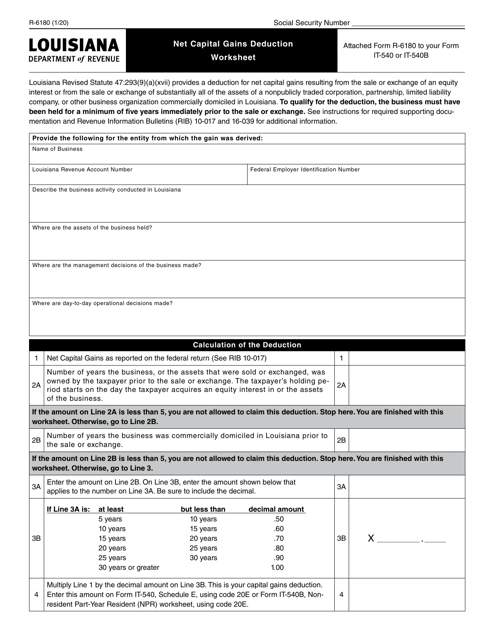

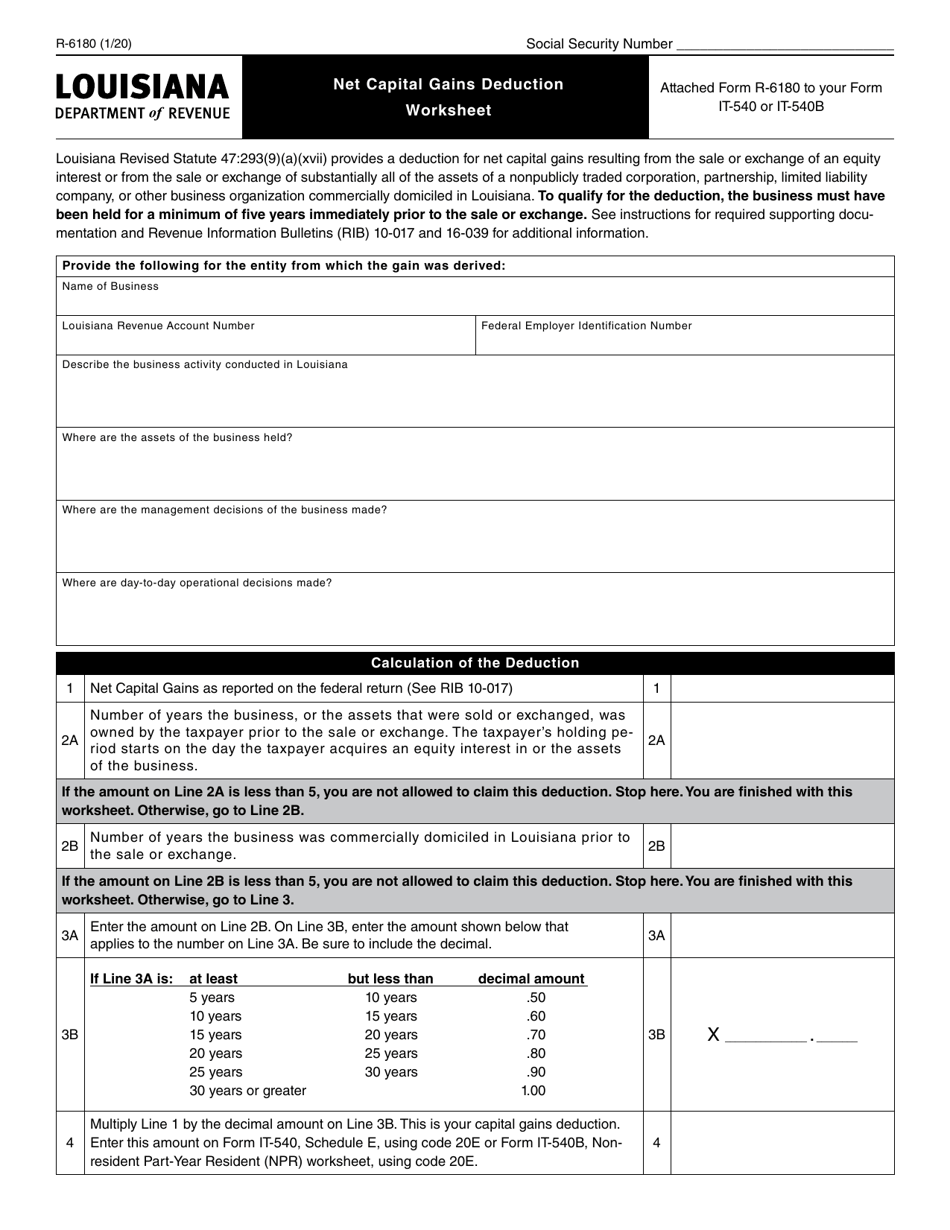

Form R-6180 Net Capital Gains Deduction Worksheet - Louisiana

What Is Form R-6180?

