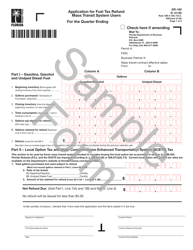

Form DR-157WT Additional Fuel Bond Worksheet - Florida

What Is Form DR-157WT?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

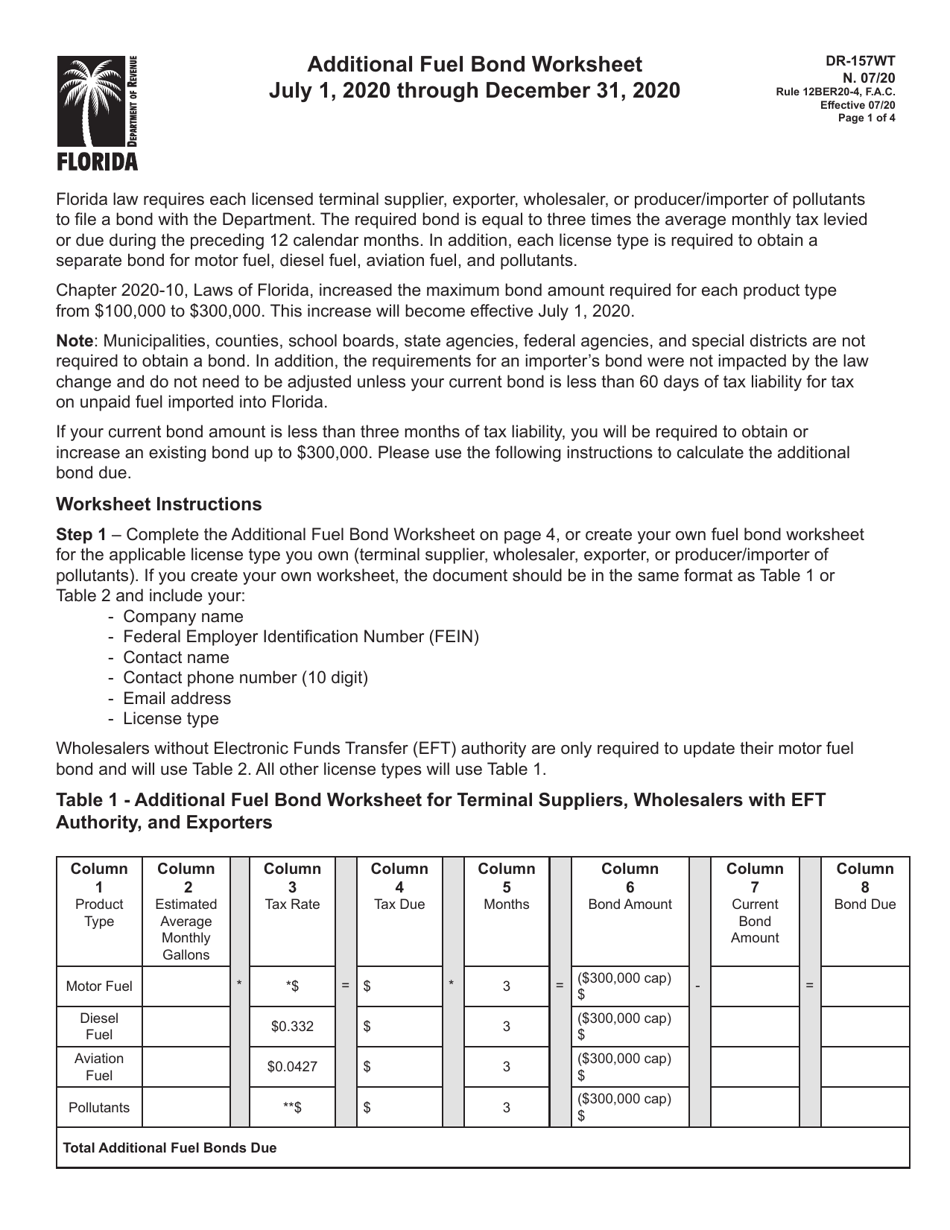

Q: What is Form DR-157WT?

A: Form DR-157WT is the Additional Fuel Bond Worksheet for the state of Florida.

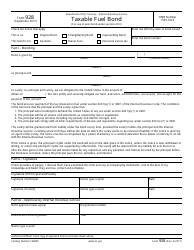

Q: What is the purpose of Form DR-157WT?

