This version of the form is not currently in use and is provided for reference only. Download this version of

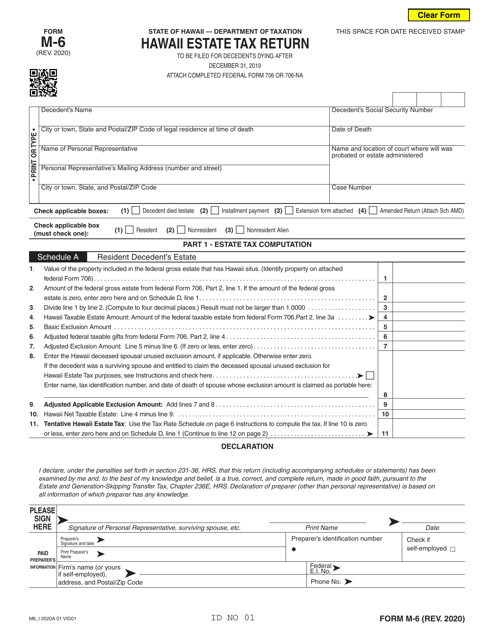

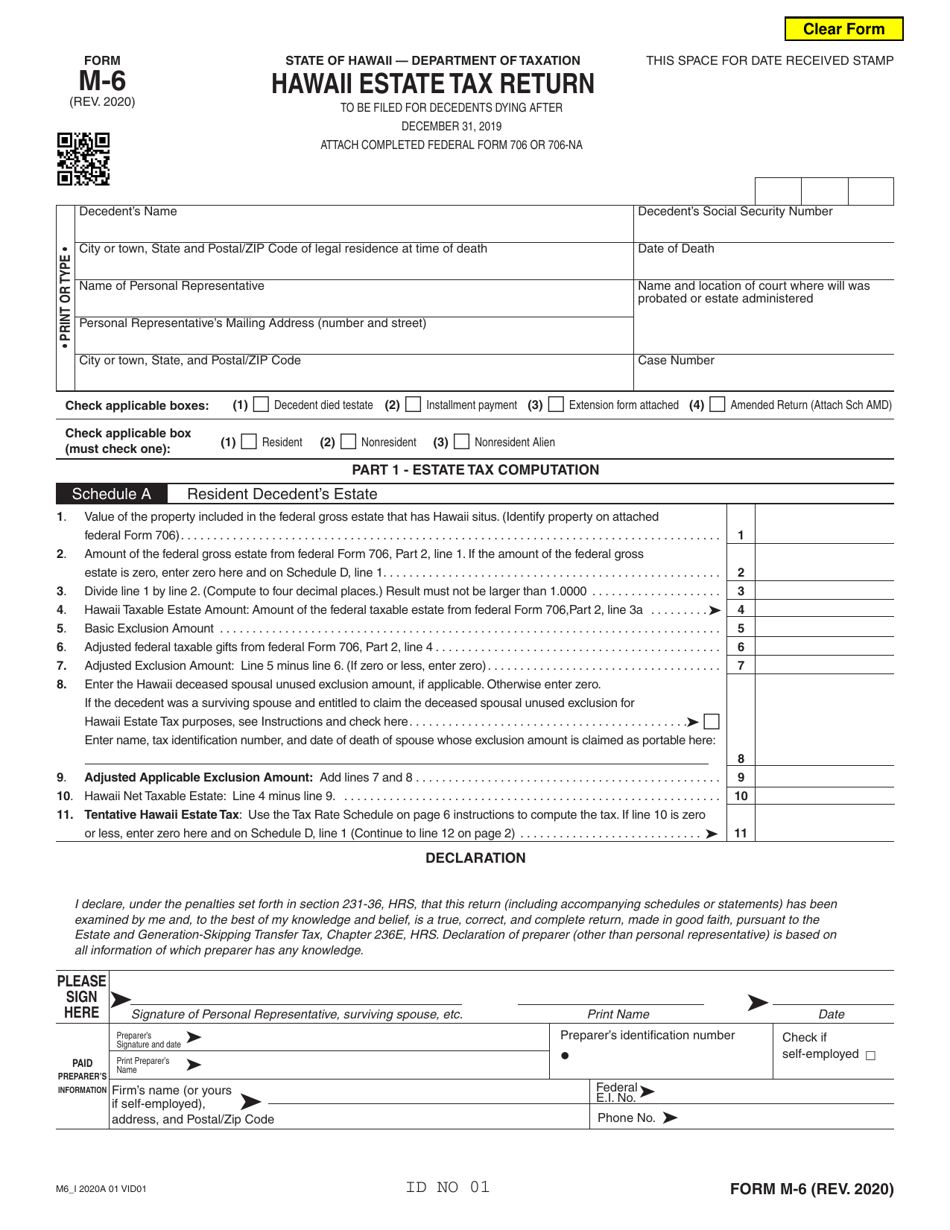

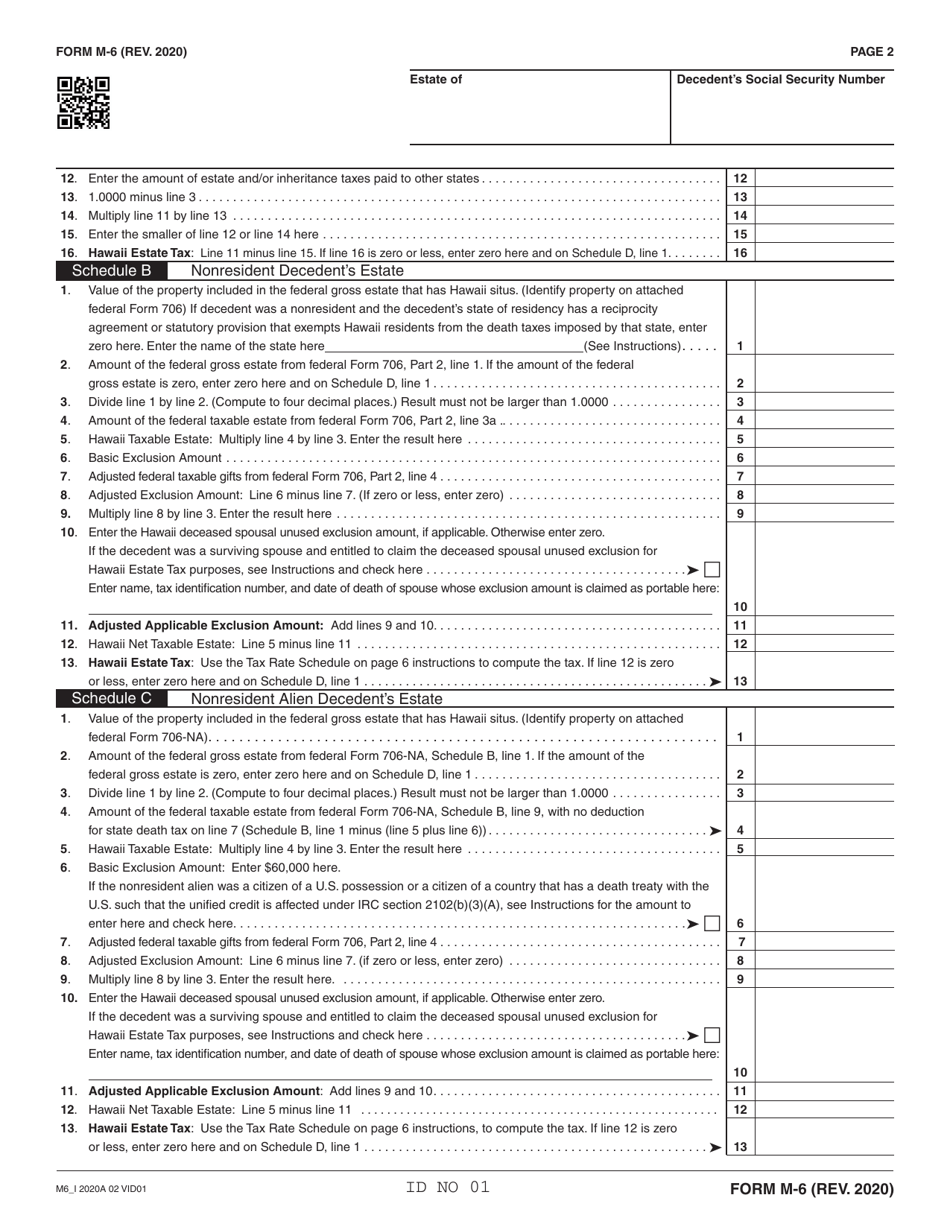

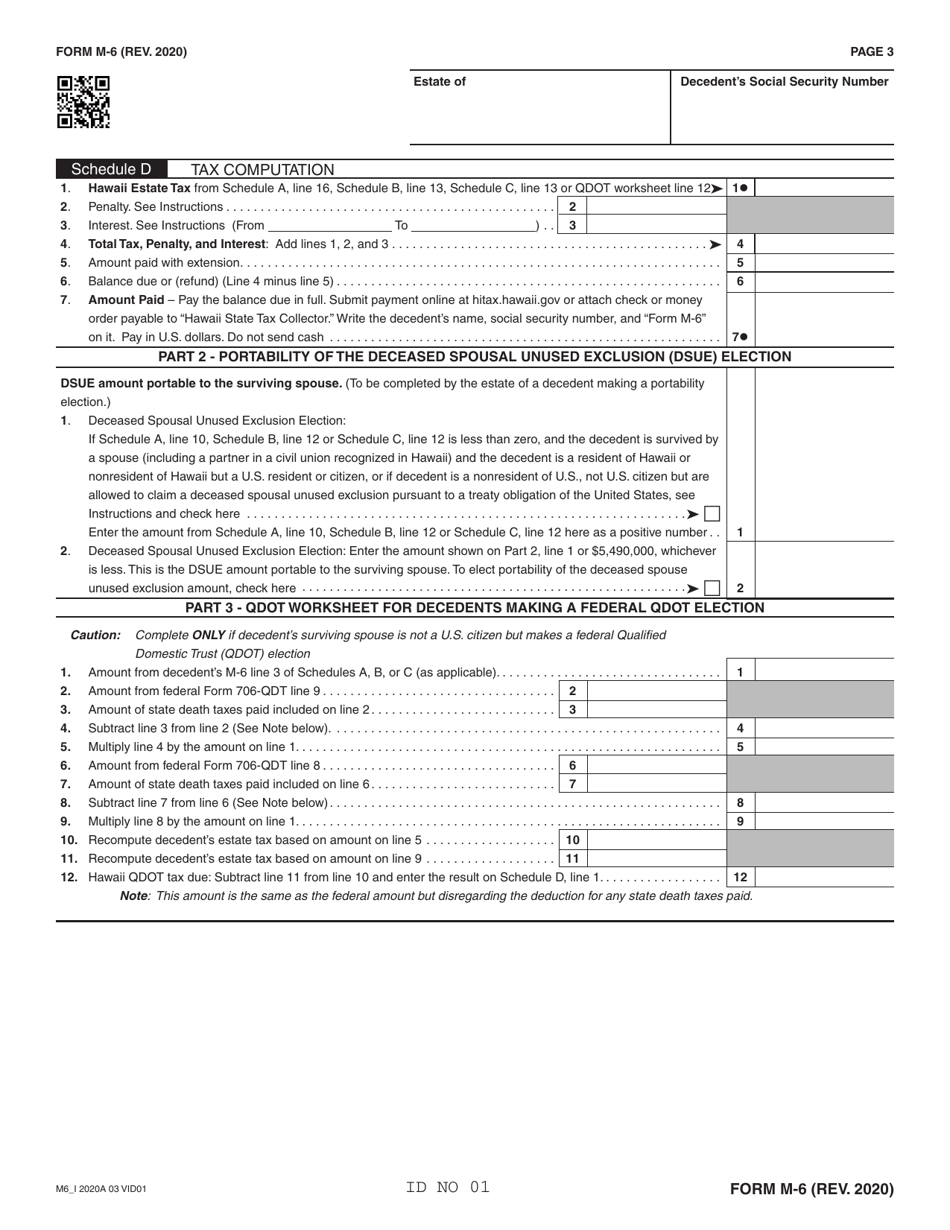

