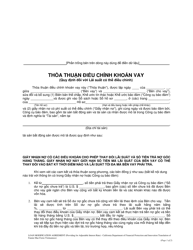

Form DFPI-CRMLA8019 Loan Modification Agreement (Providing for Adjustable Interest Rate) - California (Chinese)

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California.

The document is provided in Chinese. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DFPI-CRMLA8019 Loan Modification Agreement?

A: The DFPI-CRMLA8019 Loan Modification Agreement is a legal document used in California for loan modifications that involve an adjustable interest rate.

Q: What does the Loan Modification Agreement provide for?

A: The Loan Modification Agreement provides for changes to the terms of an existing loan, particularly the interest rate, to make it more manageable for the borrower.

Q: Is this document specific to California?

A: Yes, this document is specific to the state of California.

Q: Does this document have a Chinese version?

A: Yes, this document is available in Chinese for the convenience of Chinese-speaking individuals.

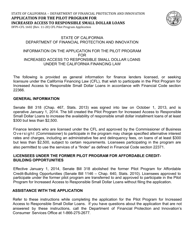

Q: What is an adjustable interest rate?

A: An adjustable interest rate is a variable interest rate that may change over time based on certain financial indexes or market conditions.

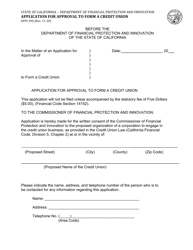

Q: Who can use the DFPI-CRMLA8019 Loan Modification Agreement?

A: The DFPI-CRMLA8019 Loan Modification Agreement can be used by borrowers and lenders in California who wish to modify the terms of an existing loan with an adjustable interest rate.

Q: Is it necessary to use this specific form for a loan modification in California?

A: While it is not mandatory to use this specific form, it is recommended as it ensures that all necessary information and provisions are included for a legally valid loan modification.

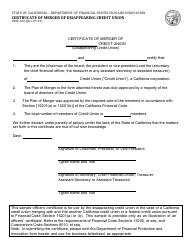

Form Details:

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of Form DFPI-CRMLA8019 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.