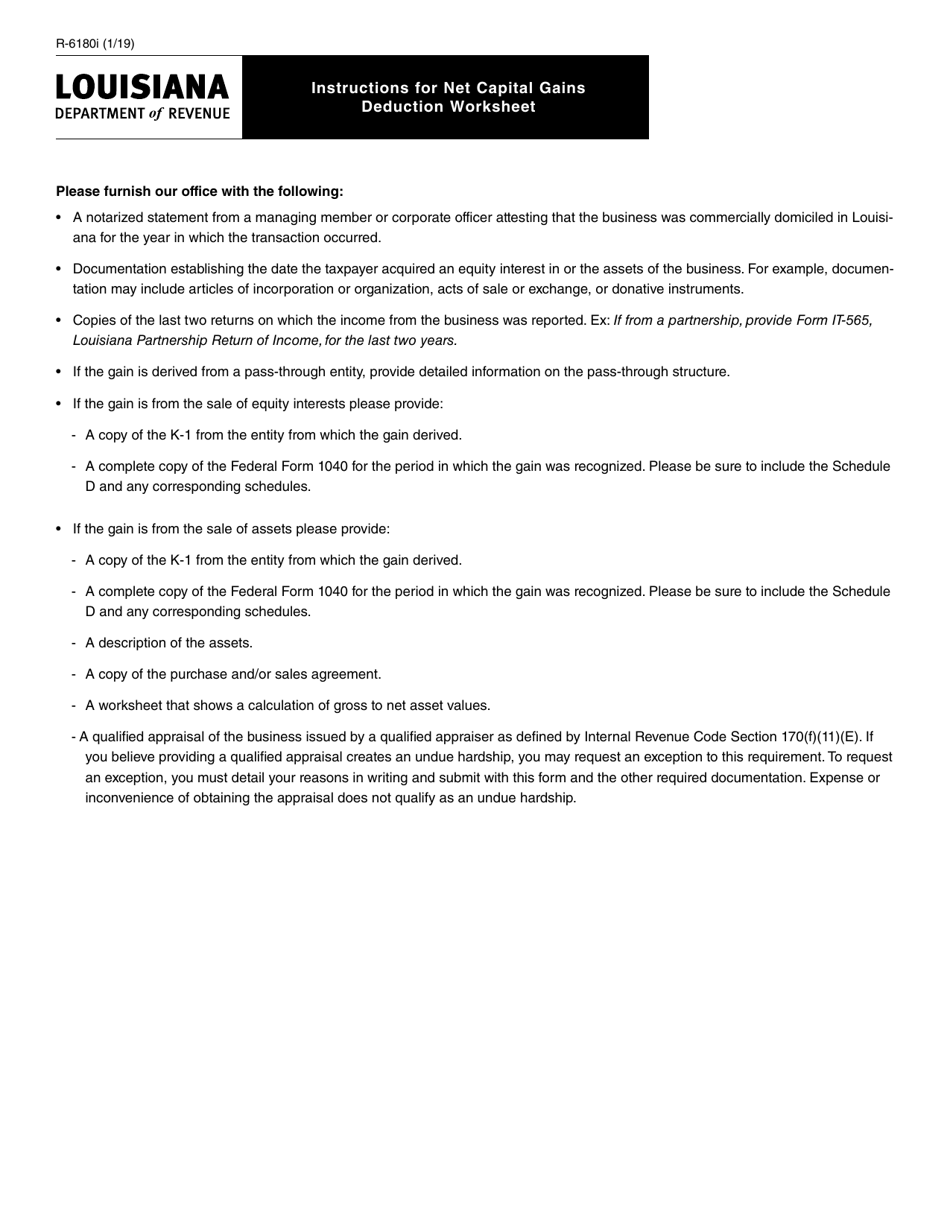

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6180?

A: Form R-6180 is the Net Capital Gains Deduction Worksheet for taxpayers in Louisiana.

Q: What is the purpose of Form R-6180?

A: The purpose of Form R-6180 is to calculate the net capital gains deduction for Louisiana taxpayers.

Q: Who needs to use Form R-6180?

A: Louisiana taxpayers who have capital gains or losses need to use Form R-6180.

Q: How do I fill out Form R-6180?

A: You need to provide information about your capital gains and losses, and follow the instructions on the form to calculate the net capital gains deduction.

Q: Is there a deadline for filing Form R-6180?

A: Yes, the deadline for filing Form R-6180 is the same as the deadline for filing your Louisiana state tax return.

Q: Can I claim the net capital gains deduction on my federal tax return?

A: No, the net capital gains deduction is specific to Louisiana state taxes and cannot be claimed on your federal tax return.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6180 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.