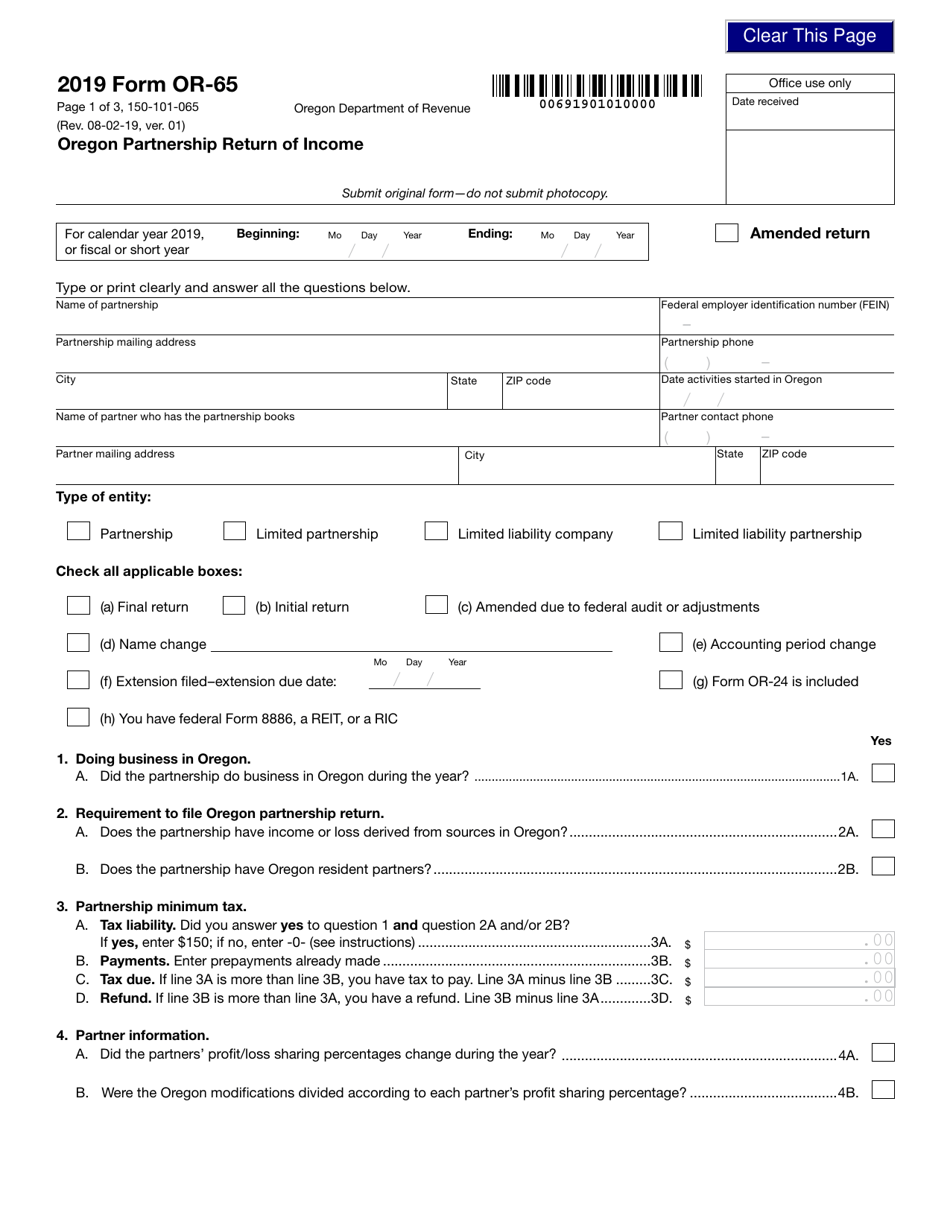

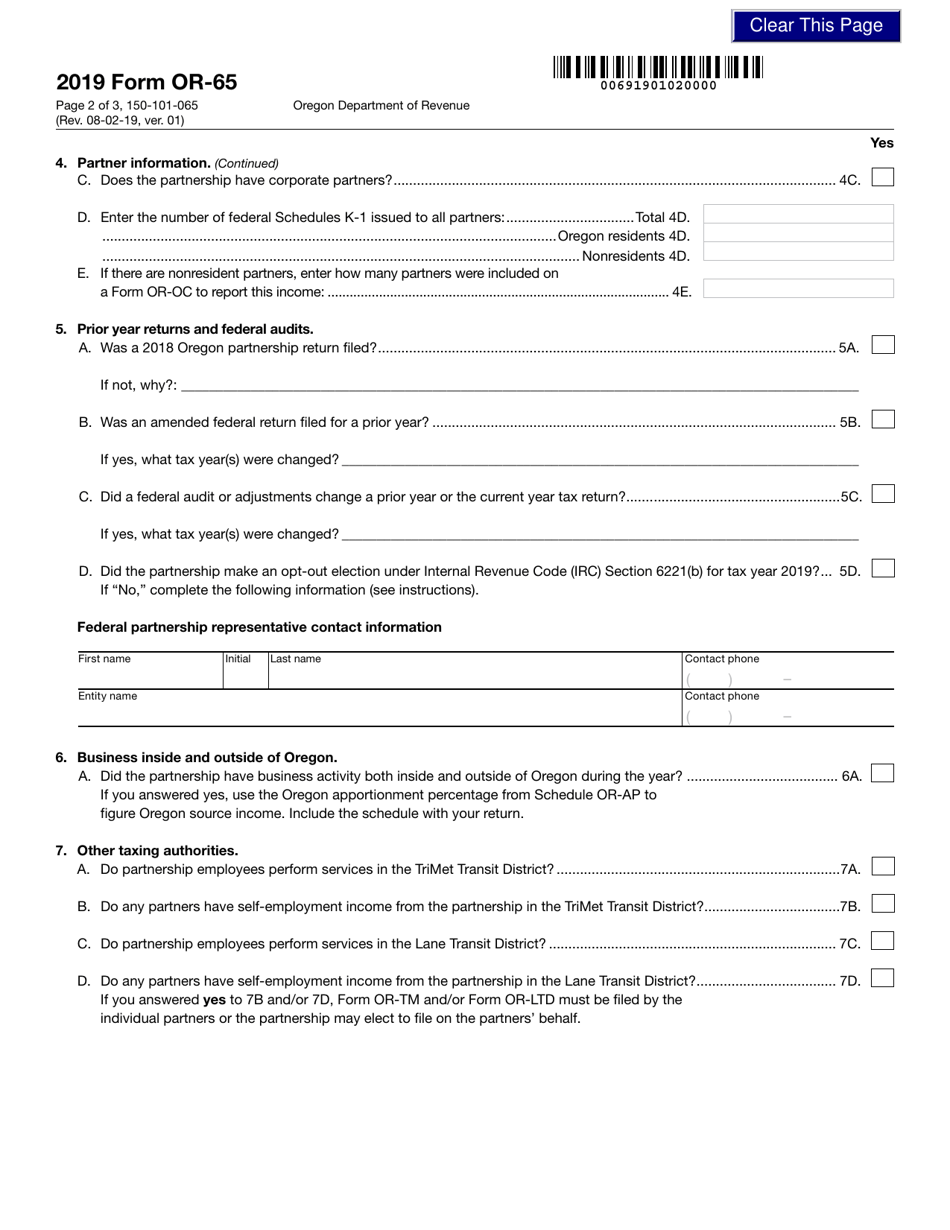

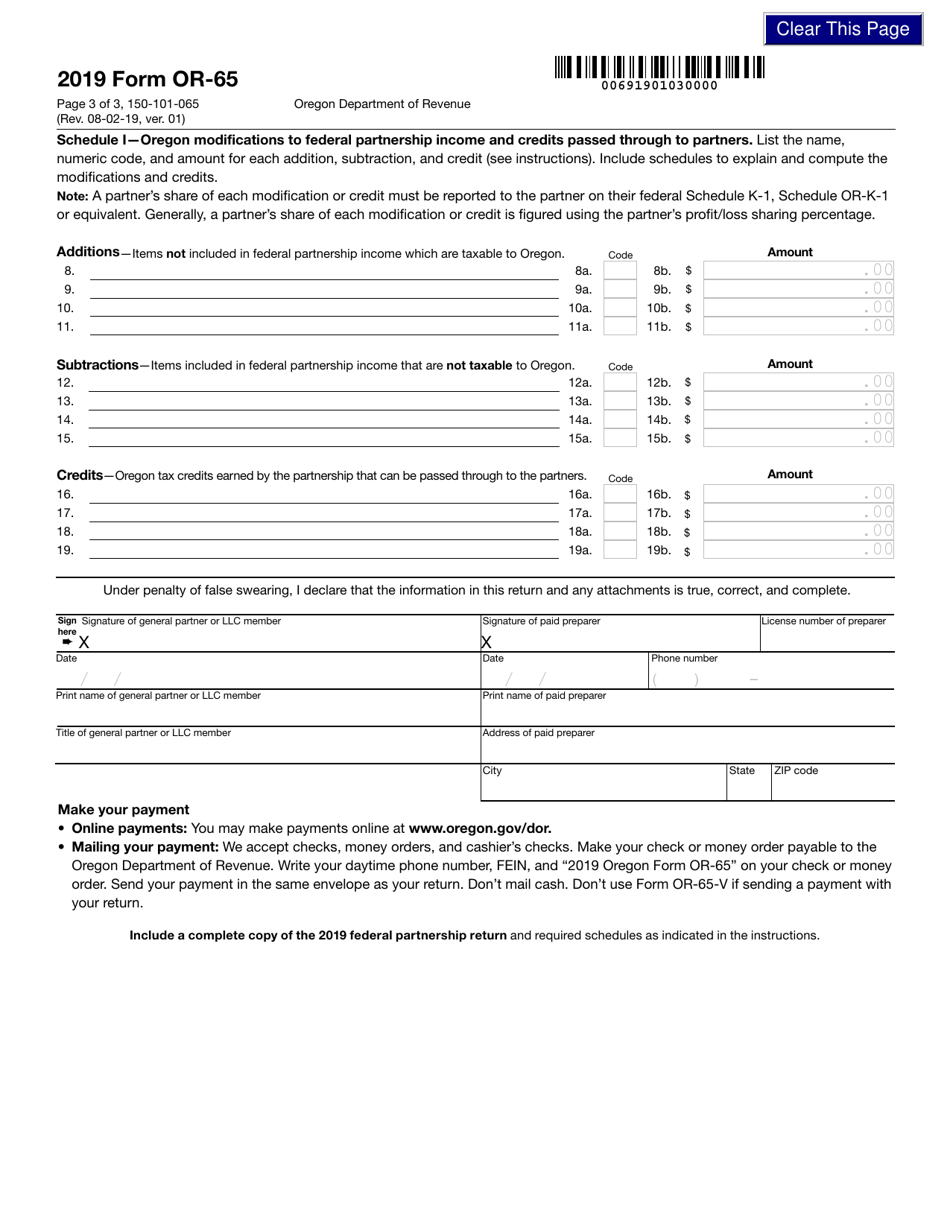

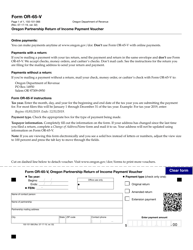

This version of the form is not currently in use and is provided for reference only. Download this version of

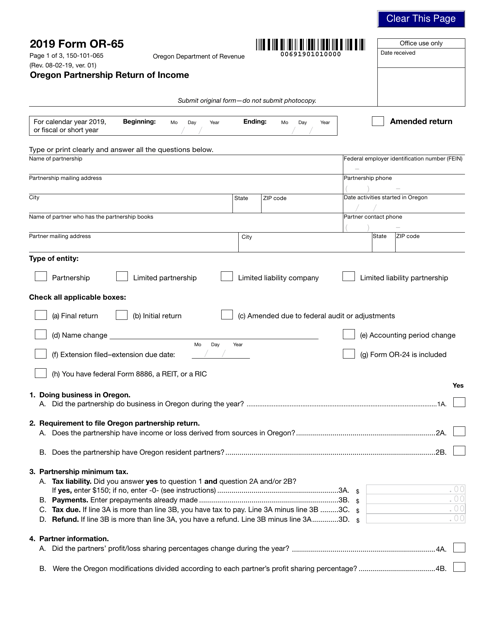

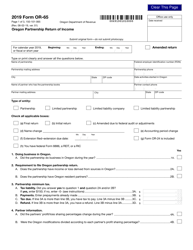

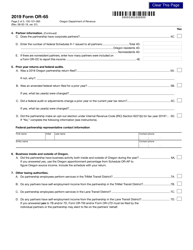

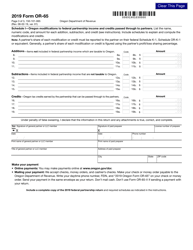

Form OR-65 (150-101-065)

for the current year.

Form OR-65 (150-101-065) Oregon Partnership Return of Income - Oregon

What Is Form OR-65 (150-101-065)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

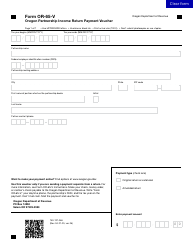

