This version of the form is not currently in use and is provided for reference only. Download this version of

Form 9

for the current year.

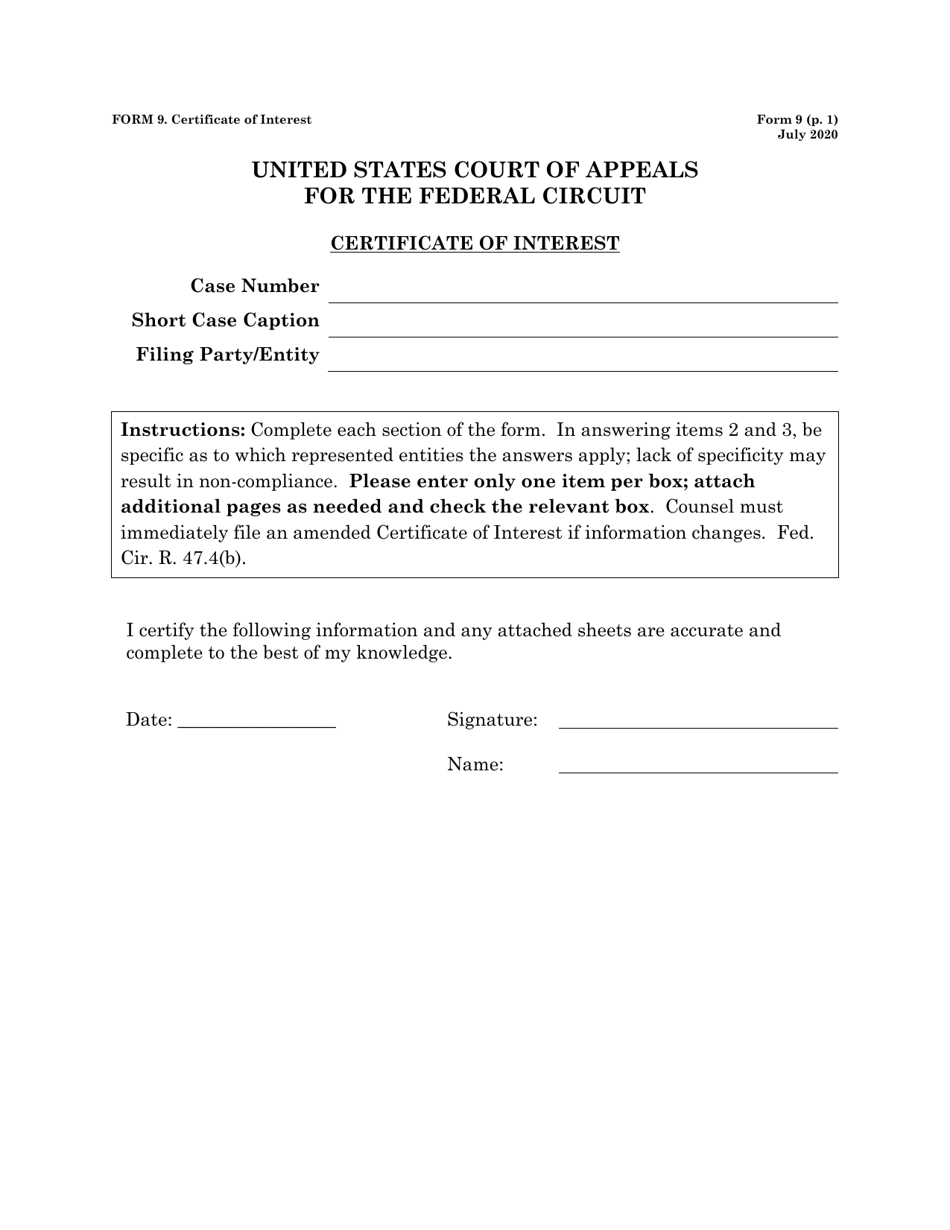

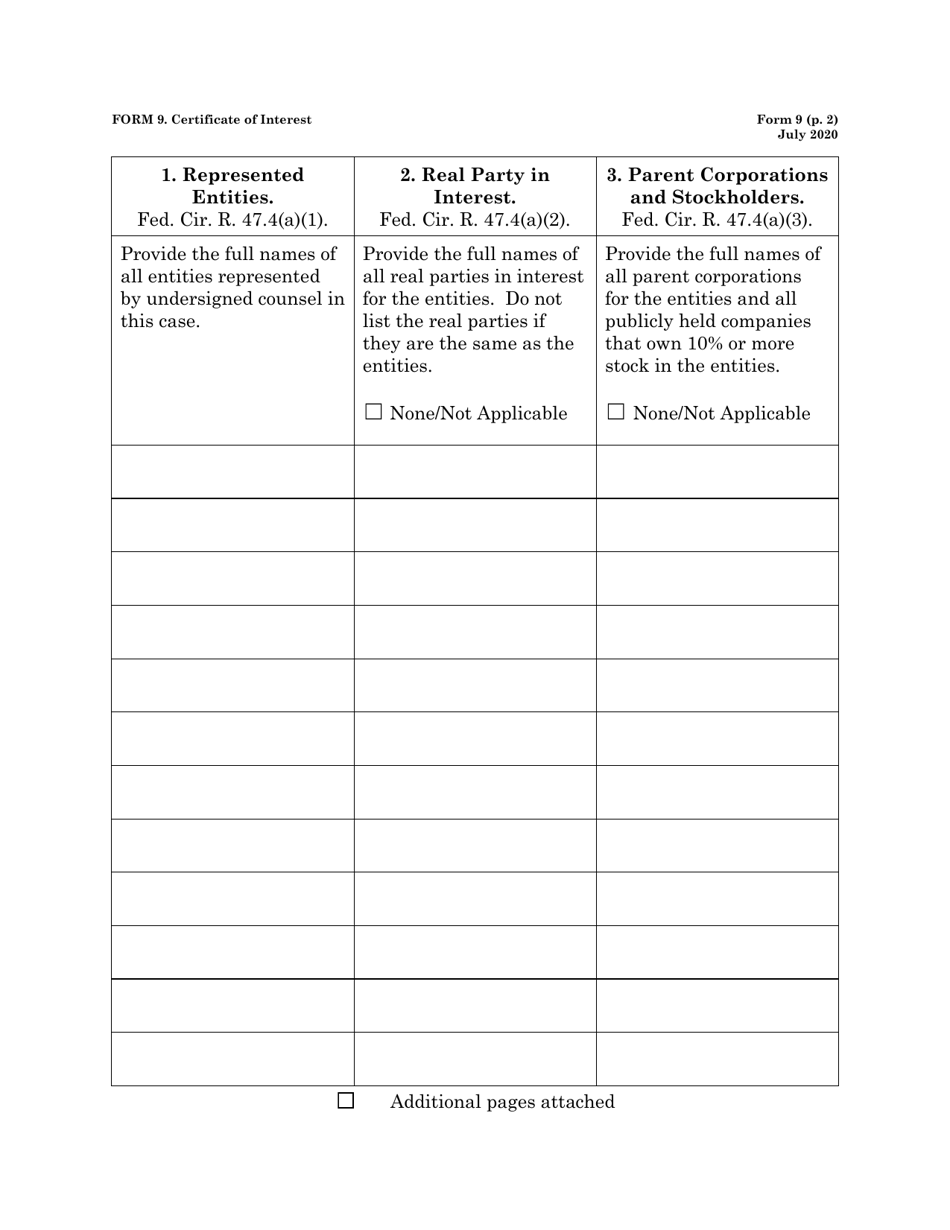

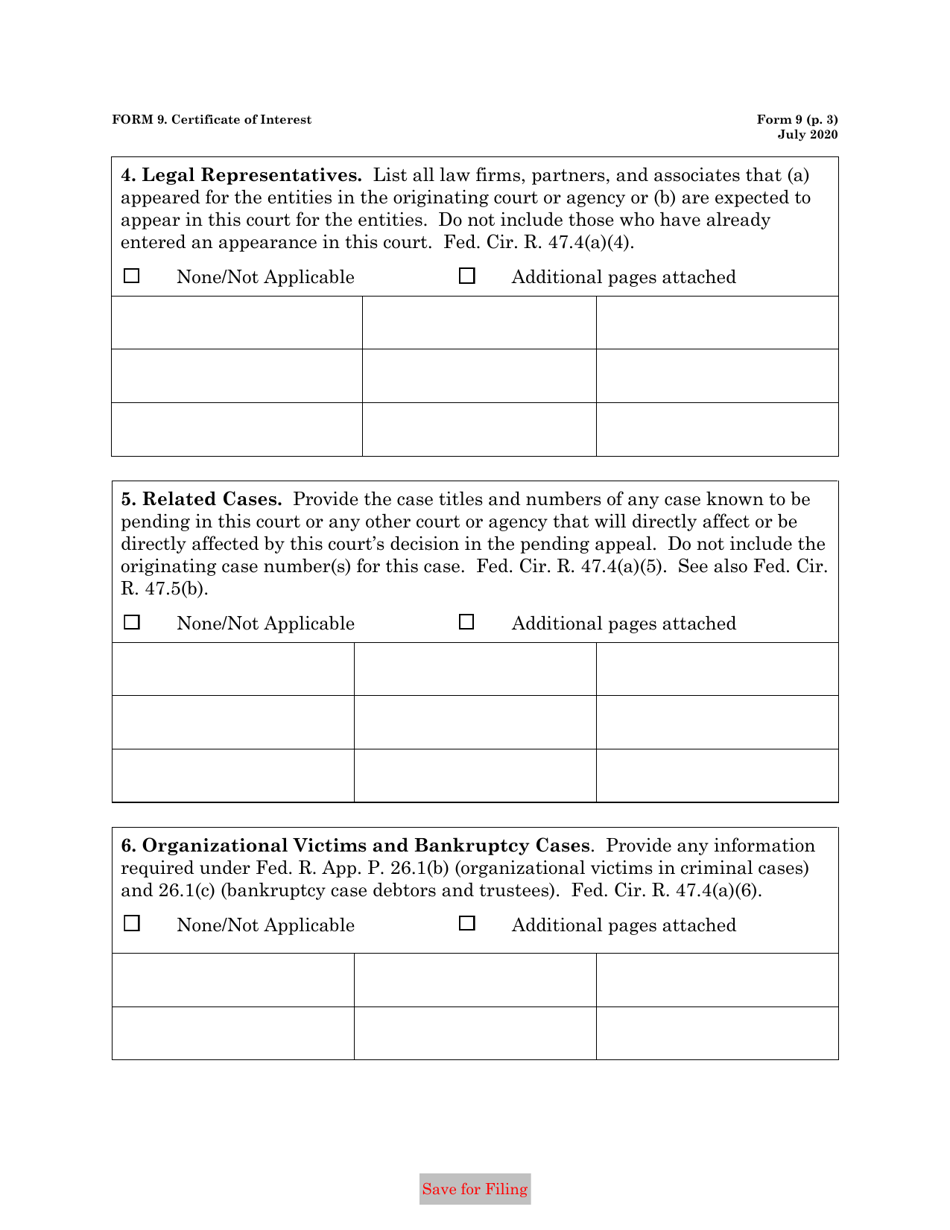

Form 9 Certificate of Interest

What Is Form 9?

This is a legal form that was released by the United States Court of Appeals for the Federal Circuit on July 1, 2020 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 9 Certificate of Interest?

A: A Form 9 Certificate of Interest is a document that provides information about the interest earned on investments or deposits.

Q: Who needs a Form 9 Certificate of Interest?

A: Individuals or organizations who have earned interest on investments or deposits may need a Form 9 Certificate of Interest.

Q: Why do I need a Form 9 Certificate of Interest?

A: You may need a Form 9 Certificate of Interest to report your income and pay taxes on the interest earned.

Q: What information is included in a Form 9 Certificate of Interest?

A: A Form 9 Certificate of Interest typically includes the name of the financial institution, the account number, the type of investment or deposit, and the amount of interest earned.

Q: When do I need to submit a Form 9 Certificate of Interest?

A: The deadline for submitting a Form 9 Certificate of Interest depends on your jurisdiction and the tax year. It is usually required to be submitted with your annual tax return.

Form Details:

- Released on July 1, 2020;

- The latest available edition released by the United States Court of Appeals for the Federal Circuit;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 9 by clicking the link below or browse more documents and templates provided by the United States Court of Appeals for the Federal Circuit.