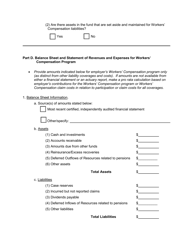

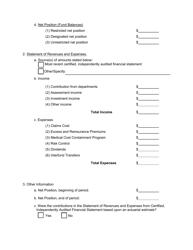

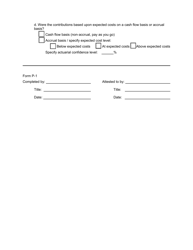

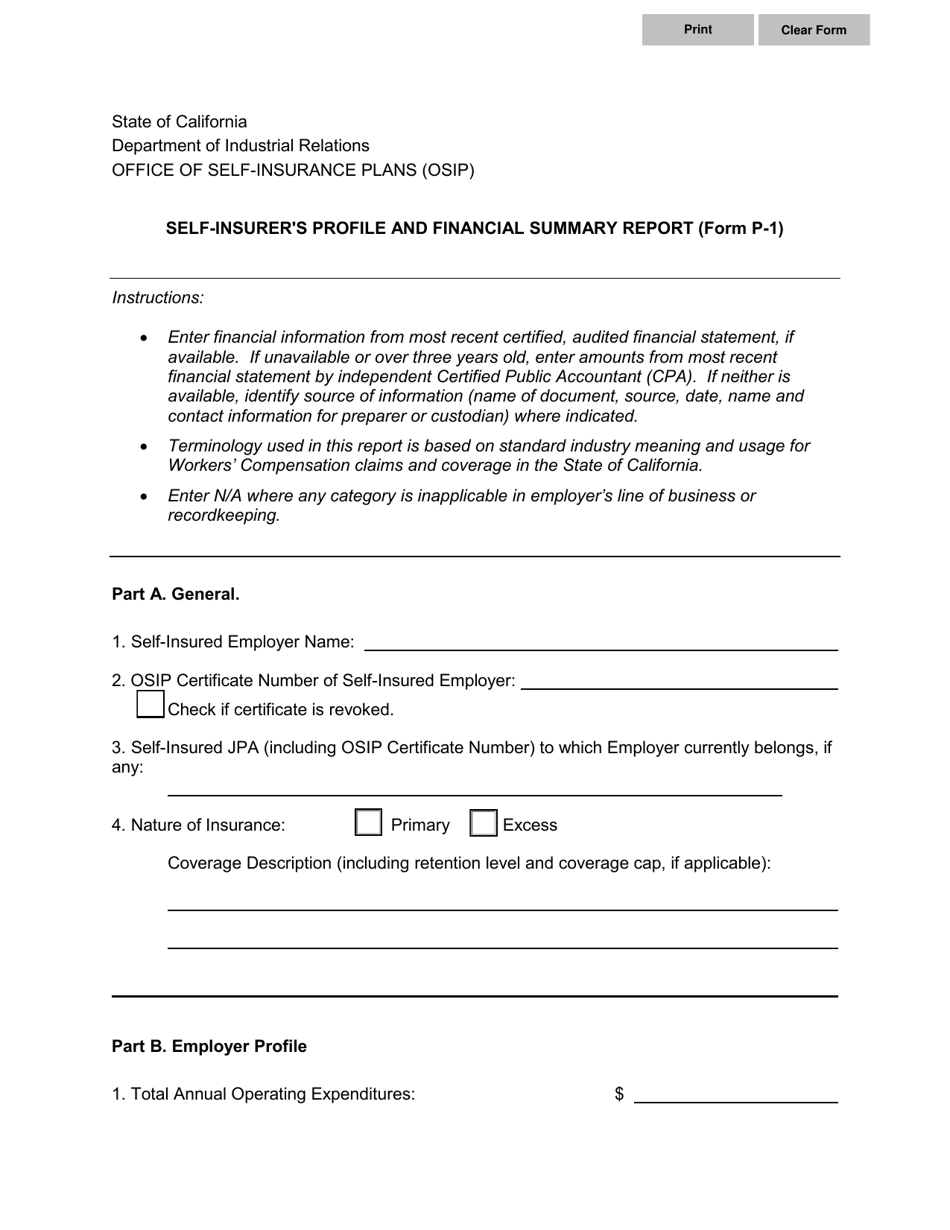

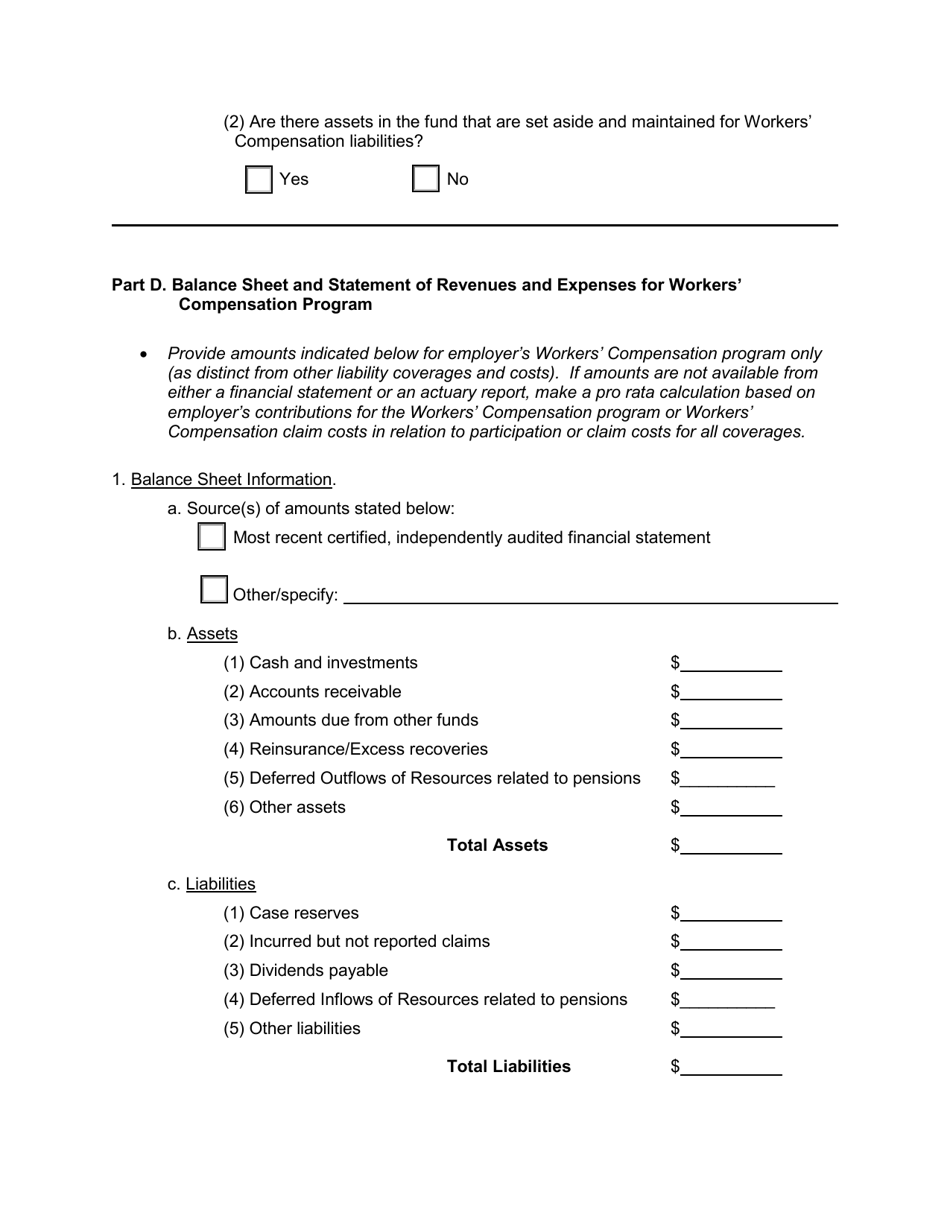

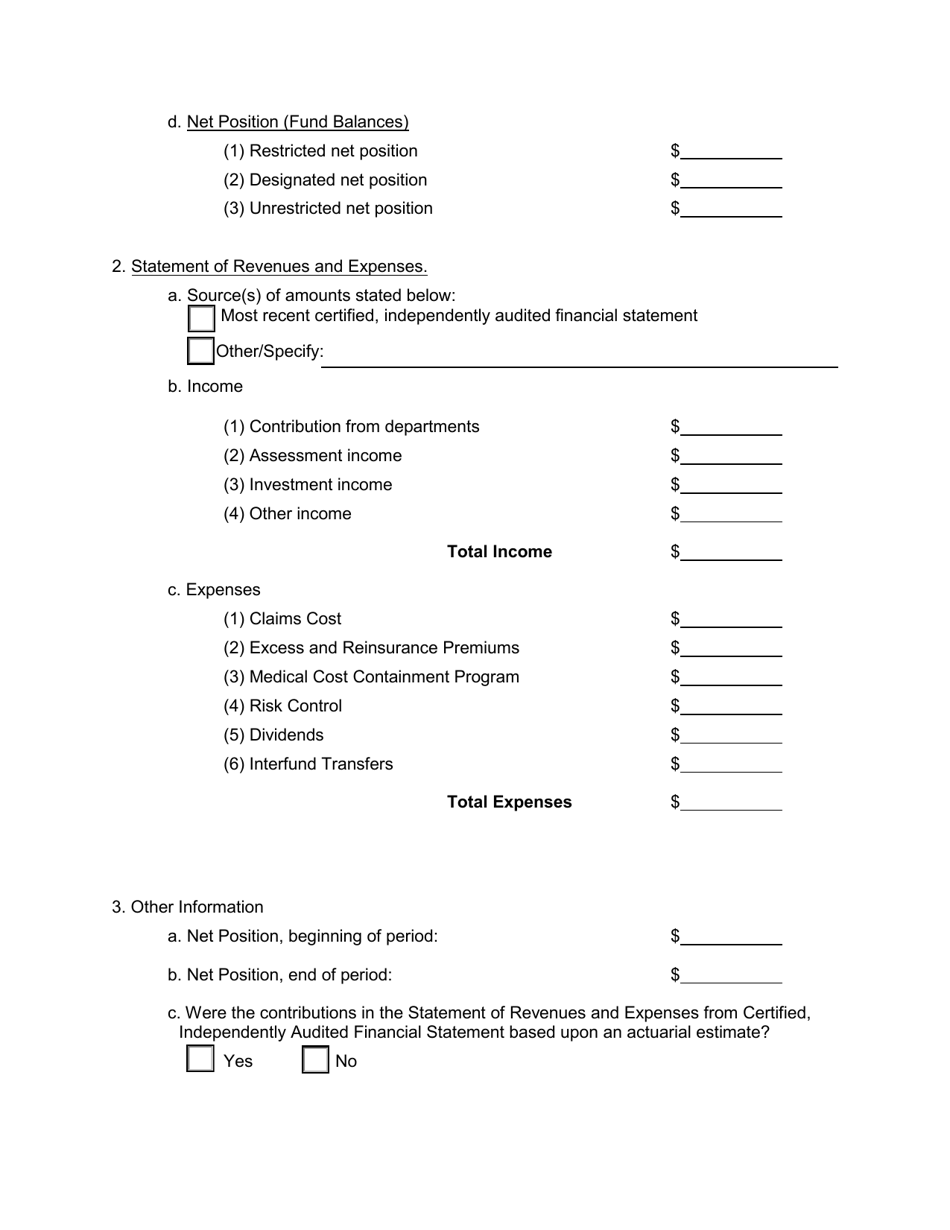

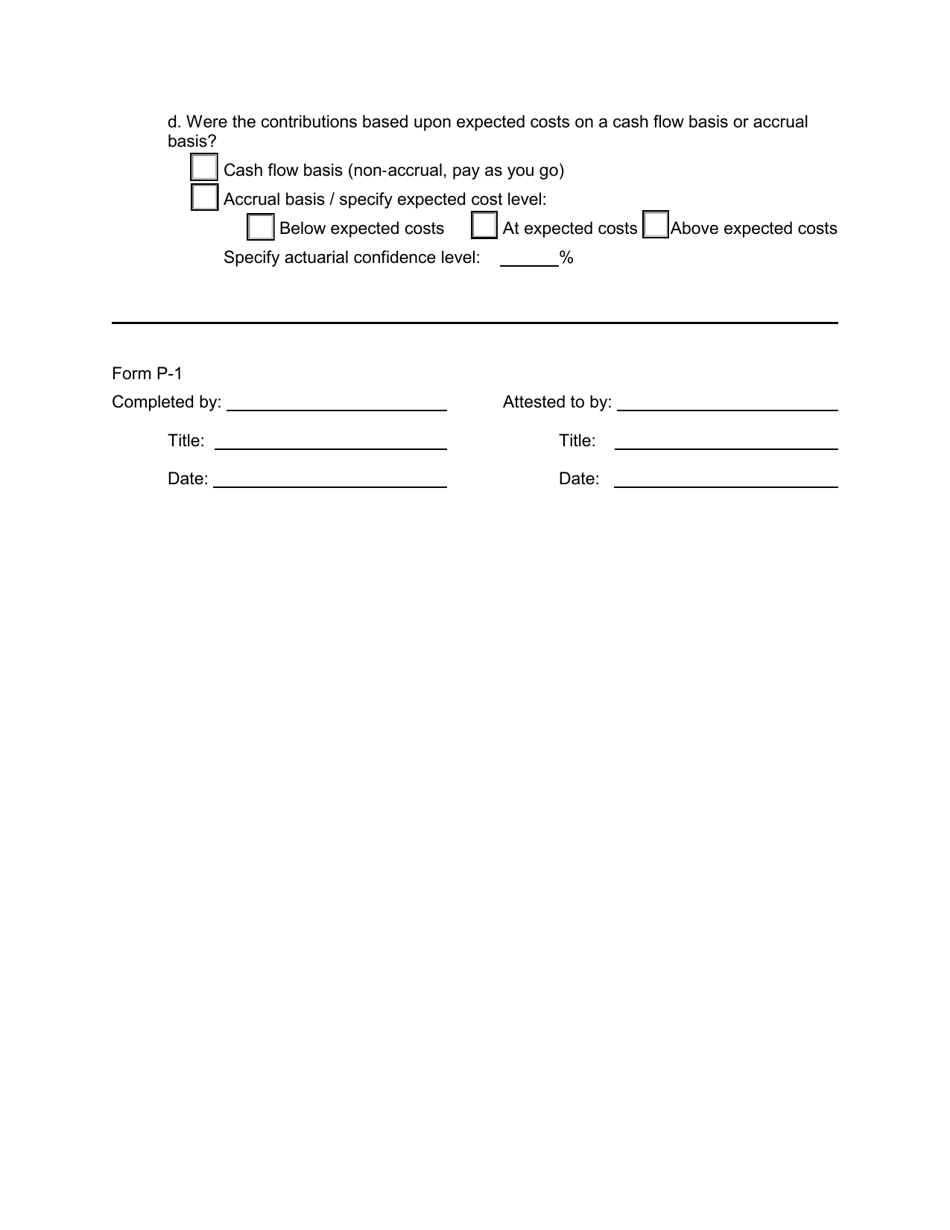

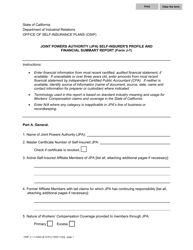

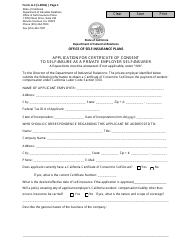

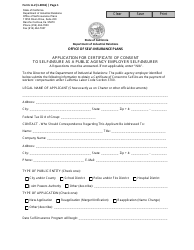

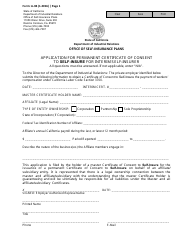

Form P-1 Self-insurer's Profile and Financial Summary Report - California

What Is Form P-1?

