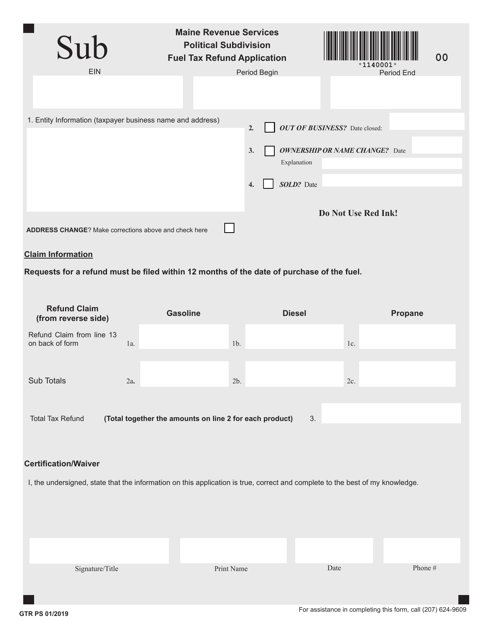

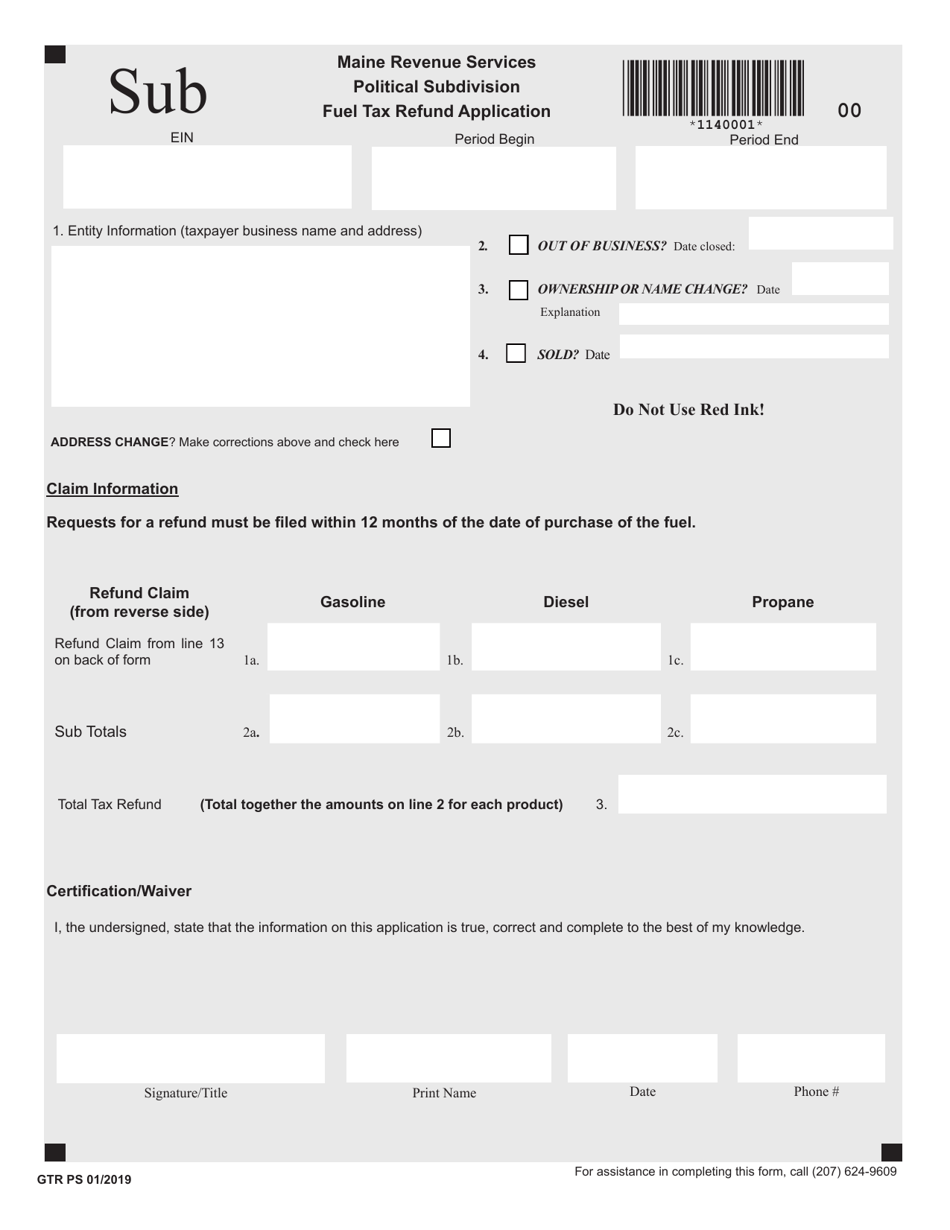

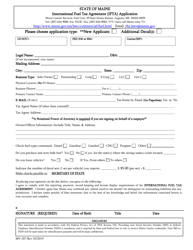

Form GTR PS Political Subdivision Fuel Tax Refund Application - Maine

What Is Form GTR PS?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GTR PS Political Subdivision Fuel Tax Refund Application?

