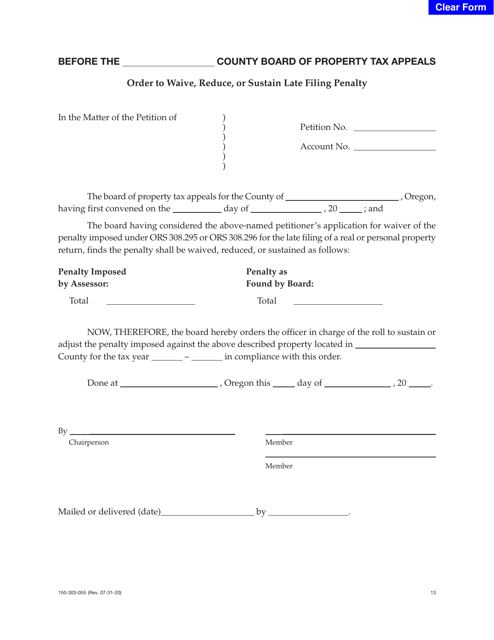

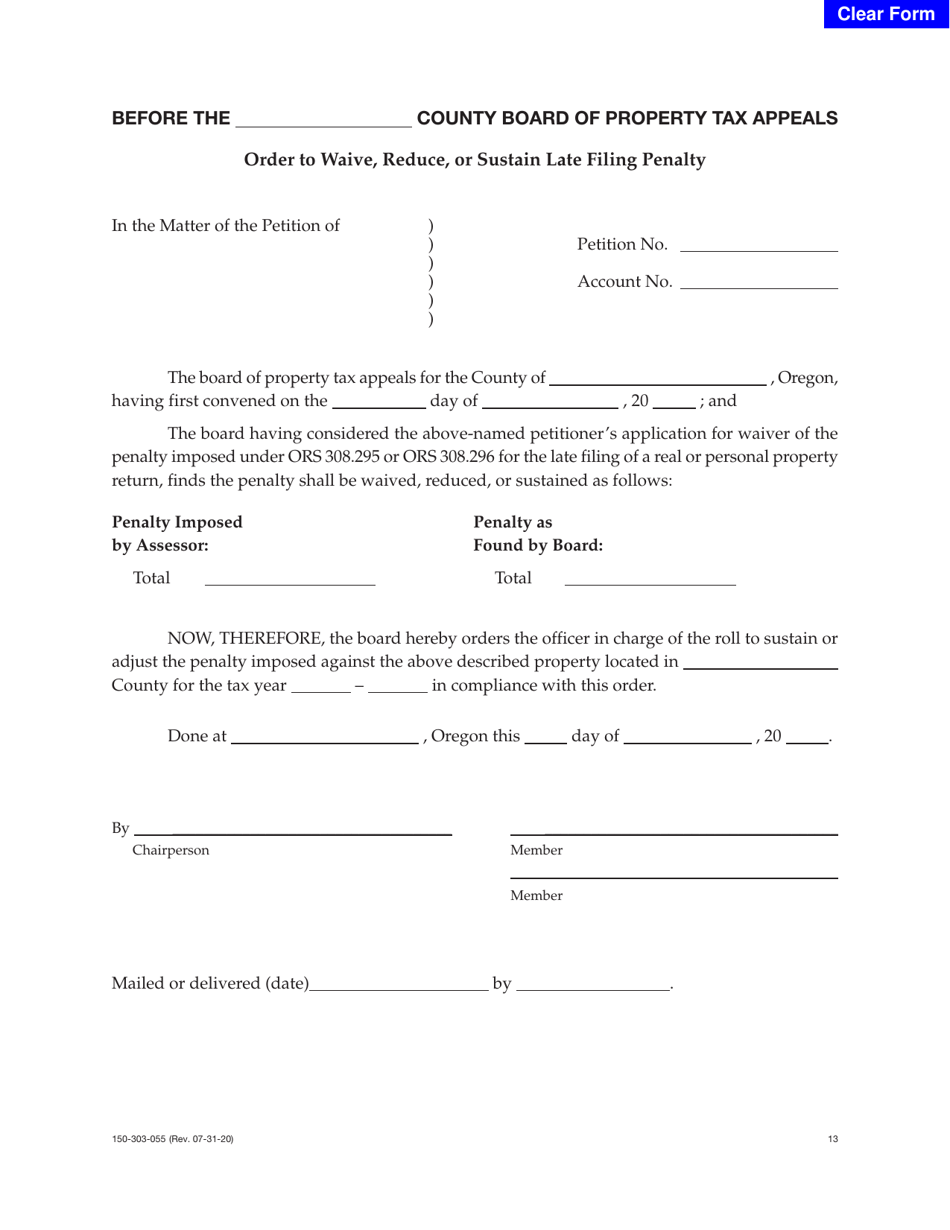

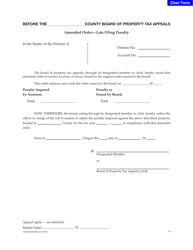

Form 150-303-055 Order to Waive, Reduce, or Sustain Late Filing Penalty - Oregon

What Is Form 150-303-055?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-055?

A: Form 150-303-055 is an Oregon tax form used to request a waiver, reduction, or sustainment of a late filing penalty.

Q: What is the purpose of Form 150-303-055?

A: The purpose of this form is to ask the Oregon tax agency to consider waiving or reducing the penalty for filing taxes late.

Q: Who can use Form 150-303-055?

A: Anyone who has incurred a late filing penalty in Oregon can use this form to request a waiver or reduction.

Q: How do I fill out Form 150-303-055?

A: You need to provide your personal information, explain the reasons for your late filing, and submit any supporting documents.

Q: Will my request always be granted?

A: There is no guarantee that your request will be granted. The Oregon tax agency will review your request and make a decision based on the information provided.

Q: Can I appeal if my request is denied?

A: Yes, if your request is denied, you have the right to appeal the decision. Follow the instructions provided by the Oregon Department of Revenue for the appeals process.

Form Details:

- Released on July 31, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-055 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.