This version of the form is not currently in use and is provided for reference only. Download this version of

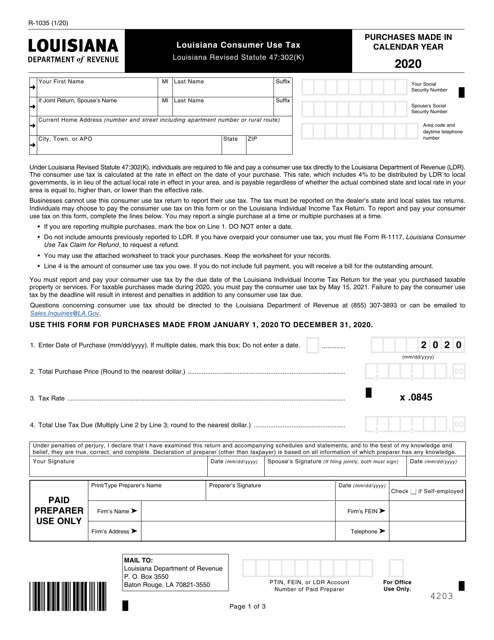

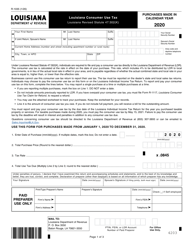

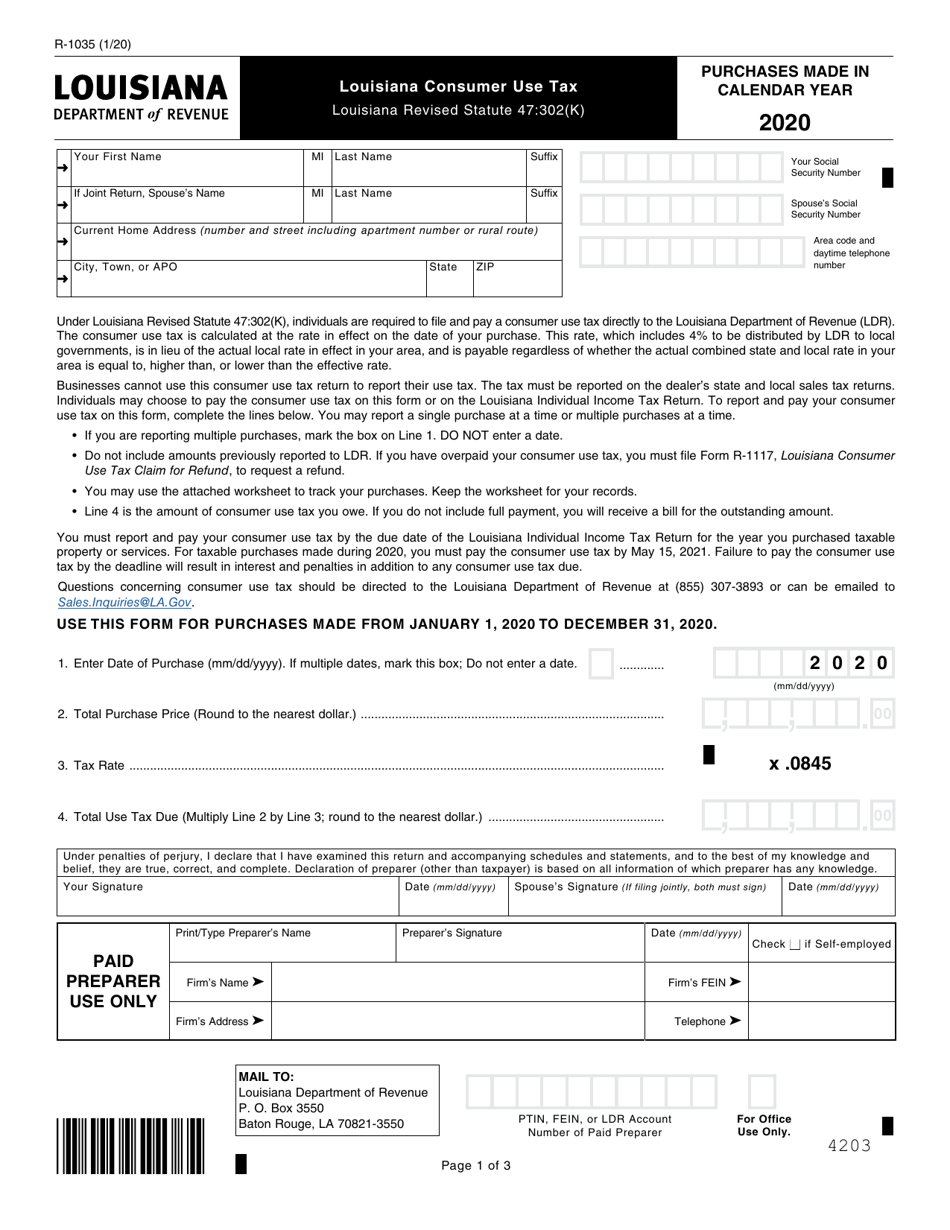

Form R-1035

for the current year.

Form R-1035 Louisiana Consumer Use Tax - Louisiana

What Is Form R-1035?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1035?

