This version of the form is not currently in use and is provided for reference only. Download this version of

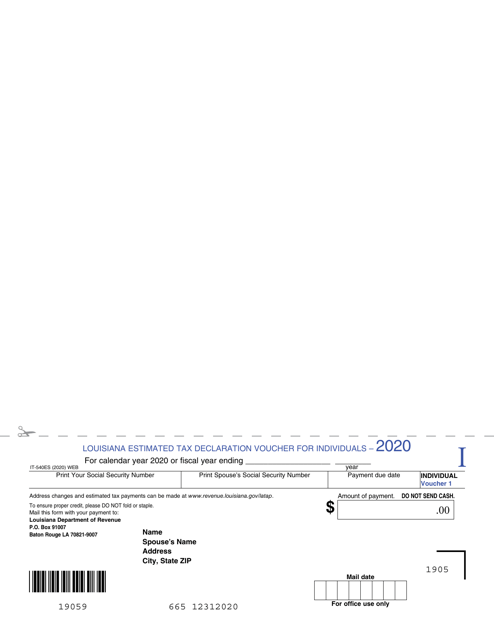

Form IT-540ES

for the current year.

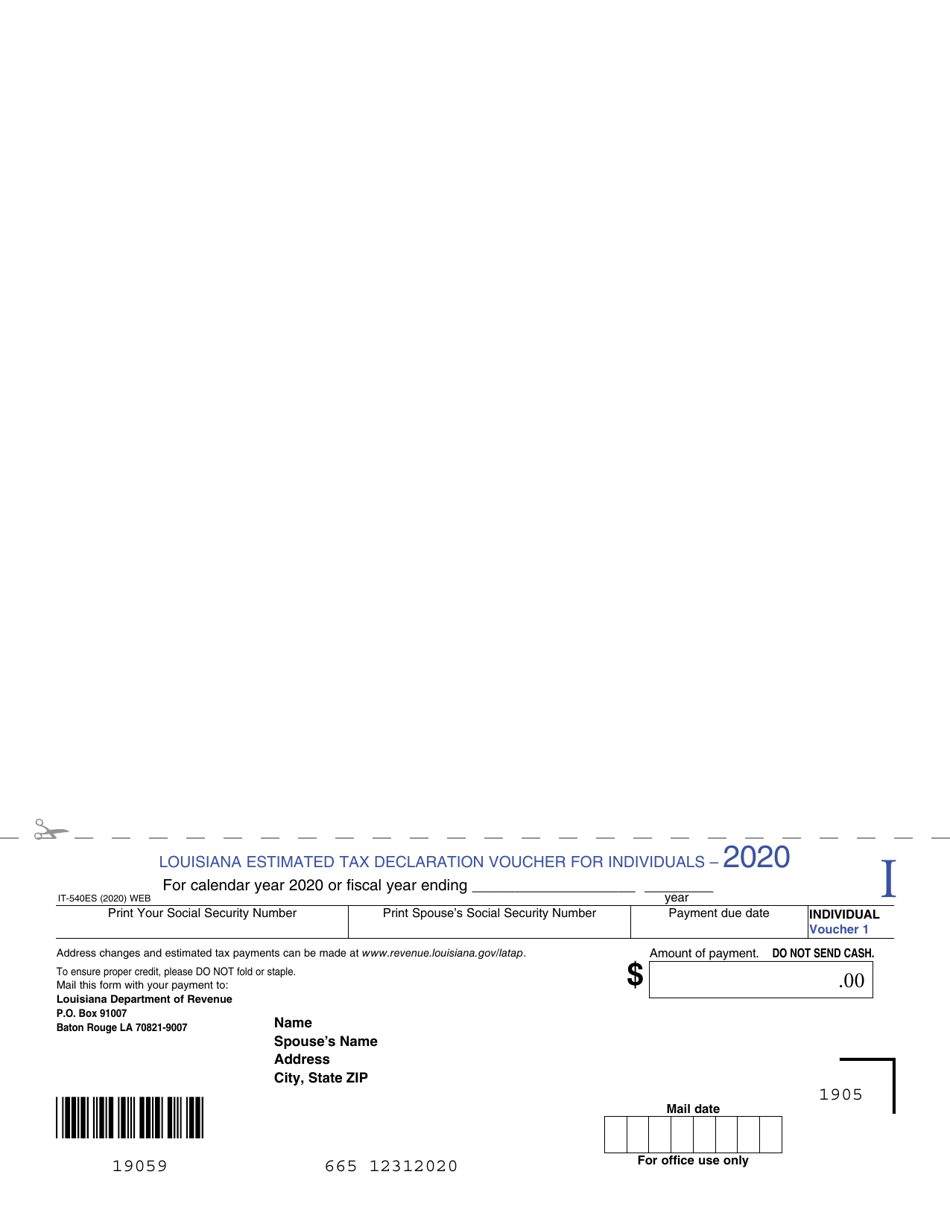

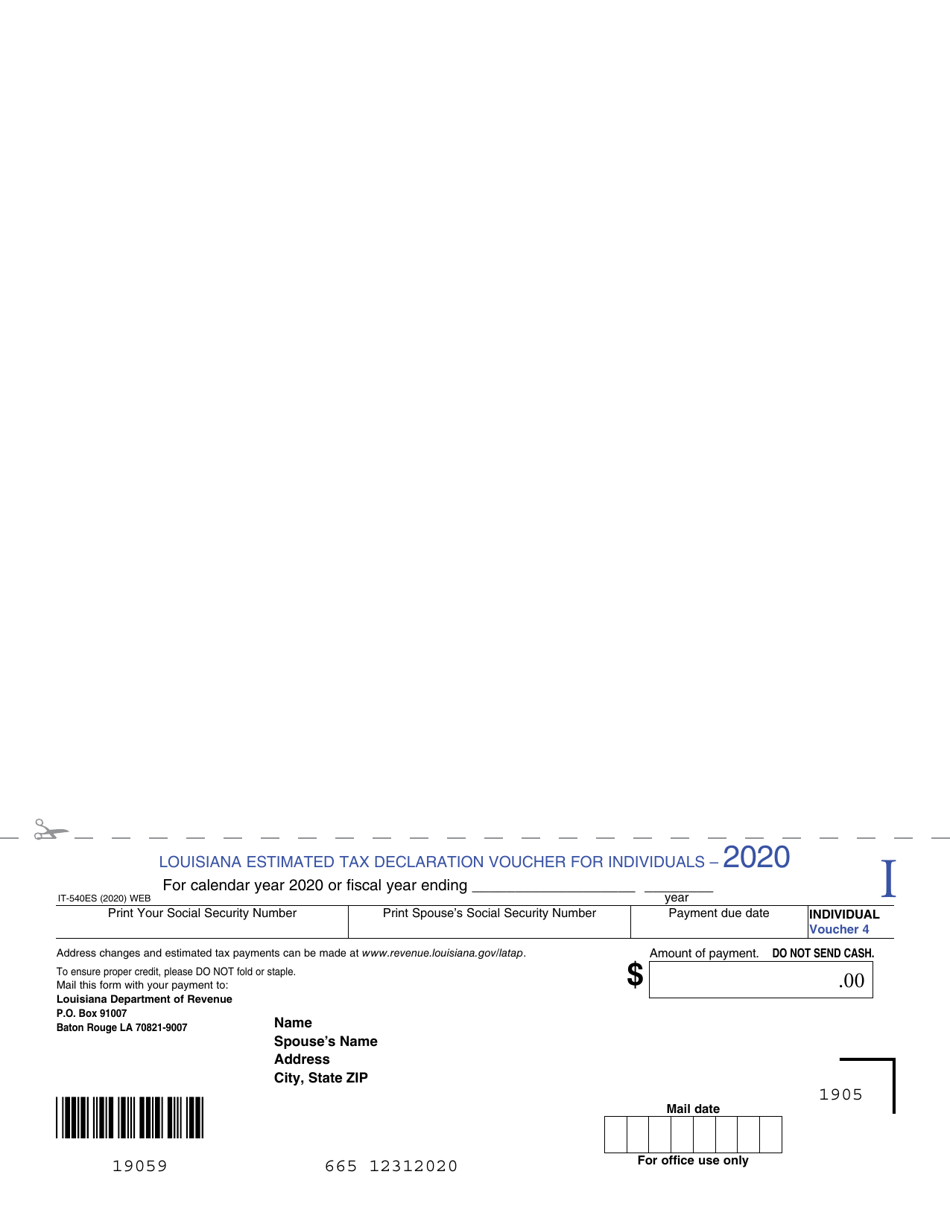

Form IT-540ES Louisiana Estimated Tax Declaration Voucher for Individuals - Louisiana

What Is Form IT-540ES?

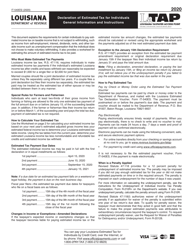

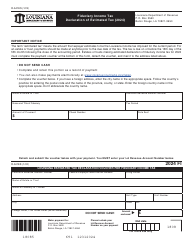

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-540ES?

A: Form IT-540ES is the Louisiana Estimated Tax Declaration Voucher for Individuals.

Q: Who should use Form IT-540ES?

A: Anyone who needs to make estimated tax payments in Louisiana should use Form IT-540ES.

Q: What is the purpose of Form IT-540ES?

A: Form IT-540ES is used to declare and pay estimated tax amounts for individuals in Louisiana.

Q: When is Form IT-540ES due?

A: Form IT-540ES is due on a quarterly basis, with due dates falling on April 15th, June 15th, September 15th, and January 15th of the following year.

Q: How do I fill out Form IT-540ES?

A: To fill out Form IT-540ES, you will need to provide your personal information, estimate your taxable income, calculate the estimated tax due, and include payment with the form.

Q: What happens if I don't file Form IT-540ES?

A: If you are required to file Form IT-540ES but fail to do so, you may be subject to penalties and interest on any underpayment of estimated tax.

Q: Are there any exceptions to filing Form IT-540ES?

A: There may be exceptions to filing Form IT-540ES if you meet certain criteria, such as having a low income or being a retired individual.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-540ES by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.