This version of the form is not currently in use and is provided for reference only. Download this version of

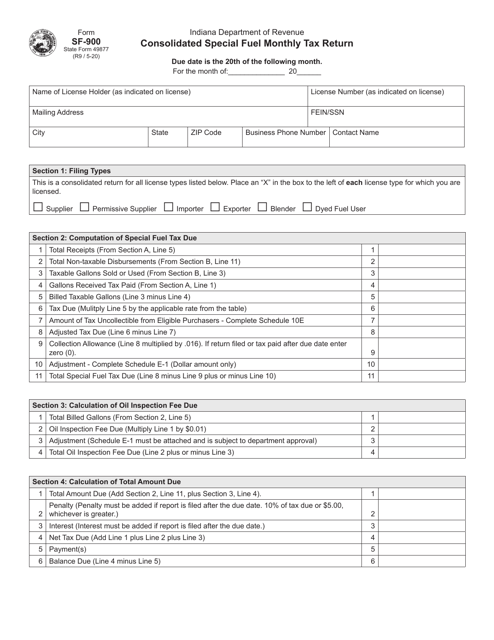

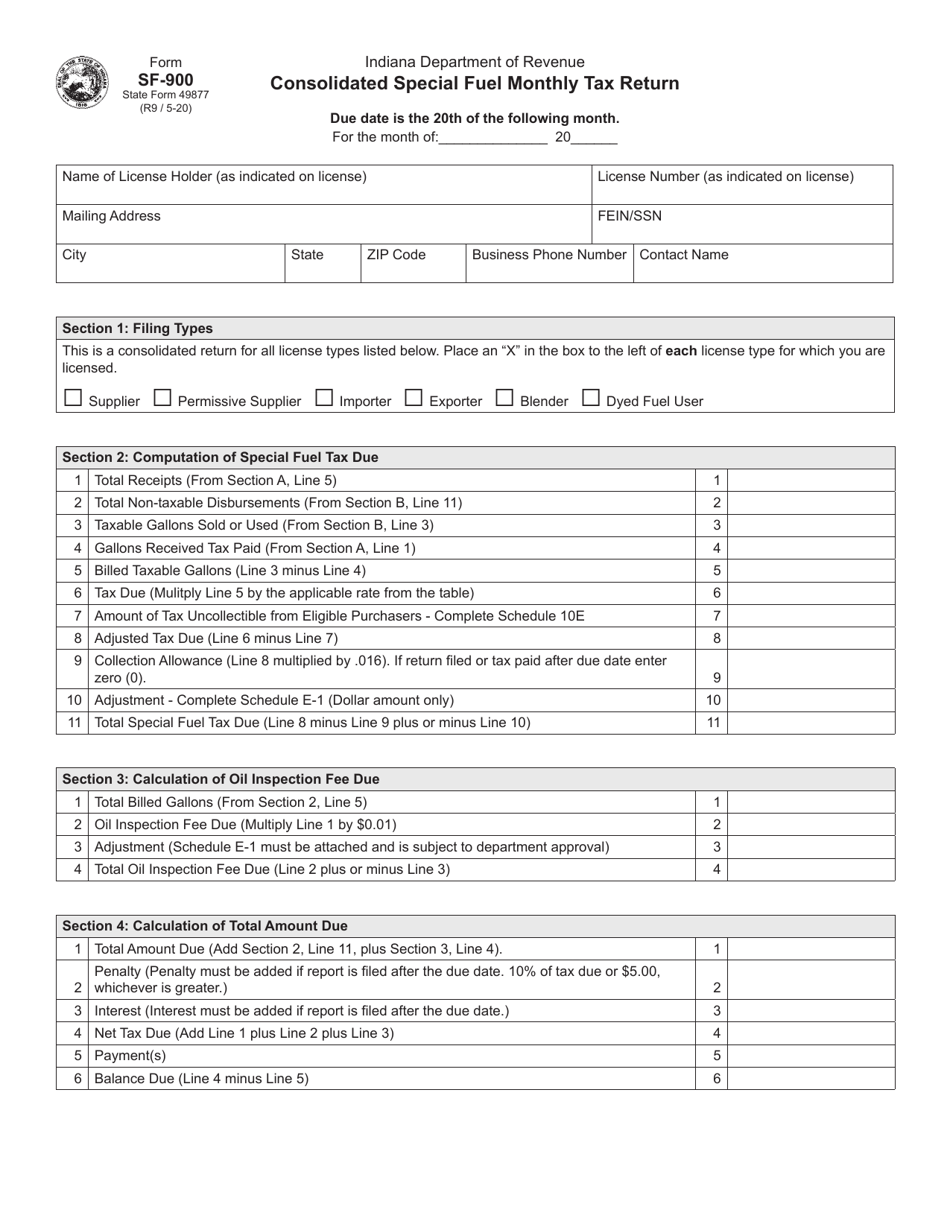

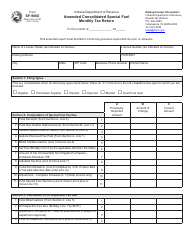

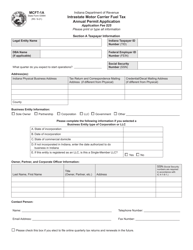

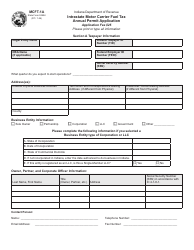

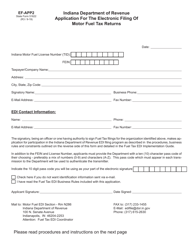

Form SF-900 (State Form 49877)

for the current year.

