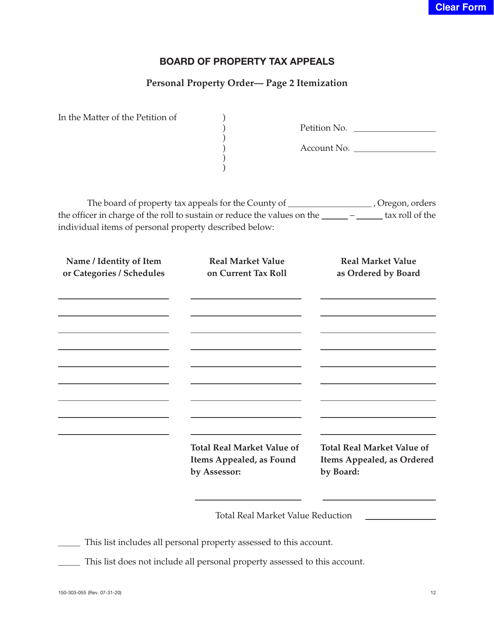

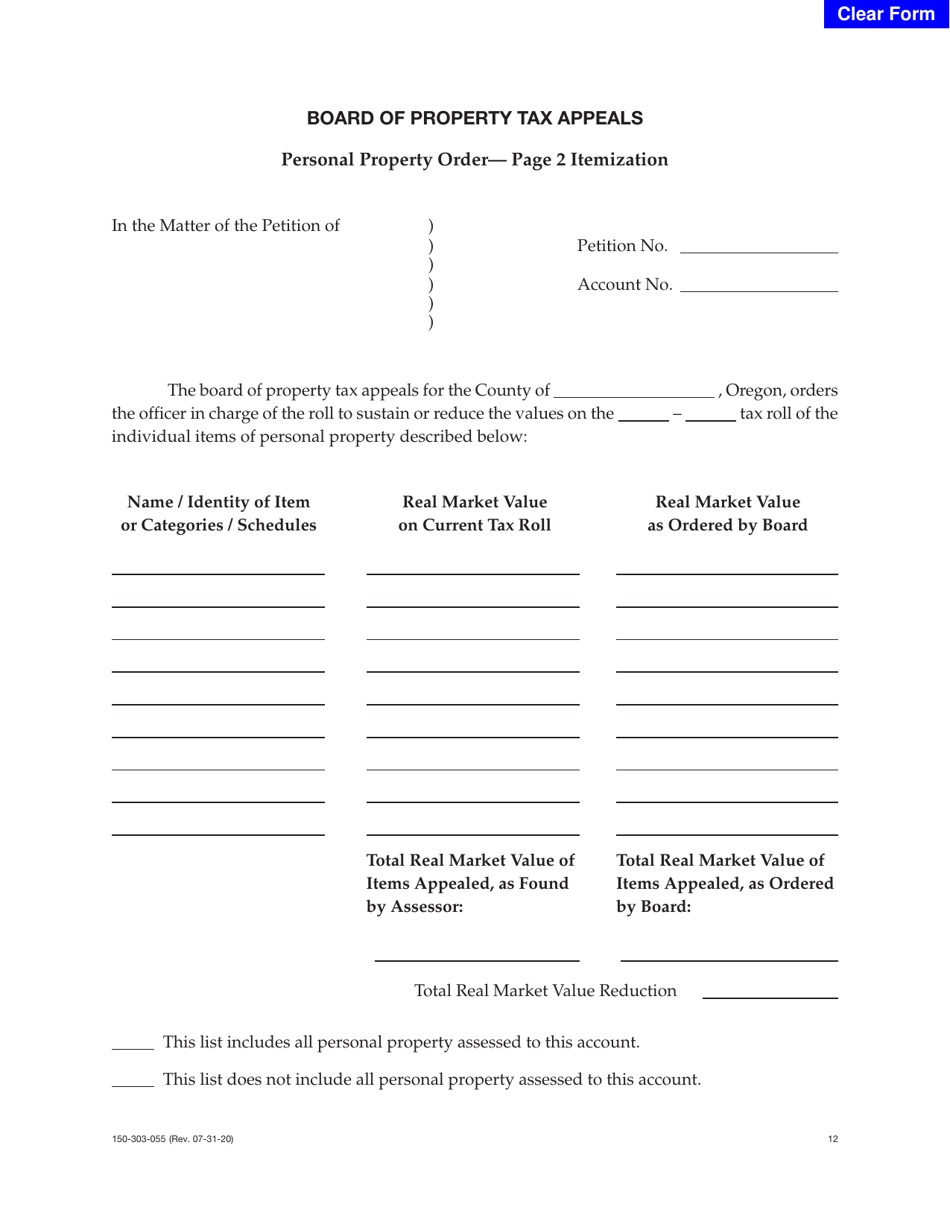

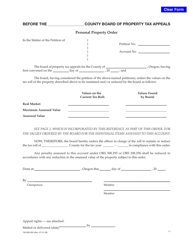

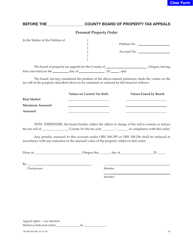

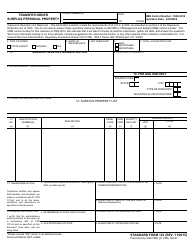

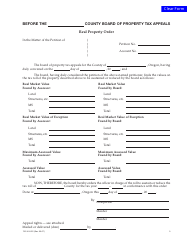

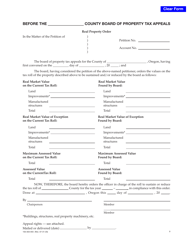

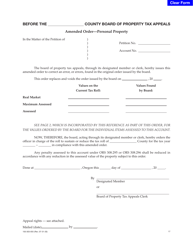

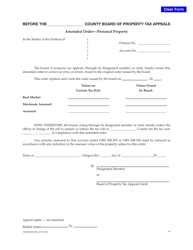

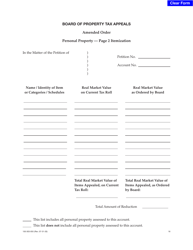

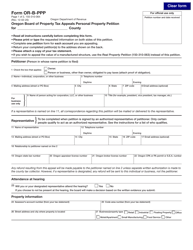

Form 150-303-055 Page 2 Personal Property Order - Itemization - Oregon

What Is Form 150-303-055 Page 2?

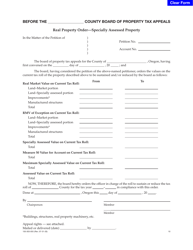

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon.The document is a supplement to Form 150-303-055, Summary of Actions - County Board of Property Tax Appeals Form. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-055?

A: Form 150-303-055 is the Personal Property Order - Itemization form used in Oregon.

Q: What is the purpose of Form 150-303-055?

A: The purpose of Form 150-303-055 is to itemize personal property for tax assessment in Oregon.

Q: Who needs to fill out Form 150-303-055?

A: Anyone who owns taxable personal property in Oregon needs to fill out Form 150-303-055.

Q: Is Form 150-303-055 specific to Oregon?

A: Yes, Form 150-303-055 is specific to Oregon and is used for personal property assessment in the state.

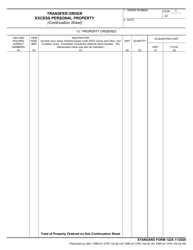

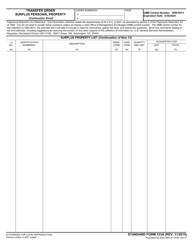

Q: What information is required on Form 150-303-055?

A: Form 150-303-055 requires information such as the description, cost, acquisition date, and other details of the personal property being assessed.

Q: When is Form 150-303-055 due?

A: Form 150-303-055 is typically due on March 15th of each year in Oregon.

Q: Are there any penalties for not filing Form 150-303-055?

A: Yes, there may be penalties for not filing Form 150-303-055 or for filing it late in Oregon.

Form Details:

- Released on July 31, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-055 Page 2 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.