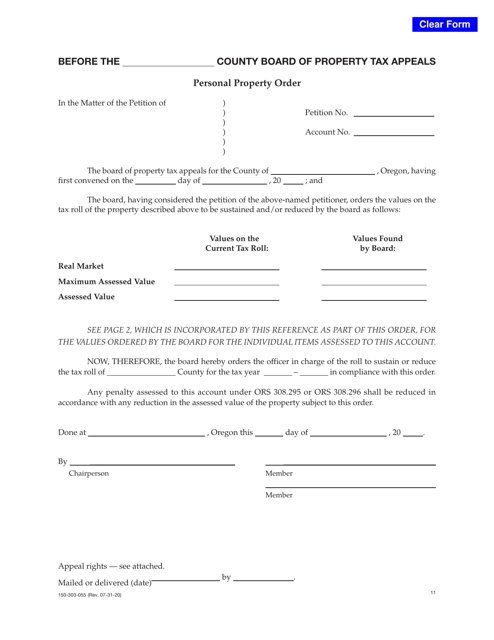

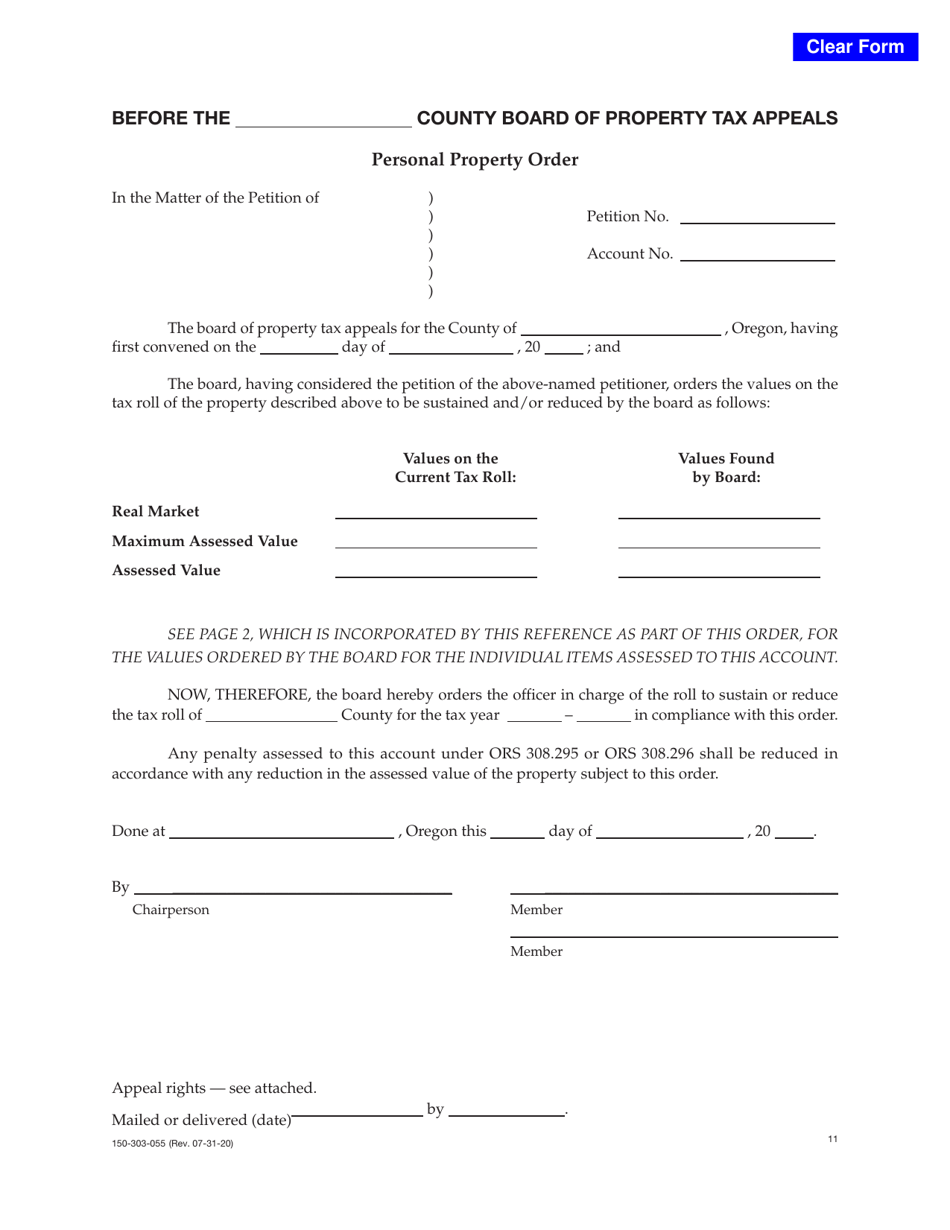

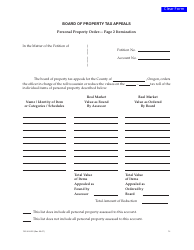

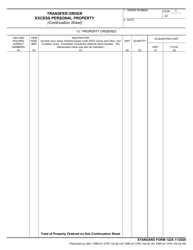

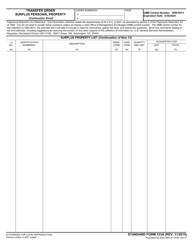

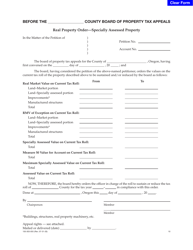

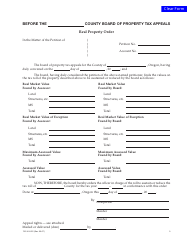

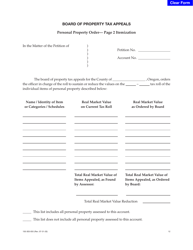

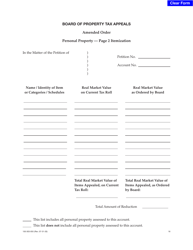

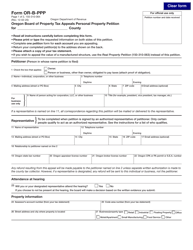

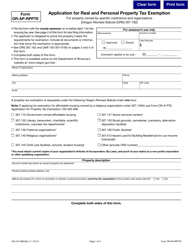

Form 150-303-055 Personal Property Order - Oregon

What Is Form 150-303-055?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-055?

A: Form 150-303-055 is a Personal Property Order in Oregon.

Q: What is a Personal Property Order?

A: A Personal Property Order is a legal document used to provide instructions for the distribution of personal property after someone's death.

Q: Who uses Form 150-303-055?

A: Form 150-303-055 is used by individuals in Oregon to specify the distribution of their personal property after their death.

Q: Why is Form 150-303-055 important?

A: Form 150-303-055 is important because it allows individuals to have control over the distribution of their personal property and ensures their wishes are followed.

Q: Is Form 150-303-055 mandatory?

A: Form 150-303-055 is not mandatory, but it is recommended to ensure your personal property is distributed according to your wishes.

Q: Can I modify Form 150-303-055?

A: Yes, you can modify Form 150-303-055 to reflect your specific instructions for the distribution of your personal property.

Q: Do I need a lawyer to fill out Form 150-303-055?

A: While it is not required to have a lawyer, consulting with an attorney can help ensure that your wishes are properly documented and legally binding.

Q: What should I do with Form 150-303-055 once it is completed?

A: Once completed, it is recommended to keep a copy of Form 150-303-055 with your important documents and provide a copy to a trusted individual who will handle your estate after your death.

Q: Can I revoke or update Form 150-303-055?

A: Yes, you can revoke or update Form 150-303-055 at any time by creating a new personal property order or by making changes to the existing form.

Form Details:

- Released on July 31, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-055 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.