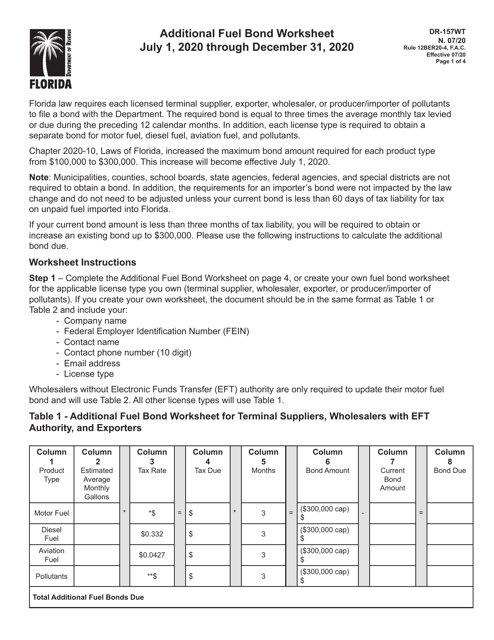

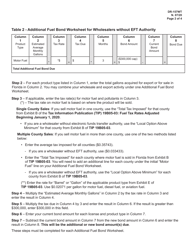

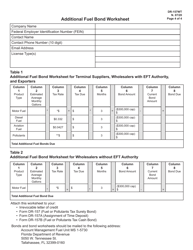

A: The purpose of Form DR-157WT is to calculate and report the amount of additional fuel tax due in the state of Florida.

Q: Who needs to file Form DR-157WT?

A: Form DR-157WT needs to be filed by taxpayers who are liable for additional fuel tax in Florida.

