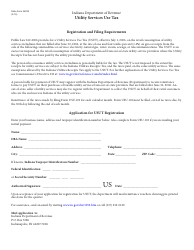

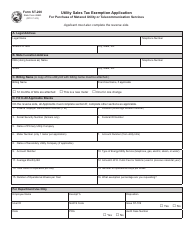

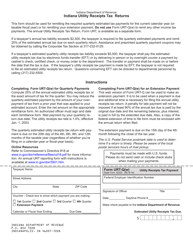

This version of the form is not currently in use and is provided for reference only. Download this version of

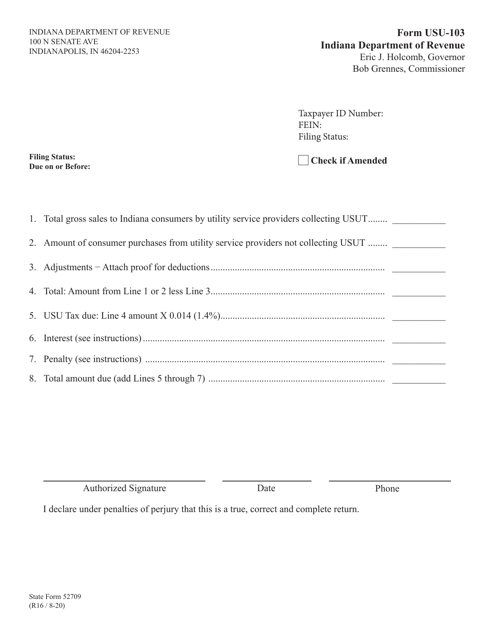

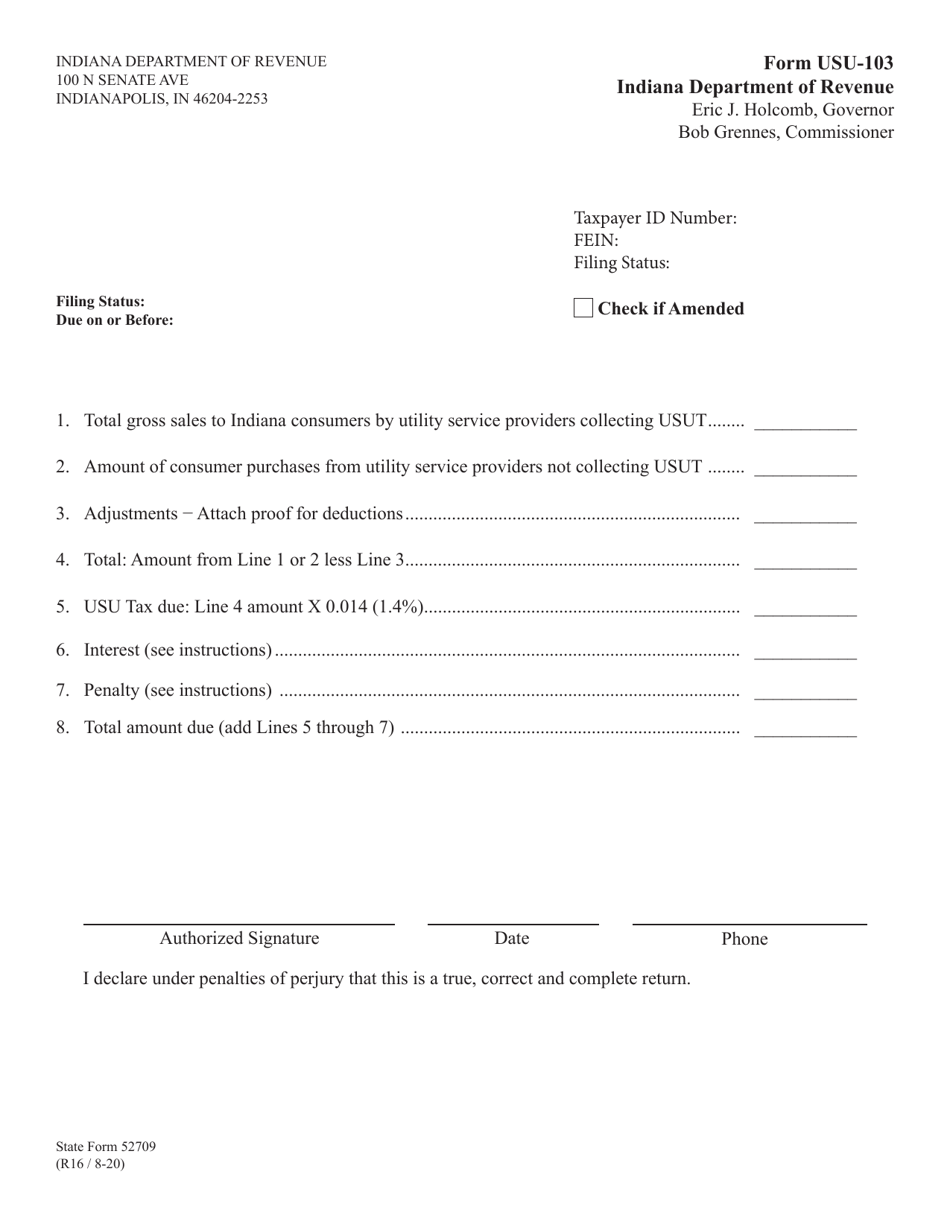

Form USU-103 (State Form 52709)

for the current year.

