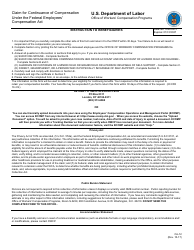

This version of the form is not currently in use and is provided for reference only. Download this version of

Form CA-5B

for the current year.

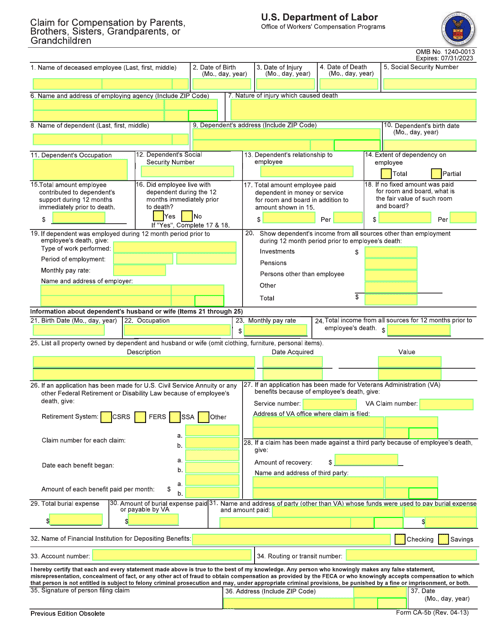

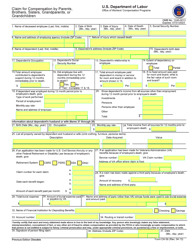

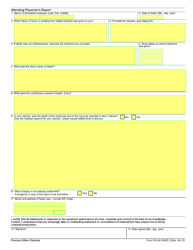

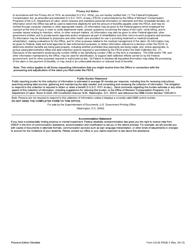

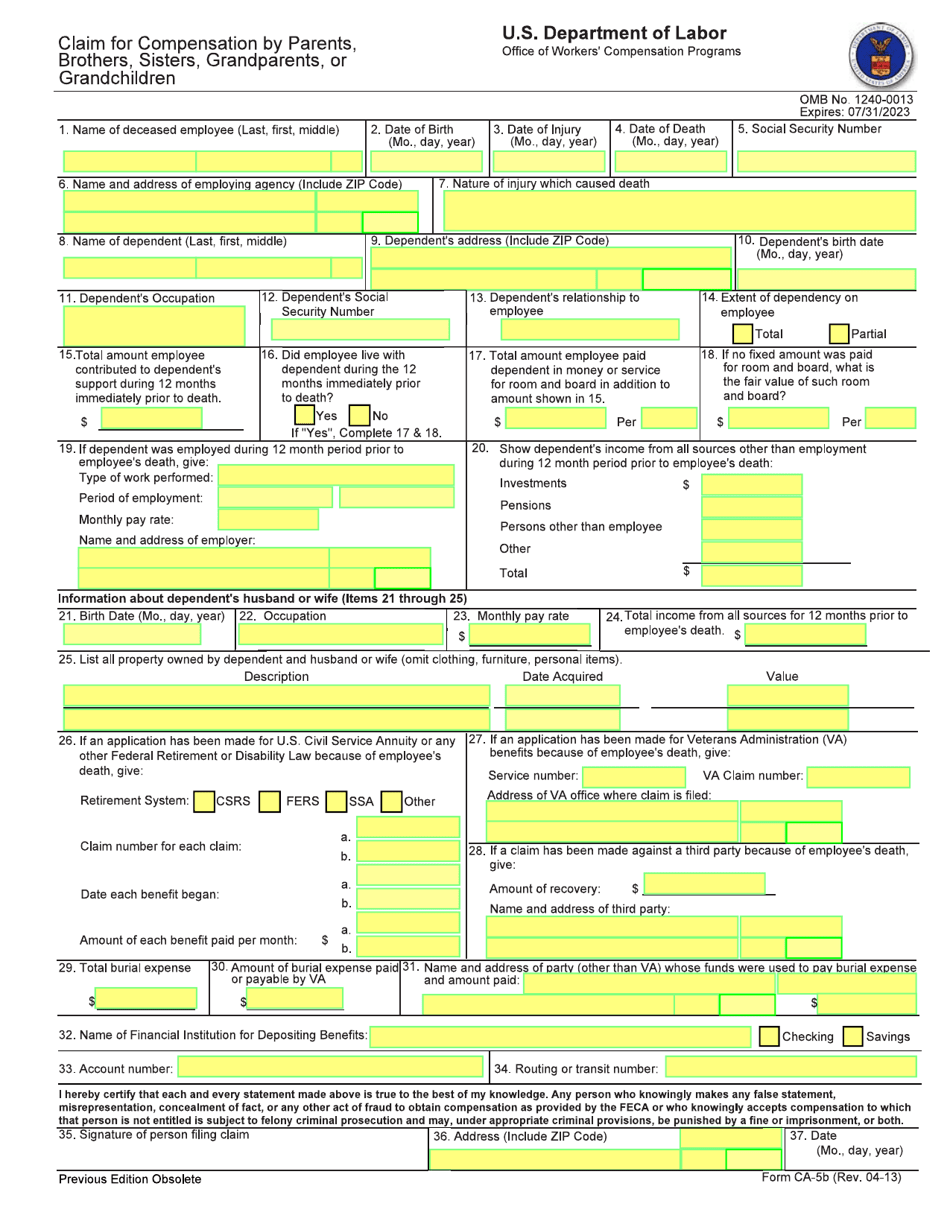

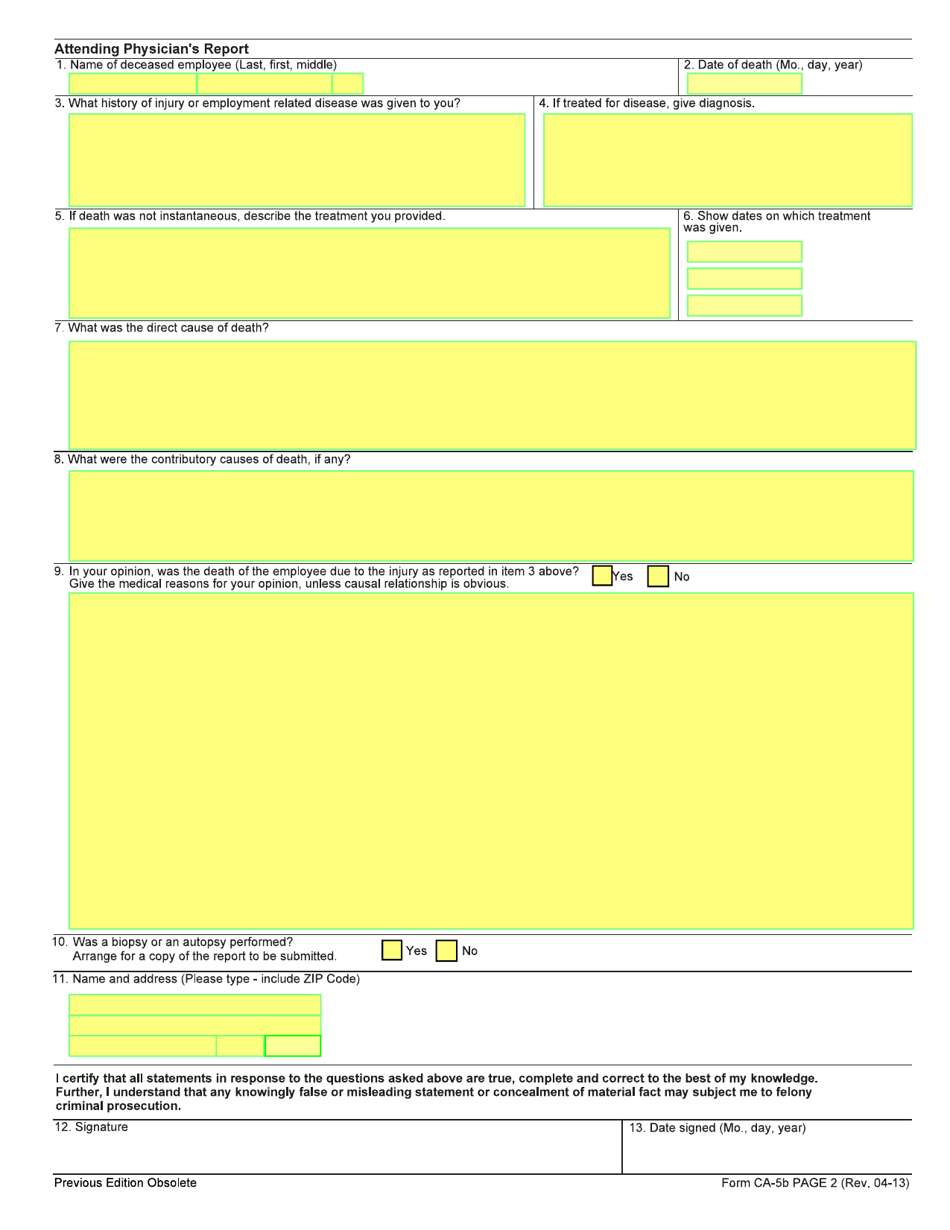

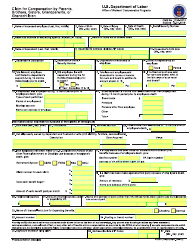

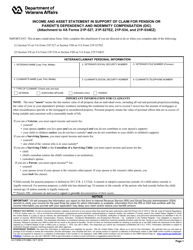

Form CA-5B Claim for Compensation by Parents, Brothers, Sisters, Grandparents, or Grandchildren

What Is Form CA-5B?

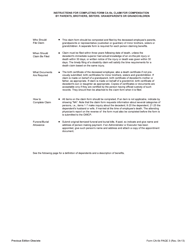

This is a legal form that was released by the U.S. Department of Labor - Office of Workers' Compensation Programs on April 1, 2013 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

