This version of the form is not currently in use and is provided for reference only. Download this version of

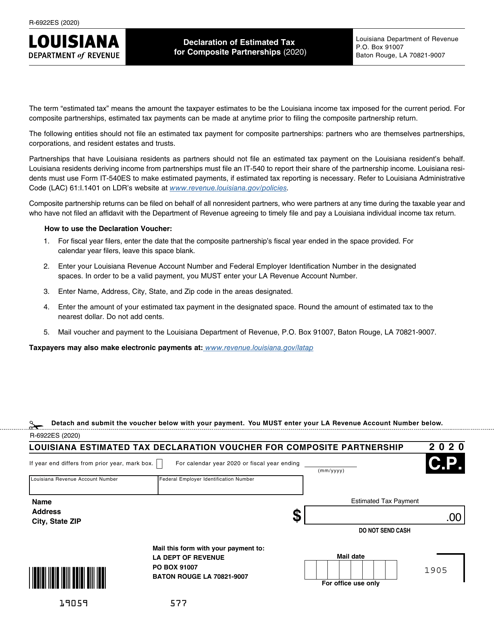

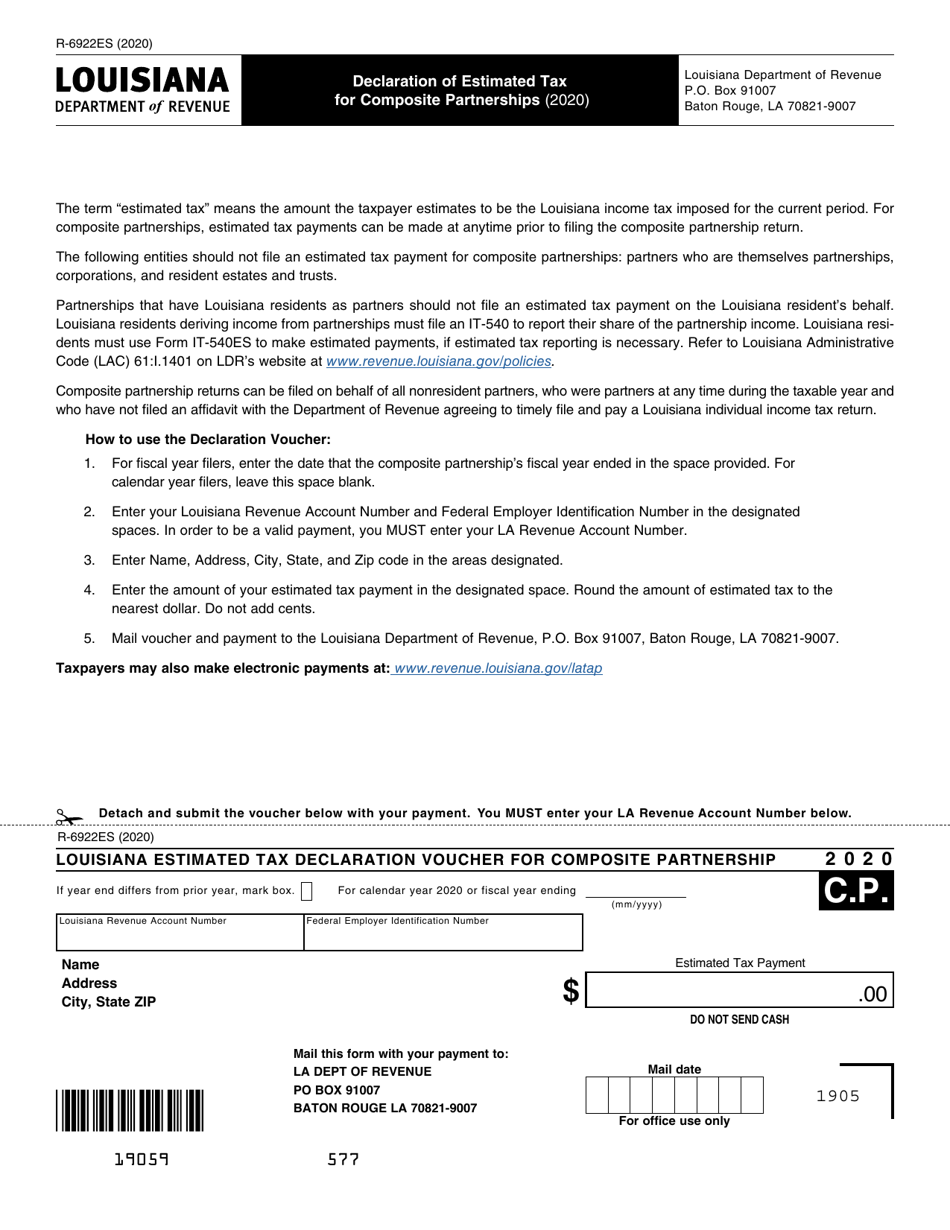

Form R-6922ES

for the current year.

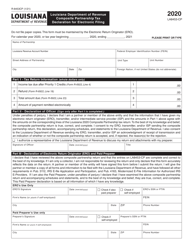

Form R-6922ES Declaration of Estimated Tax for Composite Partnerships - Louisiana

What Is Form R-6922ES?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6922ES?

A: Form R-6922ES is the Declaration of Estimated Tax for Composite Partnerships in Louisiana.

Q: Who needs to file Form R-6922ES?

A: Composite partnerships in Louisiana need to file Form R-6922ES.

Q: What is a composite partnership?

A: A composite partnership is a partnership that includes both resident and non-resident partners.

Q: What is the purpose of Form R-6922ES?

A: The purpose of Form R-6922ES is to report and pay estimated tax on behalf of the non-resident partners.

Q: When is Form R-6922ES due?

A: Form R-6922ES is due on the 15th day of the 6th month following the close of the partnership's tax year.

Q: What information is required on Form R-6922ES?

A: Form R-6922ES requires information about the partnership, estimated tax calculations, and the names and addresses of the non-resident partners.

Q: Are there any penalties for not filing Form R-6922ES?

A: Yes, failure to file or pay the estimated tax can result in penalties and interest.

Q: Can Form R-6922ES be e-filed?

A: Yes, Form R-6922ES can be e-filed if the partnership is registered with the Louisiana Department of Revenue as an e-filer.

Q: Can Form R-6922ES be amended?

A: Yes, if there are changes or corrections to the original form, an amended Form R-6922ES can be filed.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6922ES by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.