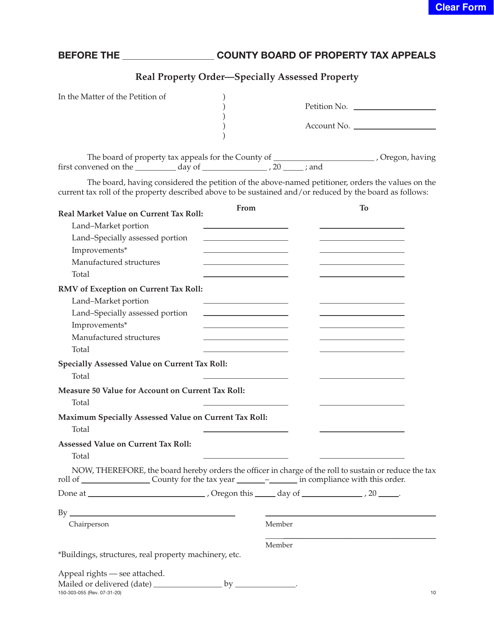

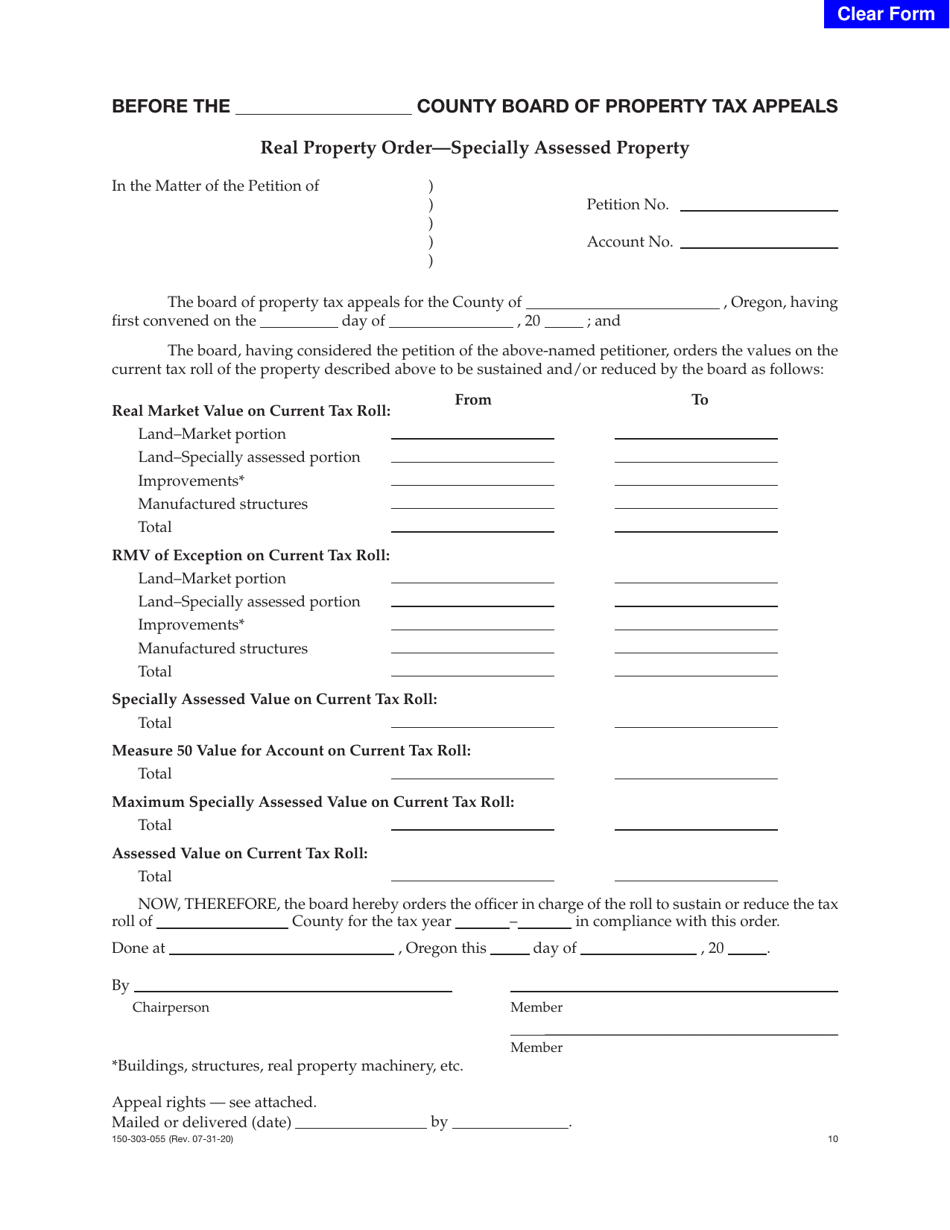

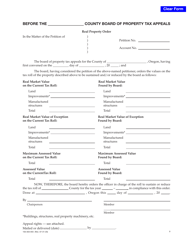

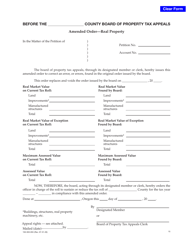

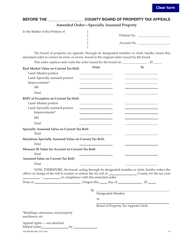

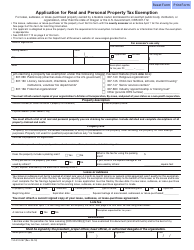

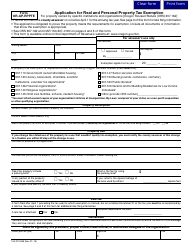

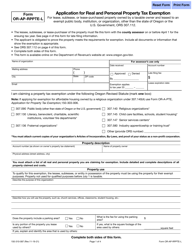

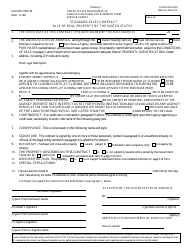

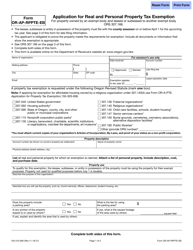

Form 150-303-055 Real Property Order - Specially Assessed Property - Oregon

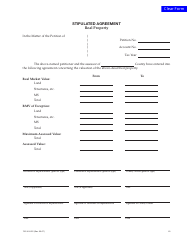

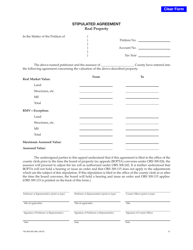

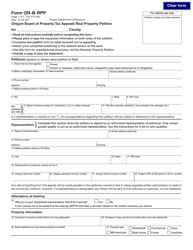

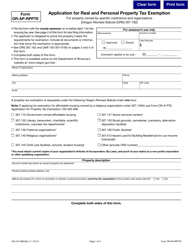

What Is Form 150-303-055?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-055?

A: Form 150-303-055 is a specific form used in Oregon for real property order for specially assessed property.

Q: What is specially assessed property?

A: Specially assessed property refers to property that is subject to a specific assessment or valuation method.

Q: When is Form 150-303-055 used?

A: This form is used when requesting a change in the assessment or value of specially assessed property in Oregon.

Q: Who needs to fill out this form?

A: This form should be completed by property owners or their authorized representatives.

Q: What information is required on Form 150-303-055?

A: The form requires information about the property, the reason for the requested change, and any supporting documentation.

Q: Are there any fees associated with this form?

A: There may be fees associated with filing this form, as determined by the Oregon Department of Revenue.

Q: How long does it take for the request to be processed?

A: The processing time varies, but it typically takes several weeks to receive a decision from the Oregon Department of Revenue.

Form Details:

- Released on July 31, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-055 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.