A: It is an application form for claiming a fuel tax refund for political subdivisions in Maine.

Q: Who can use this application?

A: Political subdivisions in Maine can use this application to claim a refund on fuel taxes.

Q: What is a political subdivision?

A: A political subdivision refers to a governmental unit or division within the state, such as a city, town, or county.

Q: What is the purpose of a fuel tax refund?

A: The purpose of a fuel tax refund is to provide a reimbursement to political subdivisions for fuel taxes paid on vehicles used for official purposes.

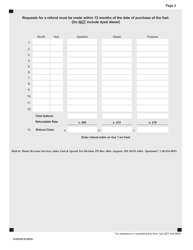

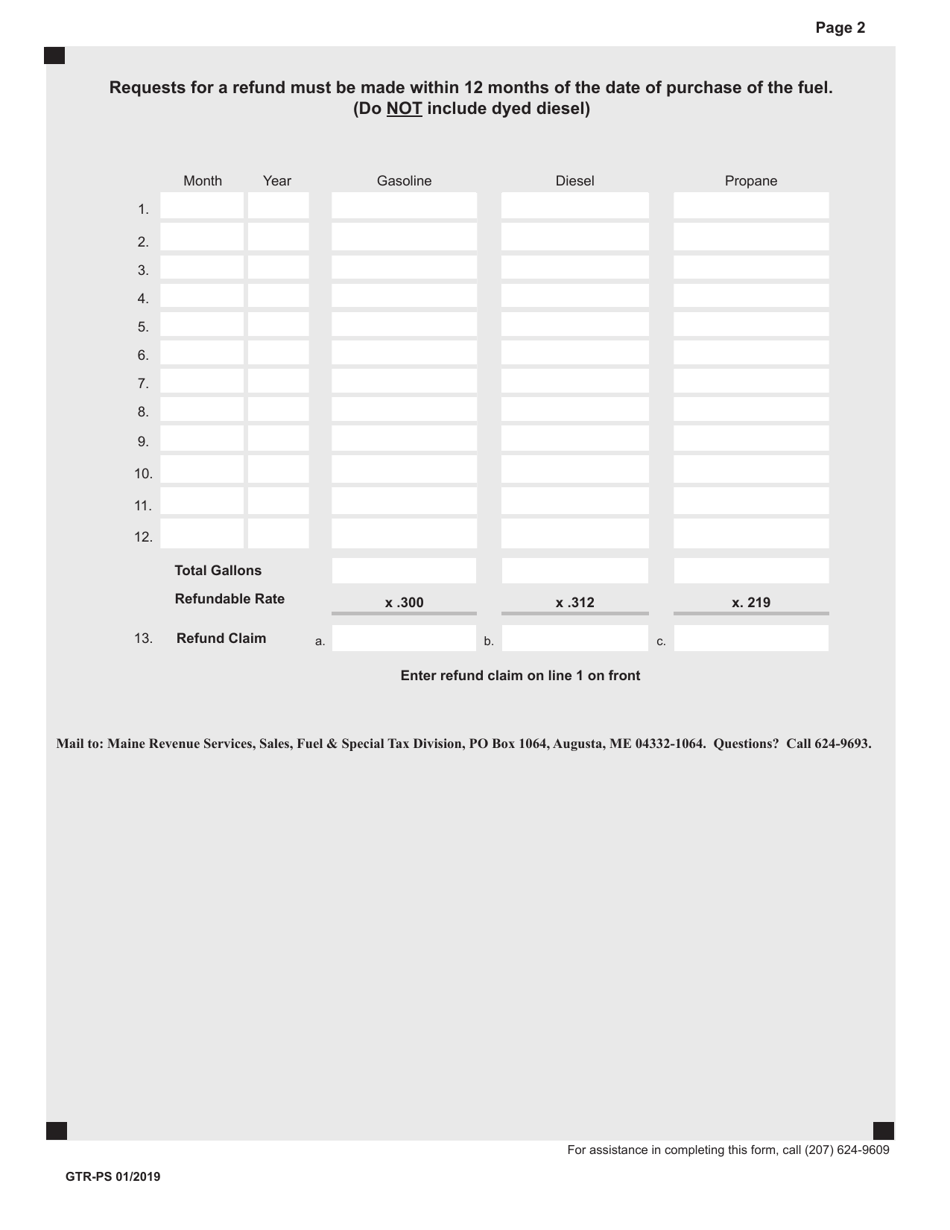

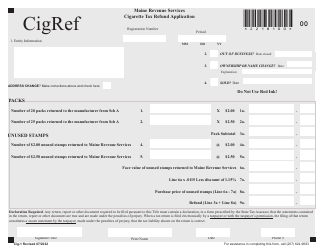

Q: What information is required in the application?

A: The application requires information such as the political subdivision's name, address, vehicle details, fuel purchases, and tax payment receipts.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GTR PS by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.