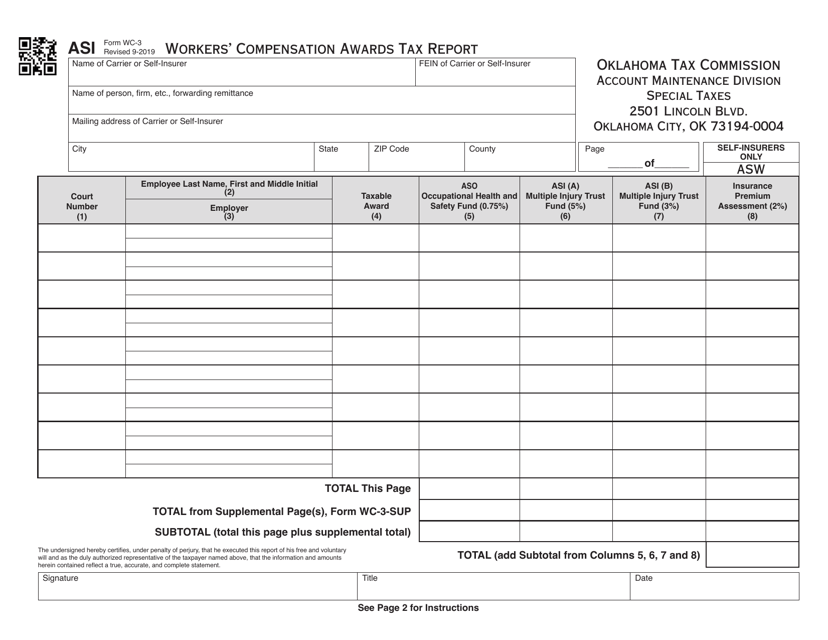

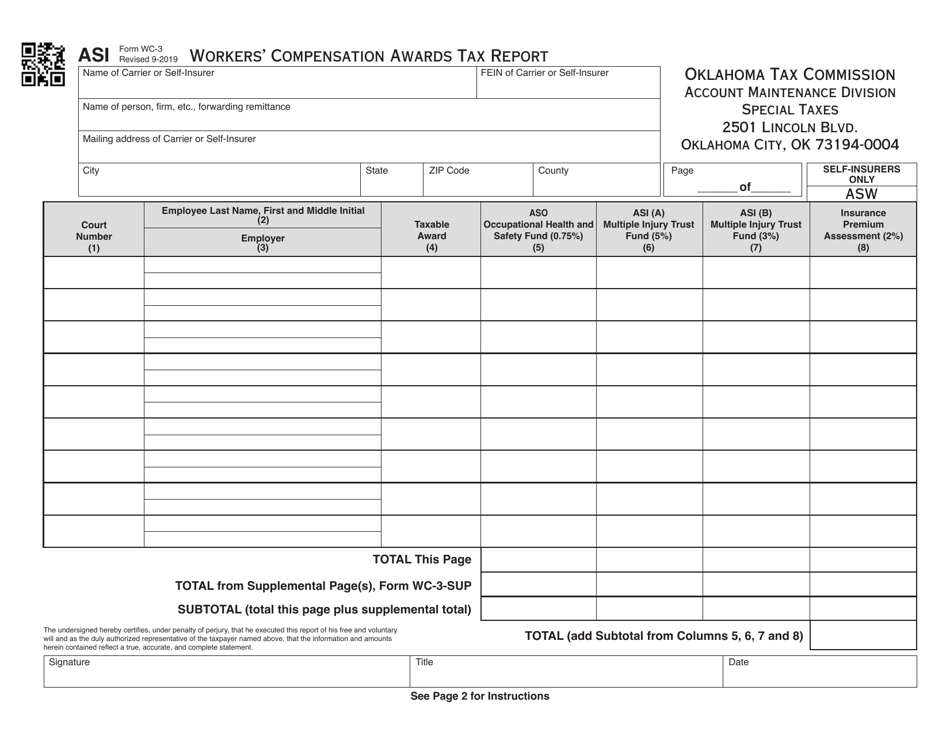

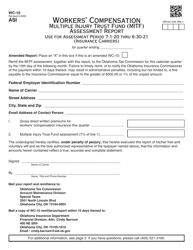

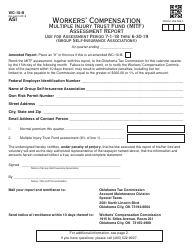

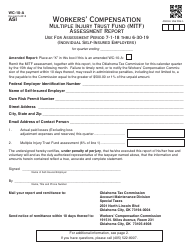

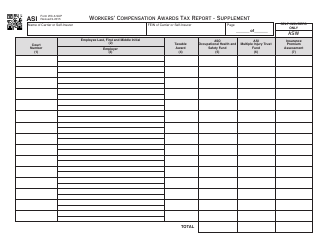

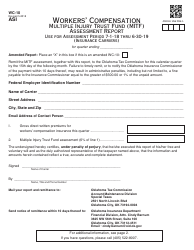

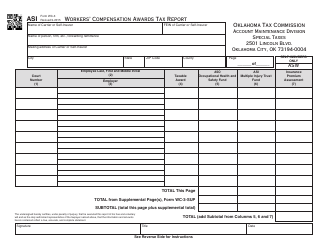

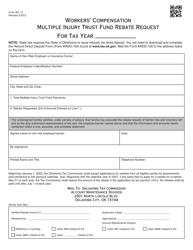

Form WC-3 Workers' Compensation Awards Tax Report - Oklahoma

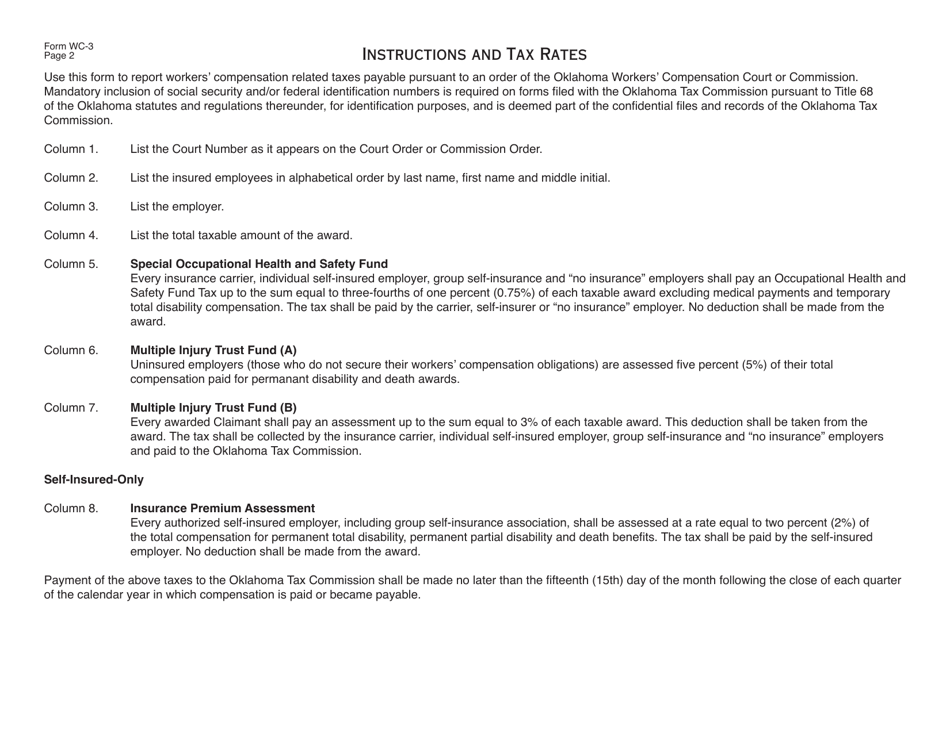

What Is Form WC-3?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WC-3?

A: Form WC-3 is the Workers' Compensation Awards Tax Report that needs to be filed in Oklahoma.

Q: What is Workers' Compensation?

A: Workers' Compensation is a type of insurance that provides benefits to employees who are injured or become ill on the job.

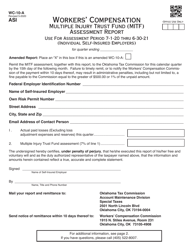

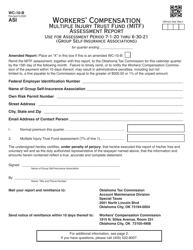

Q: Who needs to file Form WC-3 in Oklahoma?

A: Employers who make payments for workers' compensation awards in Oklahoma need to file Form WC-3.