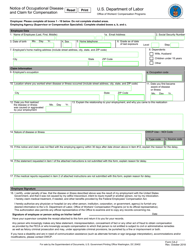

Q: Who can file Form CA-5B?

A: Parents, brothers, sisters, grandparents, or grandchildren of an employee who died due to a work-related injury or illness.

Q: What is the purpose of Form CA-5B?

A: Form CA-5B is used to claim compensation for the death of an employee who was not survived by a spouse or child.

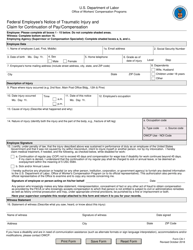

Q: How do I file Form CA-5B?

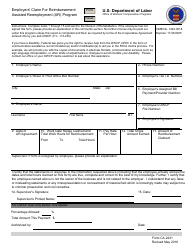

A: You can file Form CA-5B by completing the form and submitting it to the Office of Workers' Compensation Programs (OWCP), along with any required supporting documentation.

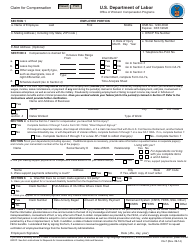

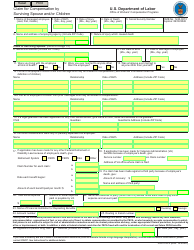

Q: What information do I need to provide on Form CA-5B?

A: You will need to provide information about the deceased employee, your relationship to the employee, and details about the death and any financial dependency.

Q: Is there a deadline for filing Form CA-5B?

A: Yes, there is a time limit for filing Form CA-5B. Generally, you must file the claim within three years of the employee's death.

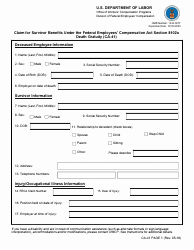

Q: What benefits can be obtained through Form CA-5B?

A: If approved, Form CA-5B can provide survivors' benefits, including compensation for funeral expenses and ongoing monetary benefits.

Form Details:

- Released on April 1, 2013;

- The latest available edition released by the U.S. Department of Labor - Office of Workers' Compensation Programs;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CA-5B by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Office of Workers' Compensation Programs.