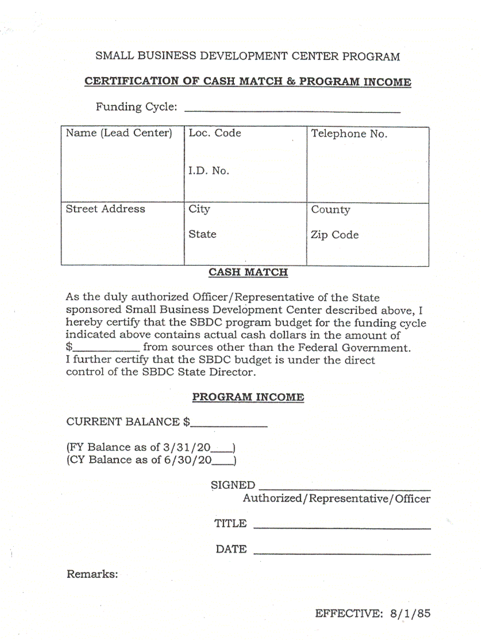

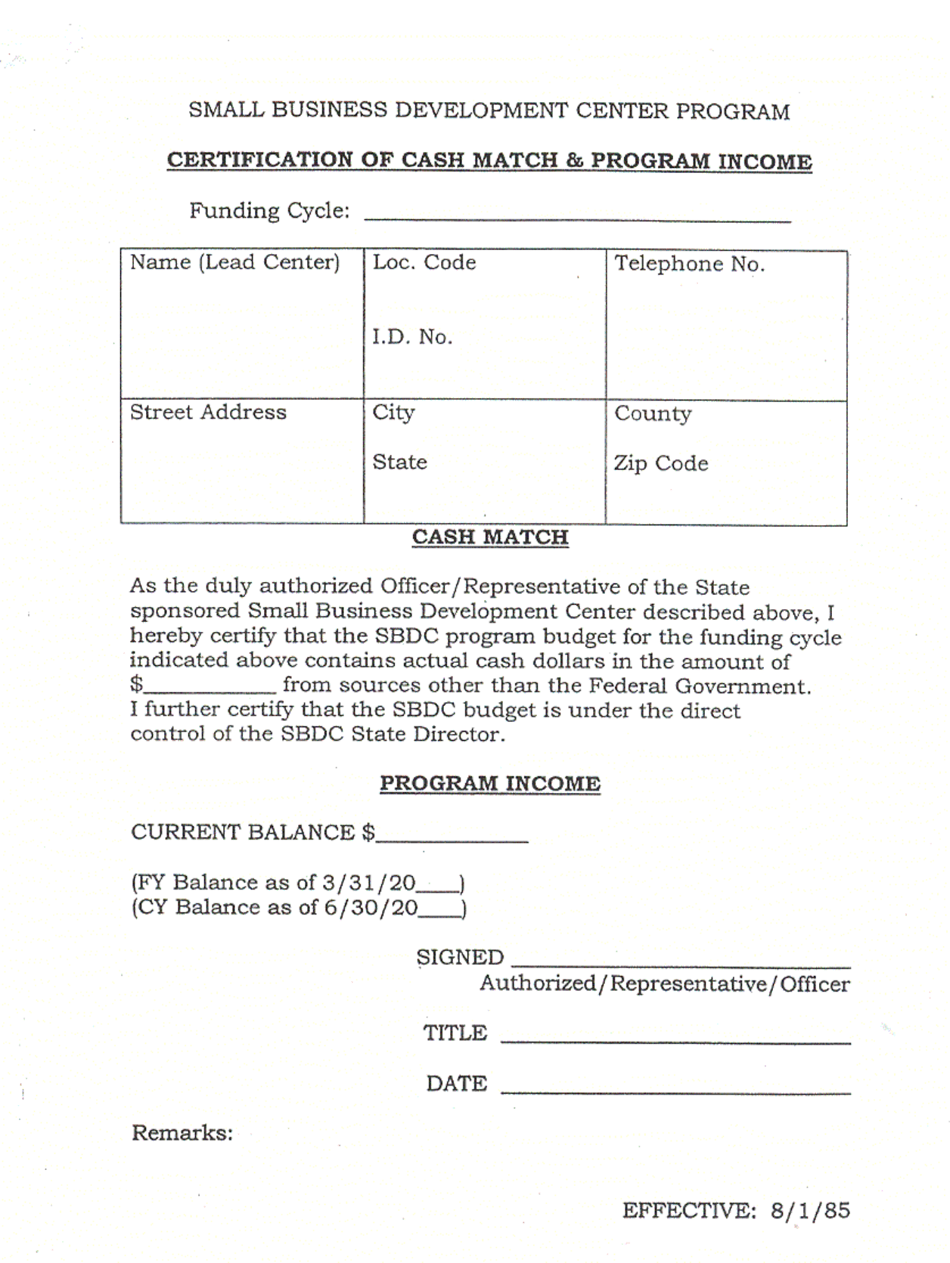

Certification of Cash Match and Program Income

Certification of Cash Match and Program Income is a 1-page legal document that was released by the U.S. Small Business Administration on August 1, 1985 and used nation-wide.

FAQ

Q: What is certification of cash match?

A: Certification of cash match refers to the process of verifying and documenting that an organization has provided the required amount of funds as a match for a specific program or project.

Q: What is program income?

A: Program income refers to the revenue generated by a program or project funded by a grant or contract. It includes fees, royalties, and proceeds from the sale of goods or services.

Q: Why is certification of cash match and program income important?

A: Certification of cash match and program income is important to ensure accountability and compliance with funding requirements. It helps demonstrate that the organization has met its obligations and has properly managed the funds.

Q: How is certification of cash match and program income done?

A: Certification is typically done through a formal process that involves reviewing financial records, invoices, receipts, and other relevant documentation. The organization may need to provide evidence of the cash match and program income sources.

Q: Who is responsible for certification of cash match and program income?

A: The organization receiving the funding is responsible for the certification of cash match and program income. They are required to maintain accurate records and documentation to support their certification.

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.