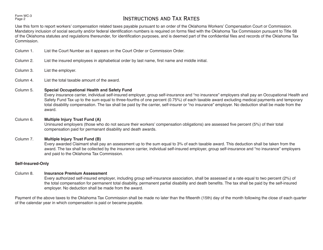

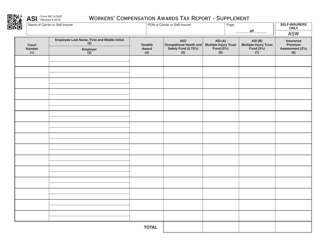

Q: What information is required on Form WC-3?

A: Form WC-3 requires information about the employer, the injured employee, the workers' compensation benefits paid, and the tax withheld.

Q: When should Form WC-3 be filed?

A: Form WC-3 should be filed annually by February 28th for the previous calendar year.

Q: Are there any penalties for not filing Form WC-3?

A: Yes, there are penalties for not filing Form WC-3 or for filing it late. It is important to file the form on time to avoid penalties.

Q: Is Form WC-3 specific to Oklahoma?

A: Yes, Form WC-3 is specific to Oklahoma and is used for reporting workers' compensation awards in the state.

Q: Are there any other forms related to workers' compensation in Oklahoma?

A: Yes, there are other forms related to workers' compensation in Oklahoma, such as Form WC-1 for reporting accidents and Form WC-2 for reporting benefits paid.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WC-3 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.