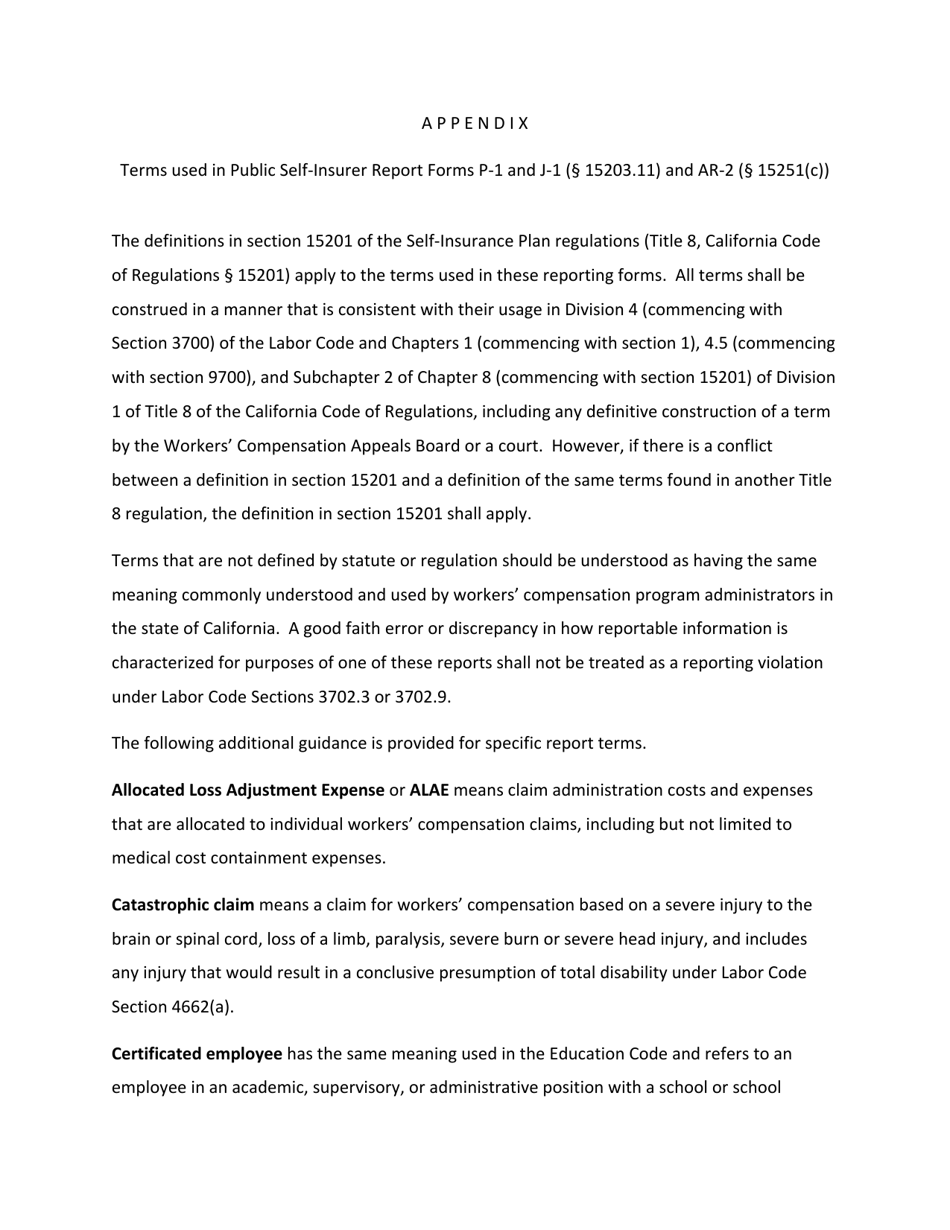

This is a legal form that was released by the California Department of Industrial Relations - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form P-1?

A: Form P-1 is the Self-insurer's Profile and Financial Summary Report in California.

Q: Who is required to file Form P-1?

A: Self-insurers in California are required to file Form P-1.

