This version of the form is not currently in use and is provided for reference only. Download this version of

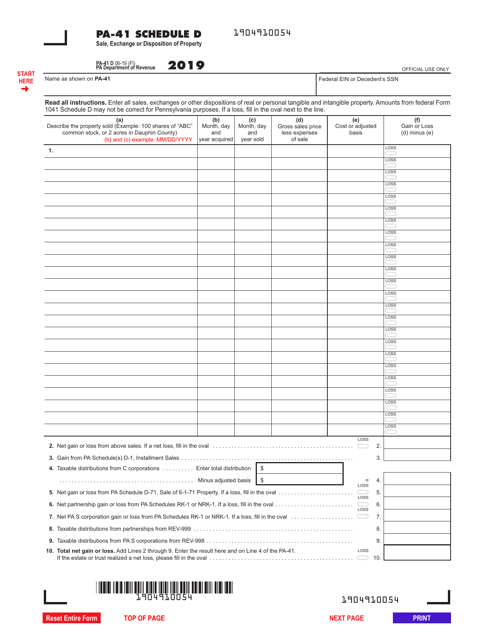

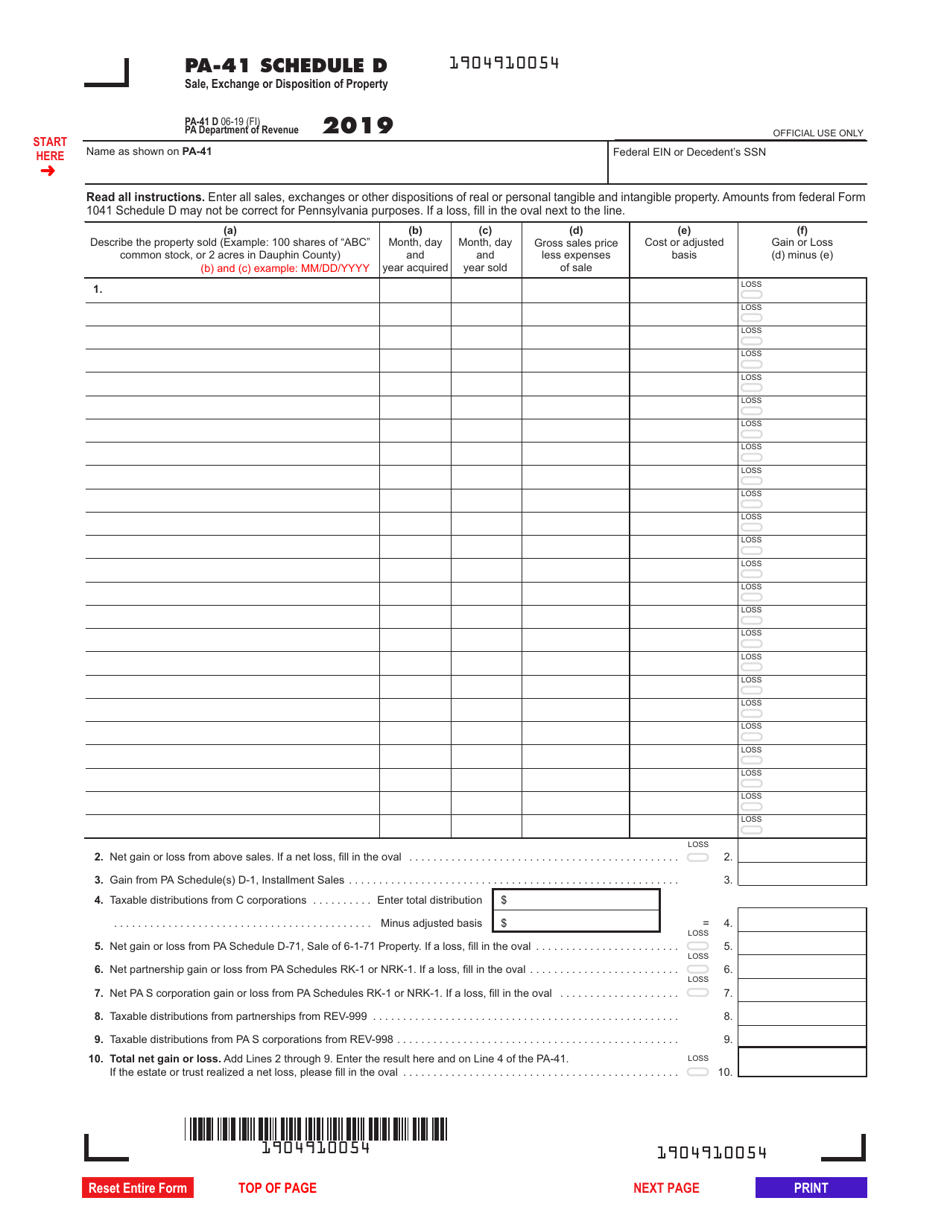

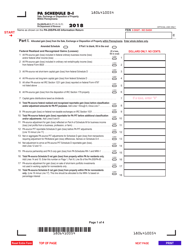

Form PA-41 Schedule D

for the current year.

