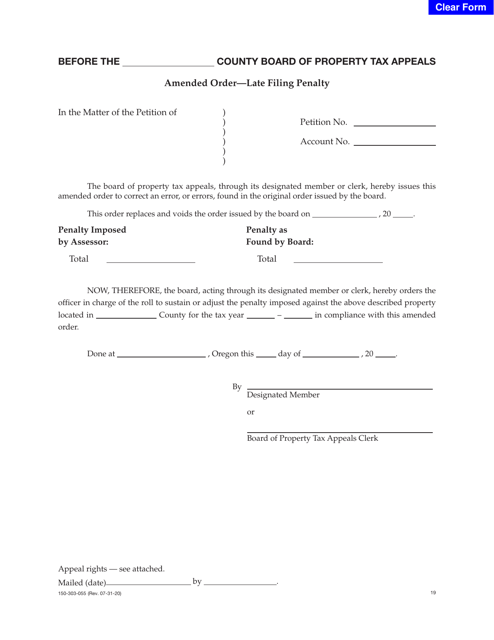

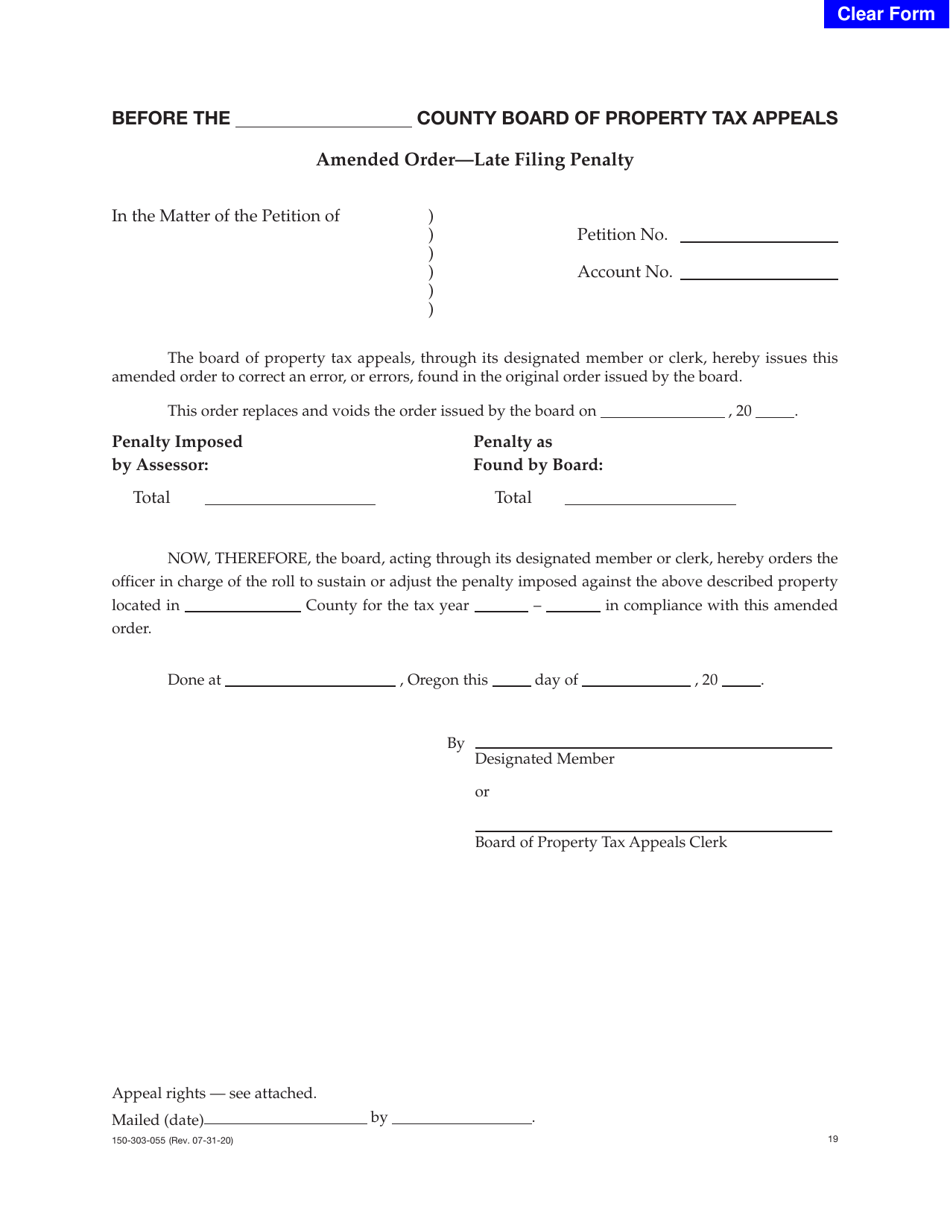

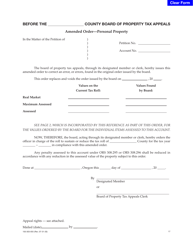

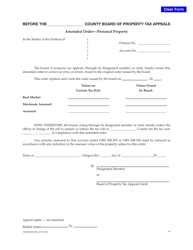

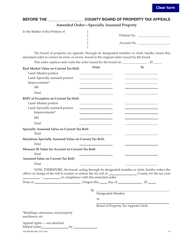

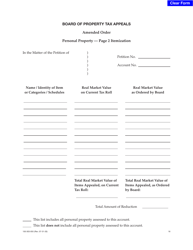

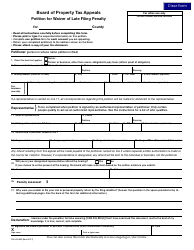

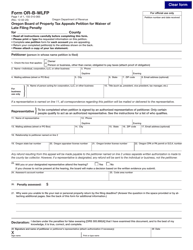

Form 150-303-055-19 Amended Order - Late Filing Penalty - Oregon

What Is Form 150-303-055-19?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

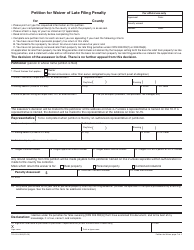

Q: What is Form 150-303-055-19?

A: Form 150-303-055-19 is a specific form used in Oregon to address late filing penalties.

Q: What does the Amended Order - Late Filing Penalty refer to?

A: The Amended Order - Late Filing Penalty refers to a revised document that addresses penalties for filing tax returns late in Oregon.

Q: What is a late filing penalty?

A: A late filing penalty is a fee imposed by the government for filing tax returns after the due date.

Q: What should I do if I receive an Amended Order - Late Filing Penalty?

A: If you receive an Amended Order - Late Filing Penalty, you should carefully review the document and take any necessary actions, such as paying the penalty or filing an appeal if you believe it was issued in error.

Form Details:

- Released on July 31, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-055-19 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.