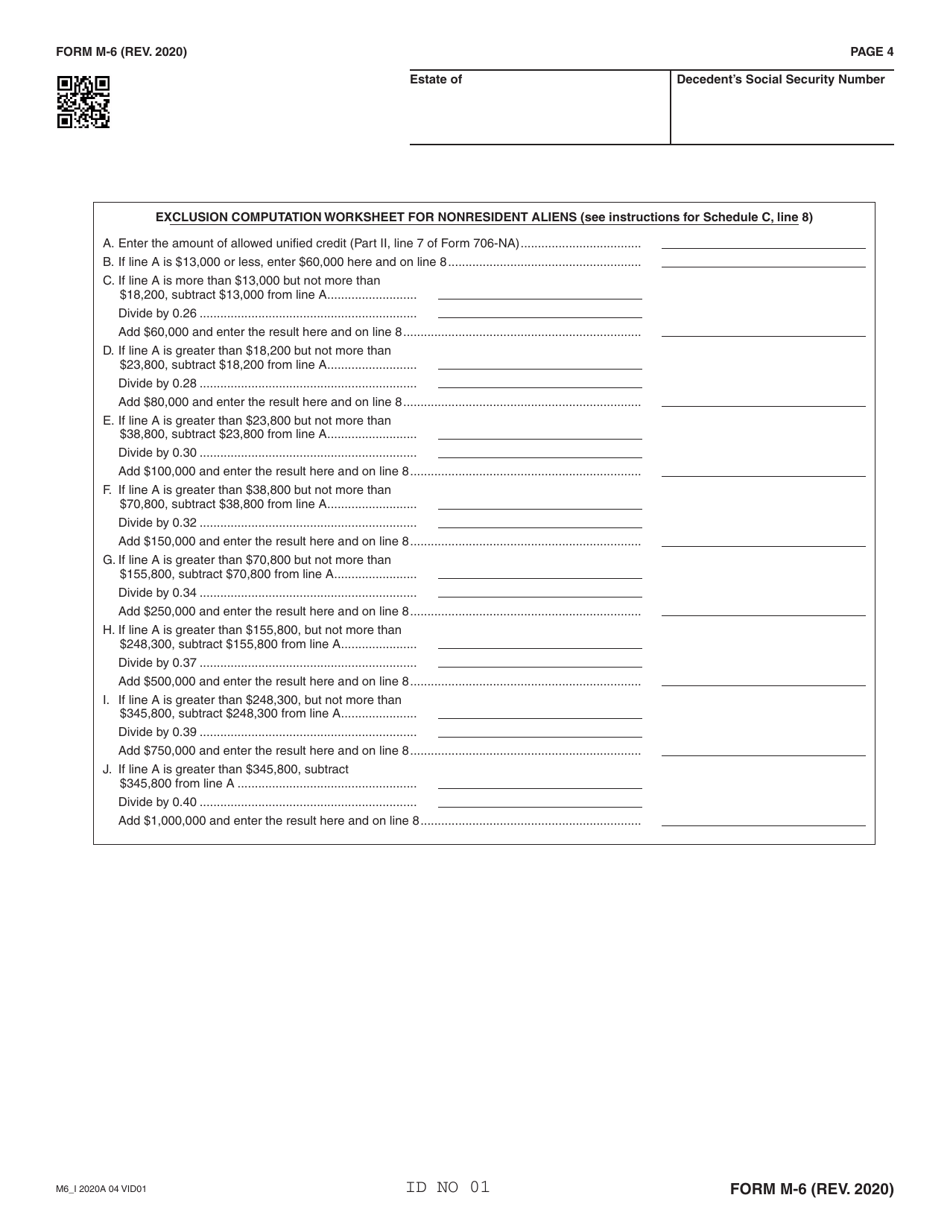

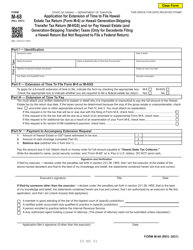

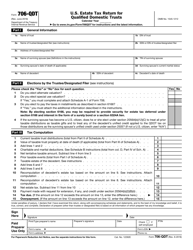

Form M-6

for the current year.

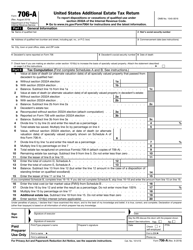

Form M-6 Hawaii Estate Tax Return - Hawaii

What Is Form M-6?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form M-6?

A: Form M-6 is the Hawaii Estate Tax Return.

Q: Who needs to file Form M-6?

A: Form M-6 must be filed by the executor or personal representative of a decedent's estate if the estate is subject to Hawaii estate tax.

Q: What information is required on Form M-6?

A: Form M-6 requires information about the decedent, the estate's assets, and any applicable deductions and credits.

Q: When is Form M-6 due?

A: Form M-6 is due within 9 months after the decedent's date of death.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-6 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.