This version of the form is not currently in use and is provided for reference only. Download this version of

Form 24

for the current year.

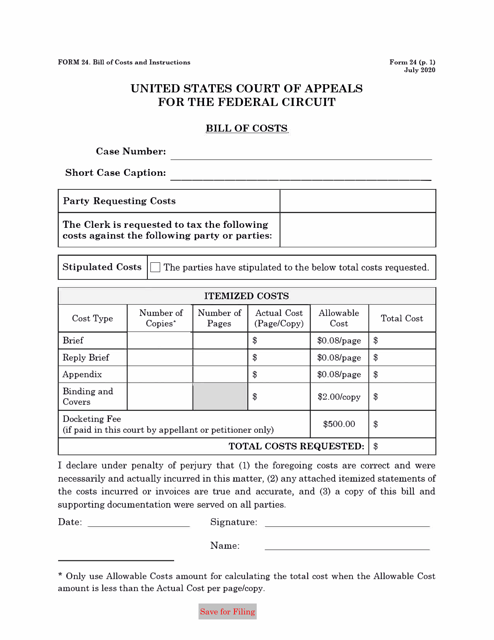

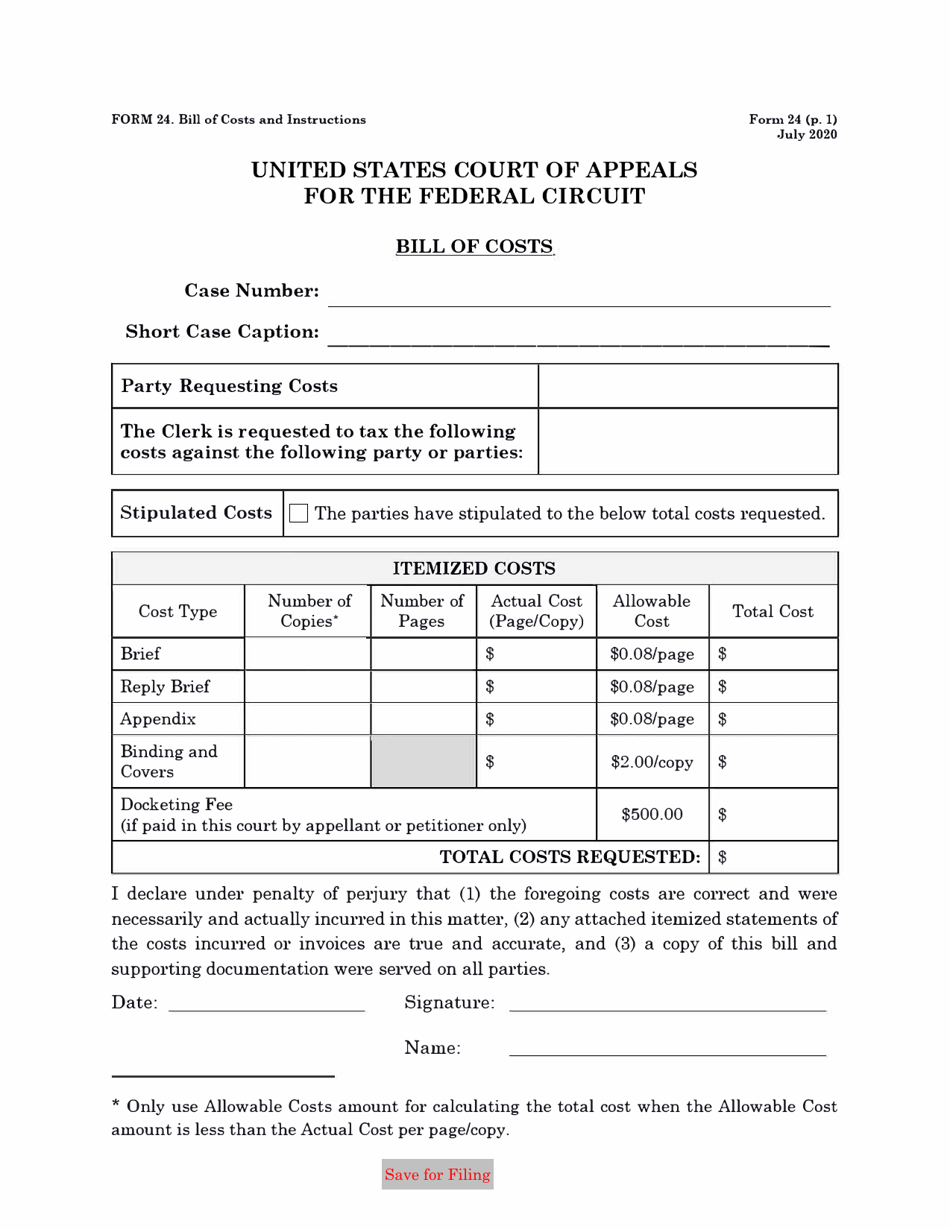

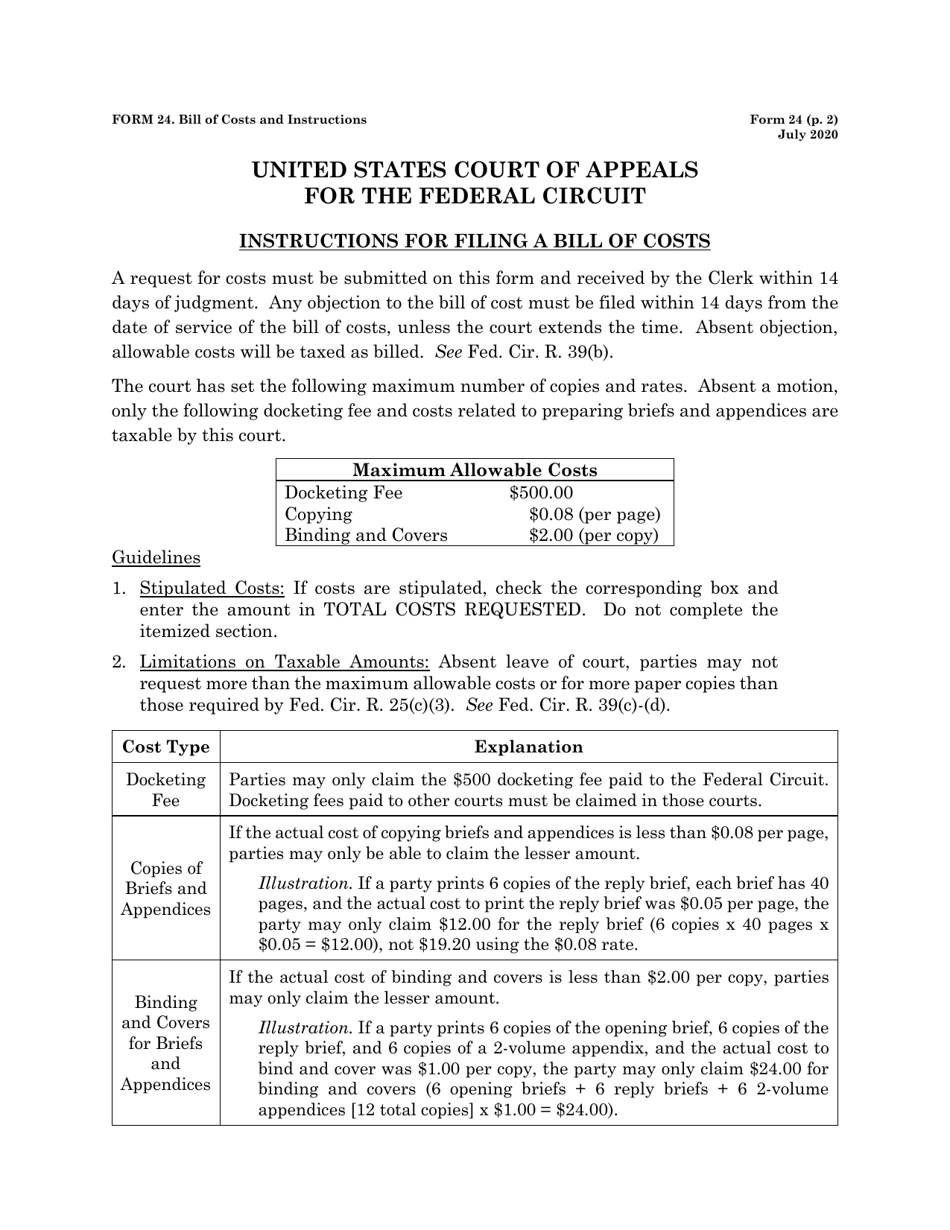

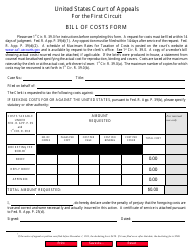

Form 24 Bill of Costs

What Is Form 24?

This is a legal form that was released by the United States Court of Appeals for the Federal Circuit on July 1, 2020 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

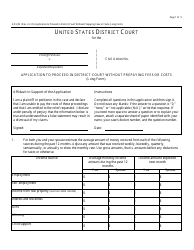

Q: What is a Form 24 Bill of Costs?

A: A Form 24 Bill of Costs is a document used to request the reimbursement of expenses incurred during a legal proceeding.

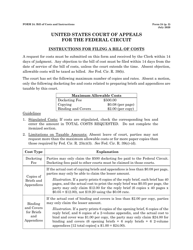

Q: What expenses can be included in a Form 24 Bill of Costs?

A: Expenses that can be included in a Form 24 Bill of Costs may include court fees, attorney fees, expert witness fees, and other related costs.

