This version of the form is not currently in use and is provided for reference only. Download this version of

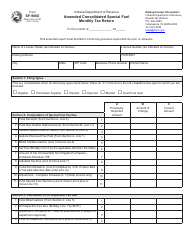

Form MF-360X (State Form 49875)

for the current year.

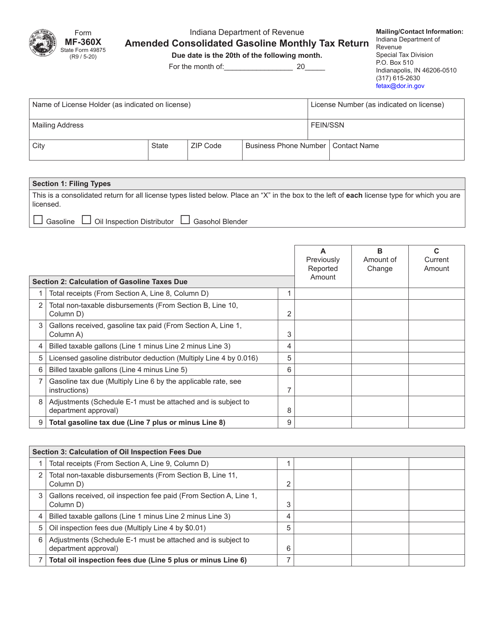

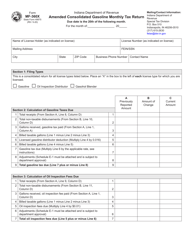

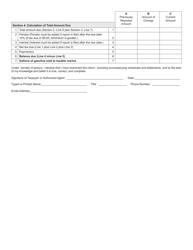

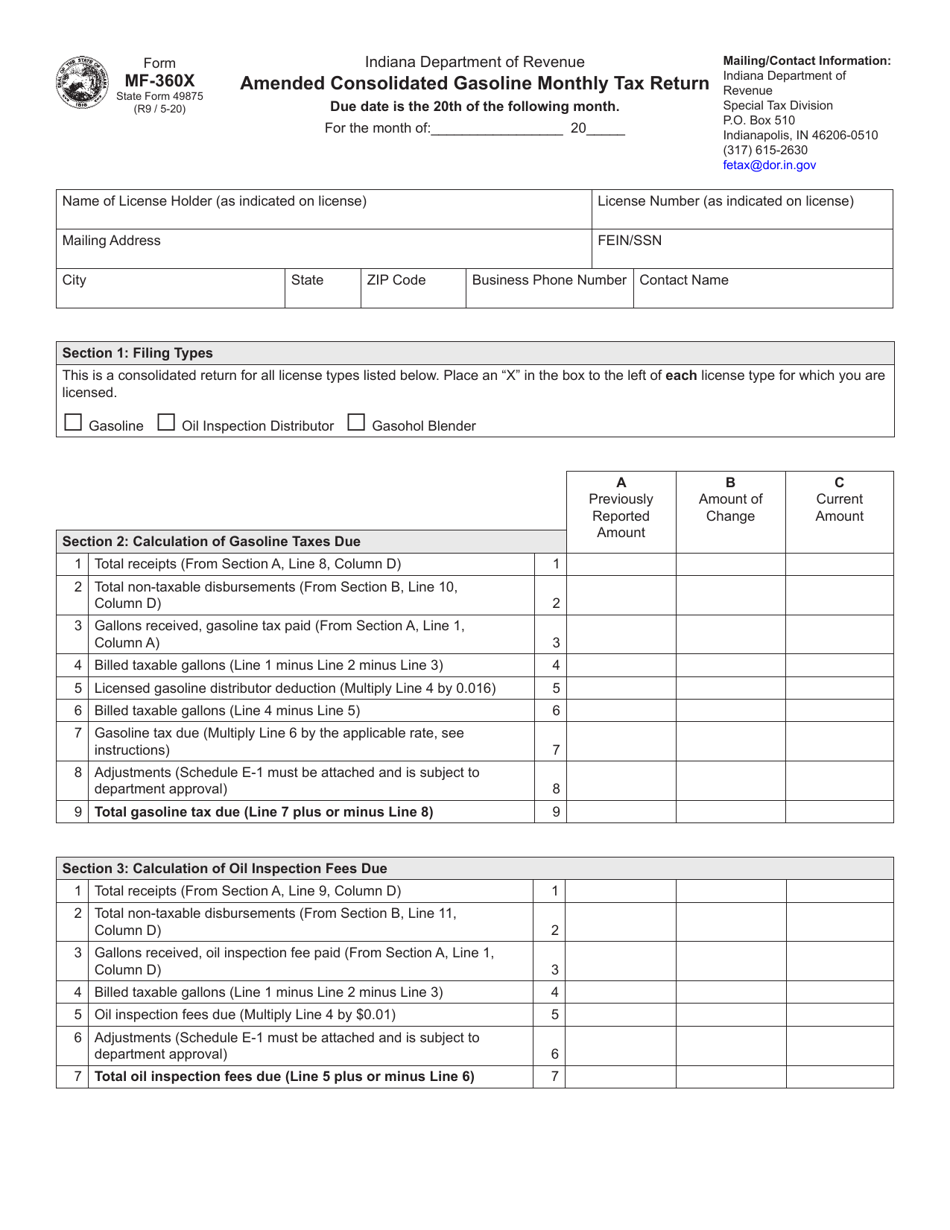

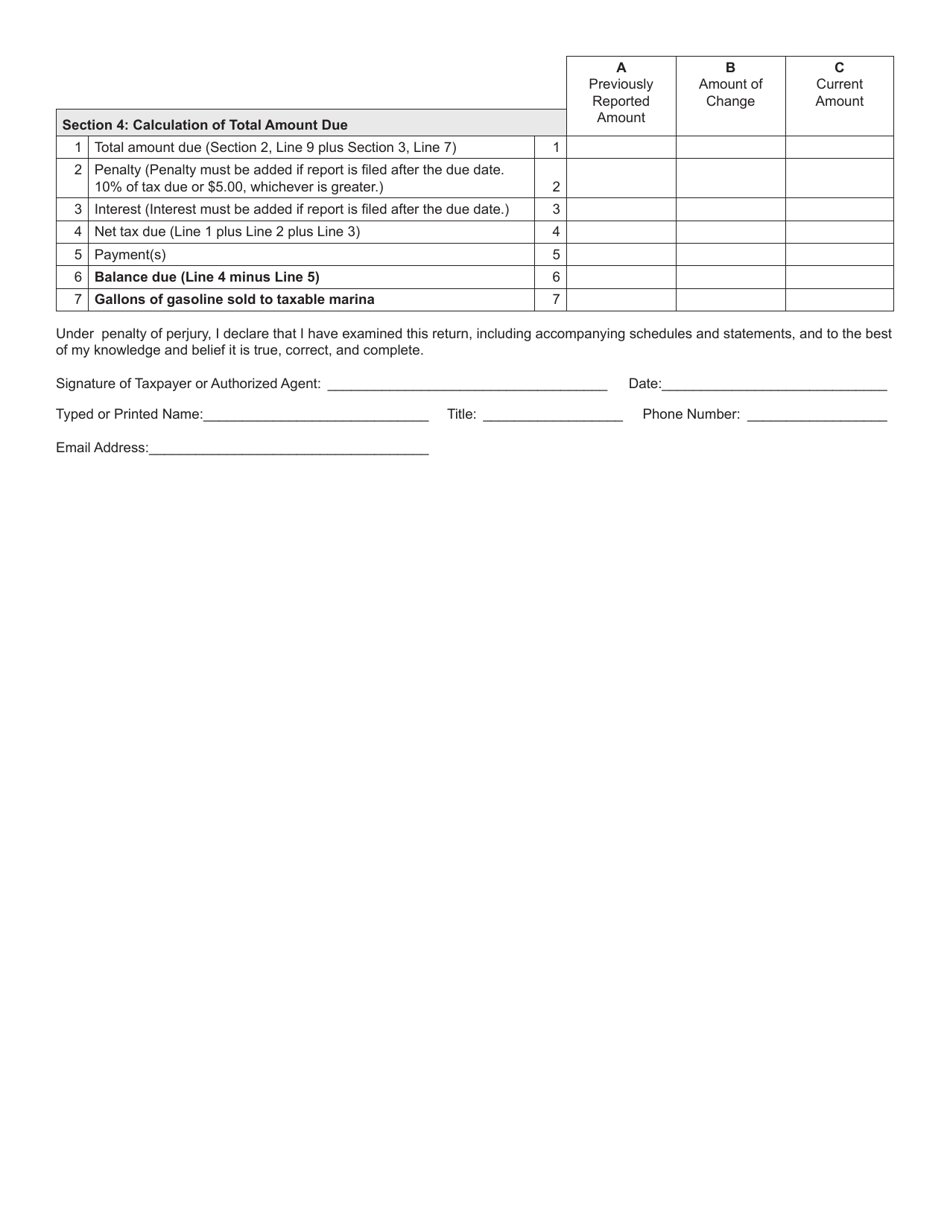

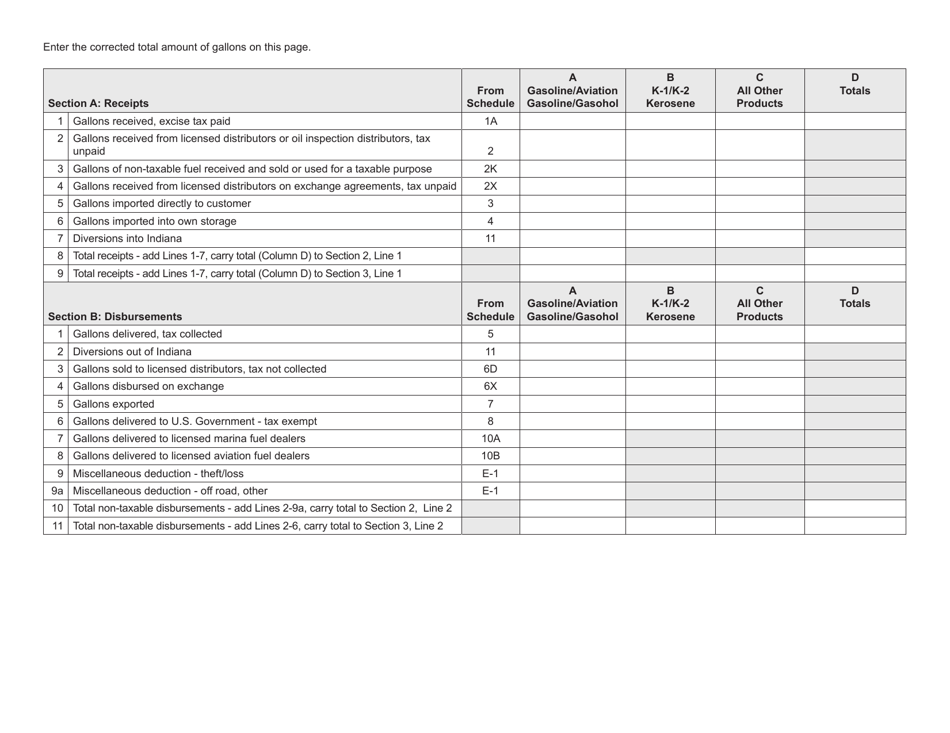

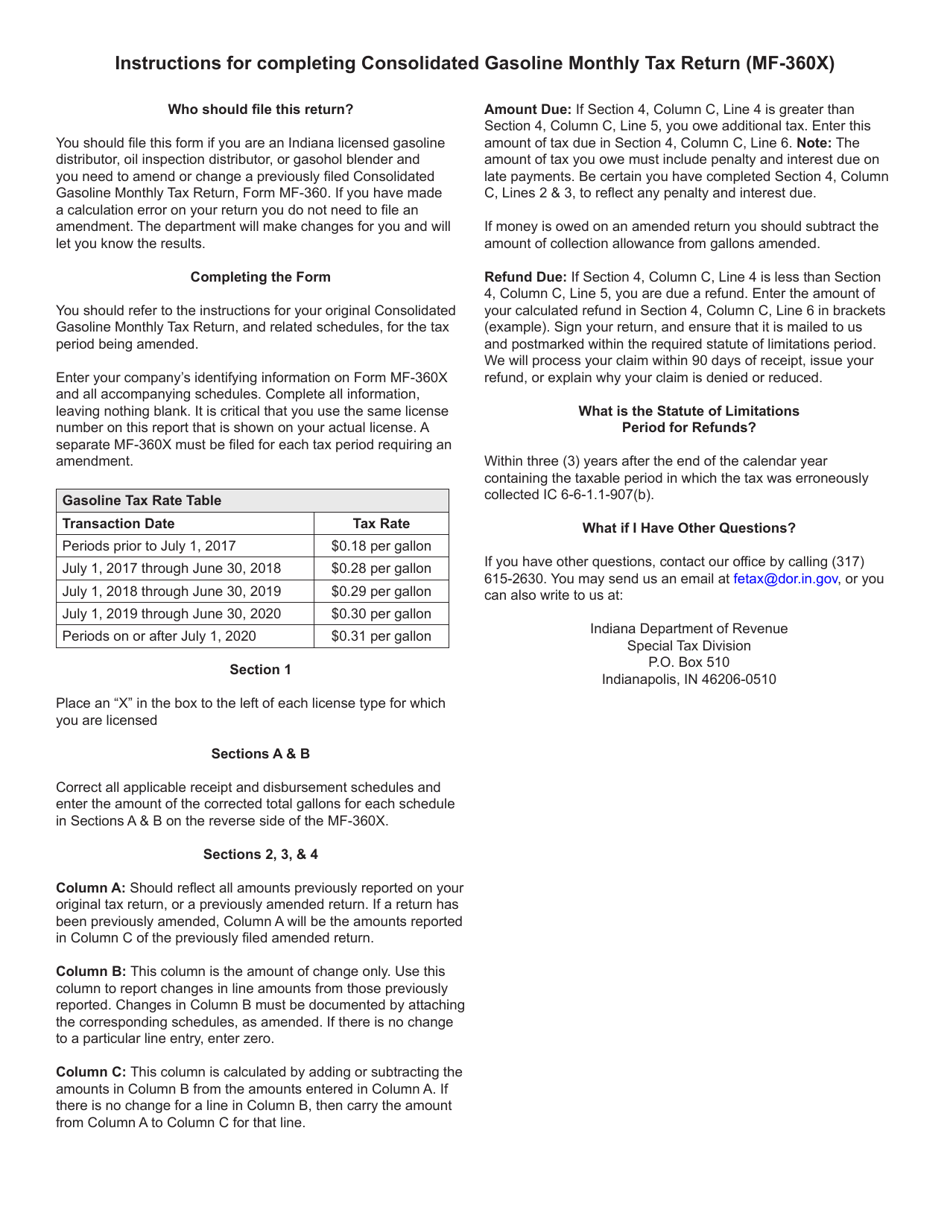

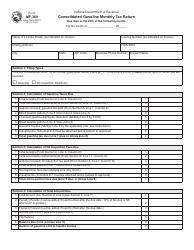

Form MF-360X (State Form 49875) Amended Consolidated Gasoline Monthly Tax Return - Indiana

