This version of the form is not currently in use and is provided for reference only. Download this version of

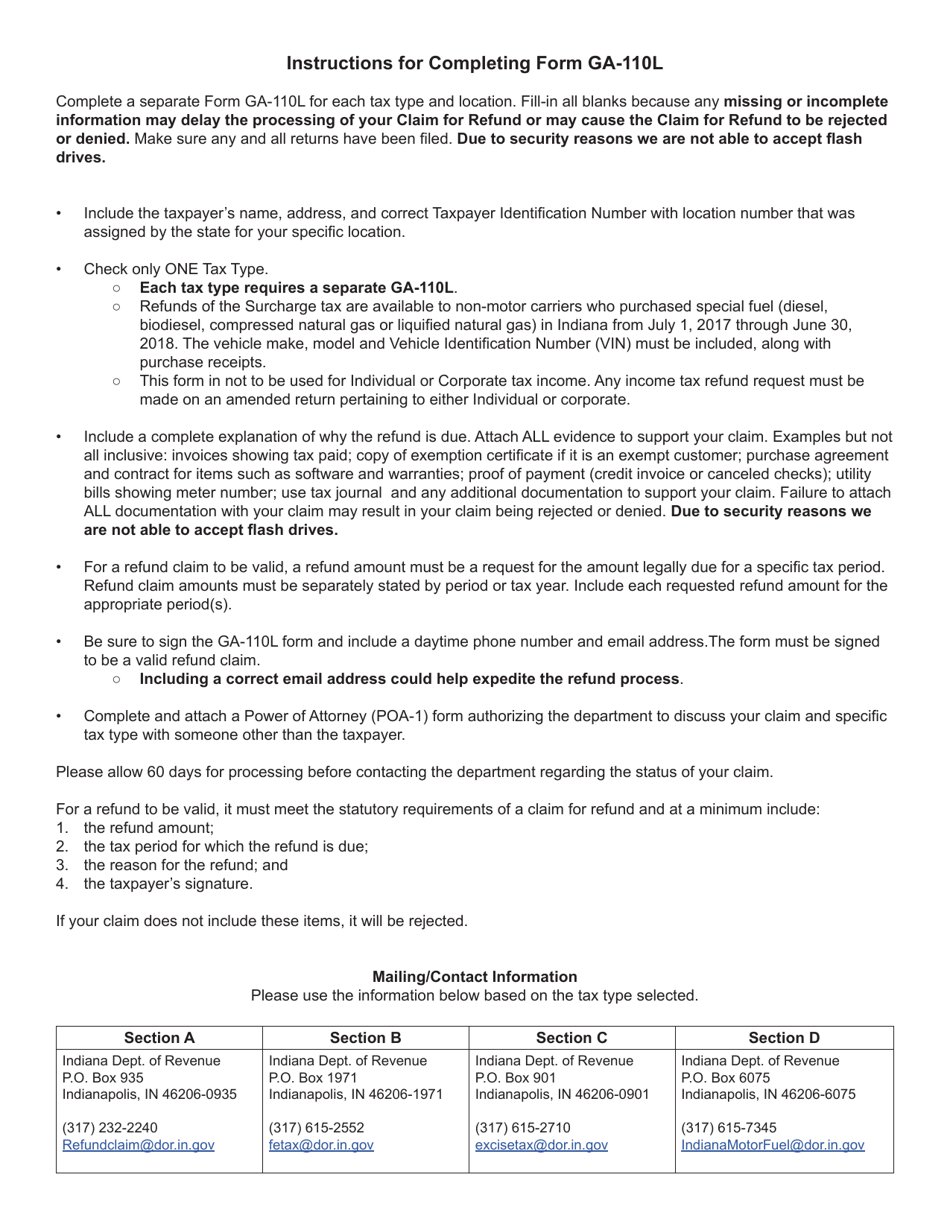

Form GA-110L (State Form 615)

for the current year.