Q: How do I complete a Form 24 Bill of Costs?

A: To complete a Form 24 Bill of Costs, you will need to provide detailed information about the expenses incurred, such as the date, description, and amount of each cost.

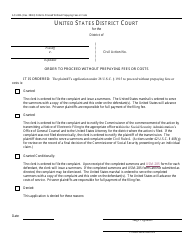

Q: What happens after I file a Form 24 Bill of Costs?

A: After filing a Form 24 Bill of Costs, it will be reviewed by the court and a decision will be made regarding the reimbursement of the expenses claimed.

Q: Can I be reimbursed for all of my expenses through a Form 24 Bill of Costs?

A: The court will decide which expenses are eligible for reimbursement based on applicable laws and regulations.

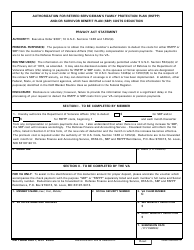

Q: Is there a deadline for filing a Form 24 Bill of Costs?

A: Yes, there is usually a deadline for filing a Form 24 Bill of Costs, which may vary depending on the jurisdiction and the specific court rules.

Q: Can I appeal the court's decision on my Form 24 Bill of Costs?

A: In some cases, you may have the option to appeal the court's decision if you disagree with the reimbursement amount or the expenses deemed eligible for reimbursement.

Q: Do I need an attorney to complete a Form 24 Bill of Costs?

A: While it is not required to have an attorney to complete a Form 24 Bill of Costs, it may be beneficial to seek legal advice to ensure accurate and appropriate expense claims.

Q: Are there any limitations on the amount of expenses that can be claimed in a Form 24 Bill of Costs?

A: Yes, there may be limitations on the amount of expenses that can be claimed, depending on the jurisdiction and the specific court rules.

Form Details:

- Released on July 1, 2020;

- The latest available edition released by the United States Court of Appeals for the Federal Circuit;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 24 by clicking the link below or browse more documents and templates provided by the United States Court of Appeals for the Federal Circuit.