Q: What is Form OR-65?

A: Form OR-65 is the Oregon Partnership Return of Income form.

Q: Who needs to file Form OR-65?

A: Partnerships doing business in Oregon need to file Form OR-65.

Q: What is the purpose of Form OR-65?

A: Form OR-65 is used to report the partnership's income and expenses to the state of Oregon.

Q: Are there any eligibility requirements to file Form OR-65?

A: No, all partnerships doing business in Oregon are required to file Form OR-65, regardless of their income or expenses.

Q: When is the due date for filing Form OR-65?

A: The due date for filing Form OR-65 is the 15th day of the third month following the close of the tax year.

Q: Is there an extension available for filing Form OR-65?

A: Yes, you can request a six-month extension to file Form OR-65, but you must still pay any tax due by the original due date.

Q: Is there any filing fee for Form OR-65?

A: No, there is no filing fee for Form OR-65.

Q: Do I need to include any additional documentation with Form OR-65?

A: You may need to include certain schedules or supporting documentation depending on your specific situation. Make sure to read the instructions carefully.

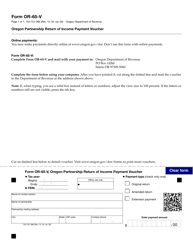

Form Details:

- Released on August 2, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-65 (150-101-065) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.