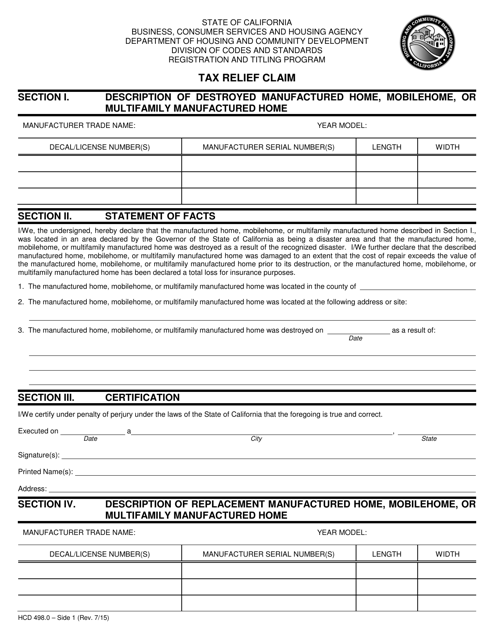

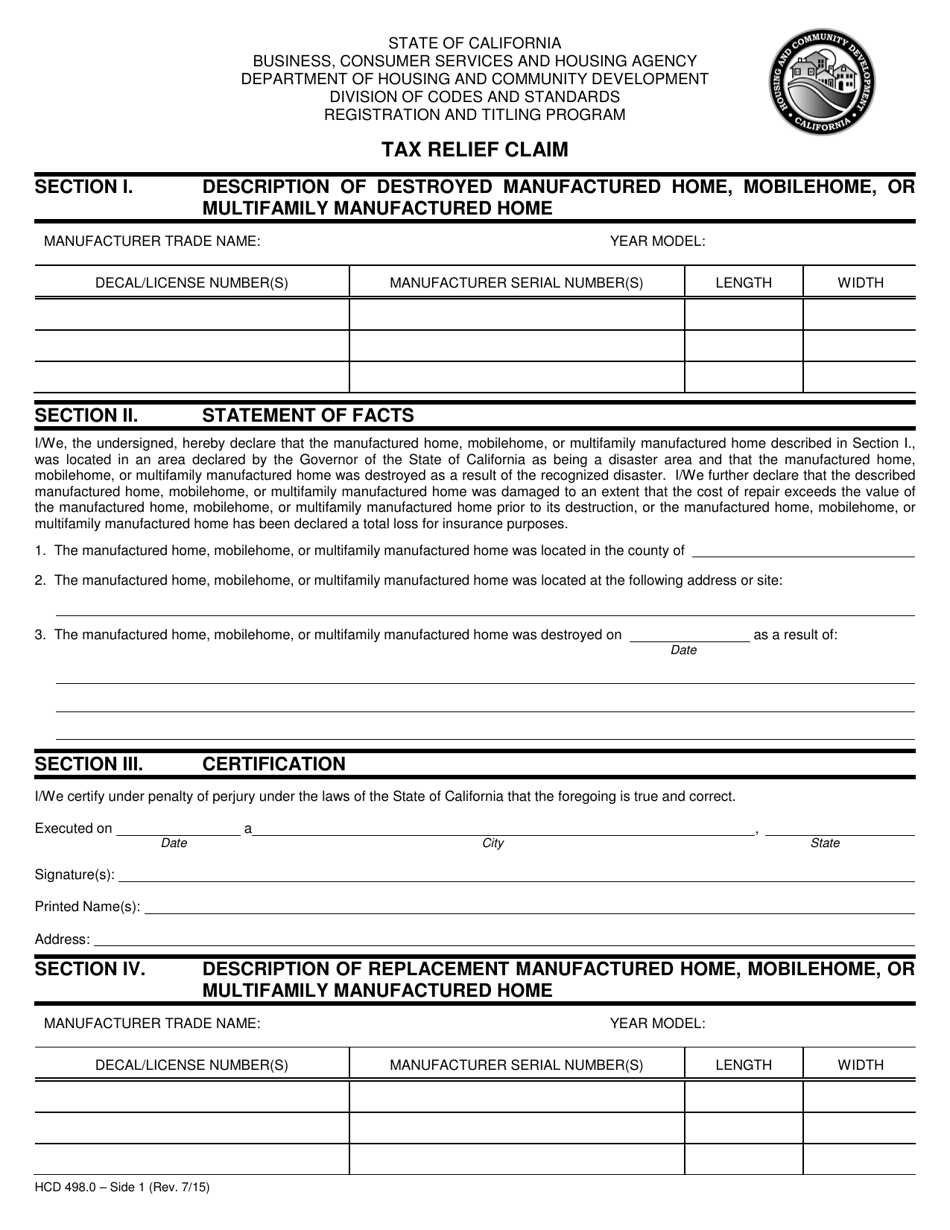

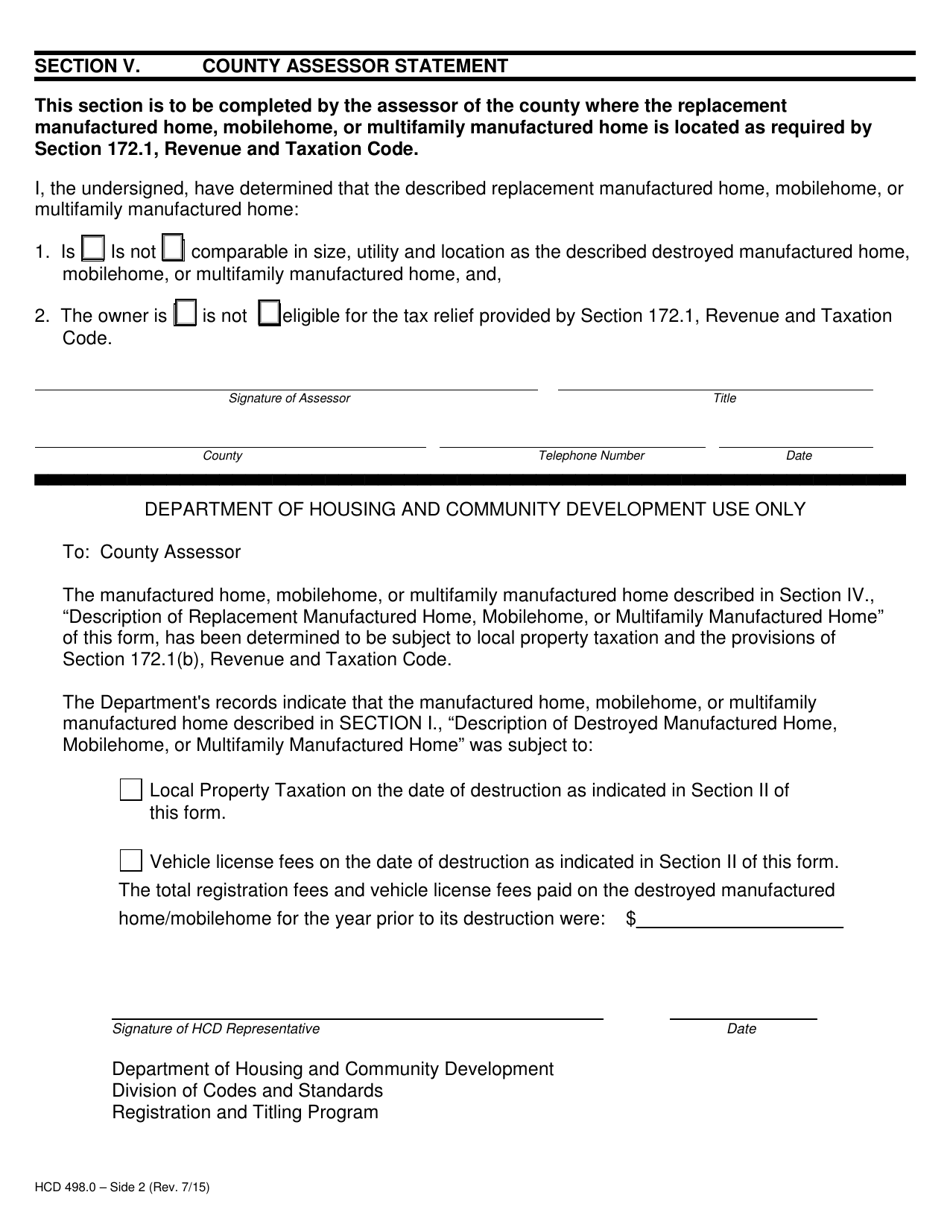

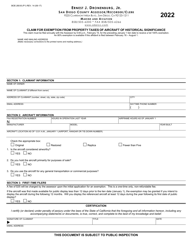

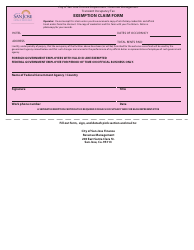

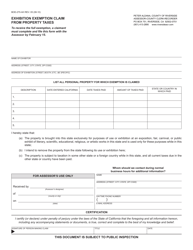

Form HCD498.0 Tax Relief Claim - California

What Is Form HCD498.0?

This is a legal form that was released by the California Department of Housing & Community Development - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HCD498.0?

A: Form HCD498.0 is a tax relief claim form specific to California.

Q: What is tax relief?

A: Tax relief refers to a reduction or elimination of taxes owed.

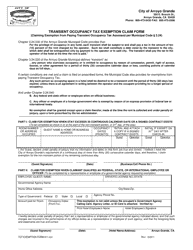

Q: Who can use Form HCD498.0?

A: Form HCD498.0 is used by individuals in California who are seeking tax relief.