Form PA-41 Schedule D Sale, Exchange or Disposition of Property - Pennsylvania

What Is Form PA-41 Schedule D?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a PA-41 Schedule D?

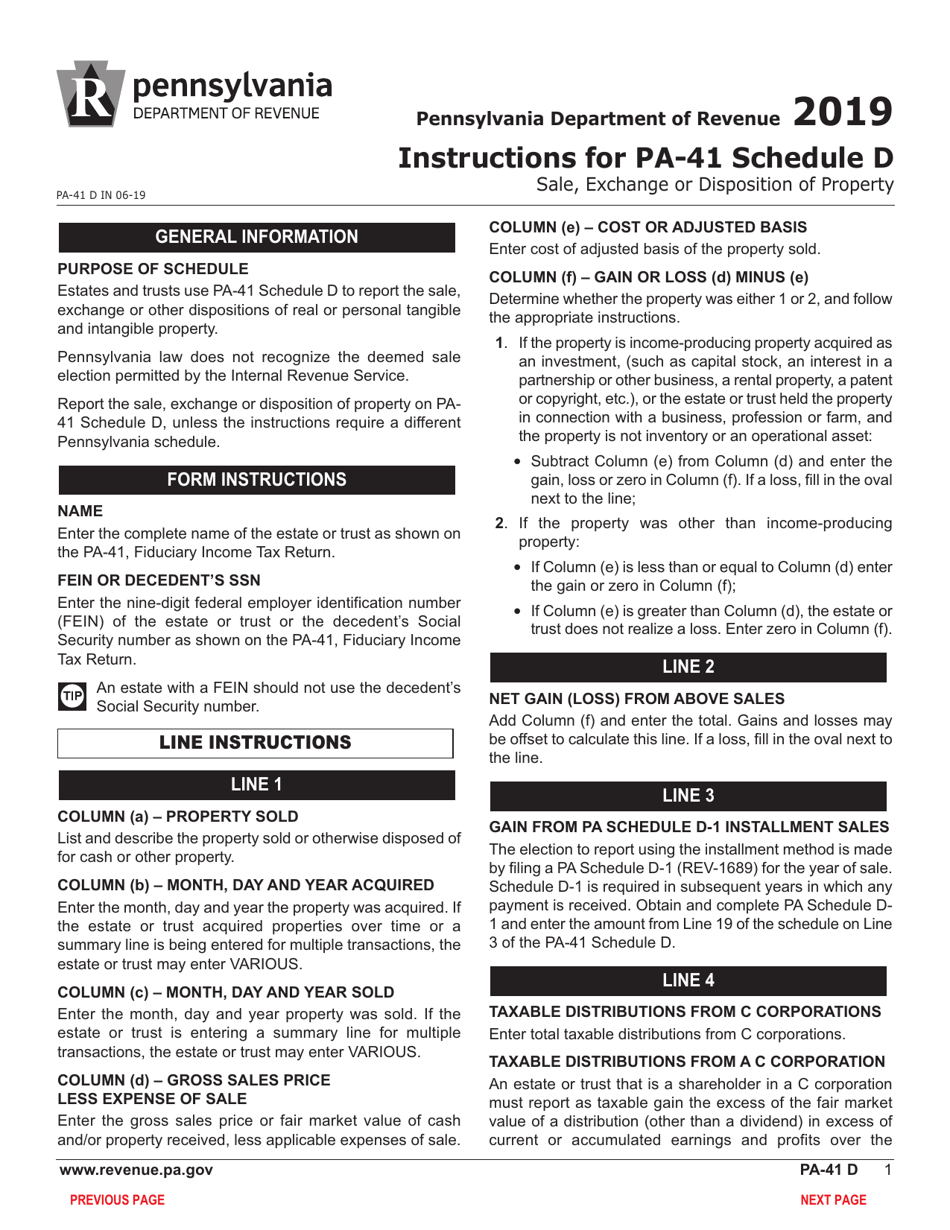

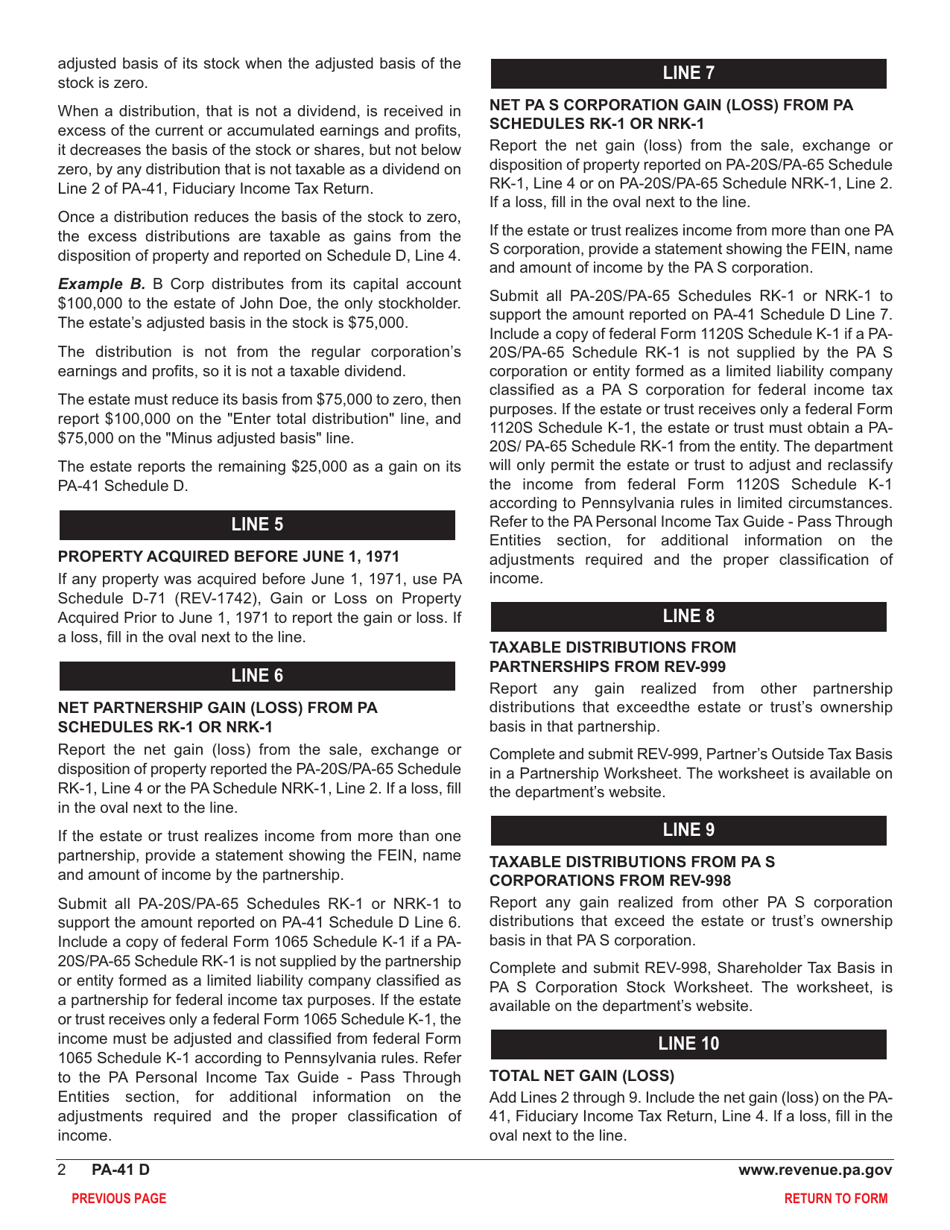

A: PA-41 Schedule D is a form used in Pennsylvania to report the sale, exchange, or disposition of property.

Q: What types of property transactions should be reported on PA-41 Schedule D?

A: Any sale, exchange, or disposition of property should be reported on PA-41 Schedule D.

Q: Who needs to file PA-41 Schedule D?

A: Individuals and businesses who have engaged in property transactions in Pennsylvania need to file PA-41 Schedule D.

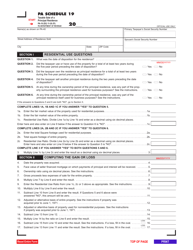

Q: How do I fill out PA-41 Schedule D?

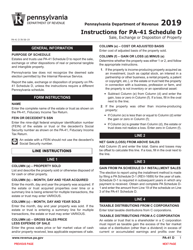

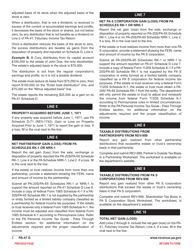

A: You will need to provide information about the property being sold or disposed of, including the date of transaction, sales price, and any related expenses.

Q: When is the deadline to file PA-41 Schedule D?

A: The deadline to file PA-41 Schedule D is typically the same as the deadline for filing your Pennsylvania state tax return, which is April 15th.

Q: Are there any penalties for not filing PA-41 Schedule D?

A: Yes, there may be penalties for failing to file PA-41 Schedule D or for providing inaccurate information.

Q: Can I file PA-41 Schedule D electronically?

A: Yes, you can generally file PA-41 Schedule D electronically using the Pennsylvania Department of Revenue's e-filing system.

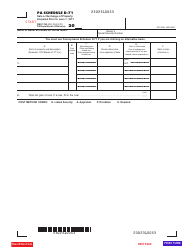

Q: Do I need to include supporting documents with PA-41 Schedule D?

A: You may need to include supporting documents, such as closing statements or other proof of the property transaction.

Q: Can I amend PA-41 Schedule D if I make a mistake?

A: Yes, you can typically amend PA-41 Schedule D if you make a mistake or need to update the information you provided.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule D by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.