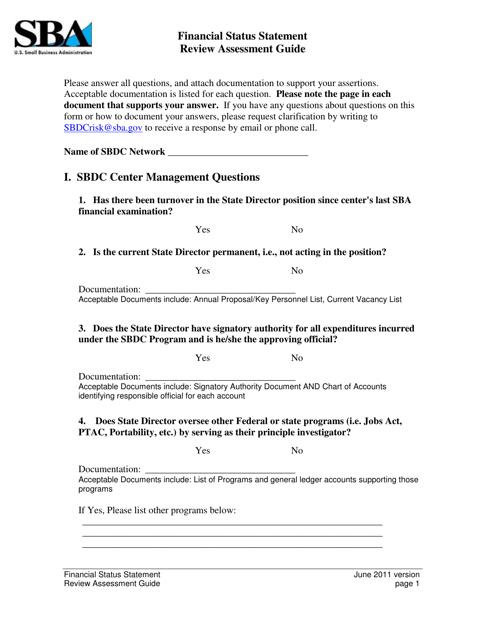

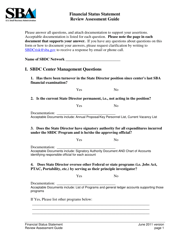

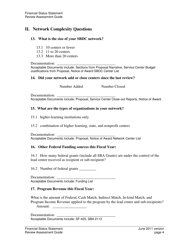

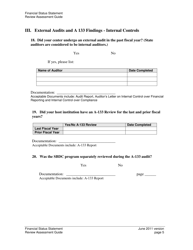

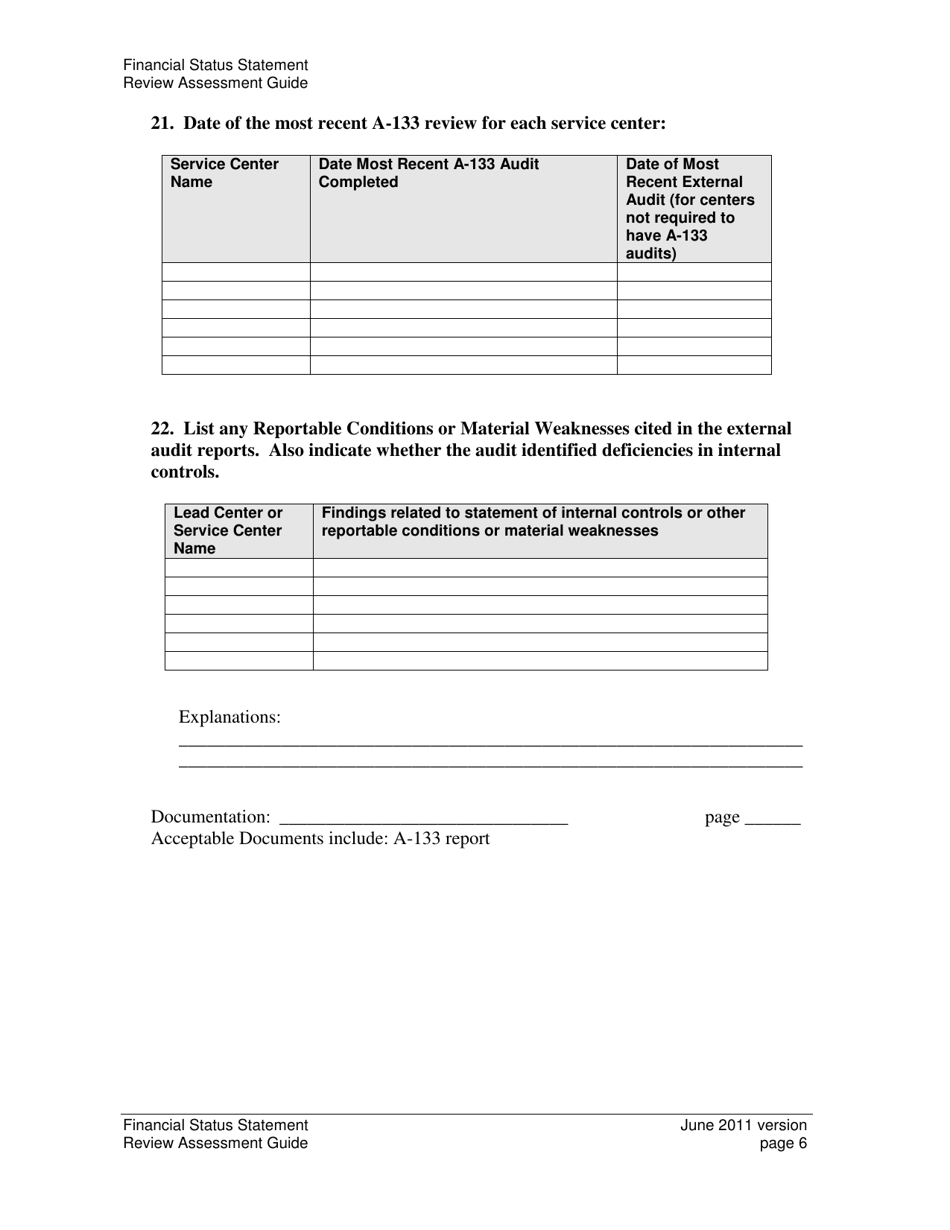

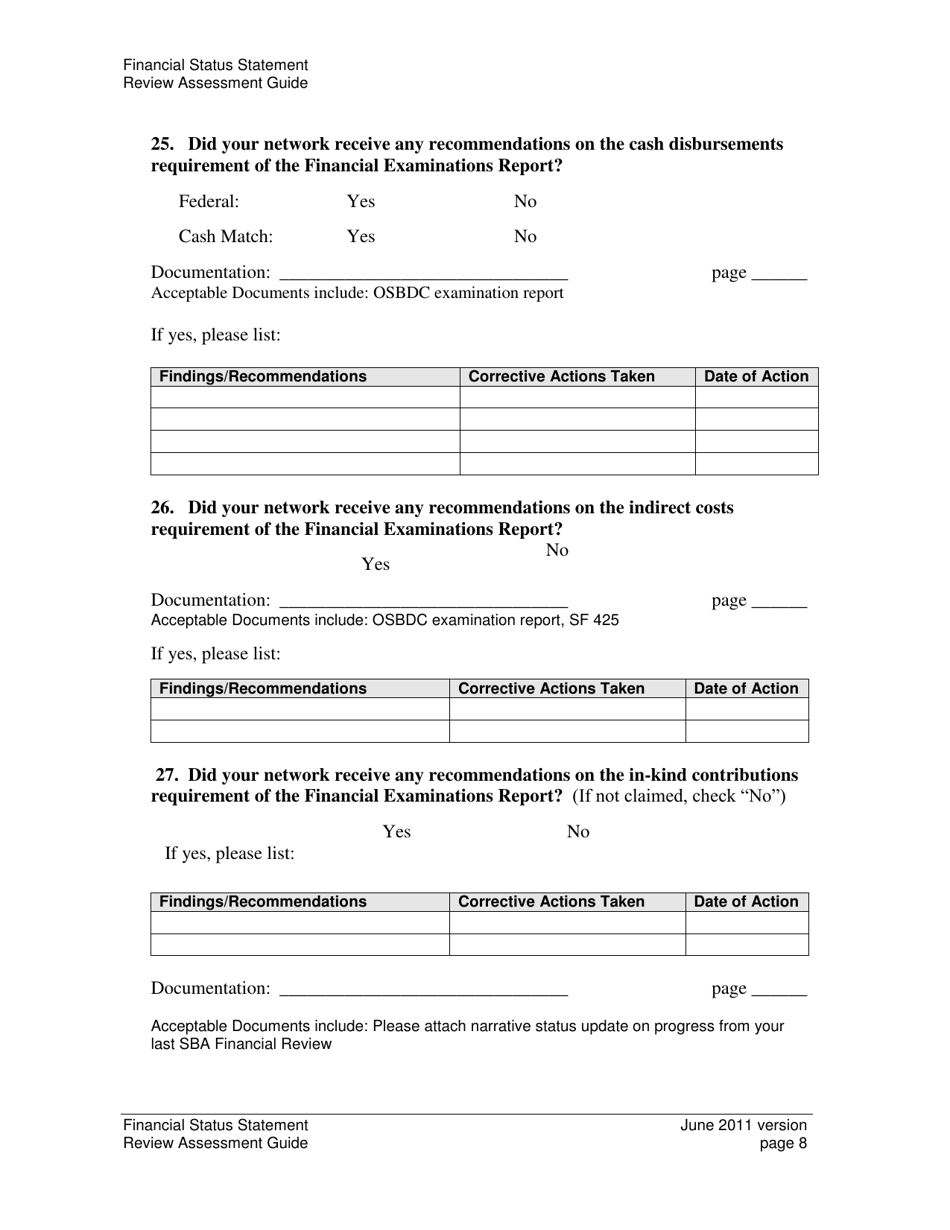

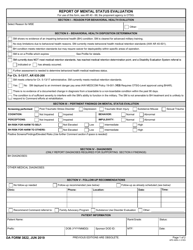

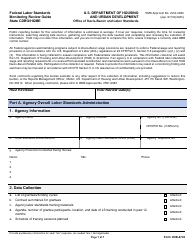

Financial Status Statement Review Assessment Guide

Financial Status Statement Review Assessment Guide is a 9-page legal document that was released by the U.S. Small Business Administration on June 1, 2011 and used nation-wide.

FAQ

Q: What is a Financial Status Statement?

A: A Financial Status Statement is a document that provides a summary of an individual or organization's financial position.

Q: Why is it important to review a Financial Status Statement?

A: Reviewing a Financial Status Statement helps assess a person or organization's financial health, identify strengths and weaknesses, and make informed decisions.

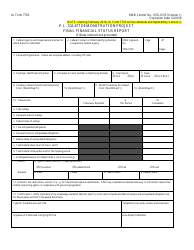

Q: What are some items included in a Financial Status Statement?

A: A Financial Status Statement typically includes a balance sheet, income statement, statement of cash flows, and any notes or disclosures.

Q: What does a balance sheet show?

A: A balance sheet shows an individual or organization's assets, liabilities, and equity at a specific point in time.

Q: What does an income statement show?

A: An income statement shows an individual or organization's revenue, expenses, and profit or loss over a specific period of time.

Q: What does a statement of cash flows show?

A: A statement of cash flows shows the movement of cash in and out of an individual or organization over a specific period of time.

Q: What should I look for when reviewing a Financial Status Statement?

A: When reviewing a Financial Status Statement, you should look for trends, significant changes, discrepancies, and any potential red flags.

Q: How can I use a Financial Status Statement to make informed decisions?

A: By analyzing the information in a Financial Status Statement, you can make decisions such as budgeting, financial planning, investment strategies, and assessing creditworthiness.

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.