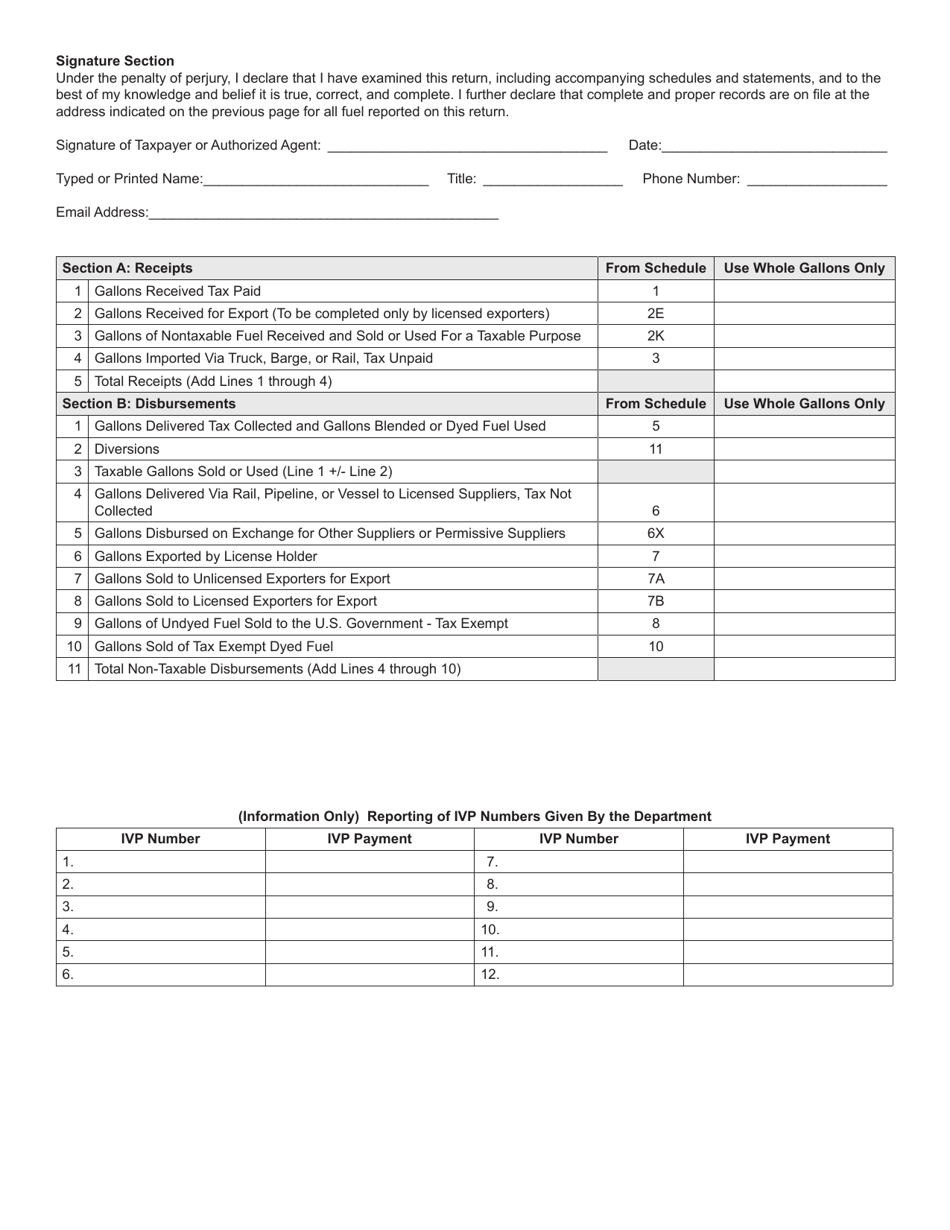

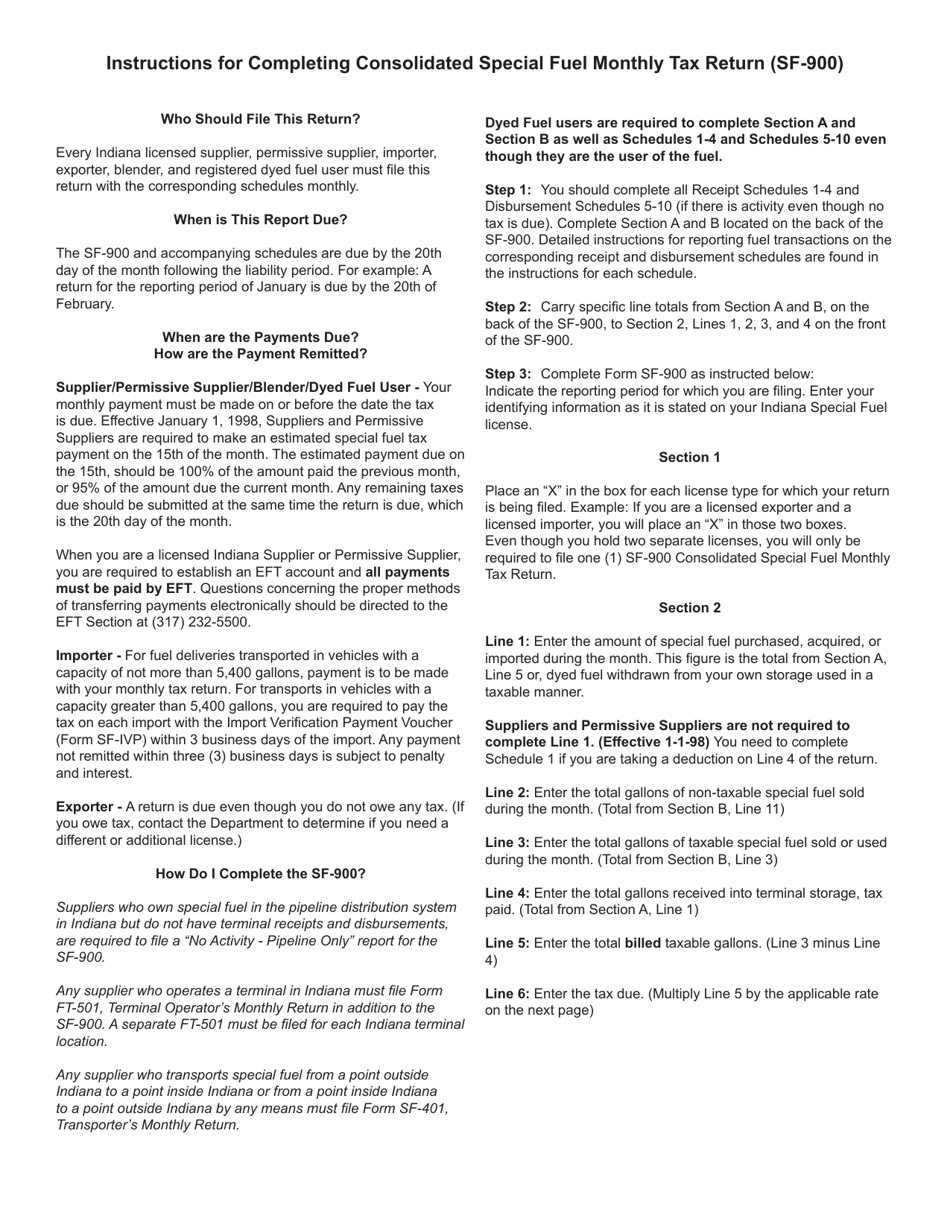

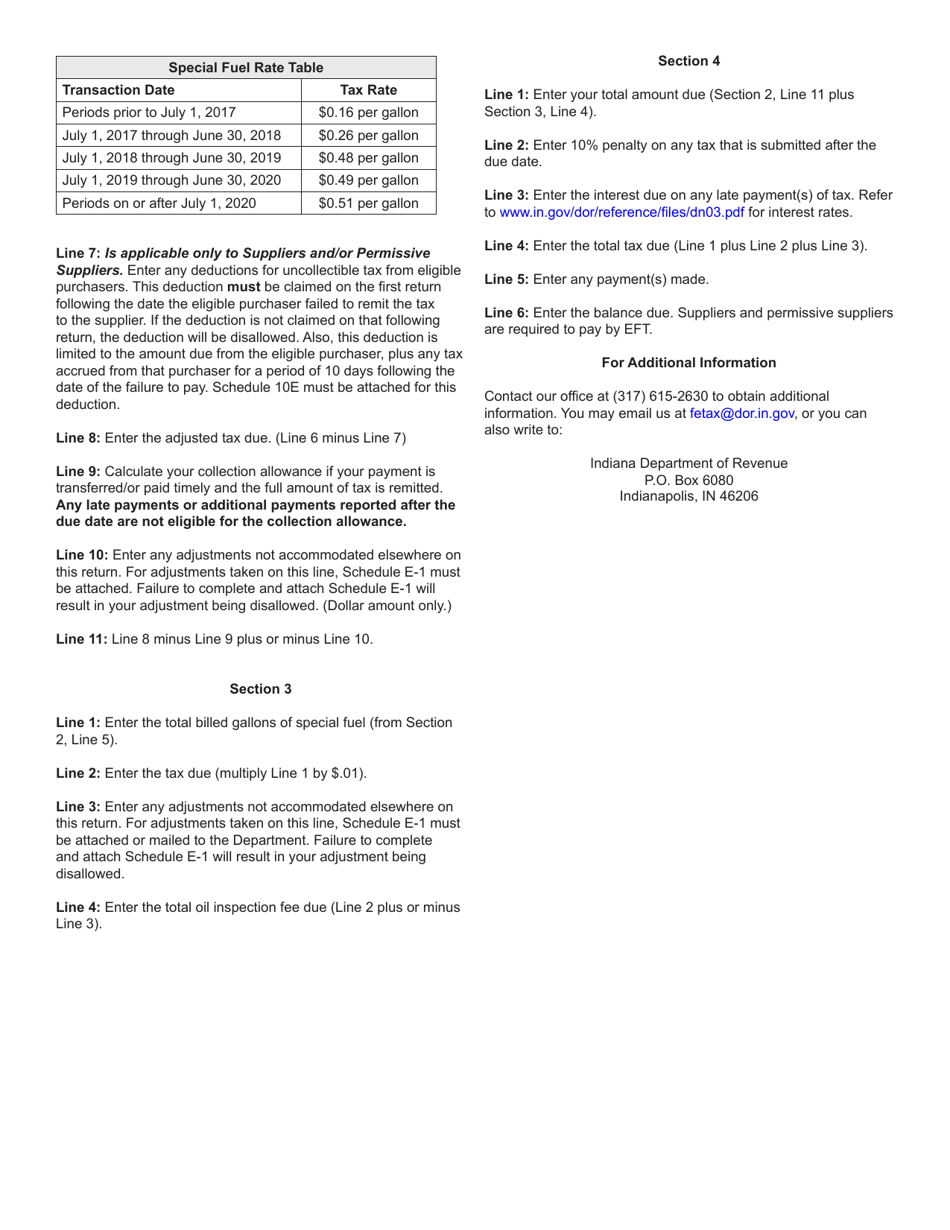

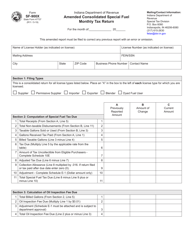

Form SF-900 (State Form 49877) Consolidated Special Fuel Monthly Tax Return - Indiana

What Is Form SF-900 (State Form 49877)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-900?

A: Form SF-900 is the Consolidated Special Fuel Monthly Tax Return for Indiana.

Q: What is the purpose of Form SF-900?

A: The purpose of Form SF-900 is to report and pay the special fuel tax in the state of Indiana.

Q: Who needs to file Form SF-900?

A: Anyone who sells, consumes, or deals with special fuel in Indiana needs to file Form SF-900.

Q: When is Form SF-900 due?

A: Form SF-900 is due on the last day of the month following the reporting period.

Q: Are there any penalties for late filing of Form SF-900?

A: Yes, there are penalties for late filing, including interest charges and possible license revocation.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-900 (State Form 49877) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.