A: Form R-1035 is the Louisiana Consumer Use Tax form.

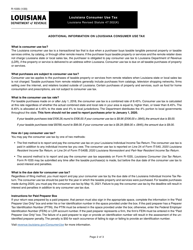

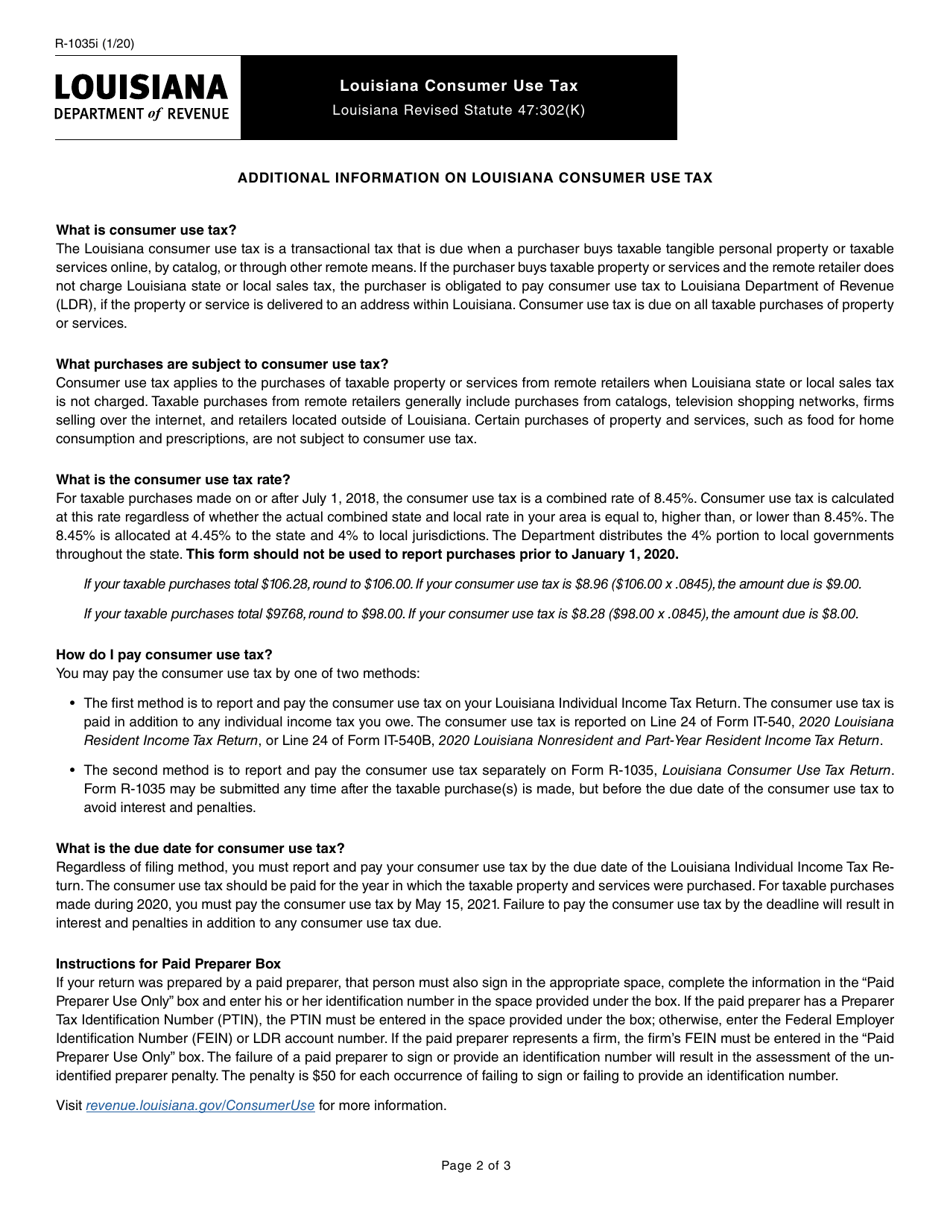

Q: What is the Louisiana Consumer Use Tax?

A: The Louisiana Consumer Use Tax is a tax that is imposed on purchases made by Louisiana residents from out-of-state vendors.

Q: Who needs to file Form R-1035?

A: Louisiana residents who have made purchases from out-of-state vendors and have not paid sales tax on those purchases.

Q: What is the purpose of filing Form R-1035?

A: The purpose of filing Form R-1035 is to report and remit the consumer use tax owed on out-of-state purchases.

Q: When is Form R-1035 due?

A: Form R-1035 is due on or before the 20th day of the month following the month in which the purchases were made.

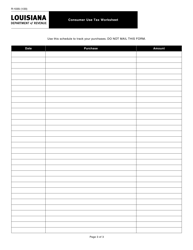

Q: What information do I need to complete Form R-1035?

A: You will need information about your out-of-state purchases, including the vendor's name and address, the date of purchase, and the amount of the purchase.

Q: What happens if I don't file Form R-1035?

A: If you do not file Form R-1035 and pay the consumer use tax owed, you may be subject to penalties and interest.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1035 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.