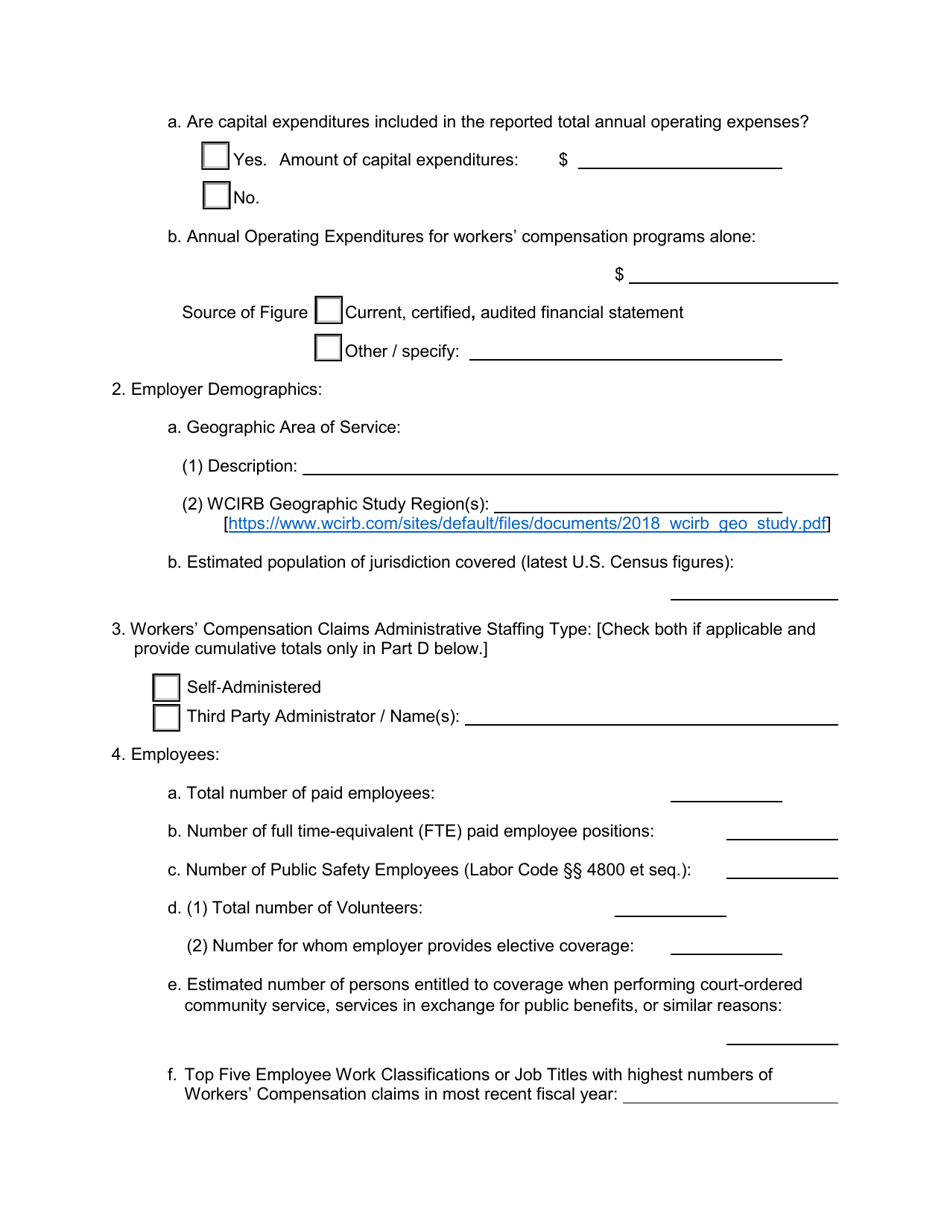

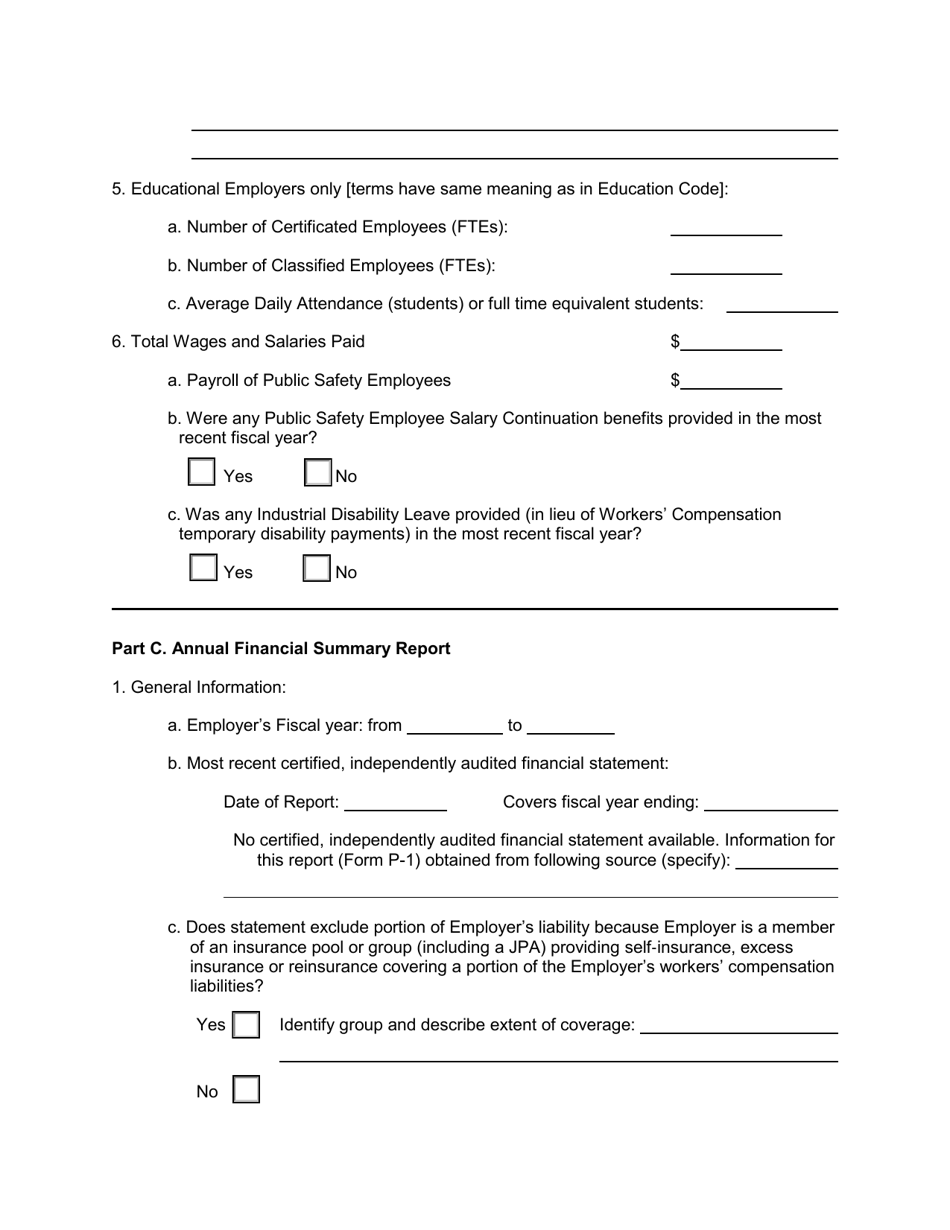

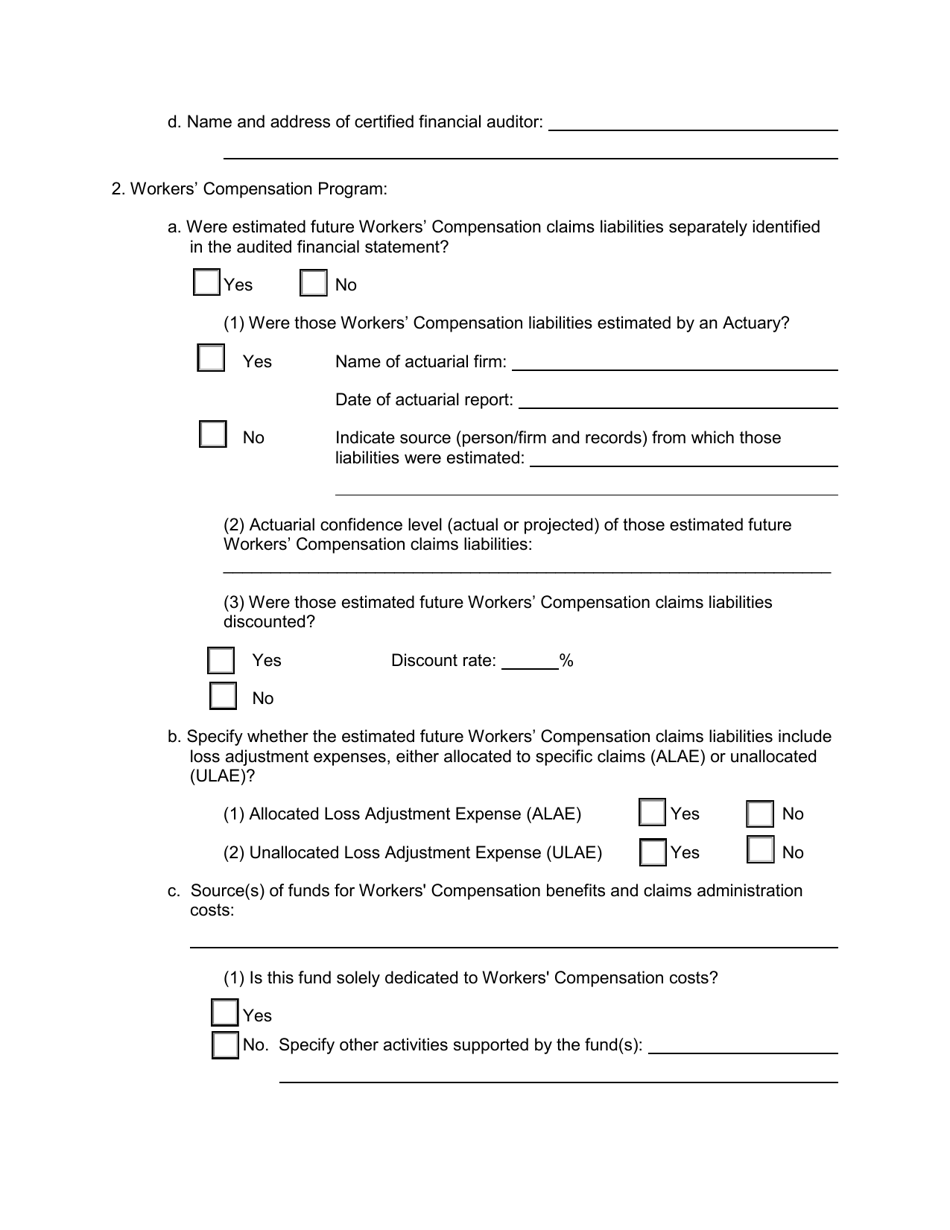

Q: What information is included in Form P-1?

A: Form P-1 includes the self-insurer's profile and financial summary.

Q: What is the purpose of Form P-1?

A: The purpose of Form P-1 is to provide information about the self-insurer's financial status.

Q: Are there any penalties for not filing Form P-1?

A: Yes, there are penalties for not filing Form P-1 or for filing late. Self-insurers should comply with the filing requirements to avoid penalties.

Q: Is Form P-1 required for self-insurers in other states?

A: No, Form P-1 is specific to California self-insurers only.

Q: Can Form P-1 be filed electronically?

A: Yes, Form P-1 can be filed electronically.

Q: Who can I contact for assistance with Form P-1?

A: For assistance with Form P-1, self-insurers can contact the California Department of Industrial Relations.

Form Details:

- The latest edition provided by the California Department of Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form P-1 by clicking the link below or browse more documents and templates provided by the California Department of Industrial Relations.