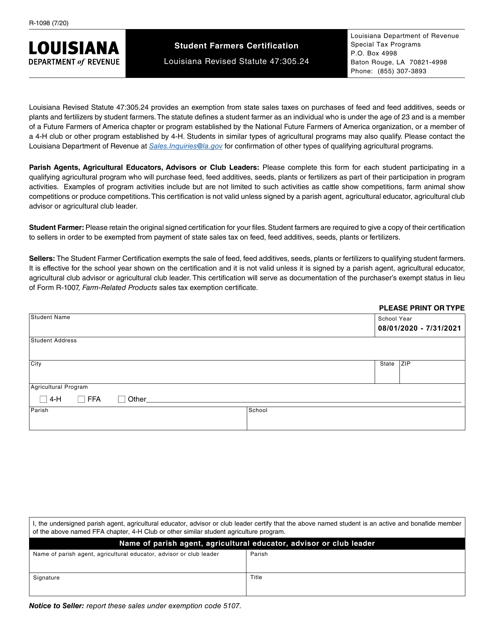

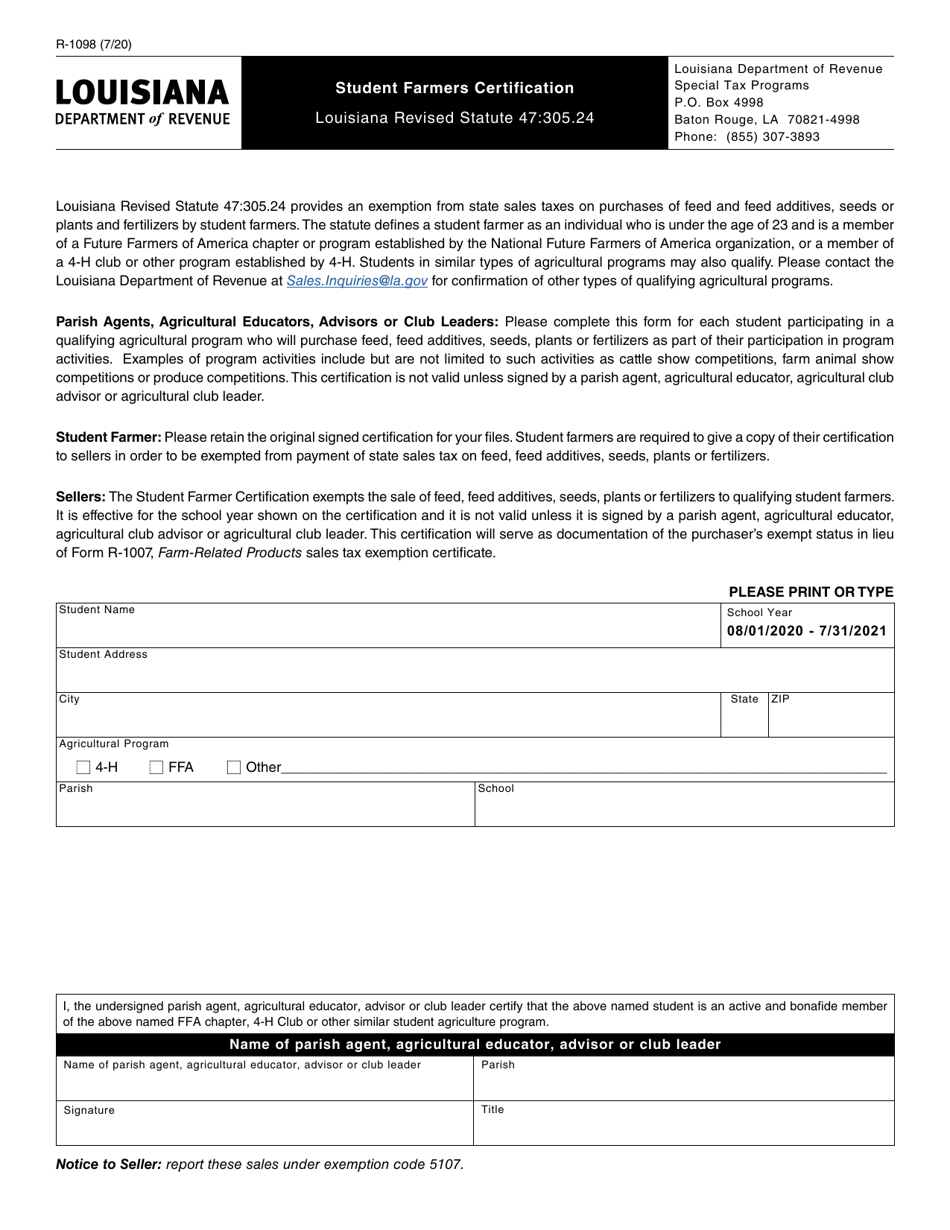

This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-1098

for the current year.

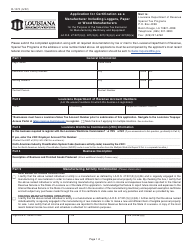

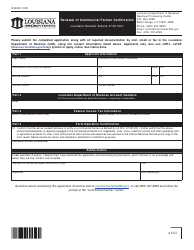

Form R-1098 Student Farmers Certification - Louisiana

What Is Form R-1098?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1098?

A: Form R-1098 is the Student Farmers Certification form in Louisiana.

Q: Who should file Form R-1098?

A: This form should be filed by student farmers in Louisiana.

Q: What is the purpose of Form R-1098?

A: The purpose of Form R-1098 is to certify that the individual is a student farmer and eligible for certain tax exemptions or benefits.

Q: What information is required on Form R-1098?

A: The form requires the student farmer's name, address, social security number, and certification of their farming activities.

Q: When is the deadline for filing Form R-1098?

A: The deadline for filing Form R-1098 is typically April 15th of the tax year.

Q: Are there any penalties for late filing of Form R-1098?

A: Yes, there may be penalties for late filing of Form R-1098, including potential loss of tax benefits or exemptions.

Q: Do I need to include supporting documentation with Form R-1098?

A: Yes, supporting documentation such as proof of farming activities may be required to accompany Form R-1098.

Q: Who can I contact for more information about Form R-1098?

A: For more information about Form R-1098, you can contact the Louisiana Department of Revenue or consult a tax professional.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1098 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.