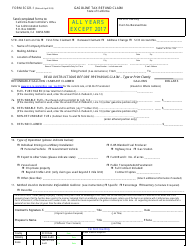

Q: What types of taxes does Form HCD498.0 apply to?

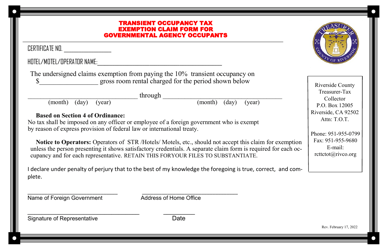

A: Form HCD498.0 applies to property taxes in California.

Q: How do I obtain Form HCD498.0?

A: Form HCD498.0 can be obtained from the California Department of Housing and Community Development.

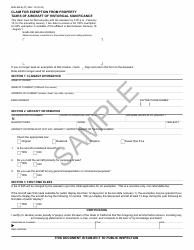

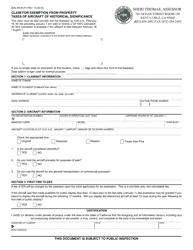

Q: What information do I need to fill out Form HCD498.0?

A: You will need information about your property and your financial situation to fill out Form HCD498.0.

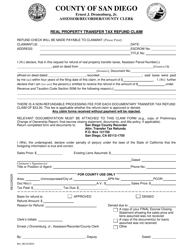

Q: What is the deadline for submitting Form HCD498.0?

A: The deadline for submitting Form HCD498.0 varies by county, so you should check with your county assessor's office for the specific deadline.

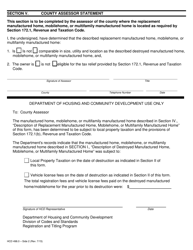

Q: What happens after I submit Form HCD498.0?

A: After you submit Form HCD498.0, the county assessor's office will review your application and determine if you qualify for tax relief.

Q: How long does it take to receive a decision on my Form HCD498.0 application?

A: The processing time for Form HCD498.0 applications varies, but you can expect to receive a decision within a few months.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the California Department of Housing & Community Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HCD498.0 by clicking the link below or browse more documents and templates provided by the California Department of Housing & Community Development.