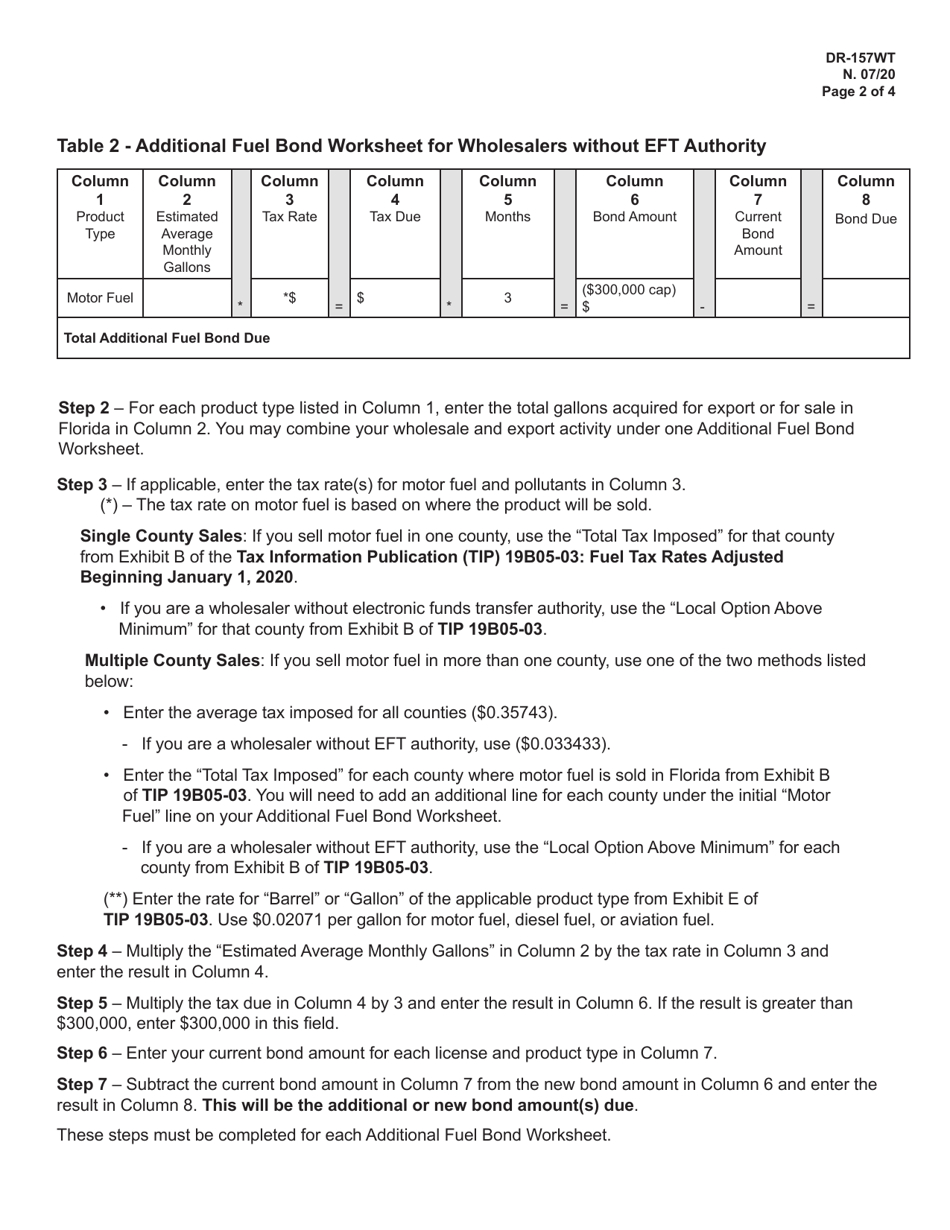

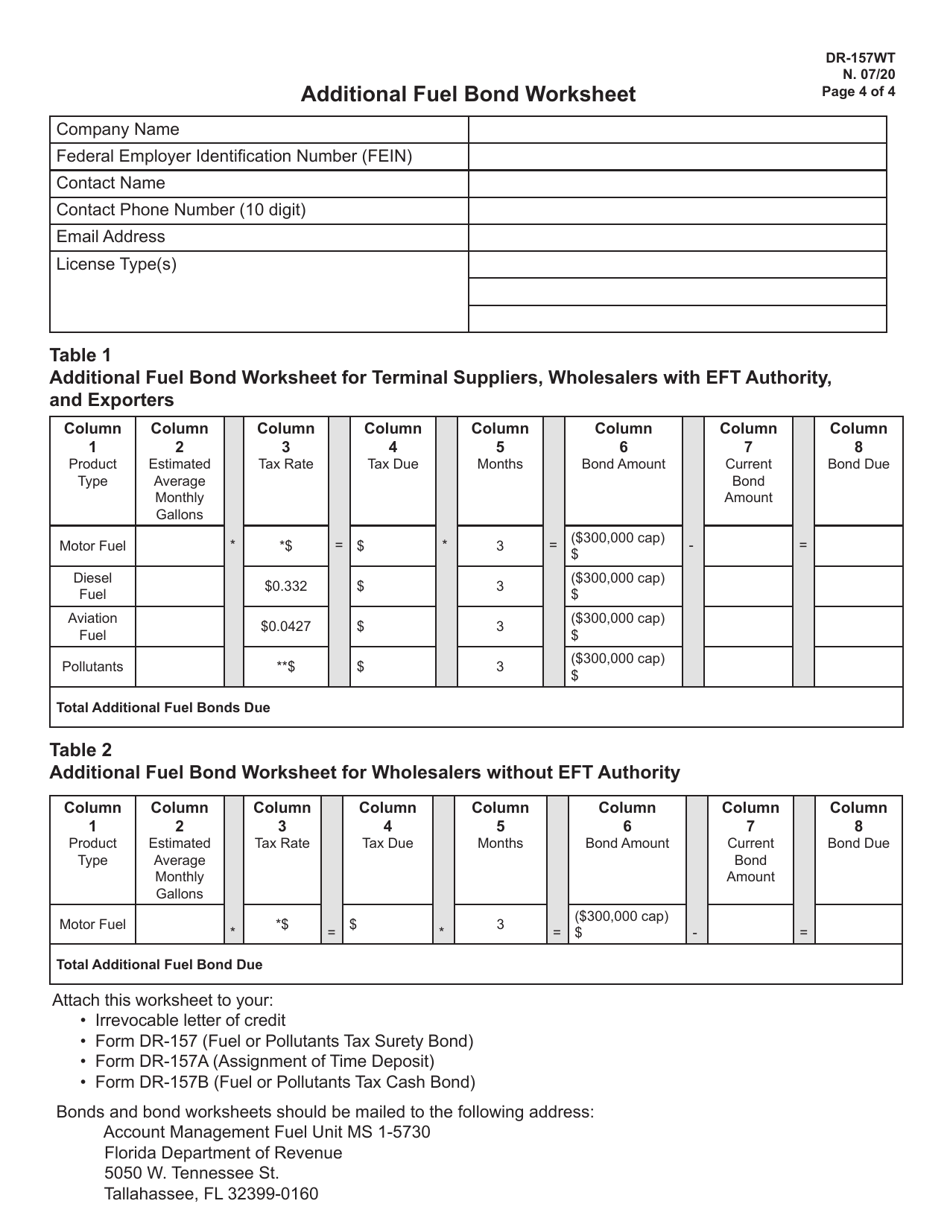

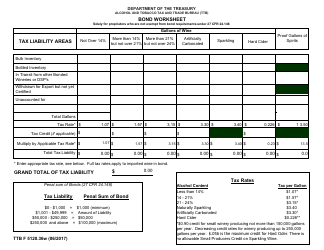

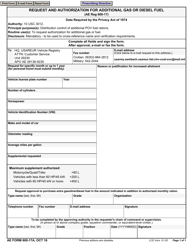

Q: What information is required on Form DR-157WT?

A: Form DR-157WT requires information such as the type and volume of fuel used, the tax rate, and the amount of tax due.

Q: When is Form DR-157WT due?

A: Form DR-157WT is due on a quarterly basis, with the due dates being April 30th, July 31st, October 31st, and January 31st.

Q: Are there any penalties for late filing of Form DR-157WT?

A: Yes, there can be penalties for late filing of Form DR-157WT, including interest charges and possible enforcement actions by the Florida Department of Revenue.

Q: Are there any exemptions to filing Form DR-157WT?

A: Yes, there are exemptions available for certain vehicles and circumstances. It is recommended to consult the Florida Department of Revenue or a tax professional for specific exemption details.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-157WT by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.