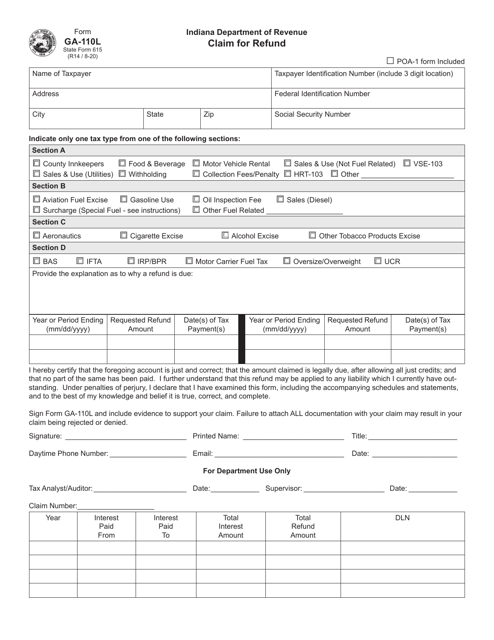

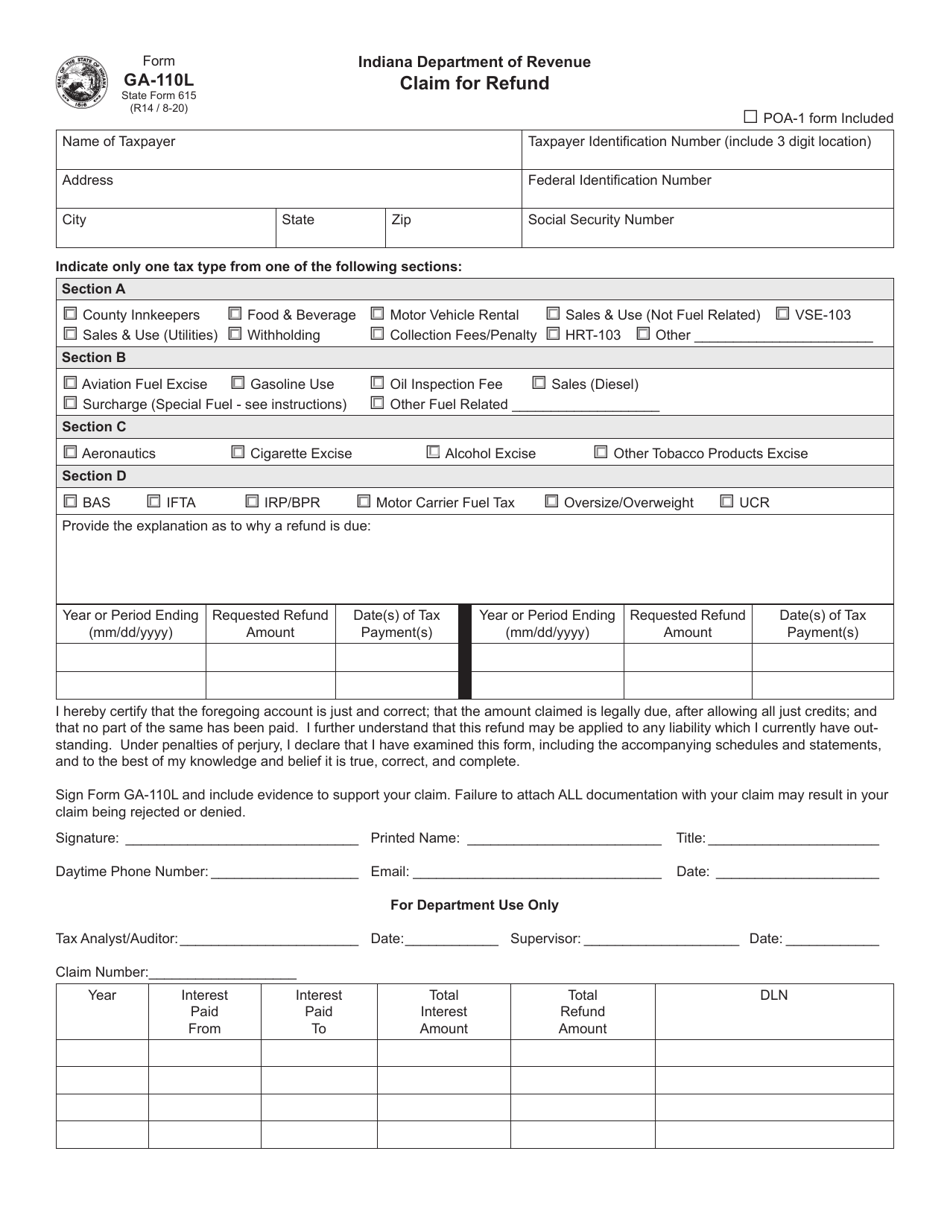

Form GA-110L (State Form 615) Claim for Refund - Indiana

What Is Form GA-110L (State Form 615)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GA-110L?

A: Form GA-110L is also known as State Form 615 and is the Claim for Refund form in Indiana.

Q: What is the purpose of Form GA-110L?

A: The purpose of Form GA-110L is to claim a refund for overpaid taxes in Indiana.

Q: Who needs to file Form GA-110L?

A: Anyone who has overpaid taxes in Indiana can file Form GA-110L to claim a refund.

Q: Is there a deadline to file Form GA-110L?

A: Yes, there is a deadline to file Form GA-110L. The deadline is generally within three years from the original due date of the tax return or within two years from the date the tax was paid, whichever is later.

Q: What supporting documents do I need to include with Form GA-110L?

A: You may need to include documents such as W-2 forms, 1099 forms, or other income statements, as well as any documentation supporting your claim for a refund.

Q: How long does it take to receive a refund after filing Form GA-110L?

A: The processing time for refunds can vary, but generally, it takes about 4-6 weeks to receive a refund after filing Form GA-110L.

Q: What if I made a mistake on Form GA-110L?

A: If you made a mistake on Form GA-110L, you can file an amended return using Form GA-110LX to correct the error.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GA-110L (State Form 615) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.