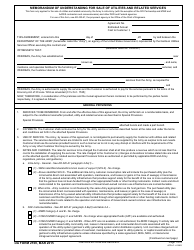

Form USU-103 (State Form 52709) Utilities Services Use Tax - Indiana

What Is Form USU-103 (State Form 52709)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form USU-103?

A: Form USU-103 is a tax form for reporting and paying Utilities Services Use Tax in the state of Indiana.

Q: What is the purpose of Form USU-103?

A: The purpose of Form USU-103 is to calculate and remit the Utilities Services Use Tax owed to the state of Indiana.

Q: Who should use Form USU-103?

A: Businesses and individuals who provide or consume utilities services in Indiana may need to use Form USU-103.

Q: What is Utilities Services Use Tax?

A: Utilities Services Use Tax is a tax levied on the consumption or use of certain utilities services in Indiana.

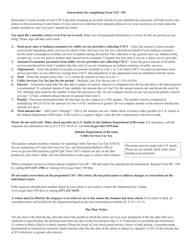

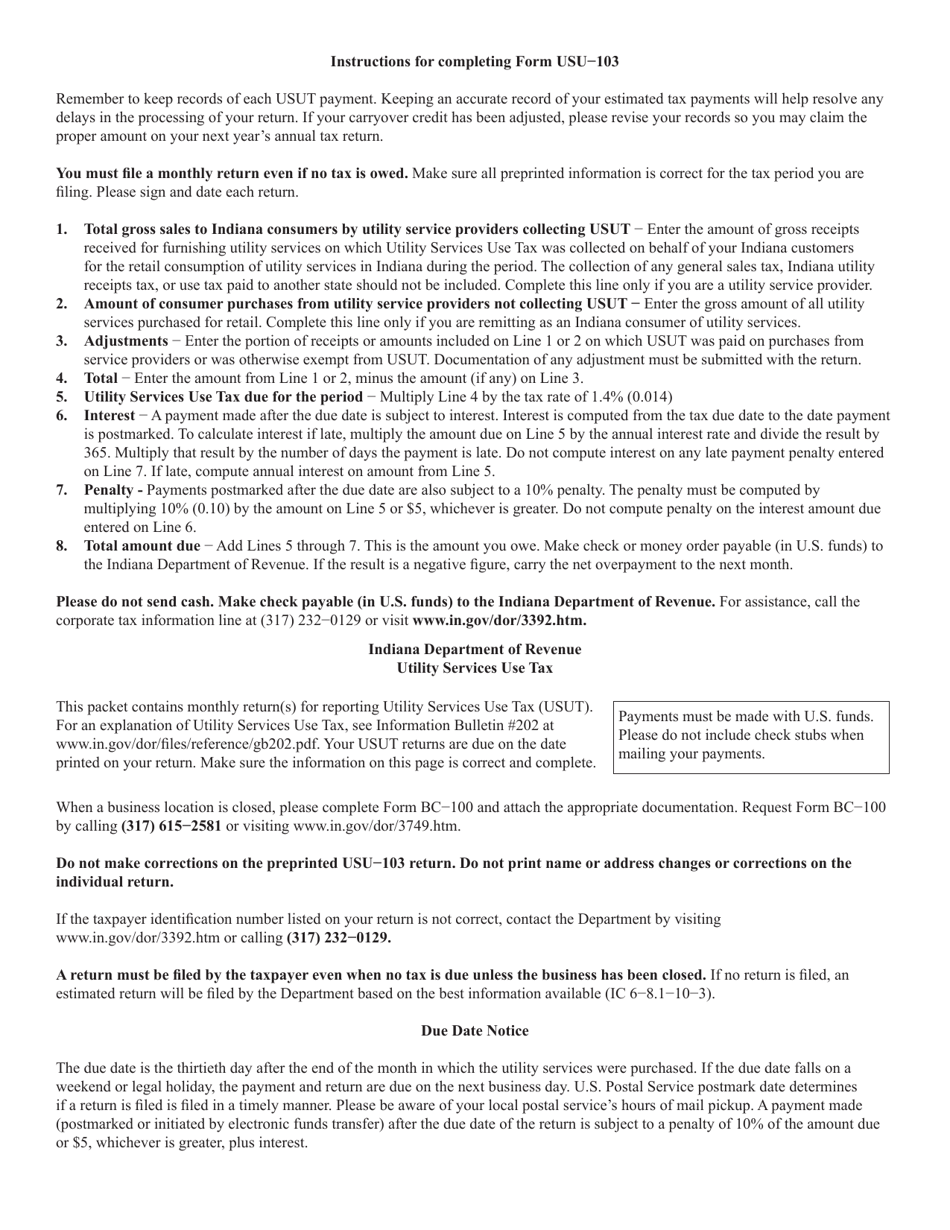

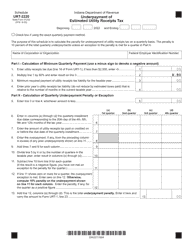

Q: When is Form USU-103 due?

A: Form USU-103 is typically due on a monthly basis, with the deadline falling on the 20th day of the following month.

Q: How do I fill out Form USU-103?

A: Form USU-103 requires you to provide information about your utilities services and the amount of tax owed. You may need to consult relevant records and calculations to complete the form accurately.

Q: Can I make payments electronically for Utilities Services Use Tax?

A: Yes, the Indiana Department of Revenue allows electronic payment options for Utilities Services Use Tax.

Q: What happens if I don't file Form USU-103?

A: If you don't file Form USU-103 or pay the owed Utilities Services Use Tax, you may be subject to penalties and interest charges by the Indiana Department of Revenue.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form USU-103 (State Form 52709) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.