What Is Form MF-360X (State Form 49875)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-360X?

A: Form MF-360X is an amended consolidated gasoline monthly tax return.

Q: What is the purpose of Form MF-360X?

A: The purpose of Form MF-360X is to report any amendments or changes to the previously filed consolidated gasoline monthly tax return in Indiana.

Q: What is a consolidated gasoline monthly tax return?

A: A consolidated gasoline monthly tax return is a form used to report and remit taxes on gasoline sales in Indiana.

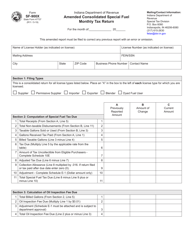

Q: When should Form MF-360X be filed?

A: Form MF-360X should be filed when there are amendments or changes to the previously filed consolidated gasoline monthly tax return.

Q: Are there any penalties for not filing Form MF-360X?

A: Yes, there may be penalties for not filing Form MF-360X or for filing it late. It is important to timely submit the amended return to avoid penalties.

Q: What information do I need to complete Form MF-360X?

A: To complete Form MF-360X, you will need information about the amendments or changes made to the original consolidated gasoline monthly tax return, as well as any supporting documentation.

Q: Who needs to file Form MF-360X?

A: Anyone who needs to report amendments or changes to a previously filed consolidated gasoline monthly tax return in Indiana must file Form MF-360X.

Q: Is Form MF-360X only for businesses?

A: No, Form MF-360X is not only for businesses. Individuals or entities that have amendments or changes to their consolidated gasoline monthly tax return must also file this form.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-360X (State Form 49875) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.